Attorney-Approved Owner Financing Contract Document

Guide to Writing Owner Financing Contract

Filling out the Owner Financing Contract form is a straightforward process. This form will guide you through the necessary details to ensure both parties are clear on the terms of the agreement. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form.

- Next, fill in the names of the buyer and seller. Make sure to include full legal names.

- Provide the property address where the transaction will take place.

- Specify the purchase price of the property.

- Outline the down payment amount that the buyer will provide.

- Detail the financing terms, including the interest rate and loan duration.

- Include any additional terms or conditions that both parties agree upon.

- Sign and date the form in the designated areas for both the buyer and seller.

After completing the form, both parties should keep a copy for their records. This ensures that everyone has access to the agreed-upon terms and can refer back to them if needed.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | An Owner Financing Contract allows the buyer to purchase property directly from the seller, bypassing traditional financing methods. |

| Parties Involved | The contract involves two main parties: the seller (owner) and the buyer. |

| Payment Structure | Payments are typically made in installments, which may include principal and interest. |

| Interest Rate | The seller sets the interest rate, which can be higher or lower than conventional loans. |

| Governing Law | The contract is governed by state laws. For example, in Texas, the Texas Property Code applies. |

| Down Payment | A down payment is often required, which can vary based on the agreement between the parties. |

| Default Consequences | If the buyer defaults, the seller may have the right to foreclose on the property. |

| Property Type | This contract can be used for various types of real estate, including residential and commercial properties. |

| Transfer of Title | The title is typically transferred to the buyer once the contract terms are fulfilled. |

| Legal Advice | It is advisable for both parties to seek legal advice before entering into an Owner Financing Contract. |

FAQ

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a seller and a buyer where the seller provides financing to the buyer to purchase a property. Instead of obtaining a traditional mortgage from a bank, the buyer makes payments directly to the seller over time. This arrangement can benefit both parties by simplifying the transaction and potentially offering more favorable terms.

Who can use an Owner Financing Contract?

Any property owner looking to sell their real estate can use an Owner Financing Contract. This option is especially appealing for sellers who want to attract buyers who may have difficulty securing traditional financing. Buyers who are interested in purchasing a home but lack sufficient credit or funds for a down payment may also find this arrangement advantageous.

What are the advantages of Owner Financing?

Owner Financing offers several benefits, including:

- Flexible terms: Sellers can set the interest rate, payment schedule, and other terms based on their preferences.

- Faster closing: The process can be quicker than traditional financing, as it often bypasses lengthy bank approvals.

- Potential for higher sale price: Sellers may command a higher price due to the financing option.

- Attracting more buyers: This financing method can widen the pool of potential buyers.

What should be included in an Owner Financing Contract?

An Owner Financing Contract should clearly outline the following elements:

- The purchase price of the property.

- The amount of the down payment.

- The interest rate and payment schedule.

- The length of the financing term.

- Any penalties for late payments.

- Conditions for default and the seller's rights.

What happens if the buyer defaults on the loan?

If the buyer defaults on the loan, the seller has specific rights outlined in the contract. Typically, the seller may initiate foreclosure proceedings to reclaim the property. The exact process and consequences will depend on the terms set forth in the Owner Financing Contract and applicable state laws. It is essential for both parties to understand these terms before entering into the agreement.

Can the Owner Financing Contract be modified?

Yes, the Owner Financing Contract can be modified if both parties agree to the changes. Any modifications should be documented in writing and signed by both the seller and the buyer. This ensures that both parties have a clear understanding of the new terms and conditions.

Is legal assistance recommended when creating an Owner Financing Contract?

Yes, seeking legal assistance is highly recommended when creating an Owner Financing Contract. A qualified attorney can help ensure that the contract complies with state laws, protects the interests of both parties, and clearly outlines all terms. This can prevent misunderstandings and disputes in the future.

Other Owner Financing Contract Templates:

Buyer's Agent Termination Letter Sample - It is advisable to seek legal advice before completing a termination form to ensure all interests are protected.

Before entering into a property transaction, it is crucial to familiarize oneself with the key aspects of the Real Estate Purchase Agreement for a successful deal. For a thorough understanding, please refer to the document on the essential real estate purchase agreement details.

Purchase Agreement Addendum - Used to update information on legal obligations for the property transfer.

Personal Guarantor - The document requires that any obligations specified be met in full, if necessary.

