Fill Out a Valid Sample Tax Return Transcript Template

Guide to Writing Sample Tax Return Transcript

Filling out the Sample Tax Return Transcript form can be straightforward if you follow the steps carefully. This form contains sensitive taxpayer information, so it’s important to handle it with care. After completing the form, you may need to submit it to the relevant tax authority or use it for your records. Here’s how to fill it out step by step:

- Gather Your Information: Collect all necessary documents, including your Social Security Number (SSN) and any other relevant financial information.

- Fill in the Date: Enter the date you are completing the form in the designated area.

- Provide Your SSN: Write your SSN clearly in the specified field. Ensure accuracy to avoid any issues.

- Enter Your Filing Status: Indicate your filing status (e.g., Single, Married Filing Jointly) as shown on your return.

- Input Income Details: Fill in your income details, including wages, salaries, and any other income sources. Be sure to check the amounts against your tax return.

- List Adjustments: If you have any adjustments to your income, such as educator expenses or self-employment tax deductions, enter those amounts in the appropriate sections.

- Calculate Tax and Credits: Input your tax liability and any credits you are eligible for, ensuring that you use the correct figures from your tax return.

- Detail Payments: Include any payments made, such as federal income tax withheld or estimated tax payments.

- Determine Refund or Amount Owed: Calculate whether you have a refund or owe taxes, and write that amount in the designated area.

- Complete Third Party Designee Section: If applicable, fill in the information for a third-party designee who can discuss your tax return with the IRS.

- Review for Accuracy: Double-check all entries for accuracy and completeness before finalizing the form.

Document Breakdown

| Fact Name | Description |

|---|---|

| Request Date | The tax return transcript was requested on August 9, 2018. |

| Response Date | The response to the request was also provided on August 9, 2018. |

| Tax Period Ending | This transcript covers the tax period ending December 31, 2017. |

| Filing Status | The taxpayer's filing status is Single. |

| Total Income | The total income reported is $15,500.00. |

| Adjusted Gross Income | The adjusted gross income is $15,323.00. |

| Total Tax Liability | The total tax liability is $1,103.00. |

| Amount Owed | The amount owed by the taxpayer is $103.00. |

FAQ

What is a Sample Tax Return Transcript?

A Sample Tax Return Transcript is a document provided by the IRS that summarizes your tax return information. It includes details such as income, deductions, and credits from a specific tax year. This transcript does not show subsequent account activity but reflects the amounts as they were originally reported or adjusted.

Who can request a Sample Tax Return Transcript?

Generally, anyone who has filed a tax return can request their transcript. This includes individuals, businesses, and tax professionals acting on behalf of clients. You will need to provide identifying information, such as your Social Security Number (SSN) or Employer Identification Number (EIN), to access your transcript.

How can I request my Sample Tax Return Transcript?

You can request your Sample Tax Return Transcript in several ways:

- Online through the IRS website using the "Get Transcript" tool.

- By mail, using Form 4506-T, which can be downloaded from the IRS website.

- By phone, calling the IRS at 1-800-908-9946 and following the prompts.

What information is included in the Sample Tax Return Transcript?

The transcript includes various details such as:

- Your total income and adjusted gross income.

- Taxable income and tax credits claimed.

- Filing status and any dependents listed.

- Payments made and any refund or amount owed.

It provides a clear snapshot of your tax situation for the specified year.

How long does it take to receive my Sample Tax Return Transcript?

If you request your transcript online, you may receive it immediately. For requests made by mail, it typically takes 5 to 10 business days to process and send the transcript. During peak tax season, processing times may be longer.

Is there a fee to obtain a Sample Tax Return Transcript?

No, there is no fee for requesting a Sample Tax Return Transcript. The IRS provides this service free of charge, whether you request it online, by mail, or by phone.

Can I use the Sample Tax Return Transcript for loan applications?

Yes, many lenders accept the Sample Tax Return Transcript as proof of income when applying for loans or mortgages. However, it's advisable to check with the specific lender to confirm their requirements.

What should I do if I notice an error in my Sample Tax Return Transcript?

If you find an error in your transcript, you should first review your original tax return. If the mistake is on the IRS's end, you may need to file an amended return using Form 1040-X. If the error is due to incorrect information you provided, you should correct it and then request a new transcript.

How long does the IRS keep my tax return information?

The IRS typically keeps tax return information for at least three years from the date you filed your return. However, if you filed a claim for a loss from bad debt or worthless securities, the IRS may keep your records for up to seven years. For more detailed inquiries, consult the IRS guidelines.

