Printable Transfer-on-Death Deed Form for the State of New York

Guide to Writing New York Transfer-on-Death Deed

Once you have the New York Transfer-on-Death Deed form ready, you can begin the process of filling it out. Make sure you have all necessary information on hand, including details about the property and the beneficiaries. Follow these steps carefully to complete the form accurately.

- Start by entering the date at the top of the form.

- Provide your name and address in the designated fields. This is typically the name of the person transferring the property.

- Next, fill in the legal description of the property. This may include the address and other identifying information. Ensure this information matches the official records.

- Identify the beneficiaries by writing their names and addresses. These are the individuals who will receive the property upon your passing.

- If there are multiple beneficiaries, indicate how the property will be divided among them. Be clear about whether it will be equally shared or in specific proportions.

- Sign the form in the appropriate section. Your signature is crucial for the document to be valid.

- Have the form notarized. This step is important as it verifies your identity and ensures that the signing process is legitimate.

- Once notarized, make copies of the completed form for your records.

- Finally, file the original deed with the county clerk's office where the property is located. This officially records the transfer-on-death designation.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The New York Transfer-on-Death Deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 2-1.11. |

| Eligibility | Any individual who owns real property in New York can create a TOD Deed, provided they are of sound mind. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed, who will receive the property upon the owner's death. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, as long as they follow the proper procedures. |

| Recording Requirements | The TOD Deed must be recorded with the county clerk in the county where the property is located for it to be effective. |

| Tax Implications | While the property remains in the owner's name, they retain full control and responsibility, including tax obligations, until their death. |

FAQ

What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death (TOD) Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. This deed is a simple way to ensure that your property goes directly to your chosen beneficiary, avoiding the lengthy and often costly probate process.

How do I create a Transfer-on-Death Deed?

To create a TOD Deed in New York, follow these steps:

- Obtain the official Transfer-on-Death Deed form from the New York State government or a reliable legal source.

- Fill out the form with the required information, including your name, the beneficiary's name, and a description of the property.

- Sign the deed in front of a notary public.

- File the deed with the county clerk's office where the property is located.

Make sure to keep a copy for your records and inform your beneficiary about the deed.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time while you are still alive. To do this, you must create a new deed that either names a different beneficiary or states that the previous deed is revoked. The new deed must also be signed and filed with the county clerk's office.

Are there any limitations on who can be a beneficiary?

In New York, you can name anyone as a beneficiary, but there are some important considerations:

- The beneficiary must be a living person or a qualified entity, such as a trust.

- It's advisable to avoid naming minor children directly, as they may require a guardian to manage the property until they reach adulthood.

Consulting with a legal expert can help clarify the best options for your situation.

What happens if the beneficiary dies before me?

If the named beneficiary passes away before you do, the Transfer-on-Death Deed becomes void. To prevent complications, you should consider naming alternate beneficiaries. This ensures that your property will still be transferred as intended, even if your primary choice is no longer available.

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be fees associated with filing the TOD Deed with the county clerk’s office. These fees can vary by county, so it's a good idea to check with your local office for specific amounts. Additionally, if you seek legal assistance in preparing the deed, there may be costs for those services as well.

Consider Popular Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Florida Form - Legal advice can clarify how it fits into your overall estate plan.

The Employee Availability form is a document used by employers to gather information about when employees are available to work. This form helps businesses schedule shifts effectively, ensuring that staffing needs are met while accommodating employees' personal commitments. To learn more about this important tool, you can visit the Employee Availability Form for guidance. Understanding how to fill out and utilize this form can lead to improved workplace efficiency and employee satisfaction.

What Is a Transfer on Death - Individuals should consult professionals to ensure proper execution and understanding of this deed.