Owner Financing Contract Example

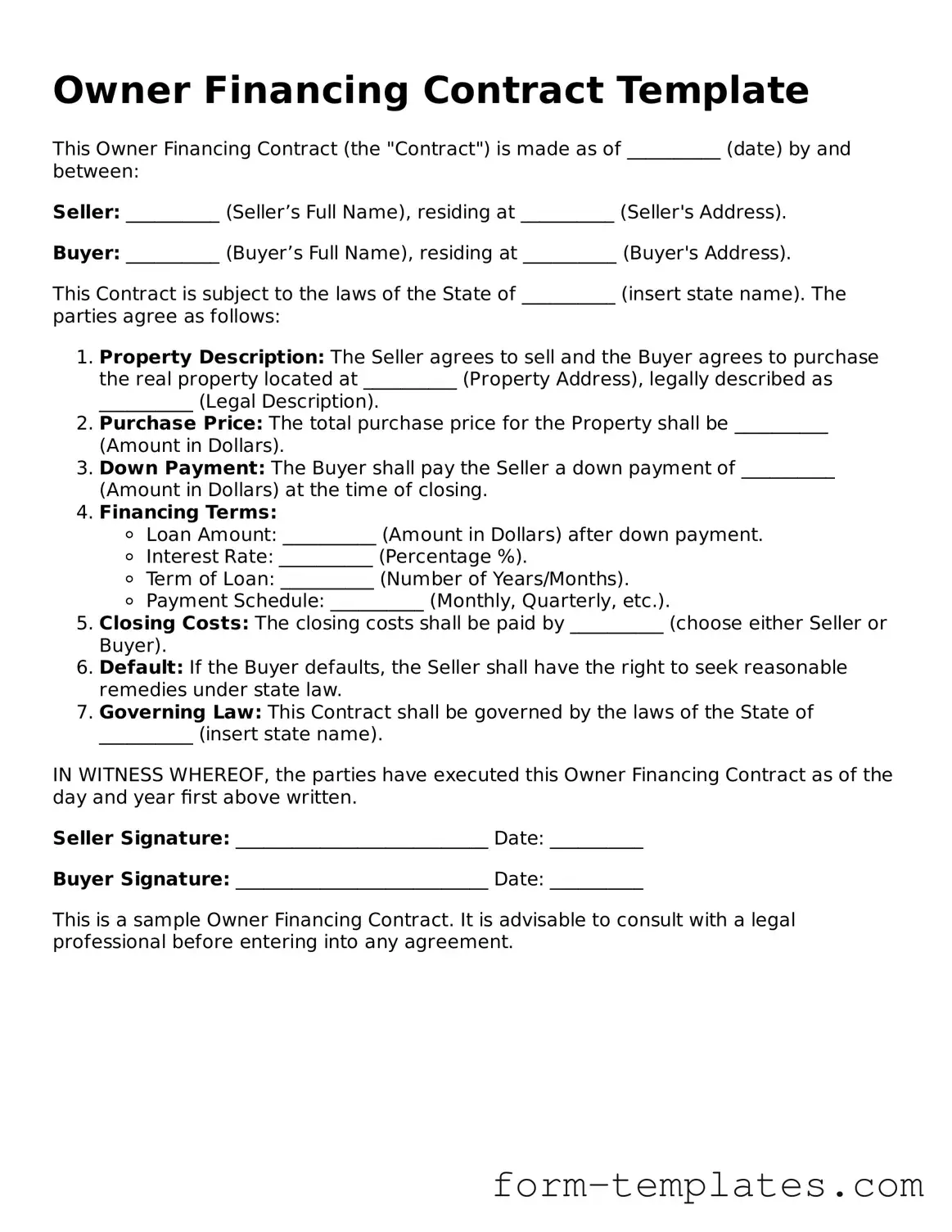

Owner Financing Contract Template

This Owner Financing Contract (the "Contract") is made as of __________ (date) by and between:

Seller: __________ (Seller’s Full Name), residing at __________ (Seller's Address).

Buyer: __________ (Buyer’s Full Name), residing at __________ (Buyer's Address).

This Contract is subject to the laws of the State of __________ (insert state name). The parties agree as follows:

- Property Description: The Seller agrees to sell and the Buyer agrees to purchase the real property located at __________ (Property Address), legally described as __________ (Legal Description).

- Purchase Price: The total purchase price for the Property shall be __________ (Amount in Dollars).

- Down Payment: The Buyer shall pay the Seller a down payment of __________ (Amount in Dollars) at the time of closing.

- Financing Terms:

- Loan Amount: __________ (Amount in Dollars) after down payment.

- Interest Rate: __________ (Percentage %).

- Term of Loan: __________ (Number of Years/Months).

- Payment Schedule: __________ (Monthly, Quarterly, etc.).

- Closing Costs: The closing costs shall be paid by __________ (choose either Seller or Buyer).

- Default: If the Buyer defaults, the Seller shall have the right to seek reasonable remedies under state law.

- Governing Law: This Contract shall be governed by the laws of the State of __________ (insert state name).

IN WITNESS WHEREOF, the parties have executed this Owner Financing Contract as of the day and year first above written.

Seller Signature: ___________________________ Date: __________

Buyer Signature: ___________________________ Date: __________

This is a sample Owner Financing Contract. It is advisable to consult with a legal professional before entering into any agreement.