Printable Operating Agreement Form for the State of Pennsylvania

Guide to Writing Pennsylvania Operating Agreement

Filling out the Pennsylvania Operating Agreement form is an important step in establishing the framework for your business. This form will guide you through the necessary details to ensure that all members are on the same page regarding the operation of your business. Follow these steps carefully to complete the form accurately.

- Begin with the title of the document. Clearly label it as the "Operating Agreement" at the top of the form.

- Enter the name of your business. This should match the name registered with the state.

- Provide the principal office address. This is where your business will be primarily located.

- List the names and addresses of all members. Include everyone who has an ownership stake in the business.

- Specify the purpose of the business. Clearly describe what your business will do.

- Outline the management structure. Decide if the business will be member-managed or manager-managed and indicate this on the form.

- Detail the capital contributions of each member. State how much each member is investing in the business.

- Include provisions for profit and loss distribution. Describe how profits and losses will be shared among members.

- Address the procedure for adding new members. Outline how new members can be admitted to the business.

- Provide information on how to handle member departures. Explain what happens if a member wants to leave the business.

- Include any additional provisions that are relevant to your business. This might cover voting rights or dispute resolution processes.

- Have all members sign the document. Ensure that each member's signature is dated.

Once the form is completed and signed, make copies for all members. Keep the original in a safe place. This document will serve as a reference for the operation of your business moving forward.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Pennsylvania Limited Liability Company Law. |

| Member Roles | It defines the roles and responsibilities of each member within the LLC. |

| Profit Distribution | The agreement specifies how profits and losses will be distributed among members. |

| Decision-Making Process | It outlines the process for making decisions, including voting rights and procedures. |

| Amendments | The Operating Agreement can be amended, and the process for doing so is typically included in the document. |

| Duration | The agreement may specify the duration of the LLC’s existence, whether it is perpetual or for a limited time. |

| Dispute Resolution | It may include provisions for resolving disputes among members, such as mediation or arbitration. |

FAQ

What is a Pennsylvania Operating Agreement?

A Pennsylvania Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC) in Pennsylvania. It serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and the rules governing the business's operations.

Is an Operating Agreement required in Pennsylvania?

No, Pennsylvania does not legally require LLCs to have an Operating Agreement. However, having one is highly recommended. An Operating Agreement can help prevent misunderstandings among members and provide a clear framework for decision-making and conflict resolution.

What should be included in a Pennsylvania Operating Agreement?

A well-drafted Operating Agreement typically includes the following elements:

- Company Information: Name, address, and purpose of the LLC.

- Member Details: Names and contributions of each member.

- Management Structure: Whether the LLC is member-managed or manager-managed.

- Voting Rights: Procedures for decision-making and voting among members.

- Profit Distribution: How profits and losses will be allocated among members.

- Amendment Procedures: How changes to the Operating Agreement can be made.

How does an Operating Agreement benefit LLC members?

Having an Operating Agreement provides several benefits:

- It clarifies the roles and responsibilities of each member.

- It helps prevent disputes by outlining procedures for conflict resolution.

- It can protect members' personal assets from business liabilities.

- It establishes a clear framework for profit distribution and management decisions.

Can an Operating Agreement be changed after it is created?

Yes, an Operating Agreement can be amended. The process for making changes should be outlined within the document itself. Typically, amendments require a certain percentage of member approval, which ensures that all members have a say in significant changes.

How is an Operating Agreement created in Pennsylvania?

To create an Operating Agreement in Pennsylvania, members can follow these steps:

- Gather all members to discuss the terms of the agreement.

- Draft the agreement, ensuring it includes all necessary components.

- Review the document for clarity and completeness.

- Have all members sign the agreement to indicate their consent.

Do I need a lawyer to draft an Operating Agreement?

While it is not mandatory to hire a lawyer, it is advisable, especially for complex LLC structures or when significant assets are involved. A legal professional can ensure that the Operating Agreement complies with Pennsylvania laws and adequately protects the interests of all members.

Where can I find a template for a Pennsylvania Operating Agreement?

Templates for Pennsylvania Operating Agreements can be found online through various legal websites, business formation services, and state resources. However, it is essential to customize any template to reflect the specific needs and agreements of the LLC members.

What happens if an LLC does not have an Operating Agreement?

If an LLC operates without an Operating Agreement, it may face challenges in managing member relationships and decision-making processes. In the absence of this document, the default rules set forth by Pennsylvania law will apply, which may not align with the members' intentions. This could lead to disputes and complications in the operation of the business.

Consider Popular Operating Agreement Forms for Specific States

What Is an Operating Agreement Llc California - Encourage accountability by clearly defining expectations.

For individuals preparing for the future, the Last Will and Testament form guide is invaluable as it clarifies how your assets will be distributed and ensures your wishes are honored. To initiate this important process, visit the comprehensive Last Will and Testament form.

Cost of Llc in Texas - This document enhances the LLC's credibility with third parties.

