Attorney-Approved Promissory Note Document

Guide to Writing Promissory Note

After obtaining the Promissory Note form, it is important to fill it out accurately to ensure that all necessary information is included. Follow these steps to complete the form correctly.

- Identify the parties involved: Enter the full names and addresses of both the borrower and the lender at the top of the form.

- Specify the loan amount: Clearly write the total amount of money being borrowed in both numerical and written form.

- Set the interest rate: Indicate the interest rate applicable to the loan, specifying whether it is fixed or variable.

- Determine the repayment terms: Outline the repayment schedule, including the start date, frequency of payments, and the total duration of the loan.

- Include any late fees: If applicable, state the amount of any late fees that will be incurred if a payment is missed.

- Sign and date the form: Both the borrower and the lender should sign and date the document to make it legally binding.

- Make copies: After signing, create copies of the completed form for both parties’ records.

Promissory NoteDocuments for Specific US States

Promissory Note Form Categories

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. |

| Legal Status | Promissory notes are legally binding contracts under the Uniform Commercial Code (UCC), which governs commercial transactions in the United States. |

| Essential Elements | For a promissory note to be valid, it must include the principal amount, interest rate, payment schedule, and signatures of the parties involved. |

| State-Specific Forms | Each state may have its own specific requirements for promissory notes. For example, California's Civil Code Section 1910 outlines the necessary elements. |

| Transferability | Promissory notes can be transferred to another party, making them negotiable instruments. This means the holder can sell or assign the note to someone else. |

| Enforcement | If a borrower defaults, the lender can take legal action to enforce the terms of the promissory note, potentially leading to court proceedings to recover the owed amount. |

FAQ

What is a Promissory Note?

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. It outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

Who uses a Promissory Note?

Individuals and businesses commonly use Promissory Notes. They are often used in personal loans, business financing, and real estate transactions. Anyone who lends money can create a Promissory Note to ensure repayment.

What information is included in a Promissory Note?

A typical Promissory Note includes the following information:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate and how it is calculated

- The repayment schedule, including due dates

- Any penalties for late payment

- Signatures of both parties

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document. Once signed, it obligates the borrower to repay the loan according to the terms outlined in the note. If the borrower fails to repay, the lender can take legal action to recover the funds.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the amended note to ensure clarity and enforceability.

What happens if the borrower defaults?

If the borrower defaults on the Promissory Note, the lender has several options. They may attempt to collect the debt through negotiation or may pursue legal action to recover the owed amount. The specific actions depend on the terms of the note and applicable laws.

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer draft a Promissory Note, consulting with one can provide peace of mind. A lawyer can ensure that the document complies with state laws and adequately protects both parties' interests.

Can I use a template for a Promissory Note?

Yes, many templates are available online for Promissory Notes. However, it is crucial to customize the template to fit your specific situation and ensure that all necessary details are included. Review the document carefully to avoid any misunderstandings.

What is the difference between a Promissory Note and a loan agreement?

A Promissory Note is a simpler document that focuses on the promise to pay. A loan agreement, on the other hand, is more detailed and may include additional terms such as collateral, representations, and warranties. Both serve different purposes but can be used together in a lending situation.

Fill out Popular Documents

Homeschool Notice of Intent - Your commitment to giving your child a personalized education starts with this form.

Using the Payroll Check form is essential for any organization aiming to maintain transparency and accuracy in wage distribution. Employers can streamline their payroll process by utilizing resources such as the Fillable Blank Check, which assists in creating a professional and compliant payroll check format.

Photobooth Contract - Understand the process for reserving the photo booth for your event.

