Printable Transfer-on-Death Deed Form for the State of Pennsylvania

Guide to Writing Pennsylvania Transfer-on-Death Deed

After gathering all necessary information, you are ready to fill out the Pennsylvania Transfer-on-Death Deed form. This deed allows you to designate a beneficiary who will receive your property upon your death without going through probate. Follow these steps carefully to ensure the form is completed correctly.

- Obtain the Transfer-on-Death Deed form from the Pennsylvania Department of State website or your local county office.

- Fill in your full name and address in the designated section. This is the name of the property owner.

- Provide a complete description of the property. Include the address and any relevant parcel identification numbers.

- Identify the beneficiary. Write the full name and address of the person or entity who will receive the property.

- Include any additional beneficiaries if desired. Ensure each has their full name and address listed.

- Sign the form in the presence of a notary public. Your signature must be notarized to be valid.

- Have the notary complete their section, confirming your identity and the authenticity of your signature.

- File the completed deed with the appropriate county office where the property is located. Be aware of any filing fees that may apply.

Once the form is filed, it becomes effective, and the designated beneficiary will have a claim to the property upon your passing. Keep a copy of the deed for your records and inform your beneficiaries of its existence.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Pennsylvania to designate beneficiaries who will receive the property upon their death, bypassing probate. |

| Governing Law | The Pennsylvania Transfer-on-Death Deed is governed by 20 Pa.C.S. § 6111.3. |

| Execution Requirements | The deed must be signed by the property owner and acknowledged before a notary public to be valid. |

| Revocation | Property owners can revoke the deed at any time before their death by executing a new deed or a formal revocation document. |

FAQ

What is a Pennsylvania Transfer-on-Death Deed?

A Pennsylvania Transfer-on-Death Deed (TODD) allows an individual to transfer real estate to a designated beneficiary upon their death, without the need for probate. This deed enables property owners to maintain control over their property during their lifetime while ensuring a smooth transition of ownership after death.

Who can use a Transfer-on-Death Deed in Pennsylvania?

Any individual who owns real estate in Pennsylvania can utilize a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals with a vested interest in real property. However, the property must be solely owned by the individual, as joint ownership may complicate the transfer process.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, follow these steps:

- Obtain the official Transfer-on-Death Deed form from a reliable source.

- Fill in the required information, including the property description and beneficiary details.

- Sign the deed in the presence of a notary public.

- Record the deed with the county recorder of deeds where the property is located.

Is there a fee to record a Transfer-on-Death Deed?

Yes, there is typically a fee associated with recording a Transfer-on-Death Deed. This fee varies by county and is generally based on the number of pages in the document. It is advisable to check with the local county recorder’s office for specific fee information.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. The property owner must execute a new deed that explicitly states the revocation or create a new Transfer-on-Death Deed that designates a different beneficiary. The revocation must also be recorded with the county recorder of deeds to ensure it is legally recognized.

What happens if the beneficiary predeceases me?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed becomes ineffective. The property will not automatically transfer to the deceased beneficiary's heirs. It is advisable to name an alternate beneficiary to ensure a smooth transfer of ownership in such cases.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. The property remains part of the owner's estate until death. However, beneficiaries may be subject to inheritance tax upon receiving the property. It is recommended to consult a tax professional for personalized advice regarding tax implications.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can only be used for real estate. This includes residential homes, commercial properties, and vacant land. It cannot be used for personal property, such as vehicles or bank accounts. For other types of assets, different estate planning tools may be necessary.

Consider Popular Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Florida Form - There are often specific requirements for witnessing or notarization.

The California Vehicle Purchase Agreement is a crucial document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form ensures that both parties are aware of their rights and obligations, providing a clear framework for the transaction. Understanding this agreement is essential for a smooth and legally compliant vehicle purchase in California, and you can find the necessary form at https://californiadocsonline.com/vehicle-purchase-agreement-form/.

Where Can I Get a Tod Form - Provides peace of mind regarding property succession.

