Attorney-Approved Personal Guarantee Document

Guide to Writing Personal Guarantee

After obtaining the Personal Guarantee form, you will need to complete it accurately to ensure it meets the requirements set forth by the lender or entity requesting it. This process involves providing personal information, agreeing to the terms, and signing the document. Follow the steps below to fill out the form correctly.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your current residential address, including street, city, state, and ZIP code.

- Fill in your contact information, including your phone number and email address.

- Indicate your Social Security number, ensuring that it is accurate and legible.

- Specify your date of birth in the format requested on the form.

- List your employment information, including your employer's name, your job title, and length of employment.

- Review any financial information sections, such as income or assets, and complete them as required.

- Read through the terms and conditions carefully, ensuring you understand your obligations.

- Sign and date the form in the provided spaces to indicate your agreement.

- Submit the completed form as instructed, whether electronically or by mail.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A personal guarantee is a legal commitment by an individual to repay a loan or debt if the primary borrower defaults. |

| Purpose | It provides lenders with additional security, ensuring that they can pursue the guarantor for repayment if necessary. |

| State-Specific Forms | Many states have specific forms for personal guarantees that comply with local laws. |

| Governing Law | The laws governing personal guarantees vary by state. For example, California Civil Code Section 2787 outlines the obligations of guarantors. |

| Enforceability | For a personal guarantee to be enforceable, it must be in writing and signed by the guarantor. |

| Limitations | Some personal guarantees may have limitations, such as a cap on the amount guaranteed or specific conditions under which the guarantee applies. |

FAQ

What is a Personal Guarantee?

A Personal Guarantee is a legal commitment made by an individual to repay a debt or fulfill an obligation if the primary borrower defaults. This form is often required by lenders or creditors when extending credit to businesses, particularly small businesses. By signing this document, the individual agrees to be personally liable for the debt, ensuring that the lender has recourse to the individual’s personal assets if necessary.

Who typically needs to sign a Personal Guarantee?

Personal Guarantees are commonly required from business owners, partners, or individuals who have significant control over a company’s finances. Lenders may ask for a Personal Guarantee when:

- The business is a startup with no established credit history.

- The loan amount is substantial relative to the business's financial standing.

- The business structure limits liability, such as LLCs or corporations.

What are the risks associated with signing a Personal Guarantee?

Signing a Personal Guarantee carries significant risks. If the business fails to meet its financial obligations, the individual who signed the guarantee may be held personally responsible for the debt. This could lead to:

- Seizure of personal assets, including savings, property, or investments.

- Negative impact on personal credit scores.

- Potential legal action from creditors.

Can a Personal Guarantee be revoked or canceled?

Generally, a Personal Guarantee cannot be revoked unilaterally. Once signed, it remains in effect until the debt is paid off or the lender agrees to release the guarantor from the obligation. It is advisable to review the terms of the guarantee and consult with legal counsel if there are concerns about its continuation.

What should I consider before signing a Personal Guarantee?

Before signing a Personal Guarantee, consider the following factors:

- Your understanding of the business's financial situation.

- The potential for the business to succeed or fail.

- Your personal financial stability and risk tolerance.

- The terms of the loan and any collateral involved.

Is it possible to negotiate the terms of a Personal Guarantee?

Yes, it is possible to negotiate the terms of a Personal Guarantee. Potential negotiable aspects include:

- Limiting the guarantee to a specific amount.

- Setting a time limit on the guarantee.

- Including provisions for the release of the guarantee under certain conditions.

Engaging in open discussions with the lender can lead to more favorable terms.

What should I do if I am unable to fulfill my obligations under a Personal Guarantee?

If you find yourself unable to meet the obligations of a Personal Guarantee, it is important to take proactive steps. Consider the following actions:

- Communicate with the lender as soon as possible to discuss your situation.

- Explore options for restructuring the debt or negotiating a payment plan.

- Consult with a financial advisor or legal professional to understand your rights and options.

Addressing the issue early can help mitigate potential negative consequences.

Other Personal Guarantee Templates:

Purchase Agreement Addendum - Includes details about closing costs that may differ from the original terms.

The Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions of a property sale, making it essential for anyone involved in the buying or selling of real estate. For a detailed understanding, you can refer to the Real Estate Purchase Agreement form, which serves as a blueprint for the transaction and details the rights and obligations of both the buyer and the seller.