Promissory Note Example

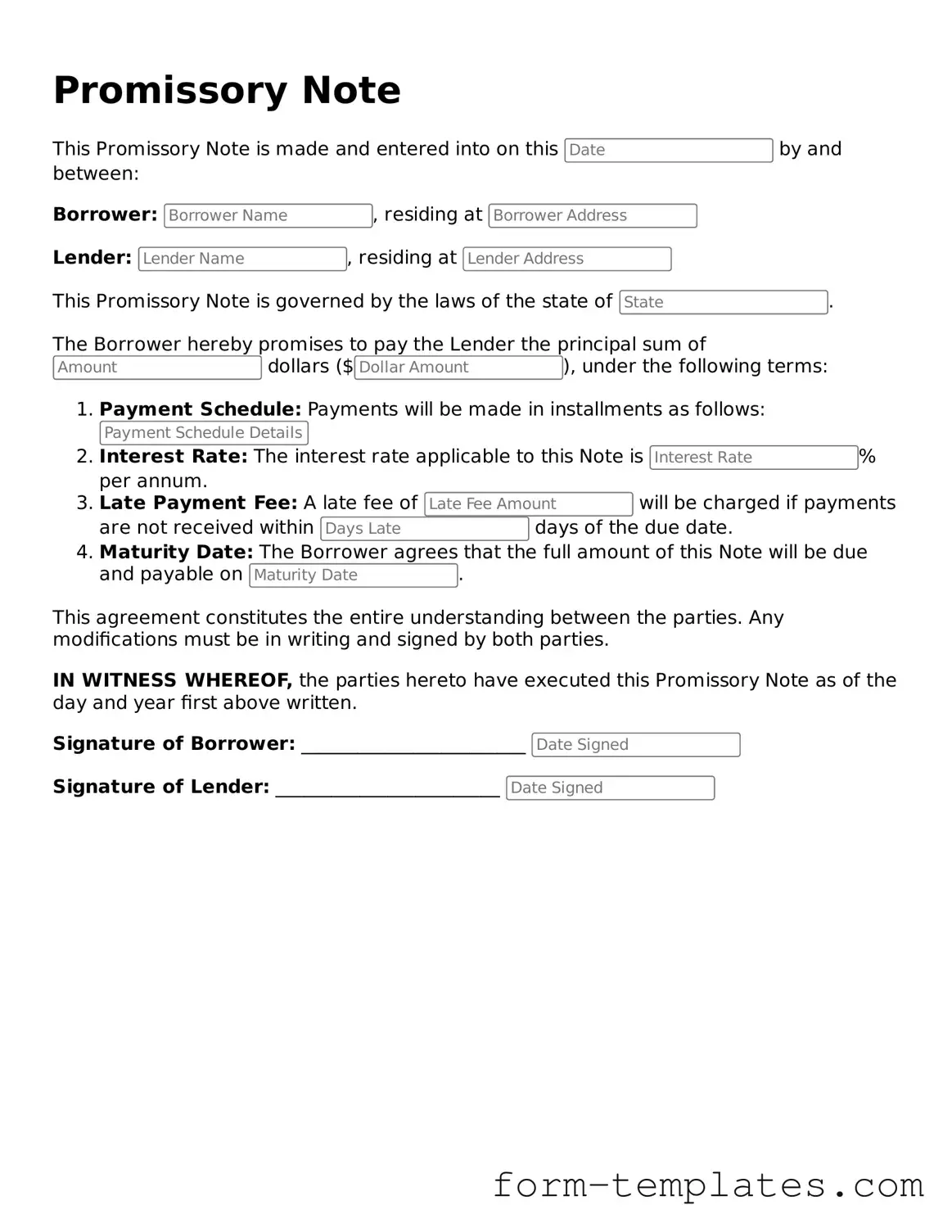

Promissory Note

This Promissory Note is made and entered into on this by and between:

Borrower: , residing at

Lender: , residing at

This Promissory Note is governed by the laws of the state of .

The Borrower hereby promises to pay the Lender the principal sum of dollars ($), under the following terms:

- Payment Schedule: Payments will be made in installments as follows:

- Interest Rate: The interest rate applicable to this Note is % per annum.

- Late Payment Fee: A late fee of will be charged if payments are not received within days of the due date.

- Maturity Date: The Borrower agrees that the full amount of this Note will be due and payable on .

This agreement constitutes the entire understanding between the parties. Any modifications must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the day and year first above written.

Signature of Borrower: ________________________

Signature of Lender: ________________________