Fill Out a Valid Stock Transfer Ledger Template

Guide to Writing Stock Transfer Ledger

After completing the Stock Transfer Ledger form, you will have a clear record of stock transfers within your corporation. This document helps ensure accurate tracking of stock ownership and facilitates smooth transactions. Follow the steps below to fill out the form correctly.

- Begin by entering the corporation’s name at the top of the form.

- In the section labeled "Name of Stockholder," write the full name of the stockholder involved in the transaction.

- Provide the stockholder's place of residence in the designated area.

- For "Certificates Issued," indicate the number of stock certificates that have been issued to the stockholder.

- Fill in the "Cert. No." section with the certificate number corresponding to the issued shares.

- Enter the "Date" when the shares were issued.

- In the "From Whom Shares Were Transferred" section, specify the name of the person or entity from whom the shares were transferred. If this is an original issue, write "original issue."

- State the "Amount Paid Thereon" for the shares being transferred.

- Record the "Date of Transfer of Shares," noting when the transfer took place.

- In the "To Whom Shares Were Transferred" section, write the name of the individual or entity receiving the shares.

- Indicate the "Certificates Surrendered" by providing the certificate number of the shares that are being surrendered.

- Next, fill in the "No. Shares" area with the number of shares being transferred.

- Finally, calculate and enter the "Number of Shares Held (Balance)" to show the remaining shares held by the stockholder after the transfer.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to track the issuance and transfer of stock shares within a corporation. |

| Corporation Name | The form requires the name of the corporation at the top, ensuring clarity regarding which entity the ledger pertains to. |

| Stockholder Information | It includes details about the stockholder, such as their name and place of residence, to identify the individual or entity holding shares. |

| Certificates Issued | The form records the certificates issued, including certificate numbers and the number of shares associated with each certificate. |

| Transfer Details | It captures essential transfer details, including the date of transfer, the party from whom shares were transferred, and the recipient of the shares. |

| Governing Law | The Stock Transfer Ledger is governed by state corporate laws, which may vary by state. For example, in Delaware, it follows Title 8, Chapter 224 of the Delaware Code. |

FAQ

What is a Stock Transfer Ledger form?

The Stock Transfer Ledger form is a document used by corporations to track the issuance and transfer of stock shares. It records essential information such as the names of stockholders, the number of shares issued, and the details of any transfers. This ledger helps maintain an accurate account of ownership and is crucial for corporate governance.

What information is required on the form?

The form requires several key pieces of information, including:

- The corporation's name

- The name of the stockholder

- The place of residence of the stockholder

- Details about the certificates issued, including certificate numbers and dates

- The number of shares issued

- The amount paid for the shares

- The date of transfer of shares

- The name of the person to whom shares were transferred

- Information on certificates surrendered

- The balance of shares held

Who needs to complete the Stock Transfer Ledger form?

The form should be completed by corporate officers or designated individuals responsible for managing stock transactions. This may include the corporation's secretary or treasurer. It is essential for maintaining accurate records of stock ownership and transfers.

How is the Stock Transfer Ledger form used?

The form serves as an official record of stock transactions. When shares are issued or transferred, the details are entered into the ledger. This helps ensure transparency and accountability in stock ownership. It can also be used for legal purposes, such as verifying ownership during disputes or corporate actions.

Is the Stock Transfer Ledger form required by law?

While the form itself may not be mandated by law, maintaining a Stock Transfer Ledger is a best practice for corporations. Many states require corporations to keep accurate records of stock ownership. Failure to do so could lead to complications in ownership disputes or compliance with corporate regulations.

What happens if information on the form is incorrect?

If there is an error on the Stock Transfer Ledger form, it is crucial to correct it promptly. Errors can lead to disputes over ownership or issues with stock transfers. Corrections should be documented clearly, and the updated information should be reflected in the ledger to maintain accuracy.

Can the Stock Transfer Ledger form be maintained electronically?

Yes, the Stock Transfer Ledger form can be maintained electronically. Many corporations use software to track stock transactions and manage their ledgers. However, it is essential to ensure that the electronic records are secure and backed up. Compliance with any relevant regulations regarding electronic record-keeping should also be observed.

Fill out Other Forms

Roof Certificate of Completion - It is essential to provide the name and contact information of the roofing company in this form.

Profits or Loss From Business - Understanding deductions available on Schedule C can lead to significant tax savings.

The Florida Articles of Incorporation form is a legal document that establishes a corporation in the state of Florida. This form outlines essential details about the corporation, including its name, purpose, and the names of its initial directors. Completing this form is a crucial step for anyone looking to create a business entity in Florida, and you can find the necessary resources at floridadocuments.net/fillable-articles-of-incorporation-form.

Physical Form for School Sports - The physical exam portion conforms to standard medical practices.

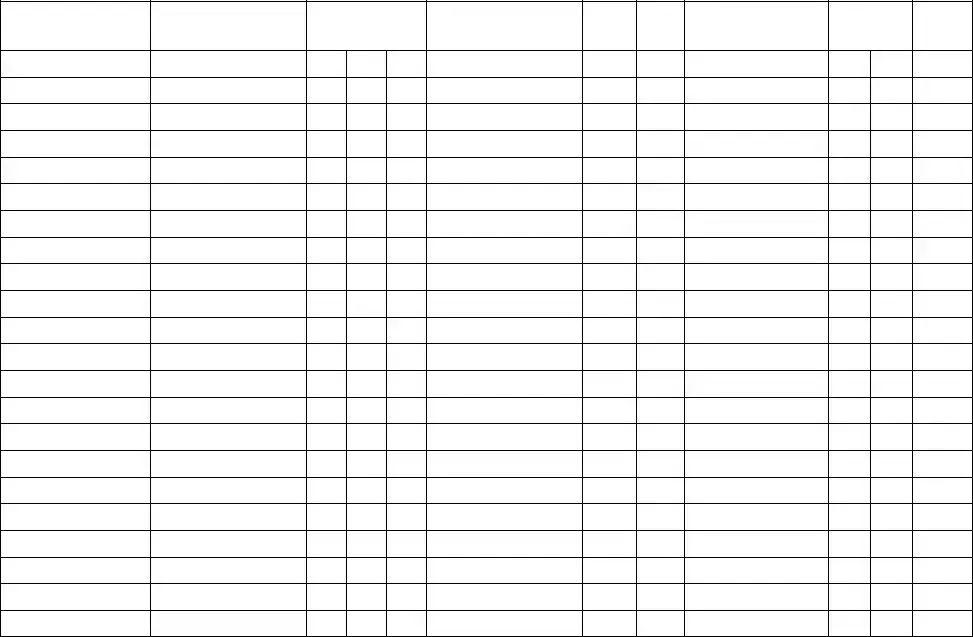

Stock Transfer Ledger Example

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)