Fill Out a Valid Profit And Loss Template

Guide to Writing Profit And Loss

Once you have the Profit and Loss form in front of you, it’s time to gather your financial information and start filling it out. This process will help you track your income and expenses over a specific period. Follow the steps below to ensure you complete the form accurately.

- Begin by entering your business name at the top of the form.

- Next, fill in the reporting period for which you are calculating the profit and loss. This could be monthly, quarterly, or annually.

- In the income section, list all sources of revenue. Include sales, services, and any other income streams. Make sure to enter the total amount for each source.

- Now, move on to the expenses section. List all operating expenses, such as rent, utilities, salaries, and supplies. Be thorough to ensure you capture all costs.

- After entering all income and expenses, calculate the total income and total expenses. This will help you see the overall financial picture.

- Subtract the total expenses from total income to determine your net profit or loss for the period.

- Finally, review the form for any errors or omissions before submitting it. Double-check all figures to ensure accuracy.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form summarizes a business's revenues and expenses over a specific period. |

| Components | It typically includes sections for gross income, operating expenses, and net profit or loss. |

| Frequency | Businesses usually prepare this form monthly, quarterly, or annually. |

| Importance | This form helps in assessing the financial health of a business. |

| Tax Reporting | Profit and Loss statements are often required for tax filings. |

| State-Specific Forms | Some states have specific requirements for the Profit and Loss form, governed by local tax laws. |

| Record Keeping | Maintaining accurate records is essential for completing the form correctly. |

| Review Process | Regular reviews of the Profit and Loss form can help identify trends and areas for improvement. |

| Comparison | Comparing multiple Profit and Loss forms over time can provide insights into business growth. |

FAQ

What is a Profit and Loss form?

A Profit and Loss form, also known as an income statement, summarizes a business's revenues, costs, and expenses over a specific period. This document helps business owners understand their financial performance, indicating whether they made a profit or incurred a loss during that time frame.

Why is the Profit and Loss form important?

The Profit and Loss form is crucial for several reasons:

- It provides a clear picture of financial performance.

- Investors and lenders often require this information to assess the viability of a business.

- It helps in making informed decisions regarding budgeting and forecasting.

- Tracking performance over time can identify trends and areas for improvement.

What information is typically included in a Profit and Loss form?

A standard Profit and Loss form includes the following sections:

- Revenue: Total income generated from sales or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs incurred in running the business, such as rent, utilities, and salaries.

- Net Profit or Loss: The final figure after subtracting total expenses from total revenue.

How often should a Profit and Loss form be completed?

The frequency of completing a Profit and Loss form can vary based on the business's needs. Many businesses prepare this statement monthly or quarterly to monitor performance closely. Others may choose to do it annually. Regular updates can help identify trends and inform strategic decisions.

Who can benefit from reviewing a Profit and Loss form?

Several stakeholders can benefit from reviewing a Profit and Loss form, including:

- Business owners seeking to understand their financial health.

- Investors looking for insights into profitability.

- Lenders assessing risk before providing financing.

- Accountants and financial advisors who need to analyze the company's financial situation.

How can a Profit and Loss form be used for tax purposes?

A Profit and Loss form is often used to report income and expenses when filing taxes. It provides a detailed account of earnings and costs, which can help determine taxable income. Keeping accurate records of this information can simplify the tax filing process and ensure compliance with tax regulations.

What are some common mistakes to avoid when preparing a Profit and Loss form?

When preparing a Profit and Loss form, consider avoiding these common mistakes:

- Failing to categorize income and expenses correctly.

- Not including all sources of revenue.

- Overlooking seasonal fluctuations in income and expenses.

- Neglecting to update the form regularly.

Fill out Other Forms

Band Seating Chart Creator - Share this form to ensure everyone has access to setup information.

The importance of having a clear and concise rental agreement cannot be overstated, as it helps to prevent misunderstandings and disputes between landlords and tenants. A well-drafted agreement, such as the Room Lease Agreement, ensures that both parties are aware of their rights and responsibilities, ultimately leading to a more enjoyable living situation.

