Fill Out a Valid Payroll Check Template

Guide to Writing Payroll Check

Filling out the Payroll Check form is straightforward. Make sure you have all necessary information ready before starting. This will help you complete the form quickly and accurately.

- Start by entering the employee's name in the designated field.

- Fill in the employee's ID number or social security number.

- Specify the pay period by entering the start and end dates.

- Input the gross pay amount for the period.

- Deduct any taxes and other withholdings, and enter the total deductions.

- Calculate the net pay by subtracting total deductions from gross pay.

- Include the check date in the appropriate field.

- Sign the form where indicated.

Once you complete these steps, review the form for accuracy before submitting it for processing. This ensures that all information is correct and helps avoid any delays in payroll processing.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to disburse wages to employees for their work performed during a specific pay period. |

| Components | This form typically includes the employee's name, pay period dates, gross pay, deductions, and net pay. |

| Frequency | Employers may issue payroll checks on a weekly, biweekly, or monthly basis, depending on their payroll schedule. |

| Legal Requirements | Each state has specific laws governing payroll practices, including minimum wage and timely payment of wages. |

| Record Keeping | Employers are required to keep payroll records for a certain number of years, often three to seven, depending on state laws. |

| Tax Withholding | Payroll checks must account for federal and state tax withholdings, as well as Social Security and Medicare contributions. |

| Direct Deposit Option | Many employers offer direct deposit as an alternative to physical checks, which can streamline payroll processing. |

| Employee Rights | Employees have the right to receive a clear and accurate payroll check, detailing all deductions and withholdings. |

FAQ

What is a Payroll Check Form?

A Payroll Check Form is a document used by employers to process employee payments. It typically includes details such as the employee's name, the amount to be paid, and the pay period. This form ensures that employees receive their wages accurately and on time.

Who needs to fill out the Payroll Check Form?

Generally, the Payroll Check Form needs to be filled out by employers or payroll administrators. However, employees may also be required to provide certain information, such as their name, address, and tax identification number. This ensures that all necessary details are captured for accurate payment processing.

What information is required on the Payroll Check Form?

The Payroll Check Form typically requires the following information:

- Employee's full name

- Employee's address

- Employee's Social Security number or tax identification number

- Pay period dates

- Gross pay amount

- Deductions (if any)

- Net pay amount

Providing complete and accurate information is essential to avoid payment delays or errors.

How often should Payroll Check Forms be submitted?

The frequency of submitting Payroll Check Forms depends on the company's payroll schedule. Many businesses process payroll on a bi-weekly or monthly basis. Therefore, the forms should be submitted accordingly to ensure employees are paid on time. Consistency in submission helps maintain an organized payroll system.

What should I do if there is an error on my Payroll Check Form?

If you notice an error on your Payroll Check Form, it is crucial to address it immediately. Here are the steps you can take:

- Contact your payroll administrator or HR department as soon as possible.

- Provide them with the correct information and any supporting documents.

- Request a correction to be made before the payroll processing deadline.

Timely communication can help resolve issues quickly and ensure that you receive the correct payment.

Fill out Other Forms

Vs 4 Form - Ensuring all required fields are filled out completely prevents unnecessary complications or delays.

Having a clear and comprehensive Room Rental Agreement is essential for both landlords and tenants, as it lays out the specifics of the rental arrangement. This agreement helps to avoid misunderstandings by detailing important aspects such as payment, responsibilities, and house rules. For those looking to create a legally binding document, you can find an example of a Room Lease Agreement that can serve as a valuable resource.

Medicare and Social Security - Beneficiaries can personalize their Medicare experience with the CMS-1763.

Payroll Check Example

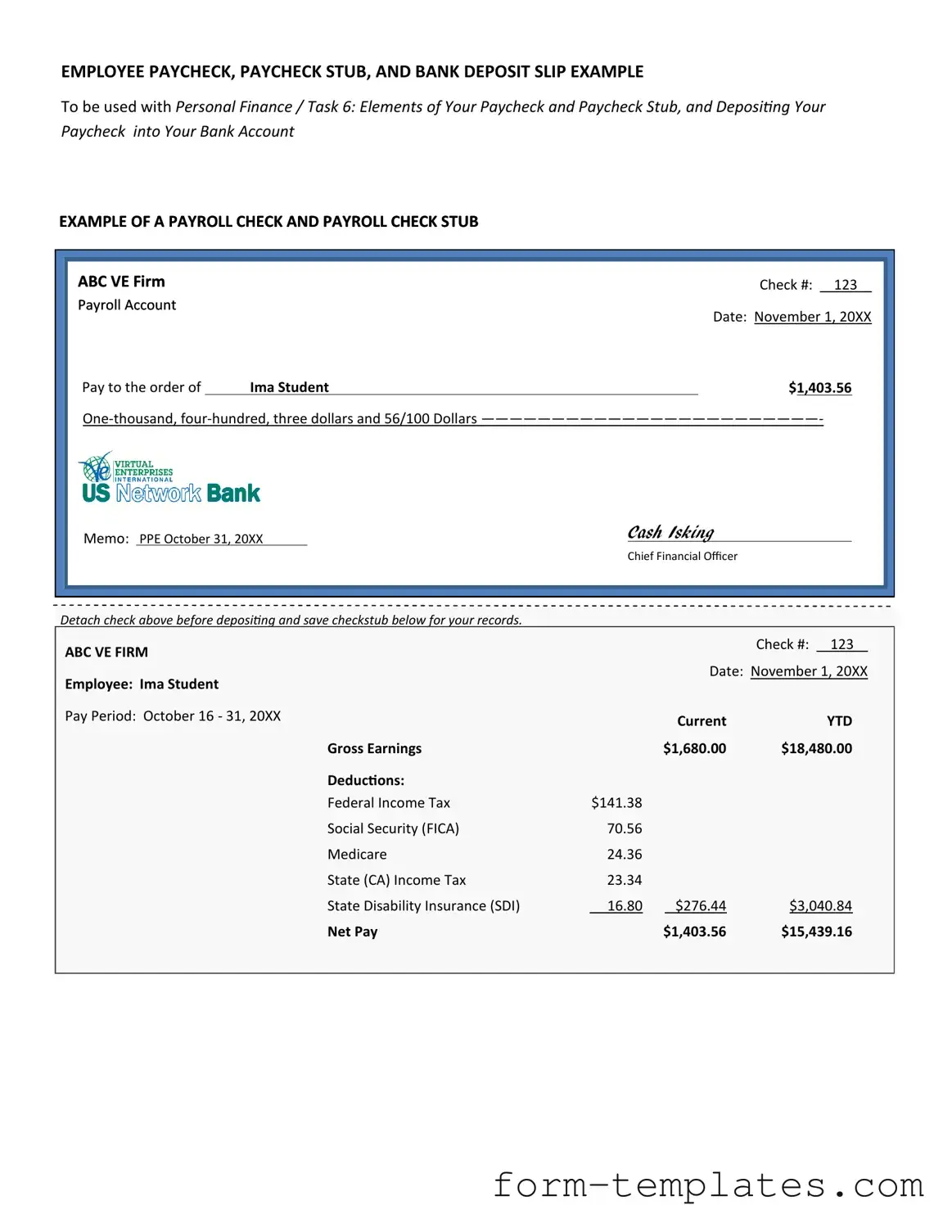

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account