Attorney-Approved Release of Promissory Note Document

Guide to Writing Release of Promissory Note

Once you have the Release of Promissory Note form in hand, it’s time to fill it out accurately. This form is essential for finalizing the agreement and ensuring that all parties are on the same page. Follow these steps to complete the form correctly.

- Read the form carefully. Make sure you understand each section before filling it out.

- Fill in your name. Write your full legal name in the designated space.

- Provide the other party's name. Enter the name of the person or entity you are releasing from the promissory note.

- Include the date. Write the date when you are completing the form.

- Describe the promissory note. Include details such as the original amount, date of the note, and any relevant identifiers.

- Sign the form. Make sure to sign where indicated to validate the release.

- Print your name. After signing, print your name below your signature.

- Provide contact information. Fill in your phone number and email address for any follow-up communication.

- Submit the form. Send it to the appropriate party or keep it for your records as needed.

After completing the form, ensure that you keep a copy for your records. This will serve as proof of the release and can be referenced in the future if necessary. If you need to send it to another party, do so promptly to maintain clear communication.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note is a legal document that signifies the cancellation of a promissory note. |

| Purpose | This form is used to formally acknowledge that the borrower has fulfilled their obligation to repay the loan. |

| Governing Law | The laws governing the release of promissory notes vary by state, often referencing the Uniform Commercial Code (UCC). |

| State-Specific Example | In California, Civil Code Section 2954.5 outlines the requirements for releasing a promissory note. |

| Signature Requirement | The release must be signed by the lender or their authorized representative to be valid. |

| Notarization | While notarization is not always required, it can provide additional legal protection and authenticity. |

| Record Keeping | Once executed, the release should be kept with the original promissory note for future reference. |

| Impact on Credit | A release of the note can positively affect the borrower's credit report by indicating that the debt has been satisfied. |

| Dispute Resolution | If disputes arise regarding the release, they may be addressed through mediation or court proceedings, depending on state law. |

FAQ

What is a Release of Promissory Note?

A Release of Promissory Note is a legal document that formally indicates that a borrower has fulfilled their obligation to repay a loan. It serves as proof that the lender no longer holds any claim against the borrower regarding that specific loan.

When is a Release of Promissory Note necessary?

This document is necessary when a borrower has paid off a promissory note in full. It protects the borrower from any future claims by the lender regarding that loan. Additionally, it can be required by the borrower to clear their financial records.

How do I obtain a Release of Promissory Note?

To obtain a Release of Promissory Note, the borrower should contact the lender after the loan has been paid in full. The lender will then prepare the release document. It is advisable to request this document in writing to ensure there is a formal record of the release.

What should be included in the Release of Promissory Note?

A comprehensive Release of Promissory Note should include:

- The names of both the borrower and lender.

- The original date of the promissory note.

- The amount that was borrowed.

- A statement confirming that the loan has been paid in full.

- The date of the release.

- The signatures of both parties.

Is a Release of Promissory Note legally binding?

Yes, once signed by both parties, a Release of Promissory Note is a legally binding document. It signifies that the lender relinquishes any rights to collect further payments on the loan, thus protecting the borrower from future claims.

What happens if a Release of Promissory Note is not issued?

If a Release of Promissory Note is not issued, the borrower may still be viewed as owing money on the loan. This can lead to complications, such as credit issues or disputes with the lender in the future. It is crucial to obtain this release to avoid any misunderstandings.

Can I create my own Release of Promissory Note?

While it is possible to create your own Release of Promissory Note, it is recommended to use a template or seek legal advice to ensure that all necessary information is included and that the document complies with state laws. An improperly drafted release may lead to issues down the line.

What should I do if my lender refuses to provide a Release of Promissory Note?

If a lender refuses to provide a Release of Promissory Note after the loan has been paid in full, the borrower should first request a written explanation. If the lender continues to refuse, the borrower may need to seek legal advice or file a complaint with the appropriate regulatory agency.

Can a Release of Promissory Note be revoked?

Generally, a Release of Promissory Note cannot be revoked once it has been signed and executed, as it is a formal acknowledgment that the debt has been satisfied. However, if there was fraud or misrepresentation involved, legal action may be necessary to address the situation.

Where should I keep my Release of Promissory Note?

It is advisable to keep the Release of Promissory Note in a safe place, such as a locked file or a safe deposit box. Having a copy readily available can be helpful for future reference, especially when dealing with credit reports or financial institutions.

Other Release of Promissory Note Templates:

Car Loan Note - Often requires notarization to enhance its legal validity.

In the context of financing, utilizing a properly formatted New Jersey Promissory Note is crucial for both lenders and borrowers, as it serves as a safeguard and a record of the loan agreement. This document not only specifies the terms of repayment but also helps in preventing misunderstandings and disputes. For those seeking a reliable template, resources like newjerseyformspdf.com/editable-promissory-note/ can be invaluable in creating a legally sound promissory note that meets New Jersey regulations.

