Printable Loan Agreement Form for the State of Texas

Guide to Writing Texas Loan Agreement

Filling out the Texas Loan Agreement form is an important step in formalizing a loan between parties. Make sure to have all necessary information ready before you start, as this will help streamline the process. Below are the steps to guide you through completing the form accurately.

- Begin by entering the date at the top of the form. This is usually the date when the agreement is signed.

- Next, fill in the names and addresses of both the lender and the borrower. Make sure to provide complete and accurate details.

- Specify the loan amount. Clearly state how much money is being lent.

- Indicate the interest rate. If the loan has an interest rate, ensure it is clearly written in percentage form.

- Outline the repayment terms. Include details on how and when the borrower will repay the loan. This could be in monthly installments or a lump sum.

- Provide any additional terms or conditions that apply to the loan. This could include late fees, prepayment options, or collateral requirements.

- Both parties should sign and date the form at the bottom. Ensure that signatures are clear and legible.

Once you have completed the form, review it for any errors or omissions. It's essential that both parties understand and agree to the terms outlined before proceeding with the loan.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Texas Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Texas. |

| Parties Involved | The form requires the names and contact information of both the lender and the borrower. |

| Loan Amount | The specific amount of money being borrowed must be clearly stated in the agreement. |

| Interest Rate | The form should specify the interest rate applicable to the loan, whether fixed or variable. |

| Repayment Terms | Details on how and when the borrower will repay the loan must be included. |

| Default Conditions | The agreement outlines what constitutes a default and the consequences of defaulting on the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

FAQ

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Texas. This form specifies the amount of the loan, interest rates, repayment terms, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities.

Who should use a Texas Loan Agreement form?

Individuals or businesses that are borrowing or lending money in Texas should use a Texas Loan Agreement form. This includes personal loans between friends or family, as well as formal loans between businesses and financial institutions. Using this form helps ensure that both parties understand the terms of the loan and can refer back to the agreement if disputes arise.

What key elements are included in a Texas Loan Agreement?

A Texas Loan Agreement typically includes the following key elements:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Schedule: Details on how and when payments will be made.

- Default Terms: Conditions that define what happens if the borrower fails to repay the loan.

- Collateral: Any assets pledged as security for the loan, if applicable.

How does one fill out a Texas Loan Agreement form?

To fill out a Texas Loan Agreement form, follow these steps:

- Begin by entering the names and contact information of both the lender and borrower.

- Clearly state the loan amount and the agreed-upon interest rate.

- Specify the repayment schedule, including due dates and payment amounts.

- Include any collateral details, if applicable.

- Both parties should sign and date the agreement to make it legally binding.

Is it necessary to have a lawyer review the Texas Loan Agreement?

While it is not legally required to have a lawyer review the Texas Loan Agreement, doing so can be beneficial. A legal professional can ensure that the document complies with state laws and adequately protects both parties' interests. This step may help prevent misunderstandings or disputes in the future.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender has several options based on the terms outlined in the agreement. These may include:

- Charging late fees as specified in the agreement.

- Taking legal action to recover the owed amount.

- Seizing collateral if it was pledged as security for the loan.

It is essential for both parties to understand these consequences before entering into the agreement.

Can a Texas Loan Agreement be modified after it is signed?

Yes, a Texas Loan Agreement can be modified after it is signed, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the lender and borrower to ensure clarity and enforceability. Verbal agreements regarding changes may not be legally binding.

Where can I obtain a Texas Loan Agreement form?

A Texas Loan Agreement form can be obtained from various sources, including legal document websites, financial institutions, or local law offices. It is important to ensure that the form is up-to-date and compliant with Texas laws. Customizing the agreement to fit specific loan terms is also advisable.

Consider Popular Loan Agreement Forms for Specific States

Printable Promissory Note Template - Loan Agreements are commonly used in both personal and business borrowing.

For effective financial management, using a well-structured tool like the Check Register form is crucial. This form not only helps in tracking deposits and withdrawals but also assists in maintaining an accurate account balance. Additionally, individuals looking for a simple way to manage their finances may benefit from using a Blank Check Template that can streamline the recording of transactions.

