Attorney-Approved Single-Member Operating Agreement Document

Guide to Writing Single-Member Operating Agreement

Completing the Single-Member Operating Agreement form is an important step for establishing the operational structure of a single-member limited liability company (LLC). This document outlines the management and financial arrangements of the LLC, ensuring clarity and legal protection for the owner.

- Begin by entering the name of the LLC at the top of the form. Ensure that the name matches the name registered with the state.

- Provide the principal address of the LLC. This should be a physical address where the business operates.

- Indicate the name of the sole member. This is the individual who owns and operates the LLC.

- Fill in the date when the agreement is being executed. This is typically the date you are completing the form.

- Detail the purpose of the LLC. Clearly state the business activities the LLC will engage in.

- Specify the management structure. Indicate that the LLC is managed by the sole member.

- Outline the financial arrangements. Include information on how profits and losses will be allocated to the member.

- Include any additional provisions that are relevant to the operation of the LLC, such as rules for transferring ownership or handling disputes.

- Sign and date the agreement at the bottom of the form. This signifies that you agree to the terms outlined in the document.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operating procedures for a single-member limited liability company (LLC). |

| Purpose | This agreement serves to establish the rights and responsibilities of the single member, protecting personal assets from business liabilities. |

| Governing Law | The governing laws for Single-Member Operating Agreements vary by state. For example, in Delaware, it is governed by Title 6, Chapter 18 of the Delaware Code. |

| Flexibility | The agreement allows for flexibility in management and operational decisions, which can be tailored to the specific needs of the member. |

| Tax Treatment | A single-member LLC is typically treated as a disregarded entity for tax purposes, meaning income and expenses are reported on the member's personal tax return. |

| Not Mandatory | While not legally required, having an operating agreement is highly recommended to clarify the member's intentions and reduce potential disputes. |

FAQ

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the ownership and operating procedures of a single-member limited liability company (LLC). This agreement serves as a blueprint for how the business will be run and clarifies the relationship between the owner and the LLC.

Why do I need a Single-Member Operating Agreement?

Having a Single-Member Operating Agreement is important for several reasons:

- It provides legal protection for your personal assets by reinforcing the separation between personal and business liabilities.

- The agreement can help prevent misunderstandings about how the business operates.

- It may be required by banks or investors when opening business accounts or applying for loans.

- It can simplify the process of transferring ownership if you decide to sell the business or bring in partners in the future.

What should be included in a Single-Member Operating Agreement?

While the specific content can vary, a typical Single-Member Operating Agreement should include:

- The name and address of the LLC.

- The name of the single member (owner).

- The purpose of the LLC.

- The management structure (typically, the owner manages the LLC).

- Provisions for handling profits and losses.

- Details on how to amend the agreement in the future.

Is a Single-Member Operating Agreement required by law?

No, a Single-Member Operating Agreement is not legally required in every state. However, many experts recommend having one to protect your limited liability status and clarify your business operations. Check your state’s specific requirements to ensure compliance.

How do I create a Single-Member Operating Agreement?

You can create a Single-Member Operating Agreement by following these steps:

- Gather necessary information about your LLC.

- Use a template or draft your own document, ensuring all key elements are included.

- Review the agreement for clarity and completeness.

- Sign the document and keep it with your business records.

Can I change my Single-Member Operating Agreement later?

Yes, you can amend your Single-Member Operating Agreement at any time. It’s advisable to document any changes in writing and keep a record of the updated agreement with your original documents. This ensures that your business operations remain clear and legally sound.

Where can I find a template for a Single-Member Operating Agreement?

Templates for a Single-Member Operating Agreement can be found online through various legal websites, business resource centers, or local government offices. Ensure that any template you use complies with your state’s specific regulations and requirements.

Other Single-Member Operating Agreement Templates:

How to File Operating Agreement Llc - Members can define the purpose and mission of the LLC in the agreement.

For those looking to establish a solid foundation for their business, utilizing an effective Operating Agreement template can be transformative. To get started, you can access the fillable form by visiting this user-friendly Operating Agreement resource.

