Fill Out a Valid Release Of Lien Texas Template

Guide to Writing Release Of Lien Texas

Once you have gathered the necessary information, you can proceed to fill out the Release of Lien form. This document is essential for formally releasing a lien on a property, ensuring that all parties involved are clear on the status of the lien. Follow these steps carefully to complete the form accurately.

- Date: Enter the current date at the top of the form.

- Holder of Note and Lien: Provide the name of the individual or entity that holds the lien.

- Holder’s Mailing Address: Fill in the complete mailing address of the lien holder, including the county.

- Note Date: Indicate the date when the original note was executed.

- Original Principal Amount: Write down the original amount of the loan or note.

- Borrower: Enter the name of the borrower who took out the loan.

- Lender: Provide the name of the lender who issued the loan.

- Maturity Date (optional): If applicable, include the date when the loan is due.

- Note and Lien Are Described in the Following Documents, Recorded in: Specify the documents that describe the lien, including where they are recorded.

- Property: Describe the property that the lien pertains to, including any improvements made.

- Acknowledgment: In the acknowledgment section, indicate the state and county where the document is being signed.

- Notary Public: After the acknowledgment, a notary public must sign and print their name, along with the expiration date of their commission.

- Corporate Acknowledgment (if applicable): If a corporation is involved, complete the corporate acknowledgment section with the necessary details.

- After Recording Return To: At the bottom of the form, include the name and address of the law office or individual to whom the document should be returned after it has been recorded.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Release of Lien form is used to officially release a lien on a property, indicating that the debt has been paid in full. |

| Governing Law | This form is governed by Texas property law, specifically the Texas Property Code. |

| Prepared By | The form is prepared by the State Bar of Texas and is intended for use by attorneys. |

| Notary Requirement | The document must be acknowledged by a notary public to be considered valid. |

| Information Included | Key details include the holder of the note and lien, the borrower's name, and property description. |

| Release of Future Claims | The holder waives any rights to enforce the lien for future debts once the lien is released. |

| Document Recording | Once completed, the form must be recorded in the county where the property is located. |

| Original Principal Amount | The form requires the original principal amount of the loan to be specified. |

| Return Instructions | After recording, the document should be returned to the law office that prepared it. |

FAQ

What is a Release of Lien Texas form?

The Release of Lien Texas form is a legal document used to formally release a lien on a property. This document is typically prepared by a lawyer and is filed when the debt secured by the lien has been paid in full. By signing this form, the lien holder acknowledges that they no longer have any claim against the property.

Who needs to use this form?

This form is primarily used by lien holders, such as lenders or creditors, who want to release their claim on a property after the borrower has fulfilled their payment obligations. It is essential for property owners to ensure that any liens are released to clear their title.

What information is required to complete the form?

To complete the Release of Lien Texas form, you will need to provide the following information:

- Date of the release

- Name of the holder of the note and lien

- Mailing address of the lien holder

- Date of the original note

- Original principal amount of the loan

- Name of the borrower

- Name of the lender

- Maturity date (if applicable)

- Description of the documents recorded

- Property description, including any improvements

How does the lien release process work?

Once the lien holder acknowledges that the debt has been paid in full, they will complete and sign the Release of Lien form. This document should then be filed with the appropriate county office where the original lien was recorded. Filing the form officially removes the lien from the property’s title.

What happens if the lien is not released?

If a lien is not released after the debt is paid, the property owner may face challenges when trying to sell or refinance the property. A lingering lien can complicate transactions and may lead to legal disputes. It is crucial to ensure that the lien is properly released to avoid these issues.

Can a Release of Lien be revoked?

Generally, once a Release of Lien has been executed and recorded, it cannot be revoked. The lien holder waives their rights to enforce the lien for future debts. However, if there was fraud or misrepresentation involved, legal action may be necessary to address the situation.

Is legal assistance required to complete this form?

Fill out Other Forms

Annual Vehicle Inspection Report - This inspection incorporates various components of the vehicle for comprehensive assessment.