Release of Promissory Note Example

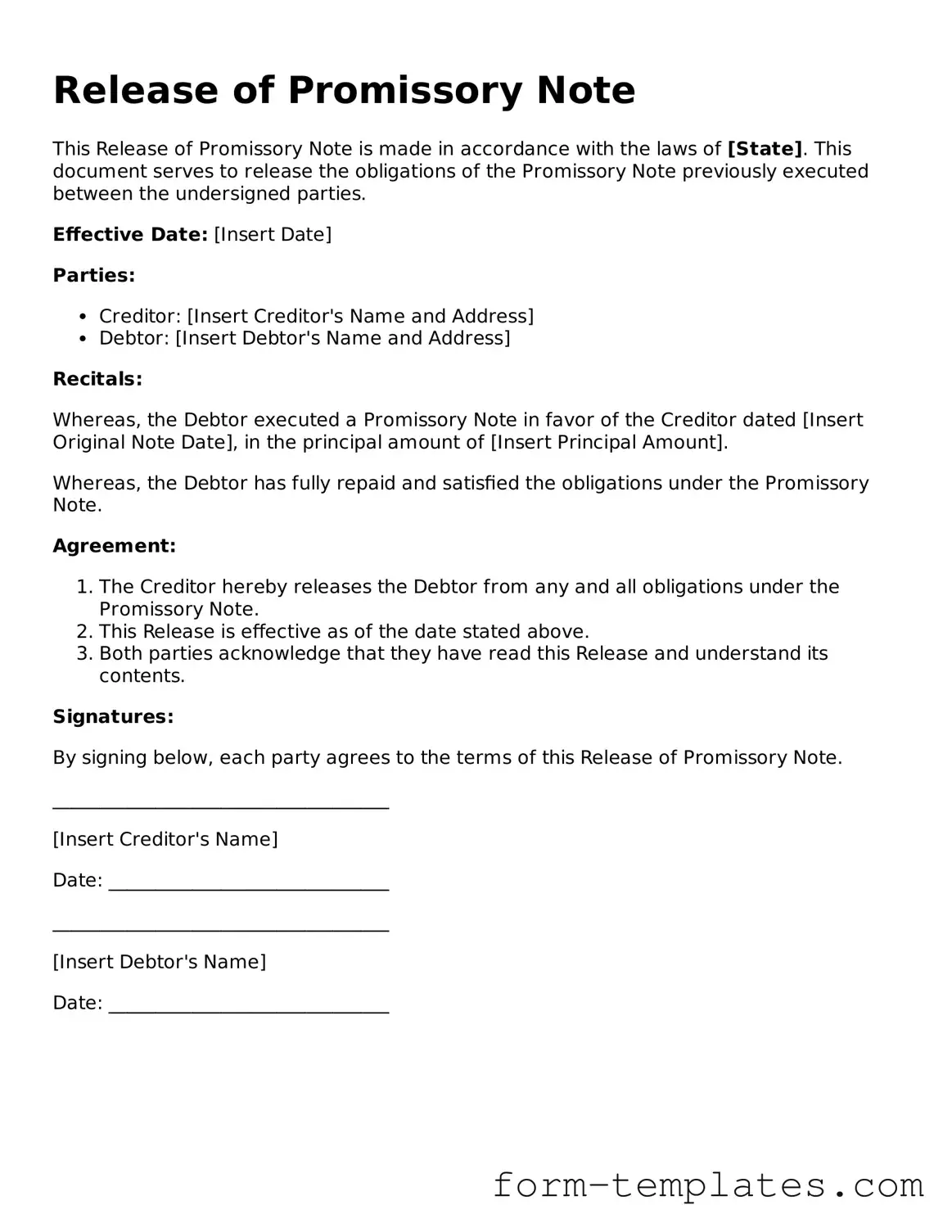

Release of Promissory Note

This Release of Promissory Note is made in accordance with the laws of [State]. This document serves to release the obligations of the Promissory Note previously executed between the undersigned parties.

Effective Date: [Insert Date]

Parties:

- Creditor: [Insert Creditor's Name and Address]

- Debtor: [Insert Debtor's Name and Address]

Recitals:

Whereas, the Debtor executed a Promissory Note in favor of the Creditor dated [Insert Original Note Date], in the principal amount of [Insert Principal Amount].

Whereas, the Debtor has fully repaid and satisfied the obligations under the Promissory Note.

Agreement:

- The Creditor hereby releases the Debtor from any and all obligations under the Promissory Note.

- This Release is effective as of the date stated above.

- Both parties acknowledge that they have read this Release and understand its contents.

Signatures:

By signing below, each party agrees to the terms of this Release of Promissory Note.

____________________________________

[Insert Creditor's Name]

Date: ______________________________

____________________________________

[Insert Debtor's Name]

Date: ______________________________