Printable Deed in Lieu of Foreclosure Form for the State of Pennsylvania

Guide to Writing Pennsylvania Deed in Lieu of Foreclosure

Once you have gathered all necessary information, you can begin filling out the Pennsylvania Deed in Lieu of Foreclosure form. This process involves providing specific details about the property and the parties involved. After completing the form, it will need to be signed and notarized before submission.

- Begin with the title section. Clearly state "Deed in Lieu of Foreclosure" at the top of the form.

- Provide the name of the grantor, which is typically the homeowner or the borrower. Include the full legal name as it appears on the property deed.

- Next, list the name of the grantee. This is usually the lender or the bank accepting the deed.

- Fill in the property address. Ensure that you include the street number, street name, city, state, and zip code for accuracy.

- Describe the property in detail. Include any relevant legal descriptions or parcel numbers, if available. This information is crucial for proper identification.

- Indicate the consideration amount. This is often $0, as the deed is being transferred in lieu of foreclosure.

- Both the grantor and grantee should sign the form. Ensure that the signatures are dated to reflect the date of signing.

- Find a notary public. The form must be notarized to verify the identities of the signers and to validate the document.

- Make copies of the completed and notarized form for your records. This can be useful for future reference.

- Finally, submit the original signed and notarized form to the appropriate county office for recording.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Pennsylvania, the deed in lieu of foreclosure is governed by state property laws and the Uniform Commercial Code. |

| Eligibility | Homeowners facing financial hardship may be eligible to negotiate a deed in lieu with their lender, provided they have exhausted other options. |

| Process | The process typically involves the borrower submitting a request to the lender, who will review the financial situation and property value. |

| Benefits | A deed in lieu can help homeowners avoid the lengthy foreclosure process and potentially minimize damage to their credit score. |

| Risks | Borrowers should be aware that a deed in lieu may still have tax implications and might not absolve them of all liabilities related to the mortgage. |

| Negotiation | It is crucial for homeowners to negotiate the terms of the deed in lieu carefully, including any potential deficiency judgments. |

| Documentation | The deed in lieu must be properly documented and recorded with the local county office to ensure legal validity. |

| Alternatives | Homeowners should consider alternatives such as loan modification or short sales before opting for a deed in lieu of foreclosure. |

FAQ

- The homeowner must be experiencing financial difficulties.

- The property must be in good condition.

- The homeowner must have tried to sell the property but was unsuccessful.

- It can help preserve the homeowner's credit score compared to a foreclosure.

- The process is usually faster and less stressful than a foreclosure.

- Homeowners can often walk away without owing additional money on the mortgage.

- They may still face tax implications on forgiven debt.

- Not all lenders may agree to this arrangement.

- The homeowner will lose their property and any equity they had built up.

- The homeowner contacts their lender to discuss the possibility of a Deed in Lieu.

- Both parties negotiate terms and conditions.

- If agreed upon, the homeowner signs the Deed, transferring ownership to the lender.

- The lender may release the homeowner from further obligations on the mortgage.

- Proof of income and financial hardship.

- A copy of the mortgage agreement.

- Any documents related to the property's condition.

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is an agreement between a homeowner and their lender. In this arrangement, the homeowner voluntarily transfers the property title to the lender to avoid foreclosure. This can help both parties: the homeowner can avoid the lengthy foreclosure process, while the lender can take possession of the property more quickly.

Who qualifies for a Deed in Lieu of Foreclosure in Pennsylvania?

Typically, homeowners who are facing financial hardship and are unable to keep up with mortgage payments may qualify. Lenders usually look for the following:

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider:

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there can be some drawbacks. Homeowners should be aware that:

How does the process work?

The process generally involves the following steps:

What documents are needed for a Deed in Lieu of Foreclosure?

Homeowners typically need to provide various documents, including:

Can a Deed in Lieu of Foreclosure affect my credit score?

Yes, it can affect your credit score, but generally less severely than a foreclosure. While it will still show up on your credit report, the impact may be less damaging, especially if you can demonstrate that you were proactive in resolving your mortgage issues.

Is a Deed in Lieu of Foreclosure the same as a short sale?

No, they are not the same. In a short sale, the property is sold for less than what is owed on the mortgage, and the lender agrees to accept that amount. In a Deed in Lieu, the homeowner simply hands over the property to the lender without selling it.

Can I change my mind after signing a Deed in Lieu of Foreclosure?

Once the Deed is signed and recorded, it is generally considered final. It is crucial to fully understand the implications before proceeding. If you have concerns, it’s wise to consult a legal expert before signing.

Where can I find the Deed in Lieu of Foreclosure form in Pennsylvania?

The form can usually be obtained from your lender or a legal professional. Additionally, many county recorder's offices provide the necessary forms online. Make sure to check that you are using the most current version of the form.

Consider Popular Deed in Lieu of Foreclosure Forms for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - It can be an effective tool for real estate agents handling distressed properties.

Sample Deed in Lieu of Foreclosure - It is essential to understand the legal ramifications before signing this deed.

Foreclosure Vs Deed in Lieu - Lenders may find this option appealing as it often leads to lower costs than pursuing foreclosure.

