Printable Promissory Note Form for the State of Pennsylvania

Guide to Writing Pennsylvania Promissory Note

Once you have the Pennsylvania Promissory Note form in front of you, it’s time to fill it out carefully. This document requires specific information to ensure it is valid and enforceable. Follow these steps to complete the form accurately.

- Start with the Date: Write the date on which the note is being created at the top of the form.

- Identify the Borrower: Clearly print the name and address of the person or entity borrowing the money.

- Identify the Lender: Next, write the name and address of the person or entity lending the money.

- Specify the Loan Amount: Indicate the total amount of money being borrowed. This should be written both in numbers and in words for clarity.

- State the Interest Rate: If applicable, include the interest rate that will be charged on the loan. Make sure to specify whether it is fixed or variable.

- Define the Payment Terms: Outline how and when the borrower will repay the loan. This includes the payment schedule and any due dates.

- Include Late Fees: If there are any late fees for missed payments, specify the amount and the conditions under which they apply.

- Signatures: Finally, both the borrower and the lender should sign and date the document. If there are witnesses or notaries required, ensure they also sign where indicated.

After completing the form, review it for accuracy. Ensure all information is correct and clearly written. Once verified, both parties can keep a copy for their records.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a defined time. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC) governs promissory notes in Pennsylvania. |

| Parties Involved | Typically, a promissory note involves two parties: the maker (the person who promises to pay) and the payee (the person who receives the payment). |

| Interest Rate | The interest rate can be specified in the note, or it may default to the legal rate if not stated. |

| Payment Terms | Payment terms should clearly outline when payments are due, whether they are monthly, quarterly, or at a single date. |

| Default Clause | A promissory note may include a default clause that specifies the consequences if the maker fails to make payments. |

| Transferability | Promissory notes can generally be transferred to another party, making them negotiable instruments. |

| Signature Requirement | The maker must sign the promissory note for it to be legally binding. |

FAQ

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a legal document in which one party (the borrower) agrees to pay a specific amount of money to another party (the lender) under agreed-upon terms. This document serves as evidence of the debt and outlines the repayment schedule, interest rate, and other relevant conditions.

What are the key components of a Promissory Note?

A typical Pennsylvania Promissory Note includes the following components:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the borrowed amount.

- Payment Schedule: Details regarding when payments are due and how they will be made.

- Maturity Date: The date by which the total amount must be repaid.

- Signatures: Signatures of both the borrower and lender, indicating agreement to the terms.

Is a Promissory Note legally binding in Pennsylvania?

Yes, a Promissory Note is legally binding in Pennsylvania as long as it meets certain criteria. The document must clearly outline the terms of the loan and be signed by both parties. If the borrower fails to repay the loan, the lender can take legal action to recover the owed amount.

Do I need a lawyer to create a Promissory Note?

While it is not mandatory to have a lawyer draft a Promissory Note, seeking legal advice can be beneficial. A lawyer can ensure that the document complies with Pennsylvania laws and adequately protects your interests. However, many templates are available online for those who wish to create their own.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to avoid potential disputes in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. The lender may pursue legal action to recover the owed amount. This could involve filing a lawsuit or seeking a judgment against the borrower. Additionally, the lender may choose to negotiate a new payment plan or settlement.

Is interest on a Promissory Note taxable?

Yes, interest earned on a Promissory Note is generally considered taxable income. The lender must report this income on their tax return. It is advisable to consult a tax professional for specific guidance regarding tax obligations related to interest income.

Can a Promissory Note be used for personal loans?

Absolutely. A Promissory Note is commonly used for personal loans between individuals, such as family members or friends. It provides clarity on the terms of the loan and can help prevent misunderstandings regarding repayment.

Are there any specific requirements for a Promissory Note in Pennsylvania?

While Pennsylvania does not have extensive requirements for Promissory Notes, it is essential that the document includes clear terms regarding the loan amount, interest rate, payment schedule, and signatures of both parties. Additionally, it should be written in a manner that is easy to understand.

Where can I find a template for a Pennsylvania Promissory Note?

Templates for Pennsylvania Promissory Notes can be found online through various legal websites. These templates often provide a basic structure that can be customized to fit specific loan agreements. It is important to ensure that any template used complies with Pennsylvania laws.

Consider Popular Promissory Note Forms for Specific States

Promissory Note Florida Pdf - A promissory note typically includes the principal amount, interest rate, and repayment schedule.

Utilizing a Check Register form can significantly enhance your financial management skills, allowing you to keep an organized record of every transaction. To take it a step further, consider using a Fillable Blank Check for an even more efficient way to monitor your expenses and ensure accurate budgeting.

Promissory Note Form California - Parties involved in the note must be clearly identified, including the lender and borrower.

