Printable Gift Deed Form for the State of Texas

Guide to Writing Texas Gift Deed

Filling out the Texas Gift Deed form is an important step in transferring property ownership. Once you have completed the form, it will need to be signed and filed appropriately to ensure the transfer is legally recognized.

- Obtain the Texas Gift Deed form. You can find this form online or at your local county clerk's office.

- Identify the grantor (the person giving the gift) and the grantee (the person receiving the gift). Fill in their full names and addresses in the designated spaces.

- Provide a description of the property being gifted. This should include the address and any relevant legal descriptions.

- State the consideration for the gift. In most cases, this will be “love and affection” or similar language, as gifts typically do not involve monetary exchange.

- Include any additional terms or conditions related to the gift, if applicable. This may involve stipulations about how the property can be used.

- Have the grantor sign the form in the presence of a notary public. The notary will also sign and seal the document to verify the authenticity of the signature.

- Submit the completed Gift Deed form to the appropriate county clerk’s office for recording. There may be a filing fee associated with this process.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by Texas Property Code, specifically Chapter 5. |

| Requirements | The deed must be in writing, signed by the grantor, and must be notarized to be valid. |

| Tax Implications | Gifts may have tax implications, and it is advisable to consult a tax professional regarding potential gift tax liabilities. |

FAQ

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is often used when someone wants to give a property as a gift to a family member or friend. It is important to note that the transfer must be voluntary and without consideration (payment).

Who can use a Gift Deed in Texas?

Any property owner in Texas can use a Gift Deed to transfer their property. This includes individuals, married couples, and even entities like trusts. However, both the giver (grantor) and the receiver (grantee) must be legally capable of entering into a contract. This means they should be of legal age and mentally competent.

What information is required to complete a Texas Gift Deed?

To complete a Texas Gift Deed, you will need the following information:

- The full legal names of the grantor (giver) and grantee (receiver).

- The property description, including the address and legal description.

- The date of the gift.

- Any specific terms or conditions related to the gift, if applicable.

Do I need to have the Gift Deed notarized?

Yes, in Texas, a Gift Deed must be notarized to be legally valid. This means that the grantor must sign the deed in front of a notary public, who will then affix their seal. Notarization helps ensure that the document is authentic and that the signatures are legitimate.

Is there a tax implication when giving a property as a gift?

Yes, there can be tax implications when transferring property as a gift. The IRS allows individuals to gift up to a certain amount each year without incurring gift tax. As of 2023, this amount is $17,000 per recipient. If the value of the property exceeds this limit, the grantor may need to file a gift tax return. It's advisable to consult a tax professional for specific guidance based on individual circumstances.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it generally cannot be revoked. The transfer is considered complete. However, if there are specific conditions outlined in the deed or if the grantor has retained certain rights, there may be exceptions. Consulting a legal expert can clarify any concerns about revocation.

How do I record a Gift Deed in Texas?

To record a Gift Deed in Texas, you must file the signed and notarized document with the county clerk's office in the county where the property is located. There may be a small fee for recording the deed. Once recorded, the deed becomes part of the public record, providing legal proof of the transfer.

What if the property has a mortgage?

If the property being gifted has an existing mortgage, the grantor should notify the lender about the transfer. The mortgage may not automatically be discharged upon the gift, and the grantee may need to assume the mortgage or refinance it. It's crucial to check the mortgage agreement for any stipulations regarding transfers of ownership.

Can I use a Gift Deed for personal property?

While a Gift Deed is specifically designed for real property, personal property can also be gifted using a different method, such as a simple written agreement or a bill of sale. However, if the personal property is of significant value, it may be wise to document the transfer formally to avoid any future disputes.

Consider Popular Gift Deed Forms for Specific States

Gift Deed California - Property given through a Gift Deed may be subject to gift tax if it exceeds a certain value.

Having a solid understanding of the California Vehicle Purchase Agreement is vital for anyone involved in a vehicle sale, as it lays down the specific terms that govern the transaction. This important document not only clarifies the expectations of both the buyer and the seller but also helps prevent potential disputes down the line. For those looking to familiarize themselves with this essential form, you can find more information here: https://californiadocsonline.com/vehicle-purchase-agreement-form.

