Printable Transfer-on-Death Deed Form for the State of Texas

Guide to Writing Texas Transfer-on-Death Deed

Filling out the Texas Transfer-on-Death Deed form is a straightforward process that allows individuals to designate beneficiaries for their property upon death. After completing the form, it is essential to file it with the appropriate county clerk's office to ensure its validity and effectiveness.

- Begin by downloading the Texas Transfer-on-Death Deed form from a reliable source or obtain a physical copy from your local county clerk's office.

- In the first section, provide the name and address of the property owner(s). This identifies who is transferring the property.

- Next, enter the legal description of the property. This can often be found on the property deed or tax records.

- Designate the beneficiary or beneficiaries. Include their full names and addresses. Be clear about whether the property will be divided among multiple beneficiaries or passed entirely to one individual.

- If desired, include any conditions or instructions regarding the transfer. This may include specific terms for how the property should be handled after the owner's passing.

- Sign and date the form in the designated area. Ensure that all property owners sign if there is more than one.

- Have the form notarized. This step is crucial for validating the deed. A notary public will confirm the identities of the signers and witness the signing.

- Finally, file the completed and notarized form with the county clerk’s office in the county where the property is located. Keep a copy for your records.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TODD) allows a property owner to transfer real estate to a beneficiary upon their death without the need for probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Texas Property Code, Chapter 114. |

| Revocability | The deed can be revoked or changed at any time by the property owner during their lifetime, allowing for flexibility in estate planning. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the property can be divided among them, ensuring that the owner’s wishes are honored. |

FAQ

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to designate one or more beneficiaries to inherit real estate upon their death. This deed enables the transfer of property without the need for probate, simplifying the process for heirs.

Who can use a Transfer-on-Death Deed in Texas?

Any individual who owns real property in Texas can use a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals holding title to real estate. It is important to note that the property must be solely owned, as joint ownership may complicate the transfer process.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, follow these steps:

- Obtain the official form from a reliable source, such as the Texas Secretary of State's website or a legal document provider.

- Fill out the form with the necessary information, including the property description and the names of the beneficiaries.

- Sign the deed in the presence of a notary public.

- File the deed with the county clerk's office in the county where the property is located.

Are there any restrictions on beneficiaries?

Yes, there are some restrictions. Beneficiaries must be individuals or entities that can legally inherit property. This includes family members, friends, or trusts. However, you cannot name pets or organizations that do not have the legal capacity to inherit.

Can I revoke or change a Transfer-on-Death Deed?

Yes, you can revoke or change a Transfer-on-Death Deed at any time before your death. To do this, you must execute a new deed that clearly states your intent to revoke the previous deed or make the necessary changes. This new deed must also be filed with the county clerk's office.

What happens if I do not name a beneficiary?

If you do not name a beneficiary on your Transfer-on-Death Deed, the property will not transfer as intended. Instead, it will become part of your estate and may go through the probate process, which can be lengthy and costly for your heirs.

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be a filing fee when you submit the Transfer-on-Death Deed to the county clerk's office. Fees vary by county, so it is advisable to check with your local office for the exact amount. Additionally, if you choose to work with an attorney or a legal service to prepare the deed, there may be additional costs involved.

What are the benefits of using a Transfer-on-Death Deed?

The benefits of a Transfer-on-Death Deed include:

- Avoiding probate, which can save time and money.

- Maintaining control of the property during your lifetime.

- Providing a clear and direct transfer of property to beneficiaries.

- Flexibility to change beneficiaries as needed.

Consider Popular Transfer-on-Death Deed Forms for Specific States

Where Can I Get a Tod Form - Suitable for individuals who want to avoid the hassle of probate.

To streamline the name verification process, commanders and law enforcement officials can utilize resources such as the Fillable Blank Check, which complements the use of the CID Name Check Request form by providing a convenient method to ensure all necessary information is accurately collected and documented.

Transfer on Death Deed Florida Form - Deadlines for recording the deed may vary by jurisdiction.

