Attorney-Approved Transfer-on-Death Deed Document

Guide to Writing Transfer-on-Death Deed

After gathering all necessary information, you can begin filling out the Transfer-on-Death Deed form. This form allows you to designate a beneficiary who will receive your property upon your passing. It is essential to ensure that all details are accurate to avoid complications later on.

- Begin by entering the name of the property owner at the top of the form. This should be the individual who currently holds the title to the property.

- Next, provide the address of the property. Include the street address, city, state, and ZIP code.

- Identify the beneficiary or beneficiaries. Include their full names and addresses. If there are multiple beneficiaries, list them in the order you prefer.

- Specify the relationship of each beneficiary to the property owner. This could be a spouse, child, friend, etc.

- Include a legal description of the property. This may be found on the current deed or property tax records.

- Sign and date the form. The property owner must sign in the presence of a notary public.

- Have the form notarized. The notary will verify the identity of the signer and add their seal.

- Submit the completed form to the appropriate local government office, typically the county recorder or clerk’s office. Make sure to keep a copy for your records.

Transfer-on-Death DeedDocuments for Specific US States

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by state law, specifically under the Uniform Real Property Transfer on Death Act, which has been adopted by several states. |

| Revocability | This deed can be revoked or changed at any time during the grantor's lifetime, ensuring flexibility in estate planning. |

| Beneficiary Rights | The beneficiary does not have any rights to the property until the death of the grantor, which protects the grantor's interests while they are alive. |

FAQ

- Obtain the appropriate form from your state’s official website or a legal document provider.

- Fill out the form with your information, the property details, and the beneficiary’s information.

- Sign the deed in the presence of a notary public.

- Record the deed with the county recorder’s office where the property is located.

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD deed) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This type of deed bypasses the probate process, enabling a smoother transition of property ownership.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate can use a Transfer-on-Death Deed. This includes homeowners, property owners, and those who hold title to real estate. However, the laws governing TOD deeds may vary by state, so it is essential to check local regulations.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, follow these steps:

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the death of the property owner. To revoke the deed, a new deed must be executed, or a formal revocation document must be filed with the county recorder’s office.

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the property owner, the property will not automatically transfer to that beneficiary's heirs. Instead, the property will be subject to the terms of the property owner's estate plan or will. It is advisable to name alternate beneficiaries to avoid complications.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. However, the beneficiary may be subject to property taxes and capital gains taxes upon inheriting the property. It is recommended to consult a tax professional for specific advice.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both documents deal with the transfer of property after death, a will typically goes through probate, whereas a TOD deed allows for a direct transfer without probate. Each serves different purposes in estate planning.

Can multiple beneficiaries be named in a Transfer-on-Death Deed?

Yes, multiple beneficiaries can be named in a Transfer-on-Death Deed. The property can be divided among the beneficiaries as specified in the deed. It is important to clearly outline how the property should be distributed to avoid disputes later.

Other Transfer-on-Death Deed Templates:

Quick Title Deed - Each state may have specific requirements for this type of deed.

The Chase Print Counter Checks form is a request for blank checks that can be printed at a Chase branch. This form provides customers with a convenient option to obtain temporary checks for immediate use. Additionally, utilizing a Blank Check Template can aid in understanding how to properly fill out and submit this form, ultimately streamlining your banking experience.

What Is Deed in Lieu of Foreclosure - The form can simplify the separation process between borrower and lender, facilitating a smooth transition.