Fill out Other Forms

Gf Number on Deed - It’s important to provide complete and truthful information on the form.

Invoice Generator - Enhance your cash flow by issuing prompt professional invoices.

In addition to completing the FedEx Release Form, it's important to have access to reliable resources that guide you through the process. For comprehensive templates and examples, you can check out Top Document Templates, which can help streamline your experience and ensure everything is filled out correctly.

Verification of Rent - This form requests verification of a tenant's rental history.

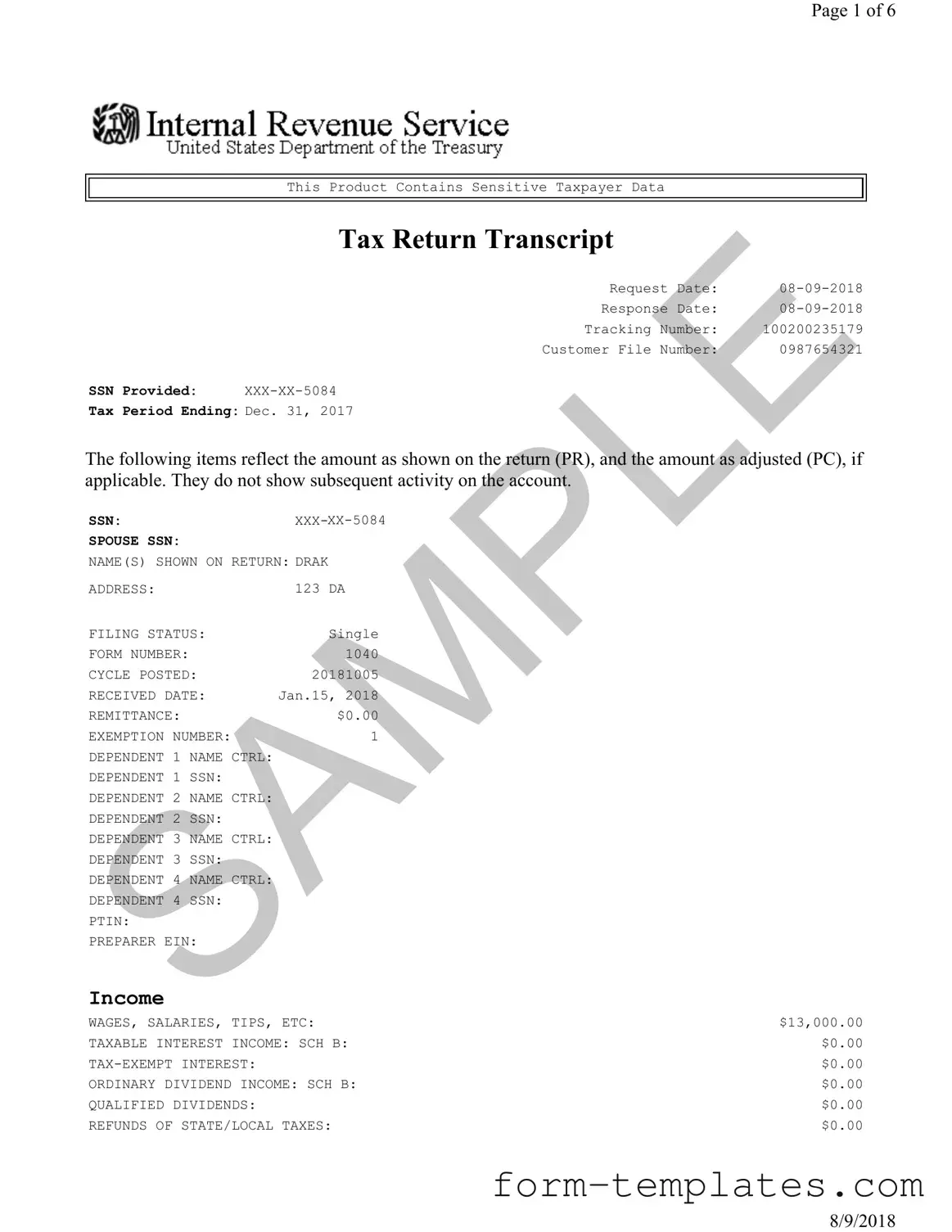

Sample Tax Return Transcript Example

Page 1 of 6

This Product Contains Sensitive Taxpayer Data

Tax Return Transcript

|

Request Date: |

|

|

Response Date: |

|

|

Tracking Number: |

100200235179 |

|

Customer File Number: |

0987654321 |

SSN Provided: |

|

Tax Period Ending: Dec. 31, 2017

The following items reflect the amount as shown on the return (PR), and the amount as adjusted (PC), if applicable. They do not show subsequent activity on the account.