Texas Transfer-on-Death Deed Example

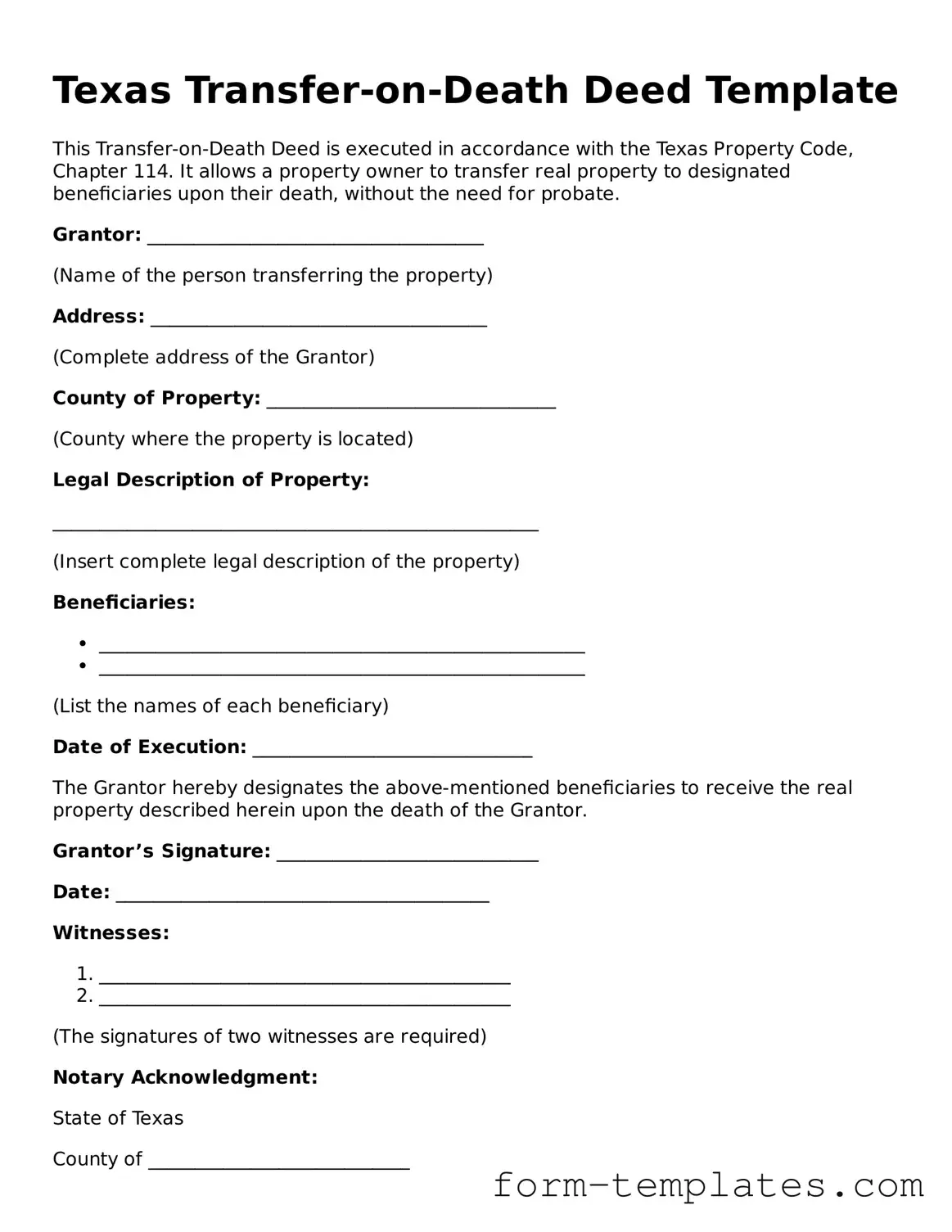

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Texas Property Code, Chapter 114. It allows a property owner to transfer real property to designated beneficiaries upon their death, without the need for probate.

Grantor: ____________________________________

(Name of the person transferring the property)

Address: ____________________________________

(Complete address of the Grantor)

County of Property: _______________________________

(County where the property is located)

Legal Description of Property:

____________________________________________________

(Insert complete legal description of the property)

Beneficiaries:

- ____________________________________________________

- ____________________________________________________

(List the names of each beneficiary)

Date of Execution: ______________________________

The Grantor hereby designates the above-mentioned beneficiaries to receive the real property described herein upon the death of the Grantor.

Grantor’s Signature: ____________________________

Date: ________________________________________

Witnesses:

- ____________________________________________

- ____________________________________________

(The signatures of two witnesses are required)

Notary Acknowledgment:

State of Texas

County of ____________________________

Subscribed and sworn to before me this ______ day of ____________, 20__.

My commission expires: ________________________

Notary Public Signature: ________________________