Printable Deed in Lieu of Foreclosure Form for the State of Texas

Guide to Writing Texas Deed in Lieu of Foreclosure

Once you have decided to proceed with a Deed in Lieu of Foreclosure, it is important to ensure that the form is filled out correctly. This step is crucial as it will help facilitate the transfer of property ownership back to the lender. Follow the steps outlined below to complete the form accurately.

- Begin by downloading the Texas Deed in Lieu of Foreclosure form from a reliable source or your lender's website.

- At the top of the form, enter the date on which you are completing the document.

- Provide the name of the borrower(s) in the designated section. Make sure to include all individuals listed on the mortgage.

- Next, write the address of the property that is subject to the deed. Include the complete street address, city, state, and zip code.

- In the section for the lender's information, input the full name of the lender or the lending institution.

- Include the lender's address, ensuring that it is accurate and complete.

- Fill in the legal description of the property. This information can usually be found on your mortgage documents or the property deed.

- Sign and date the form where indicated. All borrowers must sign the document to validate it.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Once notarized, make copies of the completed form for your records and for the lender.

- Submit the original deed to the lender as instructed, ensuring that you keep a copy for your own records.

After submitting the Deed in Lieu of Foreclosure, the lender will review the document. They may contact you for any additional information or clarification. Once everything is in order, the lender will process the deed and officially take ownership of the property.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers their property title to the lender to avoid foreclosure proceedings. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and minimize the impact on their credit score compared to a foreclosure. |

| Governing Laws | The Deed in Lieu of Foreclosure in Texas is governed by the Texas Property Code, particularly sections related to real estate transactions and foreclosure processes. |

| Requirements | Typically, lenders will require the borrower to be current on their mortgage payments or to have a valid reason for default before accepting a Deed in Lieu of Foreclosure. |

FAQ

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement between a homeowner and a lender. In this arrangement, the homeowner voluntarily transfers ownership of their property to the lender to avoid the lengthy and costly foreclosure process. This option can provide a more amicable resolution for both parties and can help the homeowner avoid the negative impact of foreclosure on their credit score.

How does the process work?

The process typically involves several steps:

- The homeowner contacts the lender to discuss the possibility of a Deed in Lieu of Foreclosure.

- Both parties agree on the terms, including any potential forgiveness of remaining mortgage debt.

- The homeowner signs the Deed in Lieu of Foreclosure form, transferring ownership of the property.

- The lender accepts the deed and the homeowner vacates the property.

It is essential for homeowners to understand the implications of this decision and to seek legal advice if necessary.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to consider:

- Less damage to credit score compared to a foreclosure.

- Potential forgiveness of remaining mortgage debt.

- A faster and less stressful process than traditional foreclosure.

- The opportunity to leave the property on better terms.

Are there any drawbacks?

While there are benefits, there are also some potential downsides:

- The lender may not agree to the deed if the property has significant negative equity.

- Homeowners may still face tax implications on forgiven debt.

- It may not be an option for all homeowners, particularly those with complicated financial situations.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility can vary by lender, but generally, homeowners who are struggling to make mortgage payments and are facing foreclosure may qualify. Lenders often look for homeowners who have a genuine financial hardship and have exhausted other options, such as loan modifications or short sales.

What happens to the homeowner's credit score?

A Deed in Lieu of Foreclosure typically results in less damage to a homeowner's credit score compared to a foreclosure. However, it will still have a negative impact. The extent of the impact can depend on various factors, including the homeowner's overall credit history.

Can the lender pursue a deficiency judgment?

In some cases, lenders may reserve the right to pursue a deficiency judgment for any remaining balance on the mortgage after the property is transferred. However, many lenders choose to forgive this debt as part of the agreement. Homeowners should clarify this with their lender before proceeding.

What should homeowners do before signing a Deed in Lieu of Foreclosure?

Before signing, homeowners should consider the following steps:

- Consult with a real estate attorney to understand the implications.

- Evaluate other options, such as loan modifications or short sales.

- Ensure they fully understand the terms of the agreement with the lender.

Taking these steps can help homeowners make informed decisions about their financial future.

Consider Popular Deed in Lieu of Foreclosure Forms for Specific States

Will I Owe Money After a Deed in Lieu of Foreclosure - Homeowners are encouraged to be forthcoming about their financial status to find the best solution.

Obtaining a Work Release form is a crucial step for individuals looking to transition from a correctional facility back into the workforce. This essential legal document not only facilitates temporary leave for employment but also aids in personal development and community involvement. For more information on how to properly complete this process, refer to the Doctor Release Form, which provides guidance on the necessary steps to take.

California Voluntary Foreclosure Deed - A choice for homeowners who want to simplify the process of leaving their property.