Texas Gift Deed Example

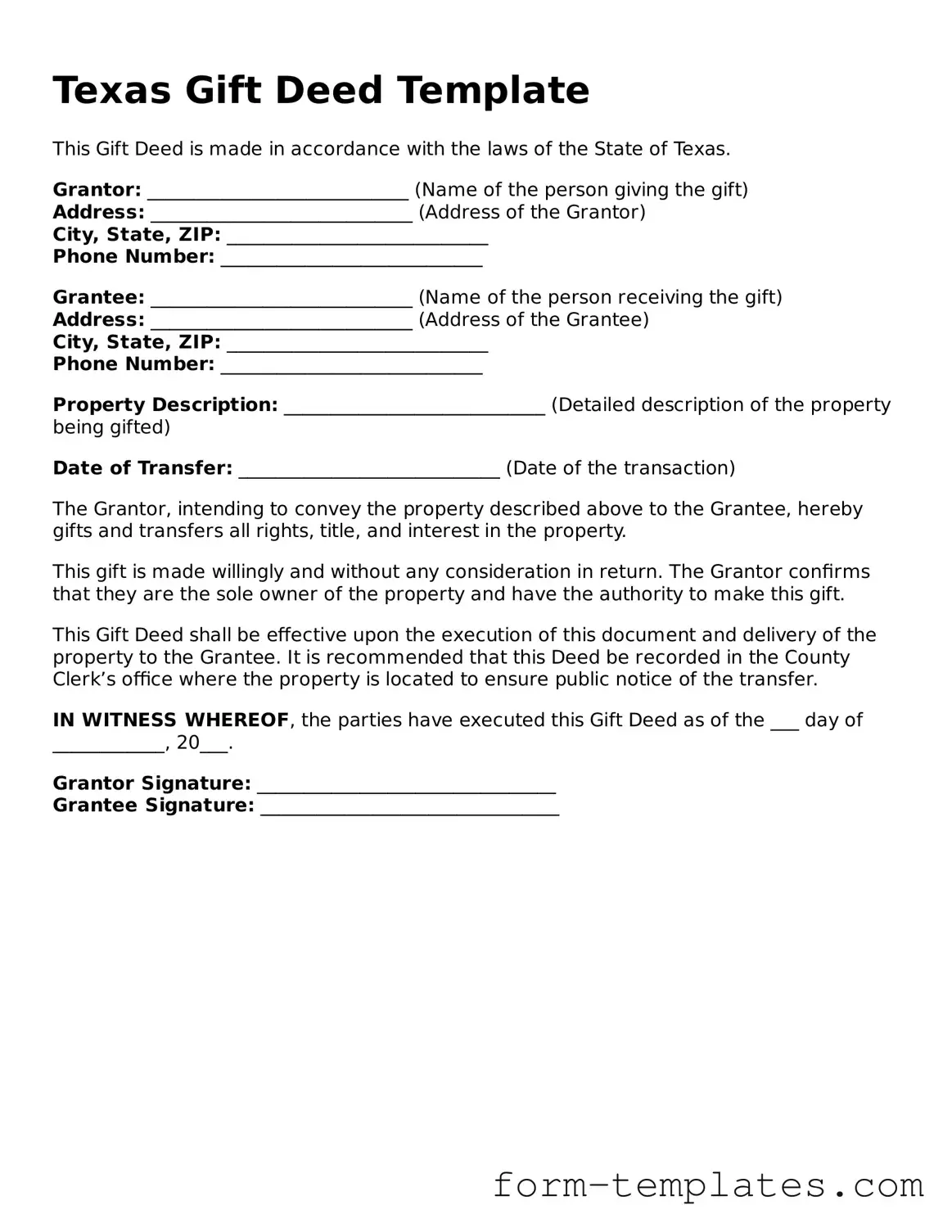

Texas Gift Deed Template

This Gift Deed is made in accordance with the laws of the State of Texas.

Grantor: ____________________________ (Name of the person giving the gift)

Address: ____________________________ (Address of the Grantor)

City, State, ZIP: ____________________________

Phone Number: ____________________________

Grantee: ____________________________ (Name of the person receiving the gift)

Address: ____________________________ (Address of the Grantee)

City, State, ZIP: ____________________________

Phone Number: ____________________________

Property Description: ____________________________ (Detailed description of the property being gifted)

Date of Transfer: ____________________________ (Date of the transaction)

The Grantor, intending to convey the property described above to the Grantee, hereby gifts and transfers all rights, title, and interest in the property.

This gift is made willingly and without any consideration in return. The Grantor confirms that they are the sole owner of the property and have the authority to make this gift.

This Gift Deed shall be effective upon the execution of this document and delivery of the property to the Grantee. It is recommended that this Deed be recorded in the County Clerk’s office where the property is located to ensure public notice of the transfer.

IN WITNESS WHEREOF, the parties have executed this Gift Deed as of the ___ day of ____________, 20___.

Grantor Signature: ________________________________

Grantee Signature: ________________________________