Printable Promissory Note Form for the State of New York

Guide to Writing New York Promissory Note

After obtaining the New York Promissory Note form, you are ready to provide the necessary information. Ensure that you have all relevant details at hand, as accurate completion is essential for the note to be valid.

- Begin by entering the date at the top of the form. This should be the date you are completing the note.

- Fill in the name and address of the borrower. This identifies the individual or entity that will be repaying the loan.

- Next, provide the name and address of the lender. This is the person or organization that is providing the funds.

- Specify the principal amount of the loan. This is the total amount being borrowed.

- Indicate the interest rate, if applicable. This should be expressed as a percentage.

- State the repayment terms. Include details such as the payment schedule and the duration of the loan.

- Include any late fees or penalties for missed payments, if relevant.

- Sign and date the form. The borrower must sign to acknowledge the terms of the loan.

- If required, have a witness sign the document as well. This can add an extra layer of validity to the note.

Once the form is completed and signed, retain a copy for your records. The lender should also keep a copy for their files. This ensures both parties have access to the terms agreed upon.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. |

| Governing Law | The New York Promissory Note is governed by Article 3 of the New York Uniform Commercial Code (UCC). |

| Parties Involved | There are typically two parties involved: the maker (who promises to pay) and the payee (who receives the payment). |

| Interest Rates | The note may specify an interest rate, which can be fixed or variable, depending on the agreement between the parties. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and include essential terms such as the amount, interest rate, and payment date. |

FAQ

What is a New York Promissory Note?

A New York Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a predetermined time or on demand. This document serves as a legal record of the debt and outlines the terms of repayment, including interest rates and payment schedules. It is commonly used in personal loans, business transactions, and real estate financing.

Who can use a Promissory Note in New York?

Any individual or business can use a Promissory Note in New York. Borrowers and lenders can create this agreement to formalize a loan arrangement. It is essential for both parties to understand the terms and conditions outlined in the note. This document can be beneficial for friends, family, or businesses looking to establish clear repayment expectations.

What are the key components of a New York Promissory Note?

A New York Promissory Note typically includes the following key components:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the unpaid balance.

- Payment Terms: Details on how and when payments will be made.

- Maturity Date: The date by which the loan must be fully repaid.

- Borrower and Lender Information: Names and contact details of both parties.

Including these components helps ensure clarity and can prevent misunderstandings in the future.

Is a New York Promissory Note legally binding?

Yes, a New York Promissory Note is legally binding once it is signed by both the borrower and the lender. It creates an enforceable obligation for the borrower to repay the loan according to the agreed-upon terms. However, it is crucial for both parties to fully understand the terms before signing to avoid potential disputes.

What happens if the borrower defaults on the Promissory Note?

If a borrower defaults on a Promissory Note, the lender has several options. They may pursue legal action to recover the owed amount, which could include filing a lawsuit. Additionally, the lender may report the default to credit bureaus, which can negatively impact the borrower’s credit score. It is often advisable for both parties to communicate openly and seek a resolution before resorting to legal measures.

Consider Popular Promissory Note Forms for Specific States

Promissory Note Florida Pdf - Interest rates specified in the note can be fixed or variable.

Promissory Note Texas - Both parties should discuss their obligations to ensure a mutually beneficial agreement.

The Check Register form is a vital tool for tracking all checks written, providing a clear overview of your financial transactions. By maintaining this record, individuals and businesses can ensure better budget management and prevent overdrafts. To simplify your financial organization, consider using a Fillable Blank Check to help you stay on top of your budgeting needs.

Promissory Note Friendly Loan Agreement Format - It is common to impose conditions on the loan in the note.

Promissory Note Form California - A clear understanding of the note's terms can help prevent future financial conflicts.

