Printable Promissory Note Form for the State of Texas

Guide to Writing Texas Promissory Note

Once you have the Texas Promissory Note form in front of you, it's time to fill it out accurately. This form serves as a written promise to repay a loan under specified terms. Ensure you have all necessary information ready to complete the form efficiently.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Identify the borrower by writing their full legal name in the designated space.

- Next, provide the lender's full legal name. This is the individual or entity loaning the money.

- Clearly state the principal amount being borrowed. This is the total amount of money that the borrower agrees to pay back.

- Specify the interest rate. Include whether it is fixed or variable, and note the percentage.

- Indicate the repayment schedule. This includes how often payments will be made (monthly, quarterly, etc.) and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable.

- Sign and date the form at the bottom. The borrower must sign, and the date of signing should be included.

- Have the lender sign the form as well, if required. This confirms their agreement to the terms.

After completing the form, both parties should keep a signed copy for their records. It’s advisable to review the terms carefully before finalizing the agreement.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, particularly Chapter 3. |

| Parties Involved | The note involves two primary parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the document. |

| Payment Terms | Payment terms must specify the due date and the method of payment, such as installments or a lump sum. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make payments as agreed. |

| Signature Requirement | The borrower must sign the note for it to be legally binding. |

| Notarization | While notarization is not required, it can add an extra layer of security and validity to the document. |

| Transferability | The note can be transferred to another party, which is known as endorsement. |

FAQ

What is a Texas Promissory Note?

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It specifies the amount borrowed, the interest rate, the repayment schedule, and any other terms agreed upon by both parties. This document serves as evidence of the debt and can be enforced in court if necessary.

Who can use a Texas Promissory Note?

Anyone involved in a lending arrangement can use a Texas Promissory Note. This includes individuals, businesses, or organizations that lend money to another party. It is commonly used for personal loans, business loans, or real estate transactions.

What are the key components of a Texas Promissory Note?

A typical Texas Promissory Note includes the following key components:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate and how it is calculated

- The repayment schedule (due dates and amounts)

- Any late fees or penalties for missed payments

- Conditions for default and the lender's rights

- Signatures of both parties

Is a Texas Promissory Note legally binding?

Yes, a Texas Promissory Note is legally binding as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed by both the borrower and the lender. If the borrower fails to repay the loan as agreed, the lender can take legal action to enforce the note.

Do I need a lawyer to create a Texas Promissory Note?

While it is not legally required to have a lawyer draft a Texas Promissory Note, consulting with one can be beneficial. A lawyer can help ensure that the document complies with Texas laws and includes all necessary terms to protect your interests. If you are unsure about the process or have complex terms, seeking legal advice is a good idea.

Can a Texas Promissory Note be modified after it is signed?

Yes, a Texas Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note to avoid confusion or disputes later on.

What happens if the borrower defaults on the Texas Promissory Note?

If the borrower defaults on the Texas Promissory Note, the lender has several options. They may choose to negotiate a new payment plan, charge late fees, or pursue legal action to recover the owed amount. The specific actions taken will depend on the terms outlined in the note and the lender's preferences.

Consider Popular Promissory Note Forms for Specific States

New York Promissory Note - Using a promissory note can strengthen personal and professional relationships.

Promissory Note Friendly Loan Agreement Format - The necessity for clear communication in a promissory note cannot be overstated.

To ensure a smooth and compliant business formation, it's essential to accurately complete the Florida Articles of Incorporation form, which can be accessed at https://floridadocuments.net/fillable-articles-of-incorporation-form. This form creates a legal foundation for your corporation, setting forth its name, purpose, and initial directors, making it a vital step for entrepreneurs in Florida.

Promissory Note Form California - In the case of non-payment, the lender may have the right to pursue collection actions.

Promissory Note Florida Pdf - A promissory note is a critical document in documenting the lender-borrower relationship.

