Attorney-Approved Vehicle Repayment Agreement Document

Guide to Writing Vehicle Repayment Agreement

Once you have the Vehicle Repayment Agreement form ready, you can begin filling it out. Ensure you have all necessary information at hand, such as your personal details and vehicle information. Follow these steps to complete the form accurately.

- Start by entering your full name in the designated field.

- Provide your current address, including street, city, state, and zip code.

- Input your contact number and email address for communication purposes.

- Fill in the vehicle details, including the make, model, year, and VIN (Vehicle Identification Number).

- Indicate the total amount owed for the vehicle.

- Specify the repayment terms, including the payment amount and frequency (weekly, bi-weekly, or monthly).

- Sign and date the form at the bottom to validate your agreement.

After completing the form, review all entries for accuracy. Once confirmed, you can submit it according to the instructions provided with the form. Ensure you keep a copy for your records.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms under which a borrower will repay a loan for a vehicle. |

| Parties Involved | This agreement typically involves two parties: the lender and the borrower. |

| Governing Law | The governing law for these agreements can vary by state. For example, in California, it is governed by the California Civil Code. |

| Payment Terms | The form specifies the amount to be paid, the payment schedule, and the interest rate, if applicable. |

| Default Conditions | It outlines what happens if the borrower defaults on the loan, including potential penalties or repossession of the vehicle. |

| Signatures Required | Both parties must sign the agreement to indicate their acceptance of the terms. |

| Record Keeping | It is important for both parties to keep a copy of the signed agreement for their records. |

FAQ

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. This agreement serves to protect both the lender and the borrower by clearly defining the repayment schedule, interest rates, and any penalties for late payments. It is essential for ensuring that both parties understand their rights and obligations regarding the loan.

Who needs to fill out a Vehicle Repayment Agreement form?

Any individual or entity that has taken out a loan to finance the purchase of a vehicle should complete a Vehicle Repayment Agreement form. This includes private buyers, dealerships, and financial institutions. The form is crucial for establishing a clear understanding of the repayment terms and preventing future disputes.

What information is required to complete the form?

To complete the Vehicle Repayment Agreement form, the following information is typically required:

- The names and contact information of both the borrower and the lender.

- Details about the vehicle, including make, model, year, and Vehicle Identification Number (VIN).

- The total loan amount and the interest rate.

- The repayment schedule, including the number of payments and the due dates.

- Any penalties for late payments or default.

What happens if the borrower defaults on the agreement?

If the borrower defaults on the Vehicle Repayment Agreement, the lender has the right to take specific actions as outlined in the agreement. These actions may include:

- Charging late fees or penalties as specified in the agreement.

- Reporting the default to credit bureaus, which can negatively impact the borrower’s credit score.

- Initiating repossession of the vehicle, depending on the terms of the agreement and state laws.

It is essential for borrowers to communicate with lenders if they are experiencing financial difficulties to explore possible solutions.

Can the terms of the Vehicle Repayment Agreement be modified?

Yes, the terms of a Vehicle Repayment Agreement can be modified, but both the borrower and lender must agree to any changes. Modifications should be documented in writing and signed by both parties to ensure clarity and enforceability. Common reasons for modifications include changes in payment amounts, extension of the repayment period, or adjustments to interest rates.

Fill out Popular Documents

Llc Purchase Agreement - It often contains sections dedicated to the representation of authority by the parties.

The CID Name Check Request form is a document used by commanders and law enforcement officials to accurately identify individuals through a background check. This form allows for the retrieval of important information, including social security numbers, to facilitate the process. If you need to request a name check, please fill out the form by clicking the button below, and don't forget to utilize the Fillable Blank Check for a smooth submission.

Writing a Character Reference for Court - This letter outlines how the individual overcomes adversity, showcasing their determination and strength of character.