SSN: |

|

|

SPOUSE SSN: |

|

|

NAME(S) SHOWN ON RETURN: DRAK |

||

ADDRESS: |

|

123 DA |

FILING STATUS: |

Single |

|

FORM NUMBER: |

|

1040 |

CYCLE POSTED: |

20181005 |

|

RECEIVED DATE: |

Jan.15, 2018 |

|

REMITTANCE: |

|

$0.00 |

EXEMPTION NUMBER: |

1 |

|

DEPENDENT 1 |

N ME CTRL: |

|

DEPENDENT 1 |

SSN: |

|

DEPENDENT 2 |

N ME CTRL: |

|

DEPENDENT 2 |

SSN: |

|

DEPENDENT 3 |

N ME CTRL: |

|

DEPENDENT 3 |

N: |

|

DEPENDENT 4 |

N ME CTRL: |

|

DEPENDENT 4 |

N: |

|

PTIN: |

|

|

PREPARER EIN: |

|

|

Income

WAGES, SALARIES, TIPS, ETC: |

$13,000.00 |

TAXABLE INTEREST INCOME: SCH B: |

$0.00 |

$0.00 |

|

ORDINARY DIVIDEND INCOME: SCH B: |

$0.00 |

QUALIFIED DIVIDENDS: |

$0.00 |

REFUNDS OF STATE/LOCAL TAXES: |

$0.00 |

8/9/2018

Page 2 of 6

ALIMONY RECEIVED: |

|

$0.00 |

BUSINESS INCOME OR LOSS (Schedule C): |

|

$2,500.00 |

BUSINESS INCOME OR LOSS: SCH C PER COMPUTER: |

|

$2,500.00 |

CAPITAL GAIN OR LOSS: (Schedule D): |

|

$0.00 |

CAPITAL GAINS OR LOSS: SCH D PER COMPUTER: |

|

$0.00 |

OTHER GAINS OR LOSSES (Form 4797): |

|

$0.00 |

TOTAL IRA DISTRIBUTIONS: |

|

$0.00 |

TAXABLE IRA DISTRIBUTIONS: |

|

$0.00 |

TOTAL PENSIONS AND ANNUITIES: |

|

$0.00 |

SAMPLE |

$0.00 |

|

TAXABLE PENSION/ANNUITY AMOUNT: |

|

|

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E): |

|

$0.00 |

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E) PER COMPUTER: |

|

$0.00 |

RENT/ROYALTY INCOME/LOSS PER COMPUTER: |

|

$0.00 |

ESTATE/TRUST INCOME/LOSS PER COMPUTER: |

|

$0.00 |

|

$0.00 |

|

FARM INCOME OR LOSS (Schedule F): |

|

$0.00 |

FARM INCOME OR LOSS (Schedule F) PER COMPUTER: |

|

$0.00 |

UNEMPLOYMENT COMPENSATION: |

|

$0.00 |

TOTAL SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS PER COM UTER: |

|

$0.00 |

OTHER INCOME: |

|

$0.00 |

SCHEDULE EIC SE INCOME PER COMPUTER: |

|

$2,323.00 |

SCHEDULE EIC EARNED INCOME PER COMPUTER: |

$15,323.00 |

|

SCH EIC DISQUALIFIED INC COMPUTER: |

|

$0.00 |

TOTAL INCOME: |

$15,500.00 |

|

TOTAL INCOME PER COMPUTER: |

$15,500.00 |

|

Adjustments to Income

EDUCATOR EXPENSES: |

|

$0.00 |

||

EDUCATOR EXPENSES PER CO PUTER: |

$0.00 |

|||

RESERVIST AND OTHER |

BUSINESS EXPENSE: |

$0.00 |

||