Texas Promissory Note Example

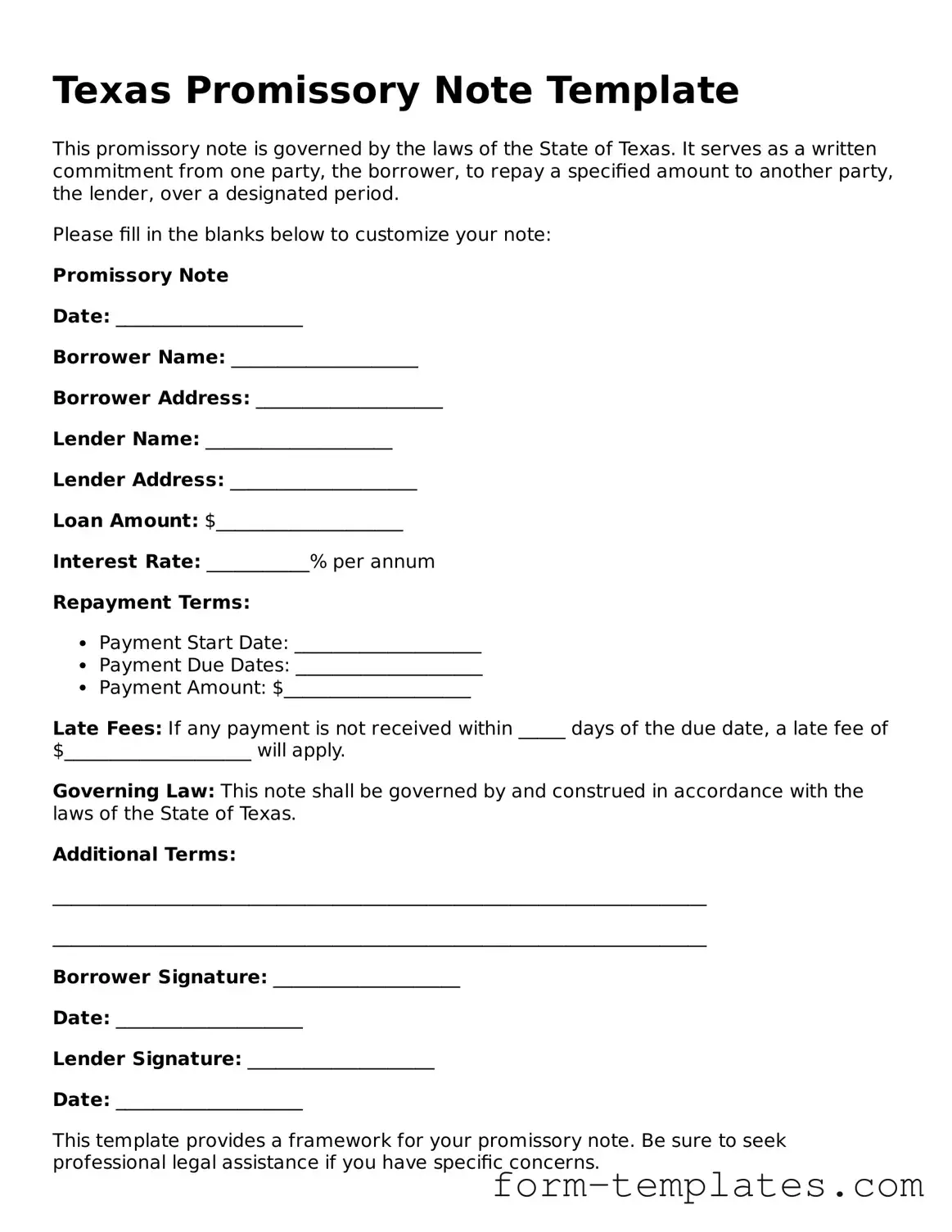

Texas Promissory Note Template

This promissory note is governed by the laws of the State of Texas. It serves as a written commitment from one party, the borrower, to repay a specified amount to another party, the lender, over a designated period.

Please fill in the blanks below to customize your note:

Promissory Note

Date: ____________________

Borrower Name: ____________________

Borrower Address: ____________________

Lender Name: ____________________

Lender Address: ____________________

Loan Amount: $____________________

Interest Rate: ___________% per annum

Repayment Terms:

- Payment Start Date: ____________________

- Payment Due Dates: ____________________

- Payment Amount: $____________________

Late Fees: If any payment is not received within _____ days of the due date, a late fee of $____________________ will apply.

Governing Law: This note shall be governed by and construed in accordance with the laws of the State of Texas.

Additional Terms:

______________________________________________________________________

______________________________________________________________________

Borrower Signature: ____________________

Date: ____________________

Lender Signature: ____________________

Date: ____________________

This template provides a framework for your promissory note. Be sure to seek professional legal assistance if you have specific concerns.