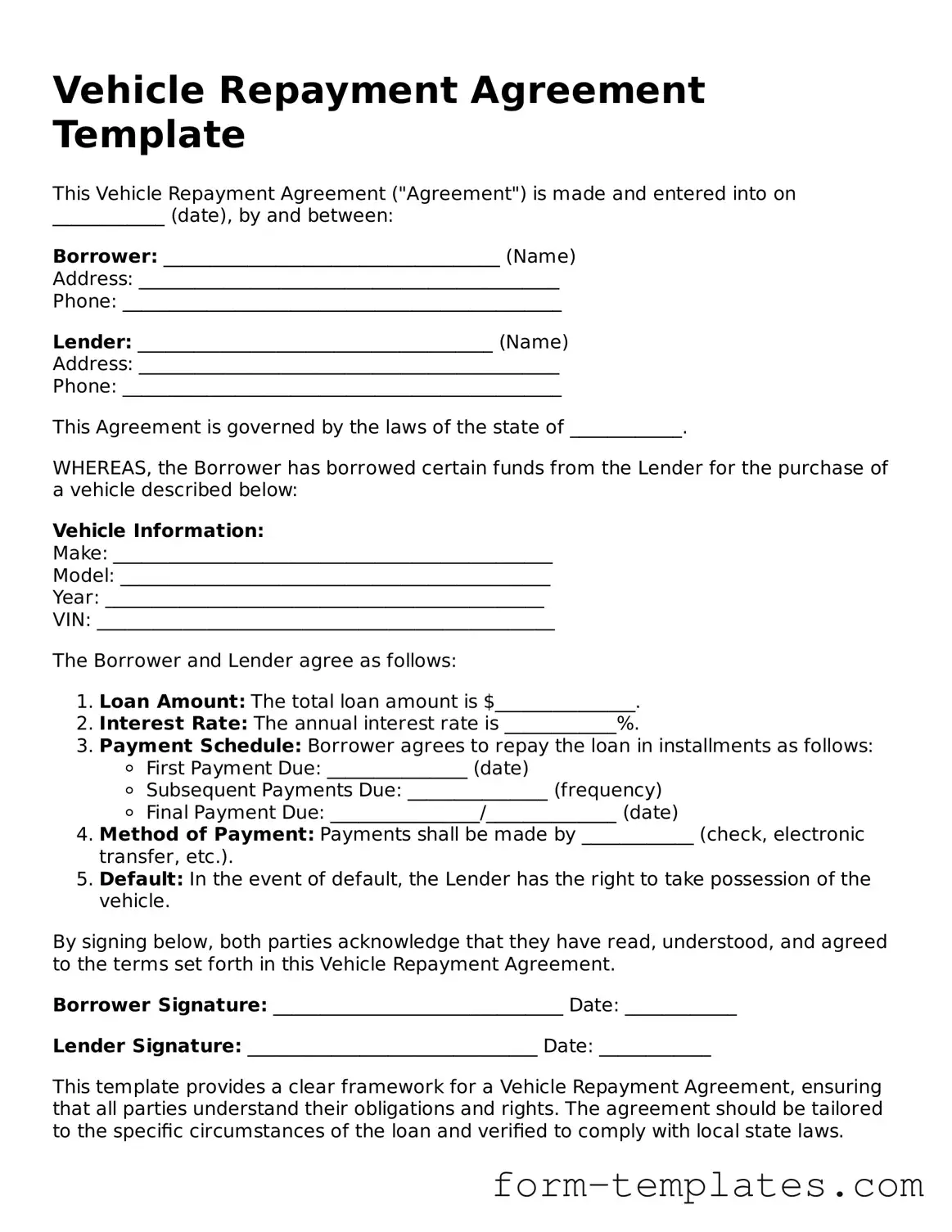

Vehicle Repayment Agreement Example

Vehicle Repayment Agreement Template

This Vehicle Repayment Agreement ("Agreement") is made and entered into on ____________ (date), by and between:

Borrower: ____________________________________ (Name)

Address: _____________________________________________

Phone: _______________________________________________

Lender: ______________________________________ (Name)

Address: _____________________________________________

Phone: _______________________________________________

This Agreement is governed by the laws of the state of ____________.

WHEREAS, the Borrower has borrowed certain funds from the Lender for the purchase of a vehicle described below:

Vehicle Information:

Make: _______________________________________________

Model: ______________________________________________

Year: _______________________________________________

VIN: _________________________________________________

The Borrower and Lender agree as follows:

- Loan Amount: The total loan amount is $_______________.

- Interest Rate: The annual interest rate is ____________%.

- Payment Schedule: Borrower agrees to repay the loan in installments as follows:

- First Payment Due: _______________ (date)

- Subsequent Payments Due: _______________ (frequency)

- Final Payment Due: ________________/______________ (date)

- Method of Payment: Payments shall be made by ____________ (check, electronic transfer, etc.).

- Default: In the event of default, the Lender has the right to take possession of the vehicle.

By signing below, both parties acknowledge that they have read, understood, and agreed to the terms set forth in this Vehicle Repayment Agreement.

Borrower Signature: _______________________________ Date: ____________

Lender Signature: _______________________________ Date: ____________

This template provides a clear framework for a Vehicle Repayment Agreement, ensuring that all parties understand their obligations and rights. The agreement should be tailored to the specific circumstances of the loan and verified to comply with local state laws.