Printable Affidavit of Gift Form for the State of Texas

Guide to Writing Texas Affidavit of Gift

After obtaining the Texas Affidavit of Gift form, it’s important to complete it accurately. This form is used to document the transfer of property as a gift. Follow these steps to ensure that you fill it out correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the person giving the gift (the donor).

- Next, enter the full name and address of the person receiving the gift (the recipient).

- Clearly describe the property being gifted. Include details such as type, location, and any identifying information.

- Indicate the value of the gift. This can be an estimated value based on market conditions.

- Both the donor and recipient should sign and date the form to validate the transaction.

- If applicable, have a witness sign the form as well.

Once completed, the form should be submitted as required, ensuring all parties retain copies for their records. Proper documentation helps avoid future disputes and clarifies ownership.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Texas Affidavit of Gift form is used to document the transfer of property as a gift. |

| Governing Law | This form is governed by Texas Property Code, Section 123.001. |

| Eligibility | Any individual can use this form to gift property to another person. |

| Notarization | The form must be notarized to be considered valid. |

| Types of Property | Real estate, personal property, and financial assets can be gifted using this form. |

| Tax Implications | Gift taxes may apply depending on the value of the property transferred. |

| Revocation | A gift made using this form can be revoked under certain circumstances. |

| Record Keeping | It is advisable to keep a copy of the completed form for personal records. |

| Additional Requirements | Some gifts may require additional documentation, such as a deed for real estate. |

FAQ

What is the Texas Affidavit of Gift form?

The Texas Affidavit of Gift form is a legal document used to transfer ownership of property or assets as a gift. It serves as proof that the giver has voluntarily transferred their interest in the property to the recipient without expecting anything in return. This form is often used for real estate, vehicles, and other valuable items.

Who needs to use the Texas Affidavit of Gift form?

Anyone who wishes to give a gift of property or assets in Texas should consider using this form. This includes individuals giving gifts to family members, friends, or charitable organizations. It helps ensure that the transfer is documented and legally recognized, which can prevent future disputes.

What information is required on the form?

The form typically requires the following information:

- The full names and addresses of both the giver (donor) and the recipient (donee).

- A detailed description of the property or asset being gifted.

- The date of the gift.

- Any conditions or restrictions related to the gift, if applicable.

Is the Texas Affidavit of Gift form legally binding?

Yes, once properly completed and signed, the Texas Affidavit of Gift form is a legally binding document. It establishes the intent of the giver to transfer ownership and can be used in court if necessary. However, it is essential that both parties understand the implications of the gift and agree to the terms outlined in the affidavit.

Do I need a notary for the Texas Affidavit of Gift form?

Yes, the form should be notarized to ensure its validity. A notary public will verify the identities of the individuals signing the document and witness the signing. This adds an extra layer of authenticity and can help prevent any disputes regarding the gift in the future.

Can the Texas Affidavit of Gift form be revoked?

Generally, once a gift is made and the affidavit is signed, it cannot be revoked. However, if the gift was made under certain conditions or if fraud was involved, there may be legal avenues to challenge the gift. It’s important to consult with a legal professional if there are concerns about revocation.

Are there tax implications associated with using the Texas Affidavit of Gift form?

Yes, there may be tax implications when giving a gift. The IRS has specific rules regarding gift taxes, and gifts above a certain value may need to be reported. Both the giver and recipient should be aware of these potential tax consequences. It is advisable to consult with a tax professional for guidance.

How do I file the Texas Affidavit of Gift form?

The Texas Affidavit of Gift form does not typically need to be filed with any government agency. However, it is important to keep a copy for personal records. If the gift involves real estate, the affidavit may need to be recorded with the county clerk's office to ensure public notice of the transfer.

What happens if the Texas Affidavit of Gift form is not used?

If the affidavit is not used, the transfer of property may still occur, but it may lead to complications. Without proper documentation, disputes could arise regarding ownership or the intent of the gift. Using the affidavit helps protect both the giver and the recipient by clearly outlining the terms of the gift.

Where can I obtain the Texas Affidavit of Gift form?

The Texas Affidavit of Gift form can often be obtained from legal stationery stores, online legal document providers, or through a lawyer. It's important to ensure that you are using the most current version of the form to comply with Texas laws.

Consider Popular Affidavit of Gift Forms for Specific States

Affidavit for Gifting a Car Florida - It’s advisable to retain copies of the Affidavit of Gift for all parties involved.

The Florida Bill of Sale form is an essential document for anyone looking to make a legitimate purchase; it ensures that all parties involved are on the same page regarding the transfer of ownership. By using this form, both buyers and sellers can safeguard their interests while clearly delineating the specifics of the sale. To access a template that suits your needs, visit Top Document Templates and get started on solidifying your transaction.