Pennsylvania Promissory Note Example

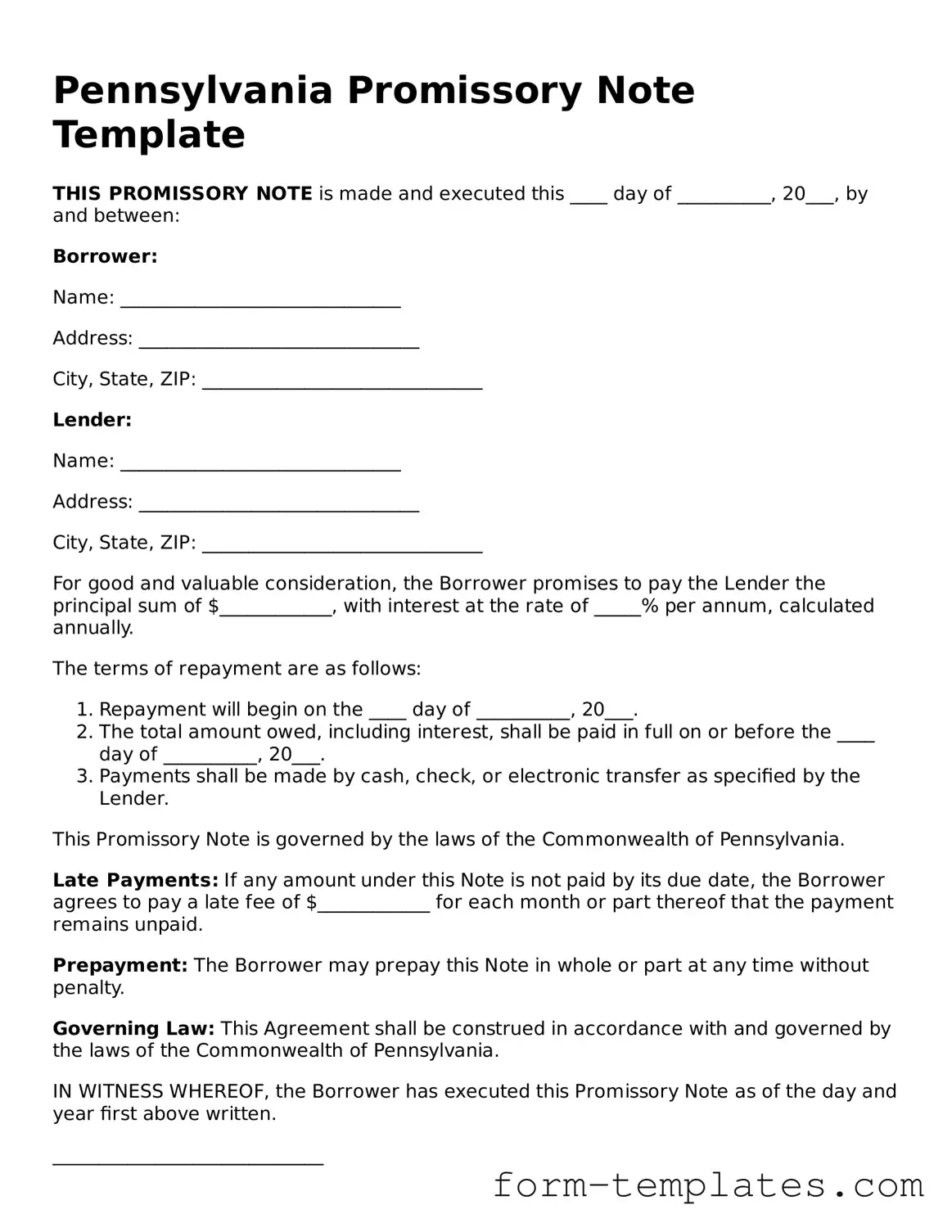

Pennsylvania Promissory Note Template

THIS PROMISSORY NOTE is made and executed this ____ day of __________, 20___, by and between:

Borrower:

Name: ______________________________

Address: ______________________________

City, State, ZIP: ______________________________

Lender:

Name: ______________________________

Address: ______________________________

City, State, ZIP: ______________________________

For good and valuable consideration, the Borrower promises to pay the Lender the principal sum of $____________, with interest at the rate of _____% per annum, calculated annually.

The terms of repayment are as follows:

- Repayment will begin on the ____ day of __________, 20___.

- The total amount owed, including interest, shall be paid in full on or before the ____ day of __________, 20___.

- Payments shall be made by cash, check, or electronic transfer as specified by the Lender.

This Promissory Note is governed by the laws of the Commonwealth of Pennsylvania.

Late Payments: If any amount under this Note is not paid by its due date, the Borrower agrees to pay a late fee of $____________ for each month or part thereof that the payment remains unpaid.

Prepayment: The Borrower may prepay this Note in whole or part at any time without penalty.

Governing Law: This Agreement shall be construed in accordance with and governed by the laws of the Commonwealth of Pennsylvania.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the day and year first above written.

_____________________________

(Borrower's Signature)

_____________________________

(Lender's Signature)