Pennsylvania Operating Agreement Example

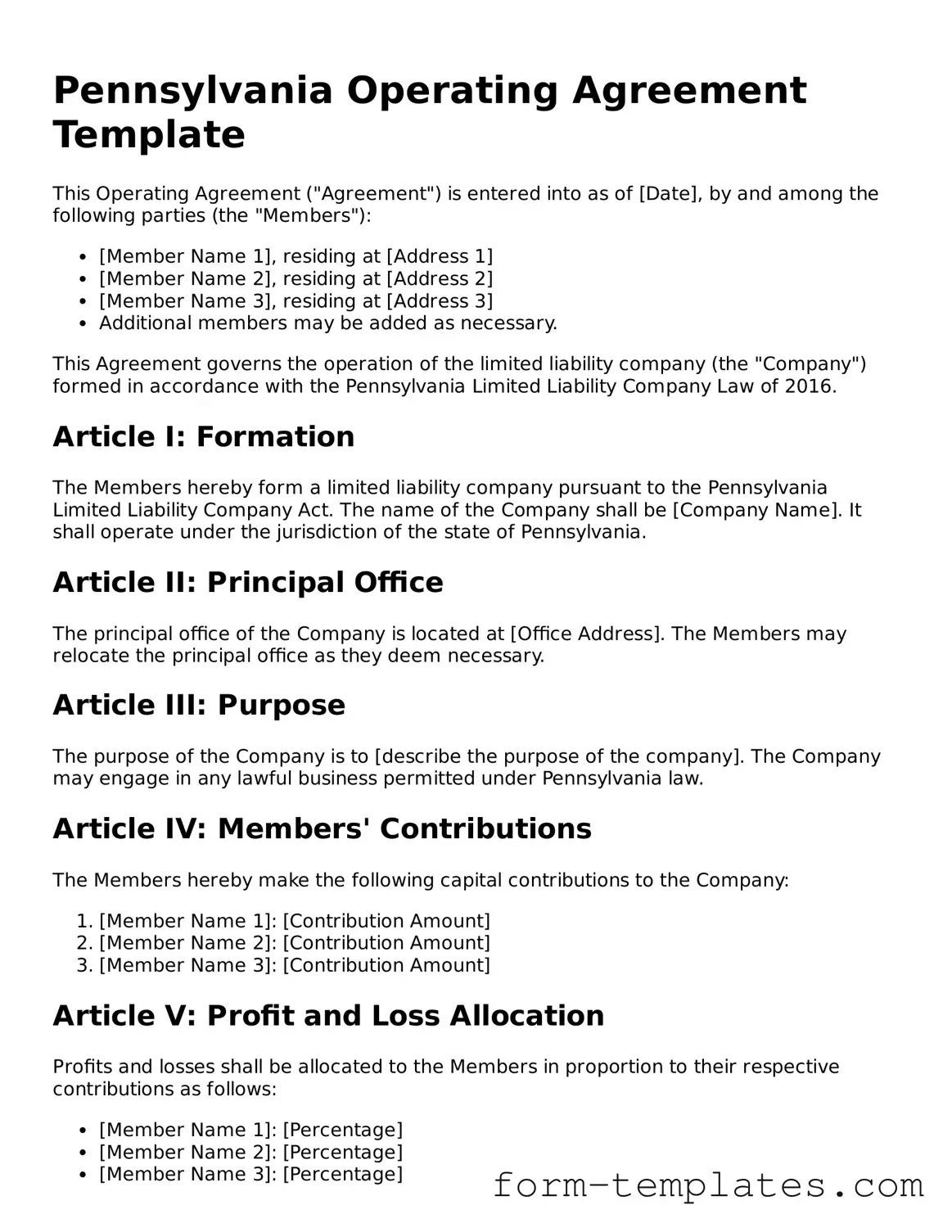

Pennsylvania Operating Agreement Template

This Operating Agreement ("Agreement") is entered into as of [Date], by and among the following parties (the "Members"):

- [Member Name 1], residing at [Address 1]

- [Member Name 2], residing at [Address 2]

- [Member Name 3], residing at [Address 3]

- Additional members may be added as necessary.

This Agreement governs the operation of the limited liability company (the "Company") formed in accordance with the Pennsylvania Limited Liability Company Law of 2016.

Article I: Formation

The Members hereby form a limited liability company pursuant to the Pennsylvania Limited Liability Company Act. The name of the Company shall be [Company Name]. It shall operate under the jurisdiction of the state of Pennsylvania.

Article II: Principal Office

The principal office of the Company is located at [Office Address]. The Members may relocate the principal office as they deem necessary.

Article III: Purpose

The purpose of the Company is to [describe the purpose of the company]. The Company may engage in any lawful business permitted under Pennsylvania law.

Article IV: Members' Contributions

The Members hereby make the following capital contributions to the Company:

- [Member Name 1]: [Contribution Amount]

- [Member Name 2]: [Contribution Amount]

- [Member Name 3]: [Contribution Amount]

Article V: Profit and Loss Allocation

Profits and losses shall be allocated to the Members in proportion to their respective contributions as follows:

- [Member Name 1]: [Percentage]

- [Member Name 2]: [Percentage]

- [Member Name 3]: [Percentage]

Article VI: Management

The management of the Company is vested in the Members. Decisions shall be made by a majority vote of the Members.

Article VII: Indemnification

The Company shall indemnify the Members to the fullest extent permitted under Pennsylvania law against any losses, claims, or expenses that may arise in connection with the Company.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

IN WITNESS WHEREOF

The Members have executed this Operating Agreement as of the date first above written.

__________________________

[Member Name 1]

__________________________

[Member Name 2]

__________________________

[Member Name 3]