Texas Affidavit of Gift Example

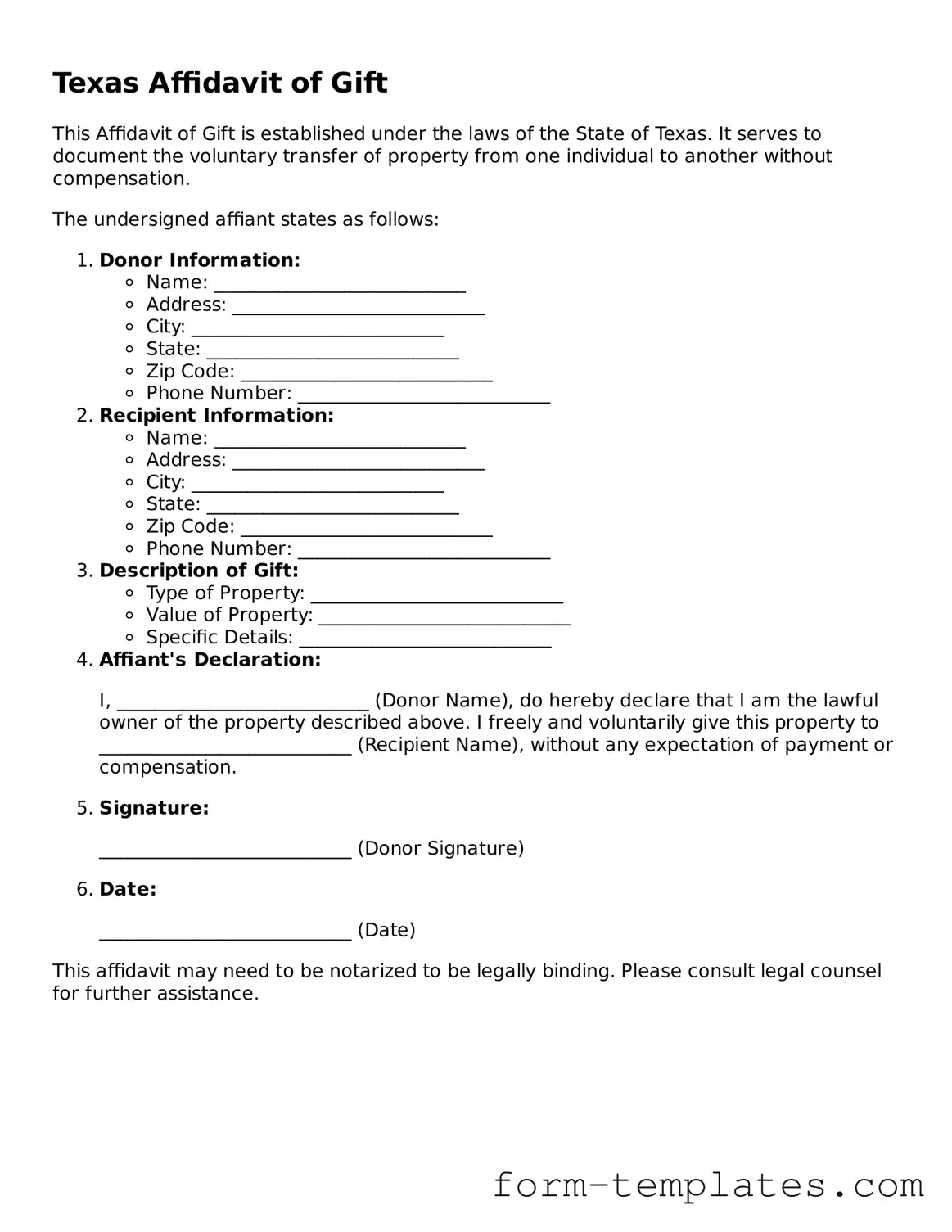

Texas Affidavit of Gift

This Affidavit of Gift is established under the laws of the State of Texas. It serves to document the voluntary transfer of property from one individual to another without compensation.

The undersigned affiant states as follows:

- Donor Information:

- Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: ___________________________

- Zip Code: ___________________________

- Phone Number: ___________________________

- Recipient Information:

- Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: ___________________________

- Zip Code: ___________________________

- Phone Number: ___________________________

- Description of Gift:

- Type of Property: ___________________________

- Value of Property: ___________________________

- Specific Details: ___________________________

- Affiant's Declaration:

- Signature:

- Date:

I, ___________________________ (Donor Name), do hereby declare that I am the lawful owner of the property described above. I freely and voluntarily give this property to ___________________________ (Recipient Name), without any expectation of payment or compensation.

___________________________ (Donor Signature)

___________________________ (Date)

This affidavit may need to be notarized to be legally binding. Please consult legal counsel for further assistance.