HEALTH |

VINGS |

CCT |

DEDUCTION: |

$0.00 |

HEALTH S VINGS |

CCT |

DEDUCTION PER CO PTR: |

$0.00 |

|

MOVING EXPENSES: F3903: |

$0.00 |

|||

SELF EMPLOYMENT T X DEDUCTION: |

$177.00 |

|||

SELF EMPLOYMENT T X DEDUCTION PER COMPUTER: |

$177.00 |

|||

ELF EMPLOYMENT T X DEDUCTION VERIFIED: |

$0.00 |

|||

KEOGH/ EP CONTRIBUTION DEDUCTION: |

$0.00 |

|||

$0.00 |

||||

EARLY WITHDRAWAL OF |

AVINGS PENALTY: |

$0.00 |

||

ALIMONY PAID |

N: |

|

|

|

ALIMONY PAID: |

|

|

$0.00 |

|

IRA DEDUCTION: |

|

|

$0.00 |

|

IRA DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION VERIFIED: |

$0.00 |

|||

TUITION AND FEES DEDUCTION: |

$0.00 |

|||

TUITION AND FEES DEDUCTION PER COMPUTER: |

$0.00 |

|||

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION: |

$0.00 |

|||

8/9/2018

Page 3 of 6

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

OTHER ADJUSTMENTS: |

|

|

$0.00 |

||

ARCHER MSA DEDUCTION: |

|

$0.00 |

|||

ARCHER MSA DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TOTAL ADJUSTMENTS: |

|

|

$177.00 |

||

TOTAL ADJUSTMENTS PER COMPUTER: |

|

$177.00 |

|||

ADJUSTED GROSS INCOME: |

$15,323.00 |

||||

ADJUSTED GROSS INCOME PER COMPUTER: |

$15,323.00 |

||||

SAMPLE |

|

||||

Tax and Credits |

|

|

|||

|

|

NO |

|||

BLIND: |

|

|

|

|

NO |

SPOUSE |

|

|

NO |

||

SPOUSE BLIND: |

|

|

NO |

||

STANDARD DEDUCTION PER COMPUTER: |

|

$4,850.00 |

|||

ADDITIONAL STANDARD DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TAX TABLE INCOME PER COMPUTER: |

$10,473.00 |

||||

EXEMPTION AMOUNT PER COMPUTER: |

|

$3,100.00 |

|||

TAXABLE INCOME: |

|

|

$7,373.00 |

||

TAXABLE INCOME PER COMPUTER: |

|

$7,373.00 |

|||

TOTAL POSITIVE INCOME PER COMPUTER: |

$15,500.00 |

||||

TENTATIVE TAX: |

|

|

$749.00 |

||

TENTATIVE TAX PER COMPUTER: |

|

$749.00 |

|||

FORM 8814 ADDITIONAL TAX AMOUNT: |

|

$0.00 |

|||

TAX ON INCOME LESS SOC SEC INCOME PER COM UTER: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE MINIMUM TAX: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE INI UM TAX PER CO UTER: |

|

$0.00 |

|||

FOREIGN TAX CREDIT: |

|

$0.00 |

|||

FOREIGN TAX CREDIT PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION TAX PER CO PUTER: |