How to Fill Out Passport Application - A recent passport photo is required to accompany the DS-11 form.

Profit And Loss Example

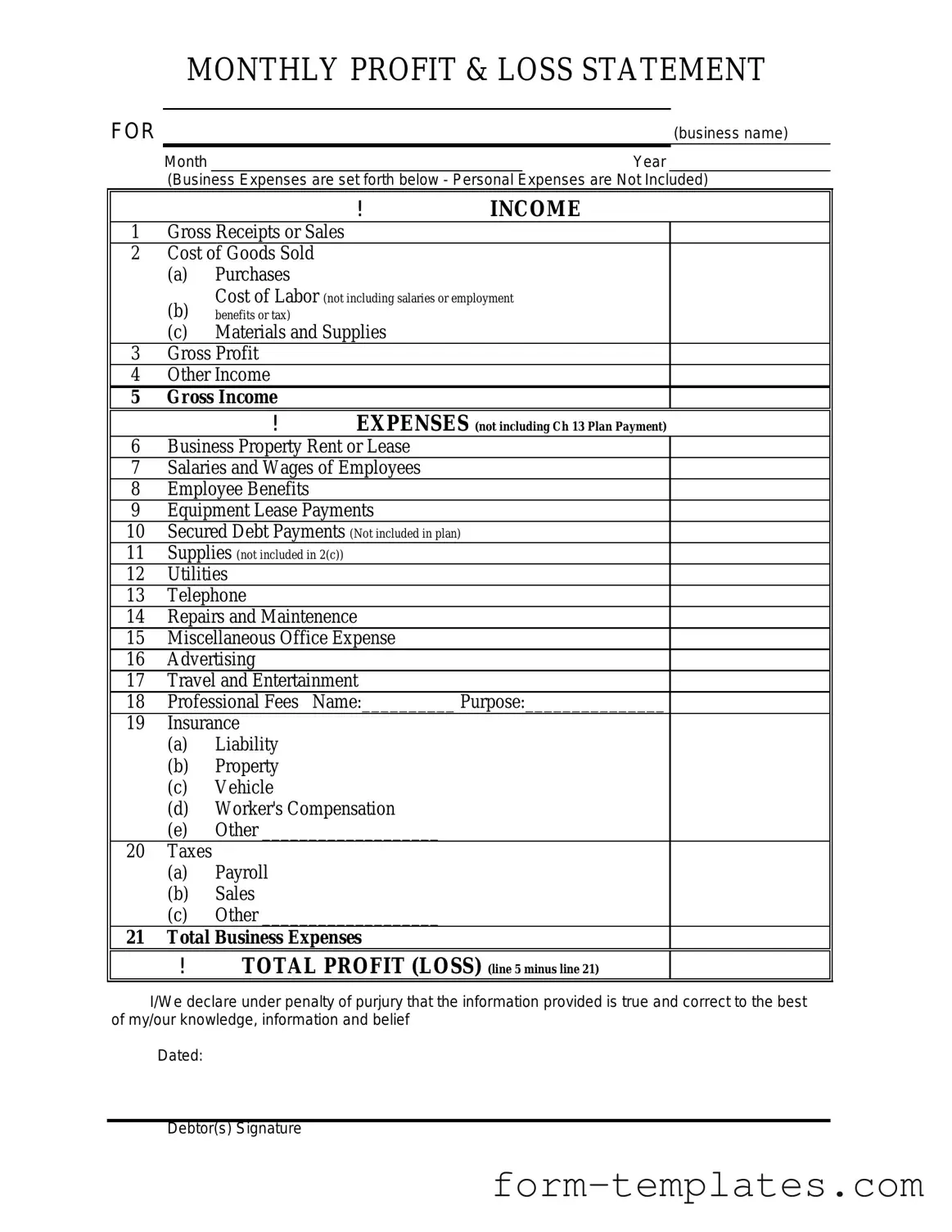

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature