Attorney-Approved Operating Agreement Document

Guide to Writing Operating Agreement

Completing the Operating Agreement form is an essential step for establishing clear guidelines and expectations for your business. Once you have gathered the necessary information, you can proceed with filling out the form. This document will help ensure that all parties involved understand their roles and responsibilities.

- Begin by entering the name of your business at the top of the form.

- Provide the principal address of your business. This should be a physical location, not a P.O. Box.

- List the names of all members involved in the business. Include their full legal names.

- Specify the percentage of ownership for each member. Ensure that the total adds up to 100%.

- Detail the management structure. Indicate whether the business will be member-managed or manager-managed.

- Outline the voting rights of each member. Clarify how decisions will be made and what constitutes a quorum.

- Include provisions for profit distribution. State how profits and losses will be shared among members.

- Address the procedures for adding new members or removing existing ones. Outline any necessary approvals or conditions.

- Provide details regarding the dissolution of the business. Explain the process for winding up affairs if the business ceases operations.

- Lastly, ensure that all members sign and date the document. This formalizes the agreement and makes it legally binding.

After completing the form, keep a copy for your records. It is advisable to share the finalized agreement with all members to ensure transparency and mutual understanding.

Operating AgreementDocuments for Specific US States

Operating Agreement Form Categories

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Purpose | This document serves to protect the members' interests and clarify the rules governing the LLC. |

| State-Specific Requirements | Each state may have specific requirements regarding the content and format of the Operating Agreement. |

| Governing Law | The Operating Agreement is governed by the laws of the state in which the LLC is formed. |

| Flexibility | Members can customize the Operating Agreement to suit their specific needs and preferences. |

| Legal Protection | Having an Operating Agreement can provide legal protection and help resolve disputes among members. |

FAQ

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC). It serves as the internal governing document for the LLC, detailing the rights and responsibilities of the members, as well as the operational guidelines for the business.

Why is an Operating Agreement important?

This document is crucial for several reasons:

- It helps prevent misunderstandings among members by clearly defining roles and responsibilities.

- It provides a framework for resolving disputes that may arise.

- It can enhance the credibility of the LLC in the eyes of banks and investors.

- In many states, an Operating Agreement is required for the LLC to operate legally.

Who should create the Operating Agreement?

All members of the LLC should participate in creating the Operating Agreement. This ensures that everyone's interests are represented and that all members understand the terms. It is advisable to consult with a legal professional to ensure that the agreement meets all legal requirements and adequately reflects the intentions of the members.

What should be included in an Operating Agreement?

An Operating Agreement should cover several key areas, including:

- The name and purpose of the LLC.

- The names and contributions of the members.

- The management structure (member-managed or manager-managed).

- Voting rights and procedures.

- Distribution of profits and losses.

- Procedures for adding or removing members.

- Dispute resolution mechanisms.

- Amendment procedures for the agreement.

Is an Operating Agreement required by law?

While not all states require an Operating Agreement for LLCs, having one is highly recommended. In states that do not mandate it, the absence of an Operating Agreement can lead to reliance on default state laws, which may not align with the members' intentions.

How often should the Operating Agreement be reviewed?

The Operating Agreement should be reviewed regularly, especially after significant changes in the business, such as new members joining, changes in ownership, or shifts in management structure. An annual review is a good practice to ensure that the agreement remains relevant and effective.

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. The process for making amendments should be outlined in the agreement itself. Typically, amendments require a majority vote of the members. It is essential to document any changes formally to maintain clarity and legal validity.

What happens if there is no Operating Agreement?

If there is no Operating Agreement, the LLC will be governed by the default laws of the state in which it was formed. This can lead to unintended consequences, such as conflicts over management decisions and profit distributions. Without a clear agreement, members may find themselves in disputes that could have been avoided.

How can I obtain an Operating Agreement template?

Operating Agreement templates are widely available online. However, it is crucial to ensure that any template used complies with the laws of your state and is tailored to your specific business needs. Consulting with a legal professional is advisable to create a customized agreement that reflects your LLC's unique circumstances.

Fill out Popular Documents

Social Media Consent Form for Employees - Clear guidelines on the photographic rights of employees are established with this form.

The Florida Bill of Sale form is a crucial document that serves as proof of the transfer of ownership of personal property, such as vehicles, equipment, or other tangible goods. This legal tool helps both buyers and sellers protect their rights by clearly outlining the transaction details. To ensure you have the correct documentation, visit Top Document Templates for assistance with obtaining the form. Ready to make your purchase official? Fill out the form by clicking the button below!

Identification Affidavit of Identity - Can be prescribed for use in obtaining travel documents.

Cash Drawer Balance Sheet - Helps establish a routine for cash drawer counts at closing time.