To facilitate the payment process for employees, employers can utilize various tools and templates, such as the Blank Check Template, which simplifies the creation of Payroll Check forms and ensures all necessary information is included for proper issuance.

Veteran Designation - The form certifies the applicant’s service in the United States uniformed services.

Release Of Lien Texas Example

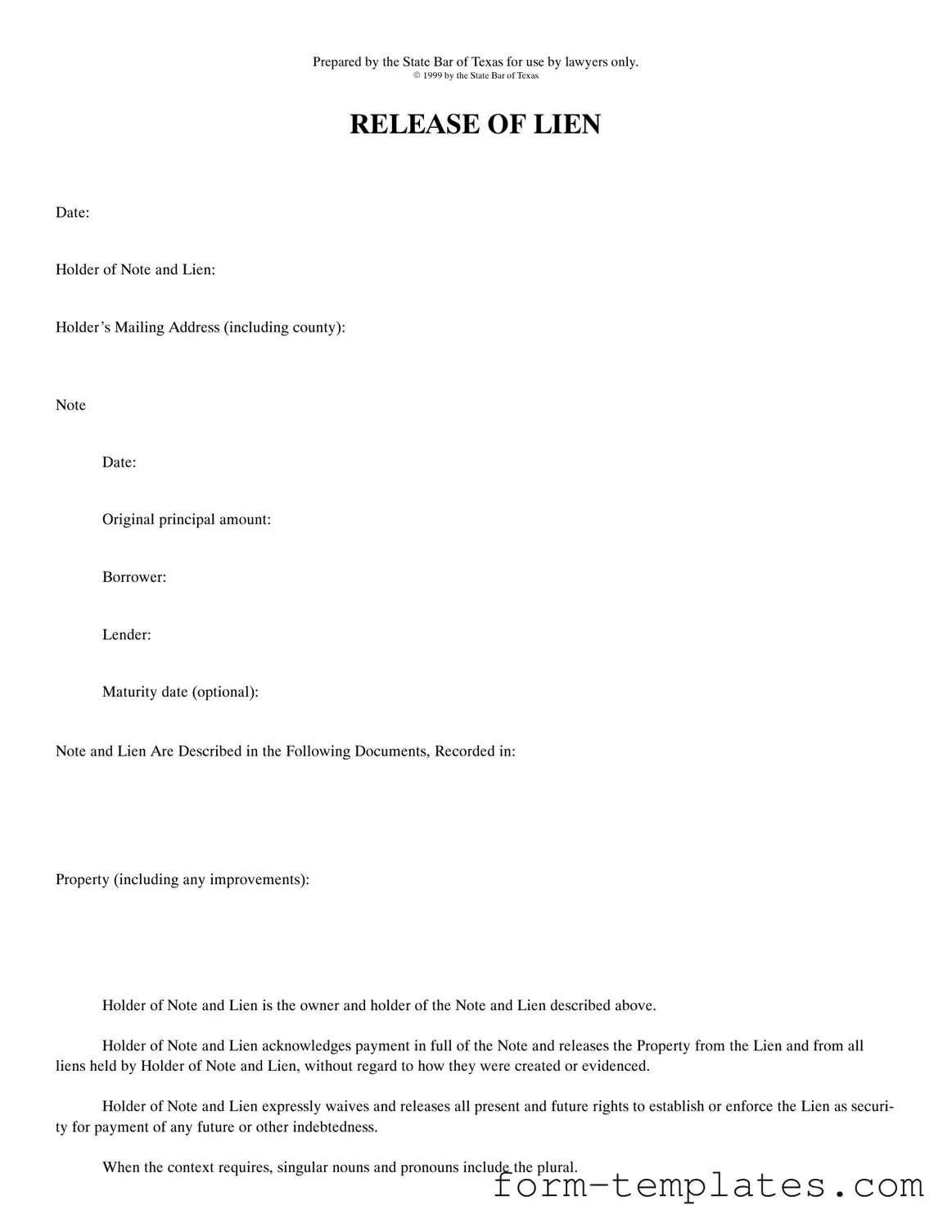

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |