Printable Lady Bird Deed Form for the State of Texas

Guide to Writing Texas Lady Bird Deed

Once you have the Texas Lady Bird Deed form, you will need to fill it out carefully to ensure that all necessary information is included. This process involves providing details about the property and the individuals involved. After completing the form, you will need to sign it in front of a notary public and then file it with the county clerk's office.

- Obtain the Texas Lady Bird Deed form from a reliable source.

- Enter the name of the property owner(s) in the designated section.

- Provide the legal description of the property. This can often be found on the property deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death.

- Specify any conditions or limitations regarding the transfer of the property.

- Include the date of execution at the bottom of the form.

- Sign the form in the presence of a notary public to validate it.

- File the completed and notarized form with the county clerk's office in the county where the property is located.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | The Texas Lady Bird Deed is a legal document that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Texas Property Code Section 5.045. |

| Benefits | One of the main benefits is that it helps avoid probate, simplifying the transfer process upon the owner's death. |

| Retained Rights | Property owners maintain the right to sell, mortgage, or change the property without needing consent from the beneficiaries. |

| Tax Implications | The Lady Bird Deed can help preserve the property tax benefits for the owner and beneficiaries, as it does not trigger a reassessment. |

| Limitations | This deed cannot be used for all types of property, such as certain types of trusts or properties held in joint tenancy. |

| Execution Requirements | The deed must be signed by the property owner and recorded in the county where the property is located to be effective. |

FAQ

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer real estate to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed is unique to Texas and provides certain advantages, particularly in avoiding probate and allowing for flexibility in property management.

What are the benefits of using a Lady Bird Deed?

There are several benefits associated with a Lady Bird Deed:

- Avoids Probate: The property automatically transfers to the beneficiaries upon the owner's death, bypassing the lengthy probate process.

- Retains Control: The property owner retains full control over the property during their lifetime, including the right to sell, mortgage, or change beneficiaries.

- Tax Benefits: The property may qualify for a step-up in basis, potentially reducing capital gains taxes for the beneficiaries.

Who can create a Lady Bird Deed?

Any individual who owns real estate in Texas can create a Lady Bird Deed. This includes homeowners, property investors, and those holding title to land. It is important for the property owner to understand their rights and responsibilities before executing this deed.

How is a Lady Bird Deed executed?

To execute a Lady Bird Deed, the property owner must:

- Draft the deed, ensuring it includes the necessary legal language to establish the life estate and the remainder interests.

- Sign the deed in the presence of a notary public.

- File the deed with the county clerk's office where the property is located.

It is advisable to seek assistance from a legal professional to ensure that the deed is properly prepared and executed.

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked by the property owner at any time during their lifetime. This can be done by executing a new deed that explicitly revokes the previous one or by transferring the property to another party. The owner’s ability to revoke the deed is one of the key advantages of this type of arrangement.

What happens if the property owner needs long-term care?

If the property owner requires long-term care, the property may be subject to Medicaid estate recovery. However, because a Lady Bird Deed allows the owner to retain control over the property, they can sell or transfer it as needed to manage their finances. It is essential to consult with a legal or financial advisor to understand the implications of long-term care on property ownership.

Are there any limitations to a Lady Bird Deed?

While a Lady Bird Deed offers many advantages, there are limitations to consider:

- The deed must be properly executed to be valid.

- It is only recognized in Texas, so it may not be applicable for properties located in other states.

- Beneficiaries must be clearly identified, and changes to beneficiaries may require additional legal action.

Understanding these limitations can help property owners make informed decisions about their estate planning.

Consider Popular Lady Bird Deed Forms for Specific States

Lady Bird Deed Florida Form - The deed can specify who inherits the property, which helps avoid disputes among family members.

The Florida Articles of Incorporation form is a legal document that establishes a corporation in the state of Florida. This form outlines essential details about the corporation, including its name, purpose, and the names of its initial directors. Completing this form is a crucial step for anyone looking to create a business entity in Florida, and you can find the necessary resources at floridadocuments.net/fillable-articles-of-incorporation-form.

Texas Lady Bird Deed Example

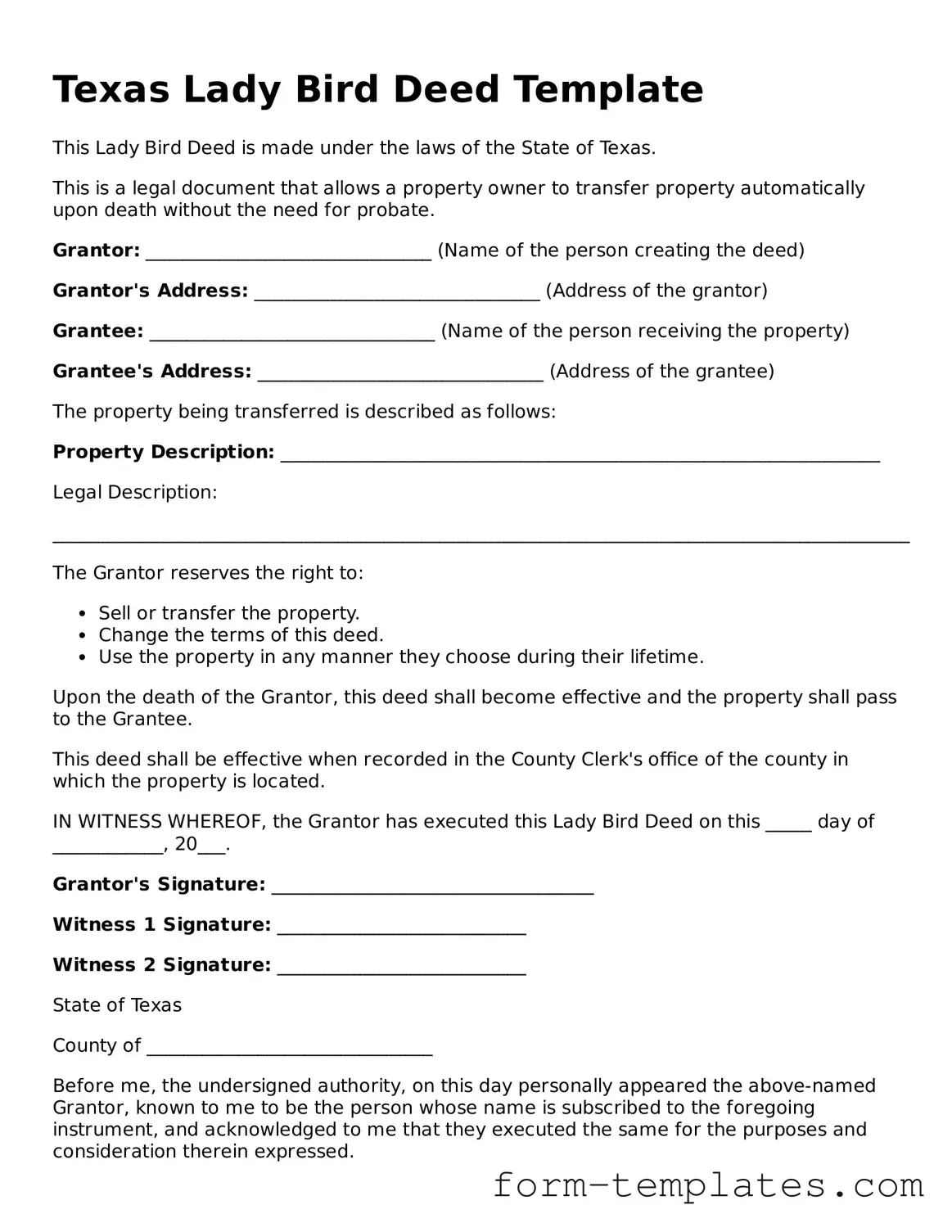

Texas Lady Bird Deed Template

This Lady Bird Deed is made under the laws of the State of Texas.

This is a legal document that allows a property owner to transfer property automatically upon death without the need for probate.

Grantor: _______________________________ (Name of the person creating the deed)

Grantor's Address: _______________________________ (Address of the grantor)

Grantee: _______________________________ (Name of the person receiving the property)

Grantee's Address: _______________________________ (Address of the grantee)

The property being transferred is described as follows:

Property Description: _________________________________________________________________

Legal Description:

_____________________________________________________________________________________________

The Grantor reserves the right to:

- Sell or transfer the property.

- Change the terms of this deed.

- Use the property in any manner they choose during their lifetime.

Upon the death of the Grantor, this deed shall become effective and the property shall pass to the Grantee.

This deed shall be effective when recorded in the County Clerk's office of the county in which the property is located.

IN WITNESS WHEREOF, the Grantor has executed this Lady Bird Deed on this _____ day of ____________, 20___.

Grantor's Signature: ___________________________________

Witness 1 Signature: ___________________________

Witness 2 Signature: ___________________________

State of Texas

County of _______________________________

Before me, the undersigned authority, on this day personally appeared the above-named Grantor, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this _____ day of ____________, 20___.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________