Operating Agreement Example

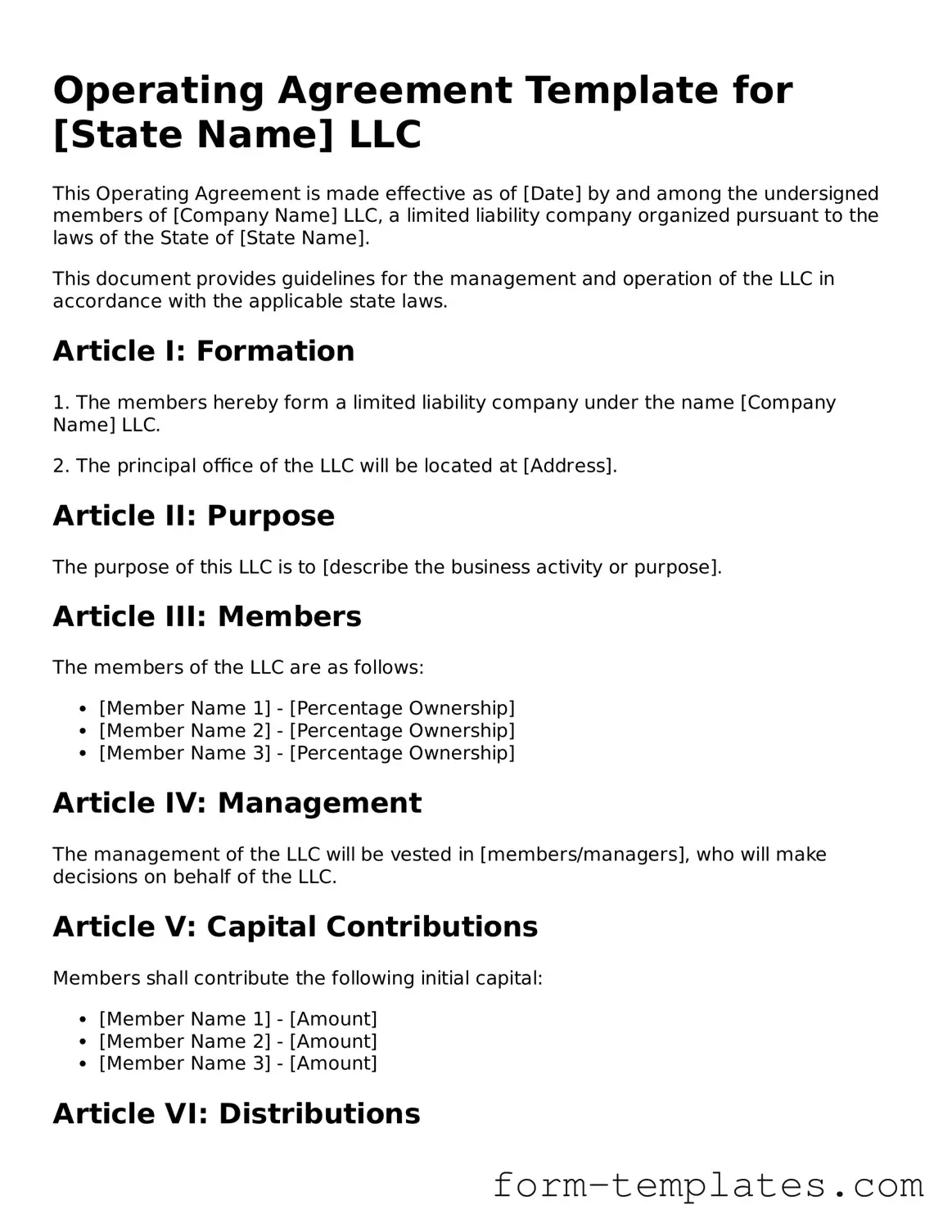

Operating Agreement Template for [State Name] LLC

This Operating Agreement is made effective as of [Date] by and among the undersigned members of [Company Name] LLC, a limited liability company organized pursuant to the laws of the State of [State Name].

This document provides guidelines for the management and operation of the LLC in accordance with the applicable state laws.

Article I: Formation

1. The members hereby form a limited liability company under the name [Company Name] LLC.

2. The principal office of the LLC will be located at [Address].

Article II: Purpose

The purpose of this LLC is to [describe the business activity or purpose].

Article III: Members

The members of the LLC are as follows:

- [Member Name 1] - [Percentage Ownership]

- [Member Name 2] - [Percentage Ownership]

- [Member Name 3] - [Percentage Ownership]

Article IV: Management

The management of the LLC will be vested in [members/managers], who will make decisions on behalf of the LLC.

Article V: Capital Contributions

Members shall contribute the following initial capital:

- [Member Name 1] - [Amount]

- [Member Name 2] - [Amount]

- [Member Name 3] - [Amount]

Article VI: Distributions

Distributions of profits and losses shall be allocated in proportion to each member's percentage of ownership.

Article VII: Meetings

Members shall hold meetings [annually/quarterly/as needed] at a time and place agreed upon by the members.

Article VIII: Amendment

This Operating Agreement may be amended only by a written agreement signed by all members.

Article IX: Governing Law

This Agreement will be governed by the laws of the State of [State Name].

IN WITNESS WHEREOF, the members have executed this Operating Agreement as of the date first above written.

_________________________

[Member Name 1], Member

_________________________

[Member Name 2], Member

_________________________

[Member Name 3], Member