|

$0.00 |

|||

EXCESS ADVANCE PREMIUM TAX CREDIT REPAY ENT OUNT: |

|

$0.00 |

|||

EXCESS |

DV NCE PREMIUM T X CREDIT REP Y ENT VERIFIED A OUNT: |

|

$0.00 |

||

CHILD & DEPENDENT C RE CREDIT: |

|

$0.00 |

|||

CHILD & DEPENDENT C RE CREDIT PER COMPUTER: |

|

$0.00 |

|||

CREDIT FOR ELDERLY |

ND DIS BLED: |

|

$0.00 |

||

CREDIT FOR ELDERLY |

ND DIS BLED PER COMPUTER: |

|

$0.00 |

||

EDUCATION CREDIT: |

|

|

$0.00 |

||

EDUCATION CREDIT PER COMPUTER: |

|

$0.00 |

|||

GRO EDUC TION CREDIT PER COMPUTER: |

|

$0.00 |

|||

RETIREMENT |

AVINGS CNTRB CREDIT: |

|

$0.00 |

||

RETIREMENT |

AVINGS CNTRB CREDIT PER COMPUTER: |

|

$0.00 |

||

PRIM RET |

|

AV CNTRB: F8880 LN6A: |

|

$0.00 |

|

EC RET |

AV CNTRB: F8880 LN6B: |

|

$0.00 |

||

TOTAL RETIREMENT |

AVINGS CONTRIBUTION: F8880 CMPTR: |

|

$0.00 |

||

RESIDENTIAL ENERGY CREDIT: |

|

$0.00 |

|||

RESIDENTIAL ENERGY CREDIT PER COMPUTER: |

|

$0.00 |

|||

CHILD TAX CREDIT: |

|

|

$0.00 |

||

CHILD TAX CREDIT PER COMPUTER: |

|

$0.00 |

|||

ADOPTION CREDIT: F8839: |

|

$0.00 |

|||

ADOPTION CREDIT PER COMPUTER: |

|

$0.00 |

|||

8/9/2018

Page 4 of 6

FORM 8396 MORTGAGE CERTIFICATE CREDIT: |

$0.00 |

|

FORM 8396 MORTGAGE CERTIFICATE CREDIT PER COMPUTER: |

$0.00 |

|

F3800, F8801 AND OTHER CREDIT AMOUNT: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS PER COMPUTER: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801 PER COMPUTER: |

$0.00 |

|

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT AMOUNT: |

$0.00 |

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

SAMPLE |

$0.00 |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT AMOUNT: |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

OTHER CREDITS: |

$0.00 |

|

TOTAL CREDITS: |

$0.00 |

|

TOTAL CREDITS PER COMPUTER: |

$0.00 |

|

INCOME TAX AFTER CREDITS PER COMPUTER: |

$749.00 |

|

Other Taxes

SE TAX: |

|

$354.00 |

SE TAX PER COMPUTER: |

|

$354.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNREPORTED TIPS: |

|

$0.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNRE ORTED TI |

ER COM UTER: |

$0.00 |

TAX ON QUALIFIED PLANS F5329 (PR): |

|

$0.00 |

TAX ON QUALIFIED PLANS F5329 PER COM UTER: |

|

$0.00 |

IRAF TAX PER COMPUTER: |

|

$0.00 |

TP TAX FIGURES (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

IMF TOTAL TAX (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

OTHER TAXES PER COMPUTER: |

|

$0.00 |

UNPAID FICA ON REPORTED TIPS: |

|

$0.00 |

OTHER TAXES: |

|

$0.00 |

RECAPTURE TAX: F8611: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES PER CO PUTER: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY VERIFIED: |

|

$0.00 |

HEALTH COVER GE REC PTURE: F8885: |

|

$0.00 |

RECAPTURE T XES: |

|

$0.00 |

TOTAL SSESSMENT PER COMPUTER: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES PER COMPUTER: |

|

$1,103.00 |

Payments

FEDERAL INCOME TAX WITHHELD: |

$1,000.00 |

|

HEALTH CARE: INDIVIDUAL RESPONSIBILITY: |

$0.00 |

|

HEALTH CARE |

0 |

|

E TIMATED TAX |

PAYMENT : |

$0.00 |

OTHER PAYMENT CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT PER COMPUTER: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT VERIFIED: |

$0.00 |

|

EARNED INCOME CREDIT: |

$0.00 |

|

EARNED INCOME CREDIT PER COMPUTER: |

$0.00 |

|

EARNED INCOME CREDIT NONTAXABLE COMBAT PAY: |

$0.00 |

|

8/9/2018

Page 5 of 6

SCHEDULE 8812 |

NONTAXABLE COMBAT PAY: |

$0.00 |

EXCESS SOCIAL |

SECURITY & RRTA TAX WITHHELD: |

$0.00 |

SCHEDULE 8812 |

TOT SS/MEDICARE WITHHELD: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT PER COMPUTER: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT VERIFIED: |