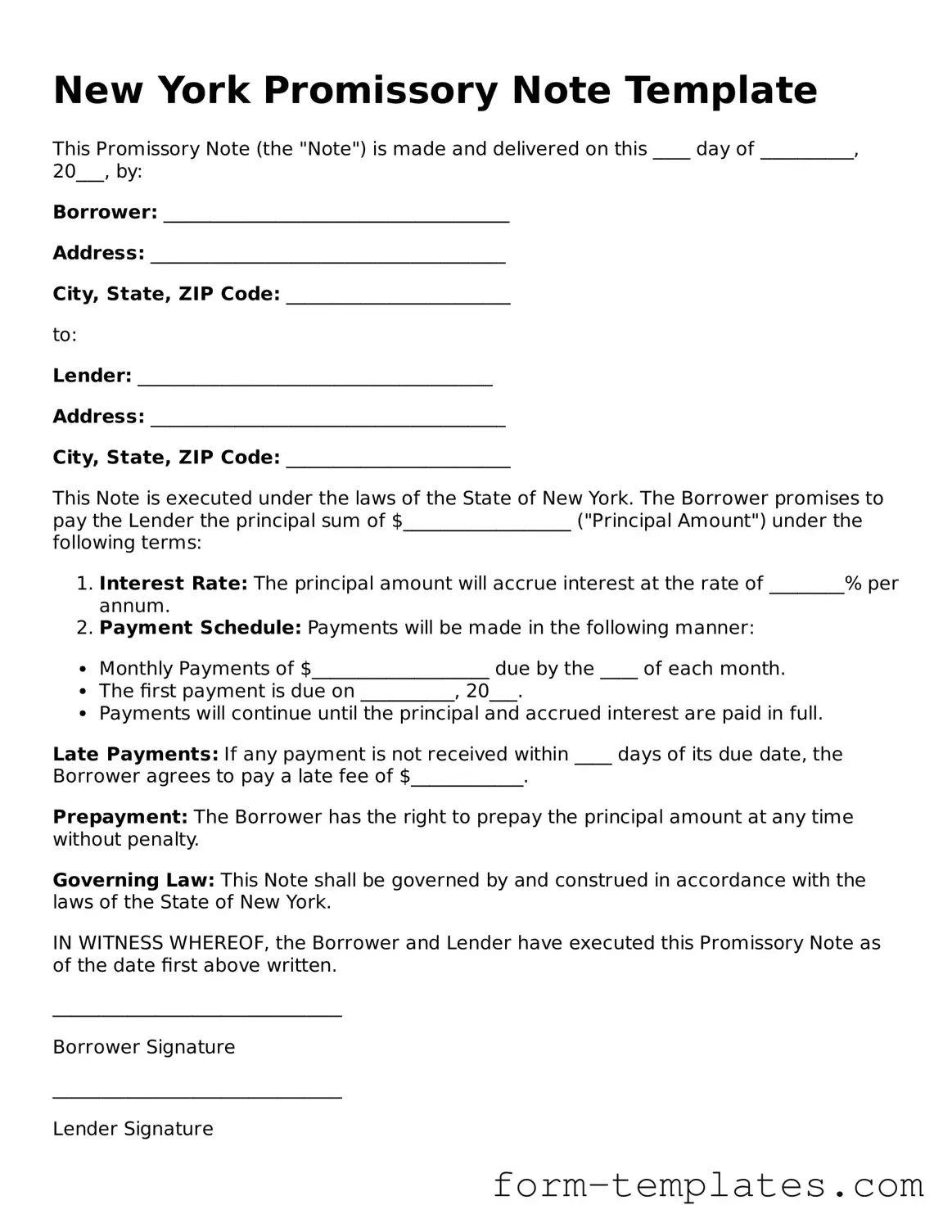

New York Promissory Note Example

New York Promissory Note Template

This Promissory Note (the "Note") is made and delivered on this ____ day of __________, 20___, by:

Borrower: _____________________________________

Address: ______________________________________

City, State, ZIP Code: ________________________

to:

Lender: ______________________________________

Address: ______________________________________

City, State, ZIP Code: ________________________

This Note is executed under the laws of the State of New York. The Borrower promises to pay the Lender the principal sum of $__________________ ("Principal Amount") under the following terms:

- Interest Rate: The principal amount will accrue interest at the rate of ________% per annum.

- Payment Schedule: Payments will be made in the following manner:

- Monthly Payments of $___________________ due by the ____ of each month.

- The first payment is due on __________, 20___.

- Payments will continue until the principal and accrued interest are paid in full.

Late Payments: If any payment is not received within ____ days of its due date, the Borrower agrees to pay a late fee of $____________.

Prepayment: The Borrower has the right to prepay the principal amount at any time without penalty.

Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF, the Borrower and Lender have executed this Promissory Note as of the date first above written.

_______________________________

Borrower Signature

_______________________________

Lender Signature