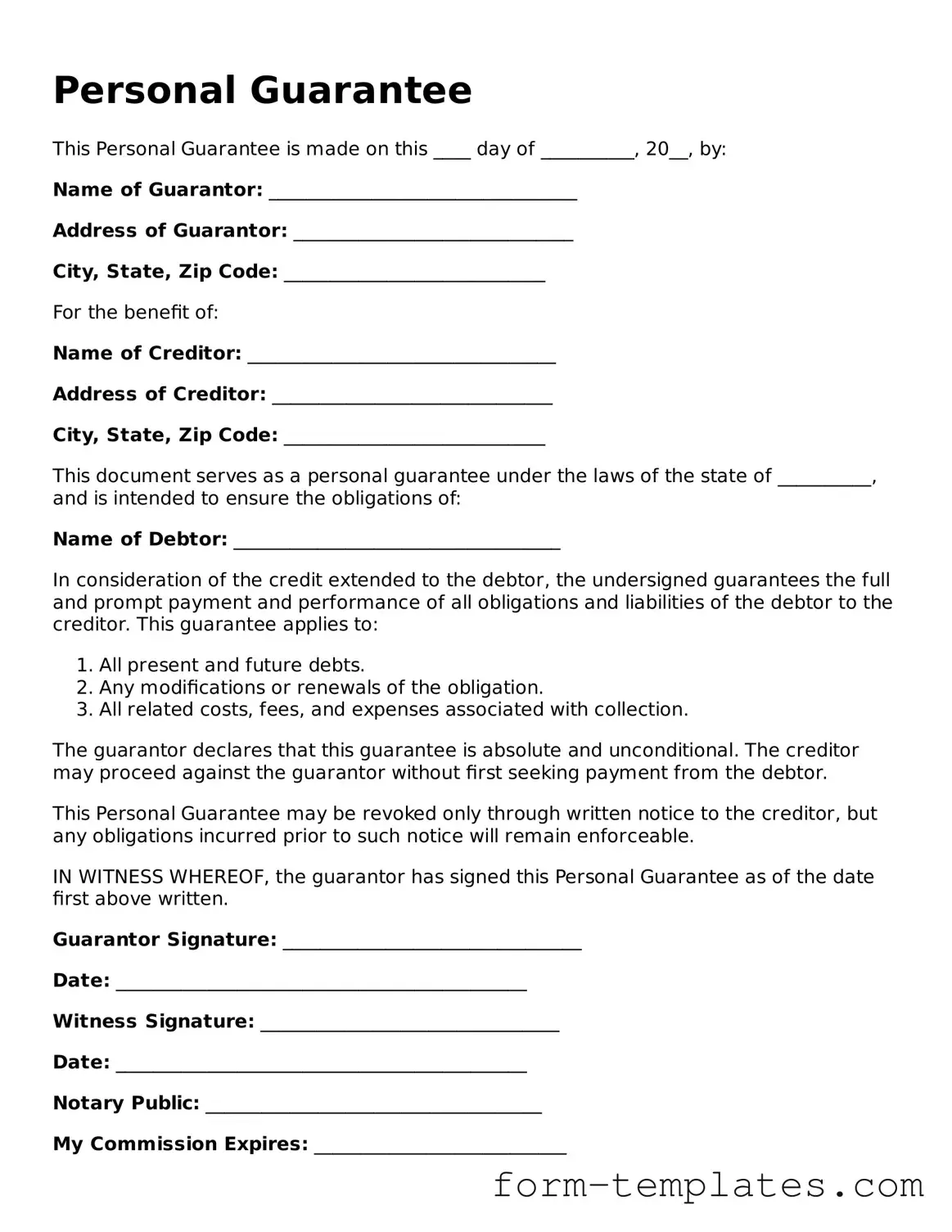

Personal Guarantee Example

Personal Guarantee

This Personal Guarantee is made on this ____ day of __________, 20__, by:

Name of Guarantor: _________________________________

Address of Guarantor: ______________________________

City, State, Zip Code: ____________________________

For the benefit of:

Name of Creditor: _________________________________

Address of Creditor: ______________________________

City, State, Zip Code: ____________________________

This document serves as a personal guarantee under the laws of the state of __________, and is intended to ensure the obligations of:

Name of Debtor: ___________________________________

In consideration of the credit extended to the debtor, the undersigned guarantees the full and prompt payment and performance of all obligations and liabilities of the debtor to the creditor. This guarantee applies to:

- All present and future debts.

- Any modifications or renewals of the obligation.

- All related costs, fees, and expenses associated with collection.

The guarantor declares that this guarantee is absolute and unconditional. The creditor may proceed against the guarantor without first seeking payment from the debtor.

This Personal Guarantee may be revoked only through written notice to the creditor, but any obligations incurred prior to such notice will remain enforceable.

IN WITNESS WHEREOF, the guarantor has signed this Personal Guarantee as of the date first above written.

Guarantor Signature: ________________________________

Date: ____________________________________________

Witness Signature: ________________________________

Date: ____________________________________________

Notary Public: ____________________________________

My Commission Expires: ___________________________