$0.00 |

AMOUNT PAID WITH FORM 4868: |

$0.00 |

|

FORM 2439 REGULATED INVESTMENT COMPANY CREDIT: |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS: |

$0.00 |

|

SAMPLE |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS PER COMPUTER: |

||

HEALTH COVERAGE TX CR: F8885: |

$0.00 |

|

PREMIUM TAX CREDIT AMOUNT: |

$0.00 |

|

PREMIUM TAX CREDIT VERIFIED AMOUNT: |

$0.00 |

|

PRIMARY NAP FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

|

SECONDARY NAP |

FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

FIRST TIME HOMEBUYER CREDIT REPAYMENT AMOUNT: |

$0.00 |

|

FORM 5405 TOTAL HOMEBUYERS CREDIT REPAYMENT PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER (2): |

$0.00 |

|

FORM 2439 AND |

OTHER CREDITS: |

$0.00 |

TOTAL PAYMENTS: |

$1,000.00 |

|

TOTAL PAYMENTS PER COMPUTER: |

$1,000.00 |

|

Refund or Amount Owed

AMOUNT YOU OWE: |

$103.00 |

APPLIED TO NEXT YEAR'S ESTIMATED TAX: |

$0.00 |

ESTIMATED TAX PENALTY: |

$0.00 |

TAX ON INCOME LESS STATE REFUND PER CO UTER: |

$0.00 |

BAL DUE/OVER PYMT USING TP FIG PER CO PUTER: |

$103.00 |

BAL DUE/OVER PYMT USING CO PUTER FIGURES: |

$103.00 |

FORM 8888 TOTAL REFUND PER CO PUTER: |

$0.00 |

Third Party Designee

THIRD P RTY DESIGNEE ID NU BER: |

|

AUTHORIZ TION INDIC TOR: |

0 |

THIRD RTY DESIGNEE N ME: |

|

Schedule

OCIAL |

ECURITY NUMBER: |

|

EMPLOYER |

ID NUMBER: |

|

BU INE |

NAME: |

|

DE CRIPTION OF BU INE /PROFESSION: |

DRAK |

|

NAICS CODE: |

000000 |

|

ACCT MTHD: |

|

|

FIR T TIME CHEDULE C FILED: |

N |

|

TATUTORY EMPLOYEE IND: |

N |

|

INCOME

GROSS RECEIPTS OR SALES: |

$2,700.00 |

RETURNS AND ALLOWANCES: |

$0.00 |

NET GROSS RECEIPTS: |

$0.00 |

COST OF GOODS SOLD: |

$0.00 |

SCHEDULE C FORM 1099 REQUIRED: |

NONE |

8/9/2018

Page 6 of 6

SCHEDULE C FORM 1099 FILED: |

NONE |

OTHER INCOME: |

$0.00 |

EXPENSES

CAR AND TRUCK EXPENSES: |

$0.00 |

DEPRECIATION: |

$0.00 |

INSURANCE (OTHER THAN HEALTH): |

$0.00 |

MORTGAGE INTEREST: |

$0.00 |

LEGAL AND PROFESSIONAL SERVICES: |

$0.00 |

SAMPLE |

$0.00 |

REPAIRS AND MAINTENANCE: |

|

TRAVEL: |

$0.00 |

MEALS AND ENTERTAINMENT: |

$0.00 |

WAGES: |

$0.00 |

OTHER EXPENSES: |

$0.00 |

TOTAL EXPENSES: |

$200.00 |

EXP FOR BUSINESS USE OF HOME: |

$0.00 |

SCH C NET PROFIT OR LOSS PER COMPUTER: |

$2,500.00 |

AT RISK CD: |

|

OFFICE EXPENSE AMOUNT: |

$0.00 |

UTILITIES EXPENSE AMOUNT: |

$0.00 |

COST OF GOODS SOLD

INVENTORY |

AT |

BEGINNING OF |

YEAR: |

$0.00 |

INVENTORY |

AT |

END OF YEAR: |

|

$0.00 |

Schedule

SSN OF |

|

NET FARM PROFIT/LOSS: SCH F: |

$0.00 |

CONSERVATION RESERVE PROGRAM PAY ENTS: |

$0.00 |

NET NONFARM PROFIT/LOSS: |

$2,500.00 |

TOTAL SE INCOME: |

$2,500.00 |

SE QUARTERS COVERED: |

4 |

TOTAL SE TAX PER COMPUTER: |

$353.12 |

SE INCOME COMPUTER VERIFIED: |

$0.00 |

SE INCOME PER COMPUTER: |

$2,308.00 |

TOTAL NET E RNINGS PER CO PUTER: |

$2,308.00 |

LONG FORM ONLY

TENTATIVE |

CHURCH RNINGS: |

$0.00 |

|

TOTAL SOC |

SEC & RR W GES: |

$0.00 |

|

E |

T X |

COMPUTER: |

$286.19 |

E MEDIC RE INCOME PER COMPUTER: |

$2,308.00 |

||

E MEDICARE TAX PER COMPUTER: |

$66.93 |

||

E FARM OPTION METHOD U ED: |

0 |

||

E OPTIONAL METHOD INCOME: |

$0.00 |

||

Form 8863 - Education Credits (Hope and Lifetime Learning Credits)

PART III - ALLOWABLE EDUCATION CREDITS

GROSS EDUCATION CR PER COMPUTER: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT PER COMPUTER: |

$0.00 |

|

|

|

This Product Contains Sensitive Taxpayer Data |

|

|

|

|

|

|

8/9/2018