Attorney-Approved Promissory Note for a Car Document

Guide to Writing Promissory Note for a Car

Filling out the Promissory Note for a Car form is a straightforward process. It involves providing essential information about the loan agreement between the borrower and the lender. After completing this form, both parties will have a clear understanding of the terms of the loan.

- Obtain the form: Download or print the Promissory Note for a Car form from a reliable source.

- Fill in the date: Write the date when the note is being executed at the top of the form.

- Identify the borrower: Enter the full name and address of the person borrowing the money.

- Identify the lender: Provide the full name and address of the person or institution lending the money.

- Loan amount: Clearly state the total amount of money being borrowed for the car purchase.

- Interest rate: Specify the interest rate applicable to the loan, if any.

- Payment terms: Outline the repayment schedule, including the frequency of payments (weekly, monthly, etc.) and the due date for the first payment.

- Late payment penalties: Describe any penalties for late payments, if applicable.

- Signatures: Both the borrower and the lender should sign and date the form at the bottom to make it legally binding.

- Make copies: After signing, make copies of the completed form for both the borrower and the lender's records.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Parties Involved | The form typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | The laws governing promissory notes vary by state. For example, in California, the Uniform Commercial Code (UCC) applies. |

| Enforceability | For the note to be enforceable, it must include essential elements such as the amount, interest rate, and payment schedule. |

FAQ

What is a Promissory Note for a Car?

A Promissory Note for a Car is a written agreement between a borrower and a lender. This document outlines the borrower's promise to repay a loan used to purchase a vehicle. It includes important details such as the loan amount, interest rate, repayment schedule, and any consequences for defaulting on the loan. This note serves as a legal record of the transaction and protects both parties involved.

Who typically uses a Promissory Note for a Car?

This type of note is commonly used by individuals or businesses that are financing the purchase of a vehicle without going through a traditional bank or financial institution. For example, if a person is buying a car from a private seller, they may use a promissory note to formalize the loan agreement. Additionally, it can also be utilized in situations where family or friends lend money for a car purchase.

What information should be included in the Promissory Note?

When creating a Promissory Note for a Car, it is important to include the following information:

- Names of the parties involved: Clearly state the names and addresses of both the borrower and the lender.

- Loan amount: Specify the total amount of money being borrowed.

- Interest rate: Indicate the interest rate, if applicable, and whether it is fixed or variable.

- Repayment schedule: Outline how and when payments will be made, including the due dates and payment amounts.

- Consequences of default: Describe the actions that may be taken if the borrower fails to make payments.

- Signatures: Both parties should sign and date the document to make it legally binding.

What happens if the borrower defaults on the loan?

If the borrower fails to make payments as outlined in the Promissory Note, the lender has the right to take certain actions. These may include charging late fees, reporting the default to credit agencies, or pursuing legal action to recover the owed amount. In some cases, the lender may also have the right to repossess the vehicle. It is essential for both parties to understand the terms of the agreement to avoid potential disputes.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It serves as a formal contract that outlines the obligations of both the borrower and the lender. To ensure its enforceability, the note should be clear, detailed, and signed by both parties. It is advisable for both parties to keep a copy of the signed document for their records.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the revised agreement. This helps to maintain clarity and avoid misunderstandings in the future. If significant changes are made, it may be beneficial to consult with a legal professional to ensure compliance with applicable laws.

Other Promissory Note for a Car Templates:

Promissory Note Release - This form can be crucial in ensuring that there are no future misunderstandings related to the loan.

To further understand the specifics and legalities of a loan agreement, individuals can refer to resources such as All New York Forms, which provide templates and guidance that ensure a well-constructed New York Promissory Note is utilized, safeguarding the rights and responsibilities of both parties involved.