Obtaining a Work Release form is crucial for individuals who wish to transition smoothly back into society, as it provides the necessary legal permission to seek employment outside of a correctional facility. It is important to understand the process involved and the documentation required, such as a Doctor Release Form, which may be needed to ensure compliance with health regulations while working.

California Voluntary Foreclosure Deed - A document that signifies a borrower’s intention to relinquish their property voluntarily.

Pennsylvania Deed in Lieu of Foreclosure Example

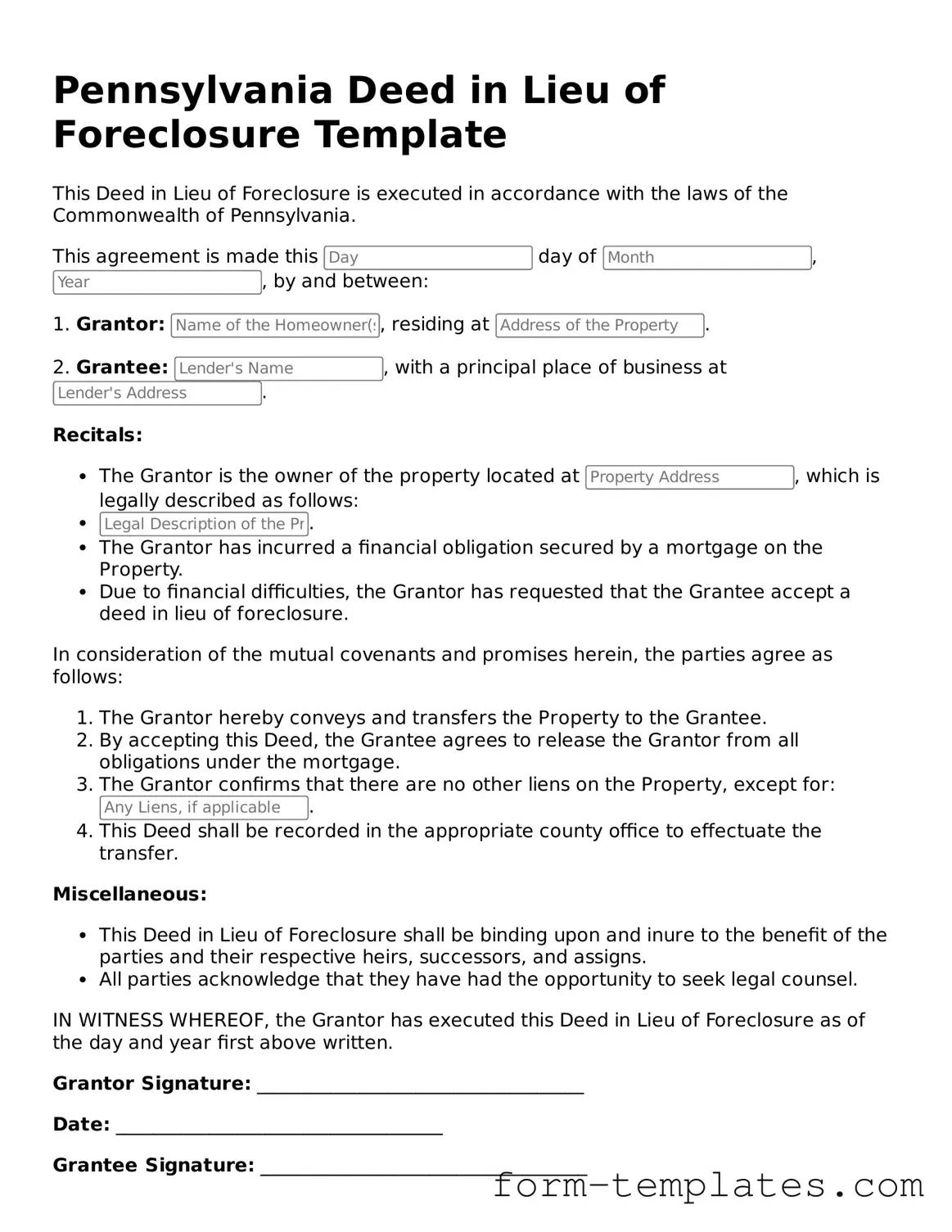

Pennsylvania Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the Commonwealth of Pennsylvania.

This agreement is made this day of , , by and between:

1. Grantor: , residing at .

2. Grantee: , with a principal place of business at .

Recitals:

- The Grantor is the owner of the property located at , which is legally described as follows:

- .

- The Grantor has incurred a financial obligation secured by a mortgage on the Property.

- Due to financial difficulties, the Grantor has requested that the Grantee accept a deed in lieu of foreclosure.

In consideration of the mutual covenants and promises herein, the parties agree as follows:

- The Grantor hereby conveys and transfers the Property to the Grantee.

- By accepting this Deed, the Grantee agrees to release the Grantor from all obligations under the mortgage.

- The Grantor confirms that there are no other liens on the Property, except for:.

- This Deed shall be recorded in the appropriate county office to effectuate the transfer.

Miscellaneous:

- This Deed in Lieu of Foreclosure shall be binding upon and inure to the benefit of the parties and their respective heirs, successors, and assigns.

- All parties acknowledge that they have had the opportunity to seek legal counsel.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor Signature: ___________________________________

Date: ___________________________________

Grantee Signature: ___________________________________

Date: ___________________________________