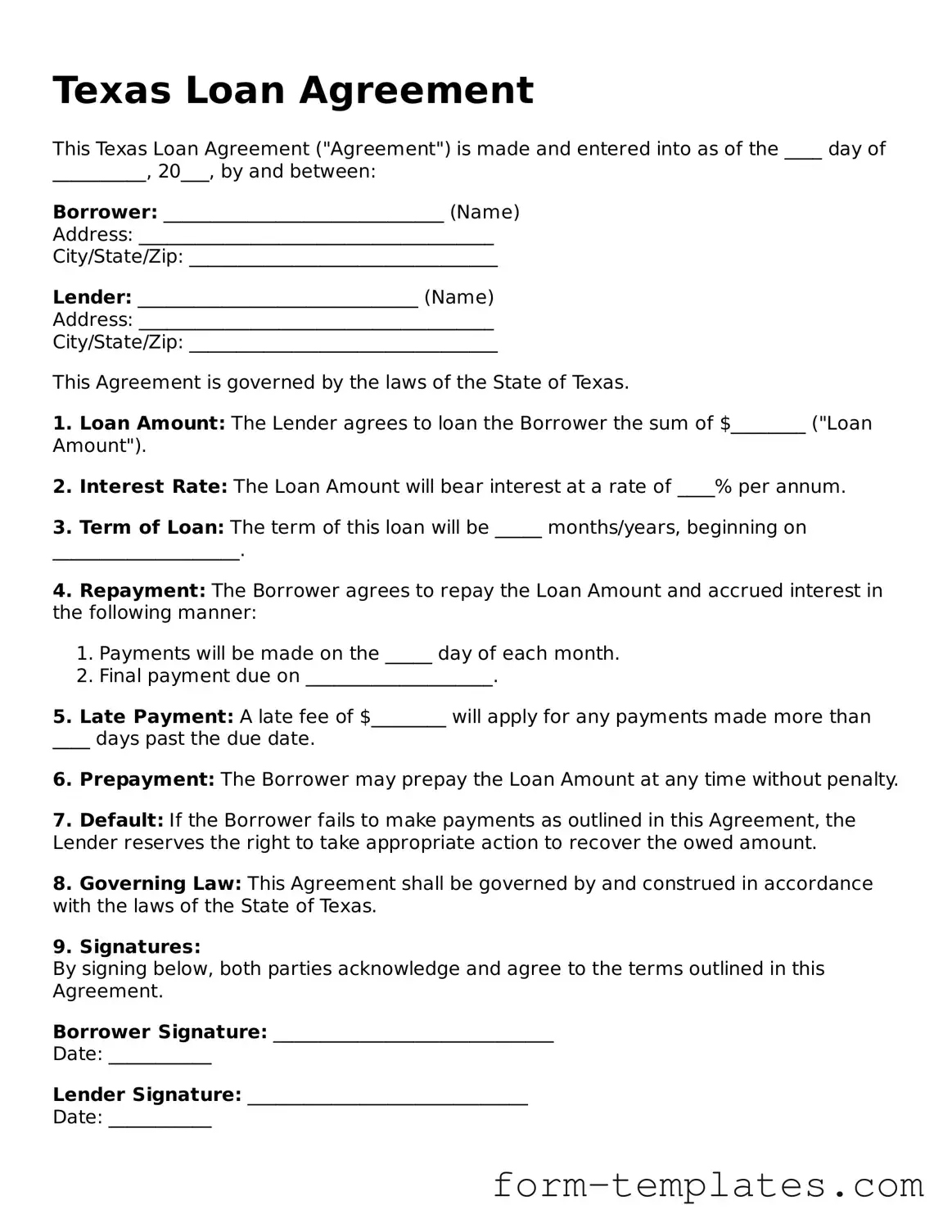

Texas Loan Agreement Example

Texas Loan Agreement

This Texas Loan Agreement ("Agreement") is made and entered into as of the ____ day of __________, 20___, by and between:

Borrower: ______________________________ (Name)

Address: ______________________________________

City/State/Zip: _________________________________

Lender: ______________________________ (Name)

Address: ______________________________________

City/State/Zip: _________________________________

This Agreement is governed by the laws of the State of Texas.

1. Loan Amount: The Lender agrees to loan the Borrower the sum of $________ ("Loan Amount").

2. Interest Rate: The Loan Amount will bear interest at a rate of ____% per annum.

3. Term of Loan: The term of this loan will be _____ months/years, beginning on ____________________.

4. Repayment: The Borrower agrees to repay the Loan Amount and accrued interest in the following manner:

- Payments will be made on the _____ day of each month.

- Final payment due on ____________________.

5. Late Payment: A late fee of $________ will apply for any payments made more than ____ days past the due date.

6. Prepayment: The Borrower may prepay the Loan Amount at any time without penalty.

7. Default: If the Borrower fails to make payments as outlined in this Agreement, the Lender reserves the right to take appropriate action to recover the owed amount.

8. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

9. Signatures:

By signing below, both parties acknowledge and agree to the terms outlined in this Agreement.

Borrower Signature: ______________________________

Date: ___________

Lender Signature: ______________________________

Date: ___________