New York Transfer-on-Death Deed Example

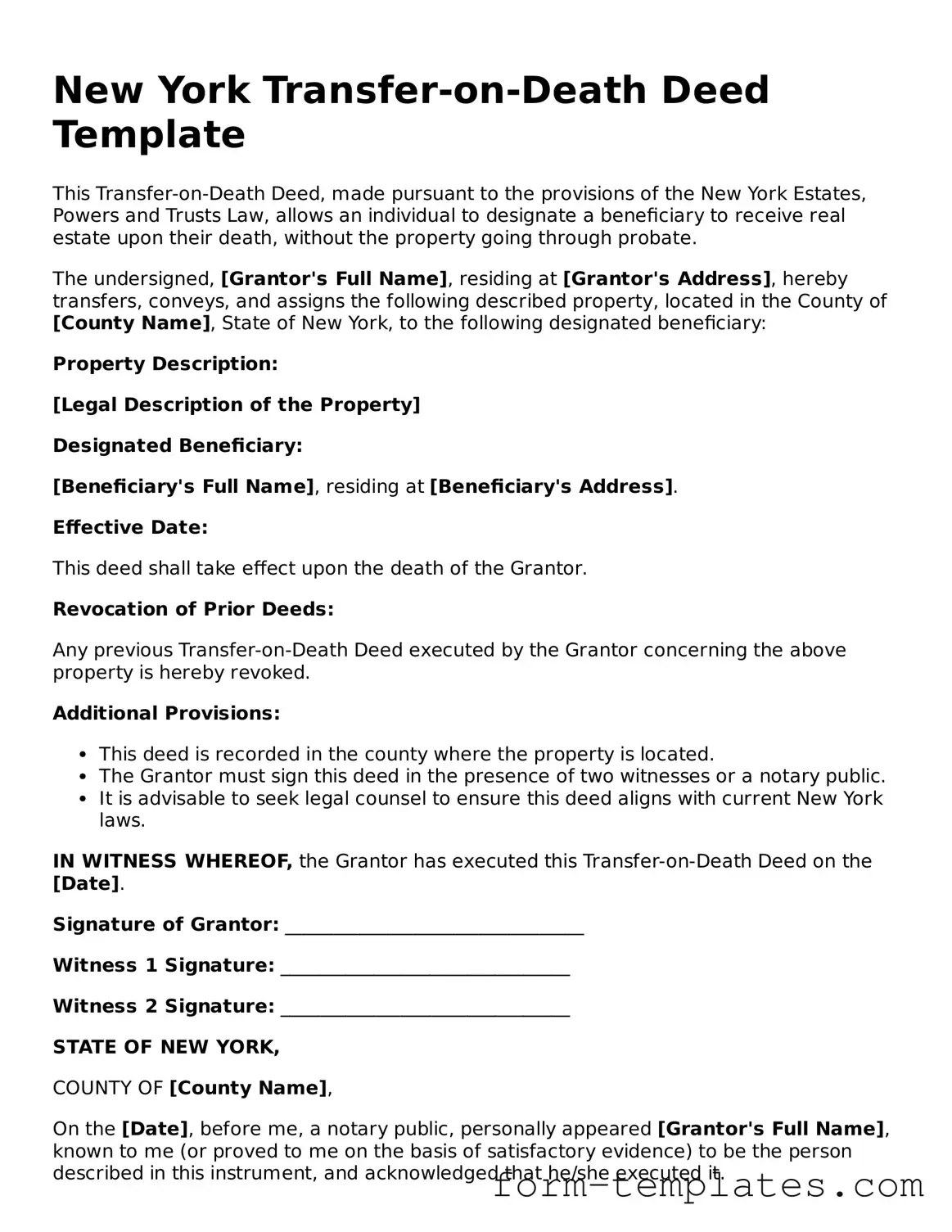

New York Transfer-on-Death Deed Template

This Transfer-on-Death Deed, made pursuant to the provisions of the New York Estates, Powers and Trusts Law, allows an individual to designate a beneficiary to receive real estate upon their death, without the property going through probate.

The undersigned, [Grantor's Full Name], residing at [Grantor's Address], hereby transfers, conveys, and assigns the following described property, located in the County of [County Name], State of New York, to the following designated beneficiary:

Property Description:

[Legal Description of the Property]

Designated Beneficiary:

[Beneficiary's Full Name], residing at [Beneficiary's Address].

Effective Date:

This deed shall take effect upon the death of the Grantor.

Revocation of Prior Deeds:

Any previous Transfer-on-Death Deed executed by the Grantor concerning the above property is hereby revoked.

Additional Provisions:

- This deed is recorded in the county where the property is located.

- The Grantor must sign this deed in the presence of two witnesses or a notary public.

- It is advisable to seek legal counsel to ensure this deed aligns with current New York laws.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on the [Date].

Signature of Grantor: ________________________________

Witness 1 Signature: _______________________________

Witness 2 Signature: _______________________________

STATE OF NEW YORK,

COUNTY OF [County Name],

On the [Date], before me, a notary public, personally appeared [Grantor's Full Name], known to me (or proved to me on the basis of satisfactory evidence) to be the person described in this instrument, and acknowledged that he/she executed it.

Notary Public: ________________________________

My Commission Expires: ________________________