Promissory Note for a Car Example

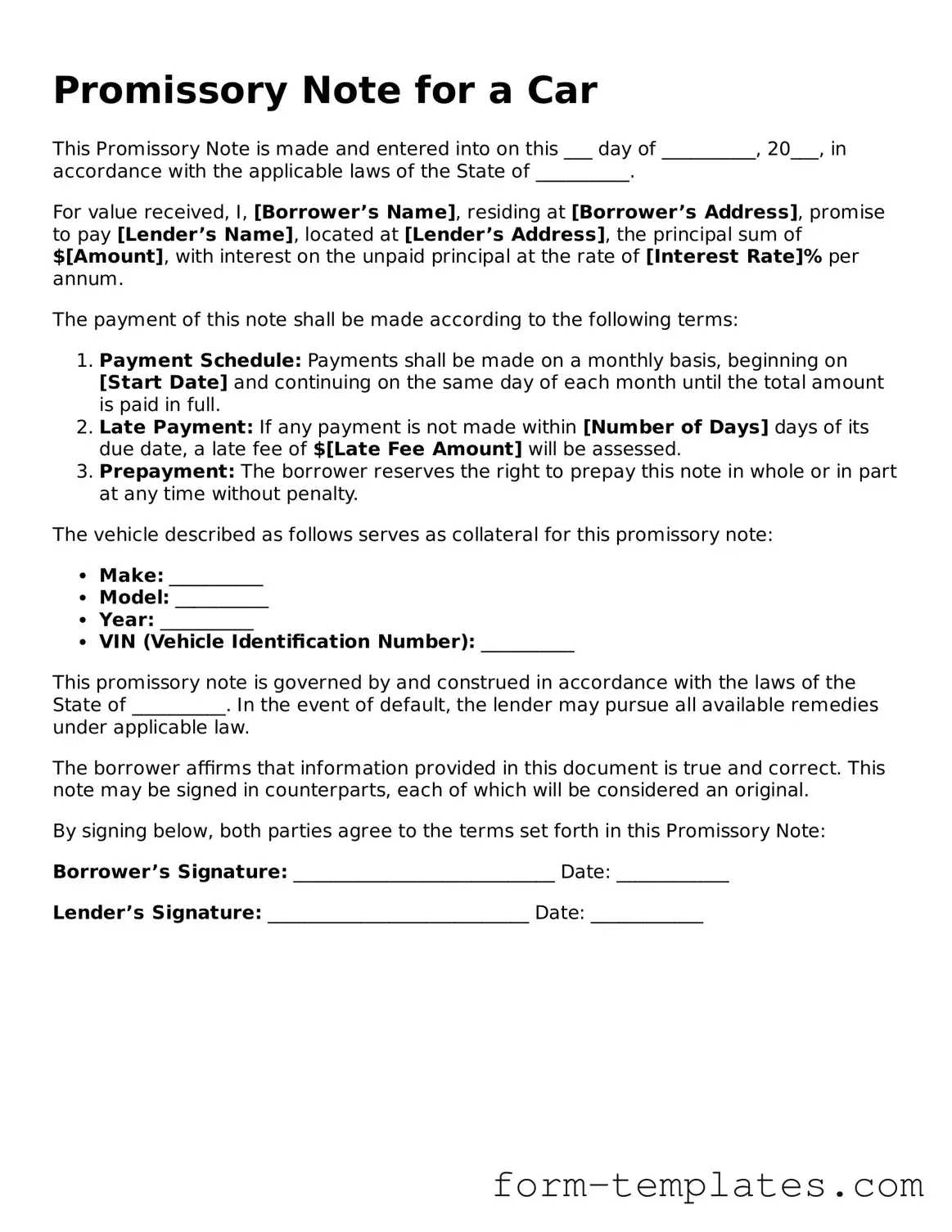

Promissory Note for a Car

This Promissory Note is made and entered into on this ___ day of __________, 20___, in accordance with the applicable laws of the State of __________.

For value received, I, [Borrower’s Name], residing at [Borrower’s Address], promise to pay [Lender’s Name], located at [Lender’s Address], the principal sum of $[Amount], with interest on the unpaid principal at the rate of [Interest Rate]% per annum.

The payment of this note shall be made according to the following terms:

- Payment Schedule: Payments shall be made on a monthly basis, beginning on [Start Date] and continuing on the same day of each month until the total amount is paid in full.

- Late Payment: If any payment is not made within [Number of Days] days of its due date, a late fee of $[Late Fee Amount] will be assessed.

- Prepayment: The borrower reserves the right to prepay this note in whole or in part at any time without penalty.

The vehicle described as follows serves as collateral for this promissory note:

- Make: __________

- Model: __________

- Year: __________

- VIN (Vehicle Identification Number): __________

This promissory note is governed by and construed in accordance with the laws of the State of __________. In the event of default, the lender may pursue all available remedies under applicable law.

The borrower affirms that information provided in this document is true and correct. This note may be signed in counterparts, each of which will be considered an original.

By signing below, both parties agree to the terms set forth in this Promissory Note:

Borrower’s Signature: ____________________________ Date: ____________

Lender’s Signature: ____________________________ Date: ____________