Single-Member Operating Agreement Example

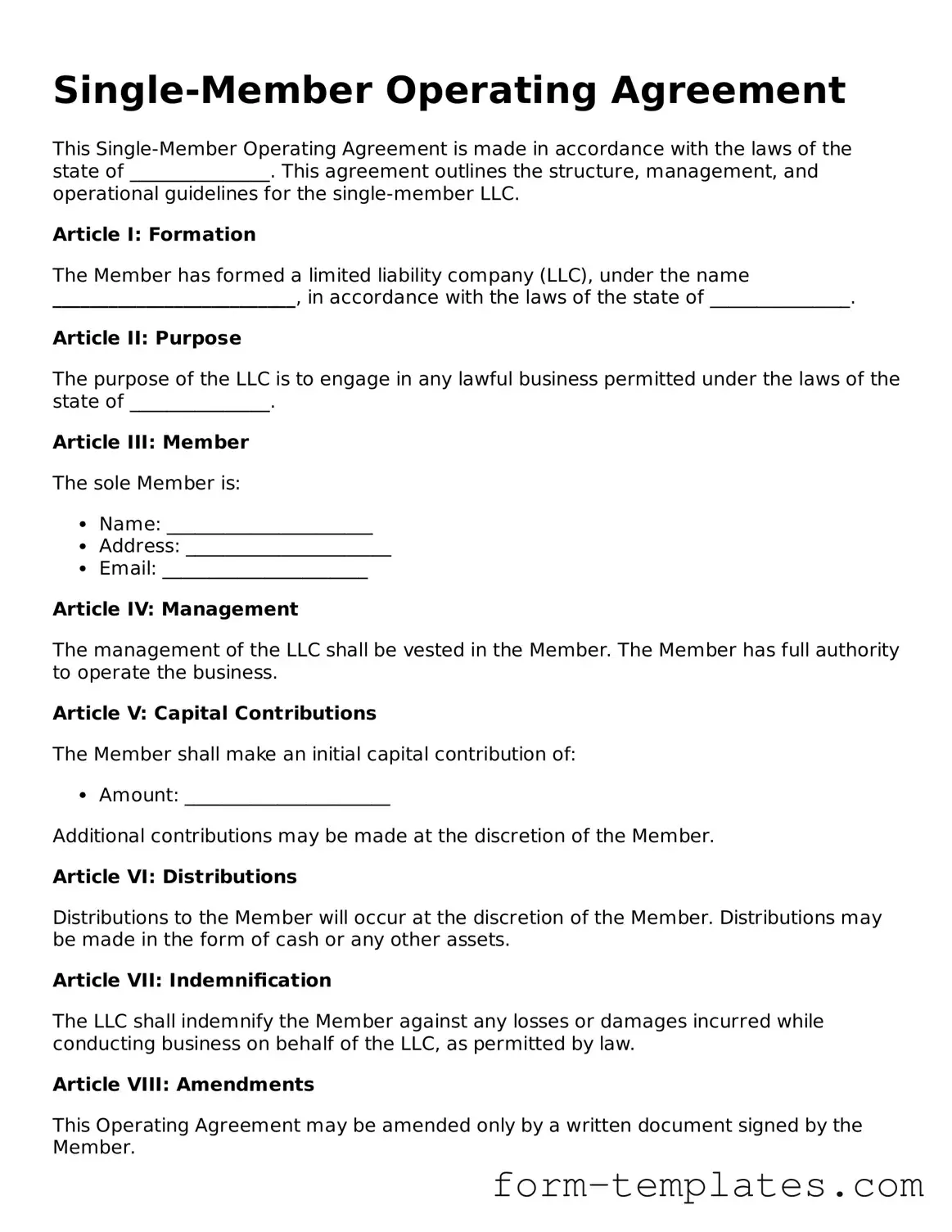

Single-Member Operating Agreement

This Single-Member Operating Agreement is made in accordance with the laws of the state of _______________. This agreement outlines the structure, management, and operational guidelines for the single-member LLC.

Article I: Formation

The Member has formed a limited liability company (LLC), under the name __________________________, in accordance with the laws of the state of _______________.

Article II: Purpose

The purpose of the LLC is to engage in any lawful business permitted under the laws of the state of _______________.

Article III: Member

The sole Member is:

- Name: ______________________

- Address: ______________________

- Email: ______________________

Article IV: Management

The management of the LLC shall be vested in the Member. The Member has full authority to operate the business.

Article V: Capital Contributions

The Member shall make an initial capital contribution of:

- Amount: ______________________

Additional contributions may be made at the discretion of the Member.

Article VI: Distributions

Distributions to the Member will occur at the discretion of the Member. Distributions may be made in the form of cash or any other assets.

Article VII: Indemnification

The LLC shall indemnify the Member against any losses or damages incurred while conducting business on behalf of the LLC, as permitted by law.

Article VIII: Amendments

This Operating Agreement may be amended only by a written document signed by the Member.

Article IX: Miscellaneous

- This agreement is governed by the laws of the state of _______________.

- If any provision of this agreement is found to be invalid or unenforceable, the remainder of this agreement will remain in effect.

IN WITNESS WHEREOF, the Member has executed this Single-Member Operating Agreement on this ____ day of ___________, 20____.

Member Signature: ______________________

Print Name: ______________________