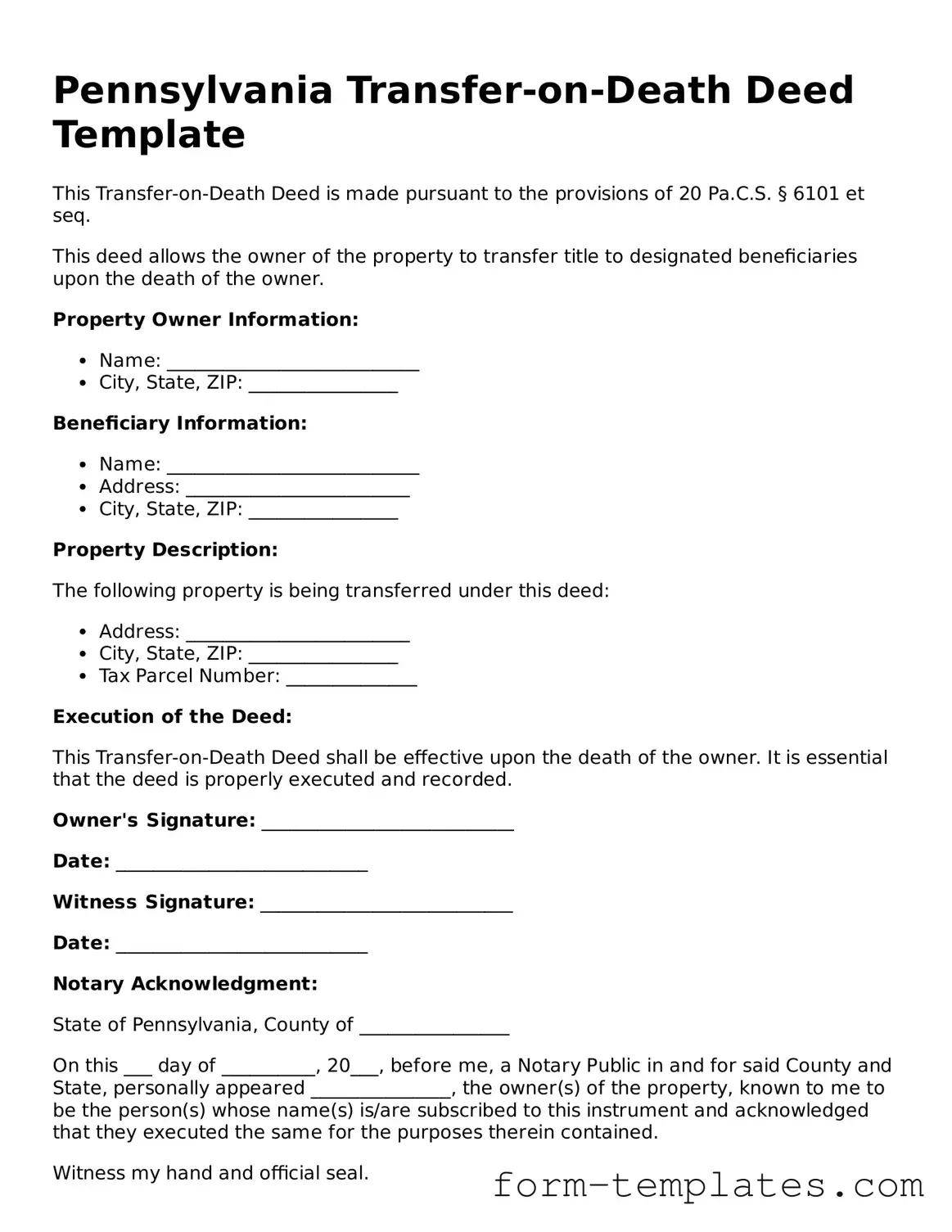

Pennsylvania Transfer-on-Death Deed Example

Pennsylvania Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the provisions of 20 Pa.C.S. § 6101 et seq.

This deed allows the owner of the property to transfer title to designated beneficiaries upon the death of the owner.

Property Owner Information:

- Name: ___________________________

- City, State, ZIP: ________________

Beneficiary Information:

- Name: ___________________________

- Address: ________________________

- City, State, ZIP: ________________

Property Description:

The following property is being transferred under this deed:

- Address: ________________________

- City, State, ZIP: ________________

- Tax Parcel Number: ______________

Execution of the Deed:

This Transfer-on-Death Deed shall be effective upon the death of the owner. It is essential that the deed is properly executed and recorded.

Owner's Signature: ___________________________

Date: ___________________________

Witness Signature: ___________________________

Date: ___________________________

Notary Acknowledgment:

State of Pennsylvania, County of ________________

On this ___ day of __________, 20___, before me, a Notary Public in and for said County and State, personally appeared _______________, the owner(s) of the property, known to me to be the person(s) whose name(s) is/are subscribed to this instrument and acknowledged that they executed the same for the purposes therein contained.

Witness my hand and official seal.

Notary Public Signature: ___________________________

My Commission Expires: ___________________________