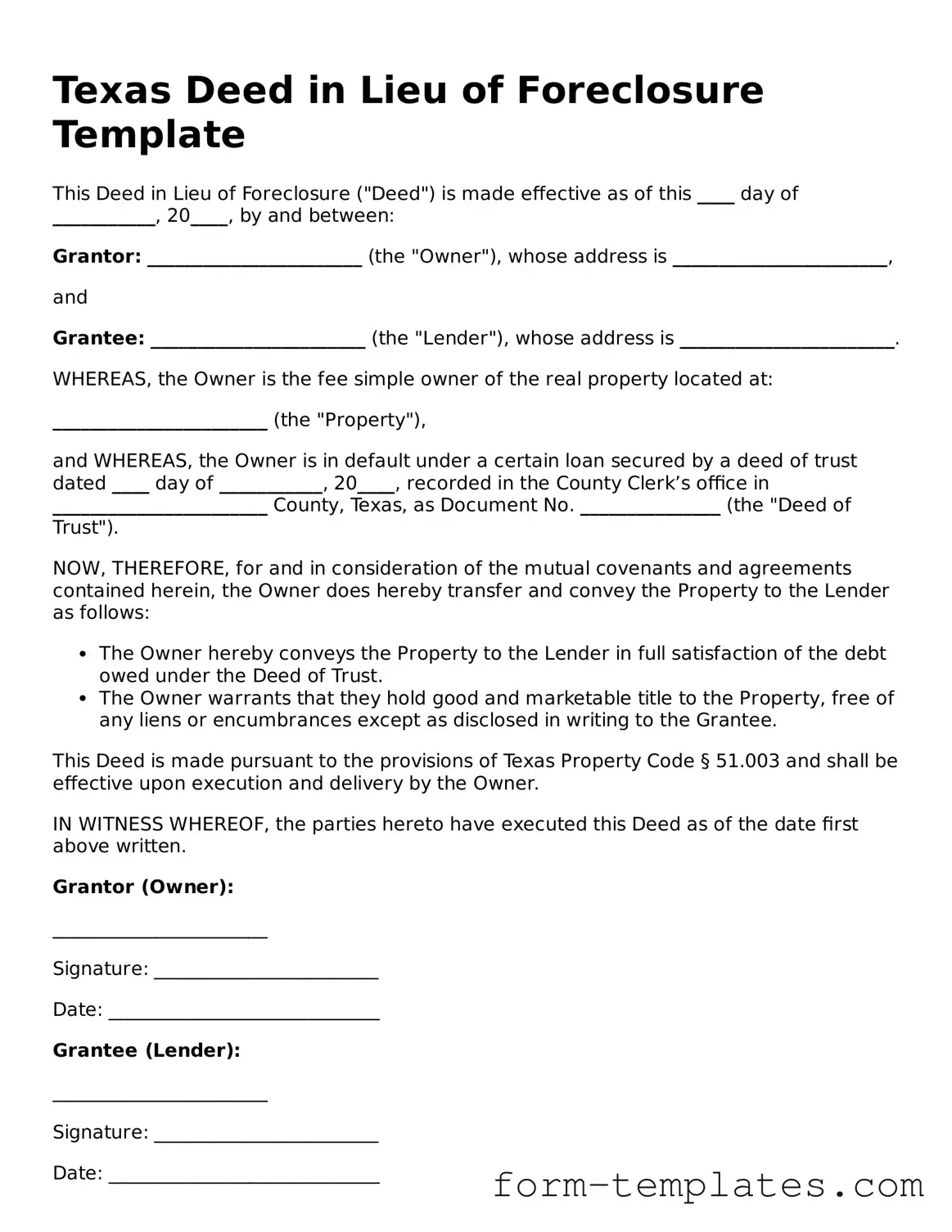

Texas Deed in Lieu of Foreclosure Example

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made effective as of this ____ day of ___________, 20____, by and between:

Grantor: _______________________ (the "Owner"), whose address is _______________________,

and

Grantee: _______________________ (the "Lender"), whose address is _______________________.

WHEREAS, the Owner is the fee simple owner of the real property located at:

_______________________ (the "Property"),

and WHEREAS, the Owner is in default under a certain loan secured by a deed of trust dated ____ day of ___________, 20____, recorded in the County Clerk’s office in _______________________ County, Texas, as Document No. _______________ (the "Deed of Trust").

NOW, THEREFORE, for and in consideration of the mutual covenants and agreements contained herein, the Owner does hereby transfer and convey the Property to the Lender as follows:

- The Owner hereby conveys the Property to the Lender in full satisfaction of the debt owed under the Deed of Trust.

- The Owner warrants that they hold good and marketable title to the Property, free of any liens or encumbrances except as disclosed in writing to the Grantee.

This Deed is made pursuant to the provisions of Texas Property Code § 51.003 and shall be effective upon execution and delivery by the Owner.

IN WITNESS WHEREOF, the parties hereto have executed this Deed as of the date first above written.

Grantor (Owner):

_______________________

Signature: ________________________

Date: _____________________________

Grantee (Lender):

_______________________

Signature: ________________________

Date: _____________________________

This Deed may be recorded in the appropriate real estate records of ________ County, Texas.