Transfer-on-Death Deed Example

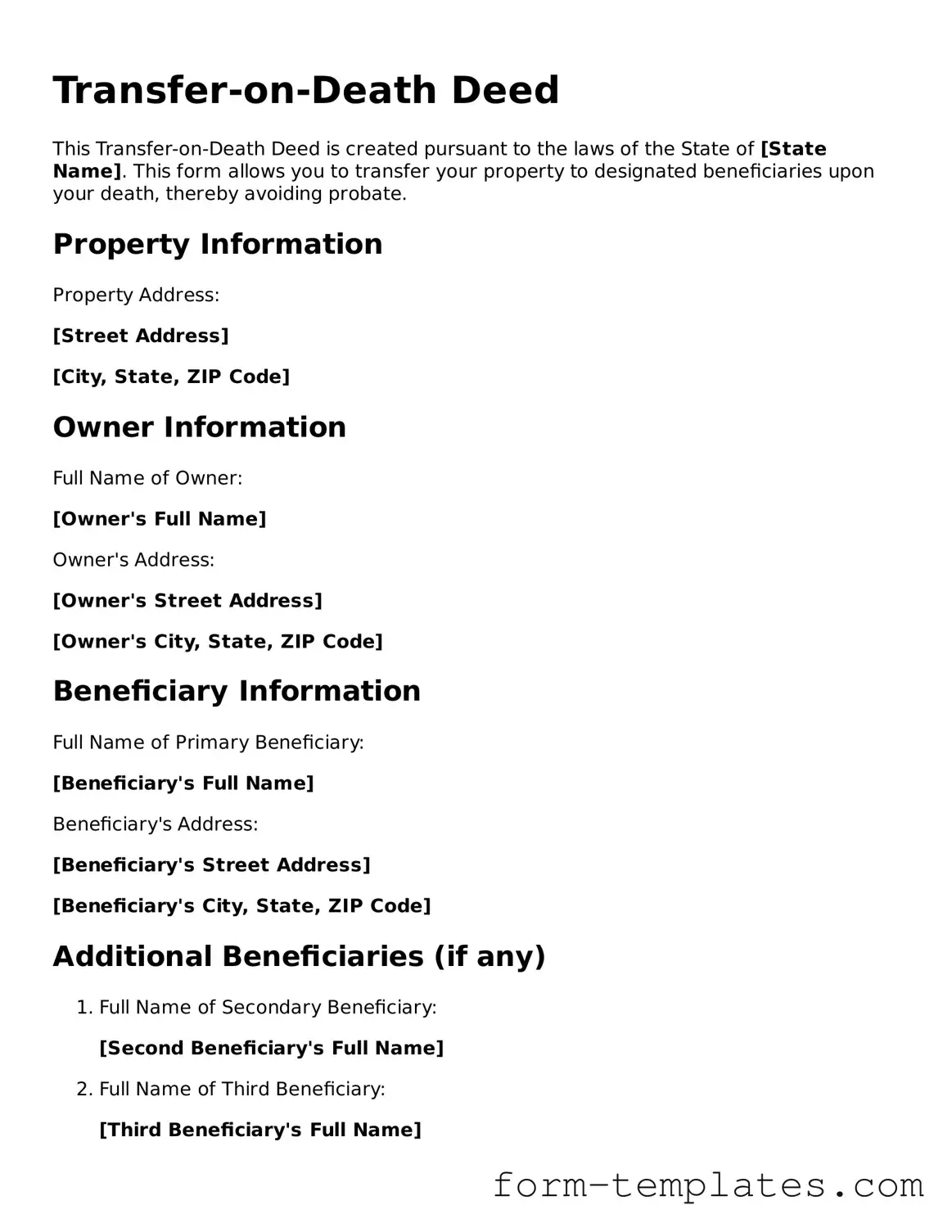

Transfer-on-Death Deed

This Transfer-on-Death Deed is created pursuant to the laws of the State of [State Name]. This form allows you to transfer your property to designated beneficiaries upon your death, thereby avoiding probate.

Property Information

Property Address:

[Street Address]

[City, State, ZIP Code]

Owner Information

Full Name of Owner:

[Owner's Full Name]

Owner's Address:

[Owner's Street Address]

[Owner's City, State, ZIP Code]

Beneficiary Information

Full Name of Primary Beneficiary:

[Beneficiary's Full Name]

Beneficiary's Address:

[Beneficiary's Street Address]

[Beneficiary's City, State, ZIP Code]

Additional Beneficiaries (if any)

- Full Name of Secondary Beneficiary:

- Full Name of Third Beneficiary:

[Second Beneficiary's Full Name]

[Third Beneficiary's Full Name]

Signature and Date

The undersigned owner hereby revokes any prior Transfer-on-Death Deeds made for the above-described property and declares this to be the Transfer-on-Death Deed in accordance with the laws of [State Name].

Owner's Signature: ______________________ Date: _____________

Witnesses (if required by state law)

- Witness 1 Name: ___________________ Signature: _____________________

- Witness 2 Name: ___________________ Signature: _____________________