Printable Loan Agreement Form for the State of New York

Guide to Writing New York Loan Agreement

Filling out the New York Loan Agreement form is an important step in securing a loan. To ensure that the process goes smoothly, follow these steps carefully. Make sure you have all the necessary information and documents on hand before you start.

- Begin by downloading the New York Loan Agreement form from the official website or obtain a physical copy.

- Read through the entire form to familiarize yourself with the required information.

- Fill in your personal details, including your full name, address, and contact information in the designated sections.

- Provide the details of the loan, such as the amount you wish to borrow and the purpose of the loan.

- Specify the repayment terms, including the interest rate, repayment schedule, and due dates.

- If applicable, include any collateral information to secure the loan.

- Review the terms and conditions carefully, ensuring you understand your obligations.

- Sign and date the form at the bottom, indicating your agreement to the terms outlined.

- If required, have a witness or co-signer sign the document as well.

- Make a copy of the completed form for your records before submitting it to the lender.

Once you have filled out the form, review it one last time for any errors or missing information. Submitting a complete and accurate form will help expedite the loan approval process.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The New York Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York. |

| Parties Involved | The form typically includes the names and addresses of both the lender and the borrower. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The interest rate applicable to the loan is detailed, including whether it is fixed or variable. |

| Repayment Terms | The form outlines the repayment schedule, including due dates and payment methods. |

| Default Conditions | Conditions under which the borrower may be considered in default are specified. |

| Signatures | Both parties must sign the agreement to indicate their acceptance of the terms. |

FAQ

What is a New York Loan Agreement form?

A New York Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in New York. This agreement specifies the amount borrowed, the interest rate, the repayment schedule, and any collateral involved. It serves to protect both parties by clearly detailing their rights and responsibilities.

Why is it important to have a written loan agreement?

Having a written loan agreement is crucial for several reasons:

- Clarity: It ensures that both parties understand the terms of the loan, reducing the potential for misunderstandings.

- Legal Protection: In the event of a dispute, a written agreement can serve as evidence in court.

- Enforceability: A signed document is typically easier to enforce than a verbal agreement.

- Record Keeping: It provides a formal record of the transaction, which can be useful for tax purposes or future reference.

What should be included in a New York Loan Agreement?

A comprehensive New York Loan Agreement should include the following key elements:

- Loan Amount: Clearly state how much money is being borrowed.

- Interest Rate: Specify the interest rate and whether it is fixed or variable.

- Repayment Terms: Outline the repayment schedule, including due dates and the total repayment period.

- Default Terms: Define what constitutes a default and the consequences for failing to meet the terms.

- Signatures: Ensure both parties sign the agreement to make it legally binding.

Can a New York Loan Agreement be modified after it is signed?

Yes, a New York Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is essential to document any modifications in writing, and both parties should sign the amended agreement. This helps maintain clarity and ensures that all parties are on the same page regarding the new terms.

Consider Popular Loan Agreement Forms for Specific States

Loan Agreement Template California - The document often details the right of the lender to check the borrower’s credit history.

The importance of the Work Release form cannot be overstated, as it plays a crucial role in facilitating the transition from incarceration to the workforce. By utilizing a Work Release Form, individuals can gain valuable job experience and contribute to society, all while adhering to the requirements set forth by the legal system. This process not only supports personal rehabilitation but also promotes a positive reintegration into the community.

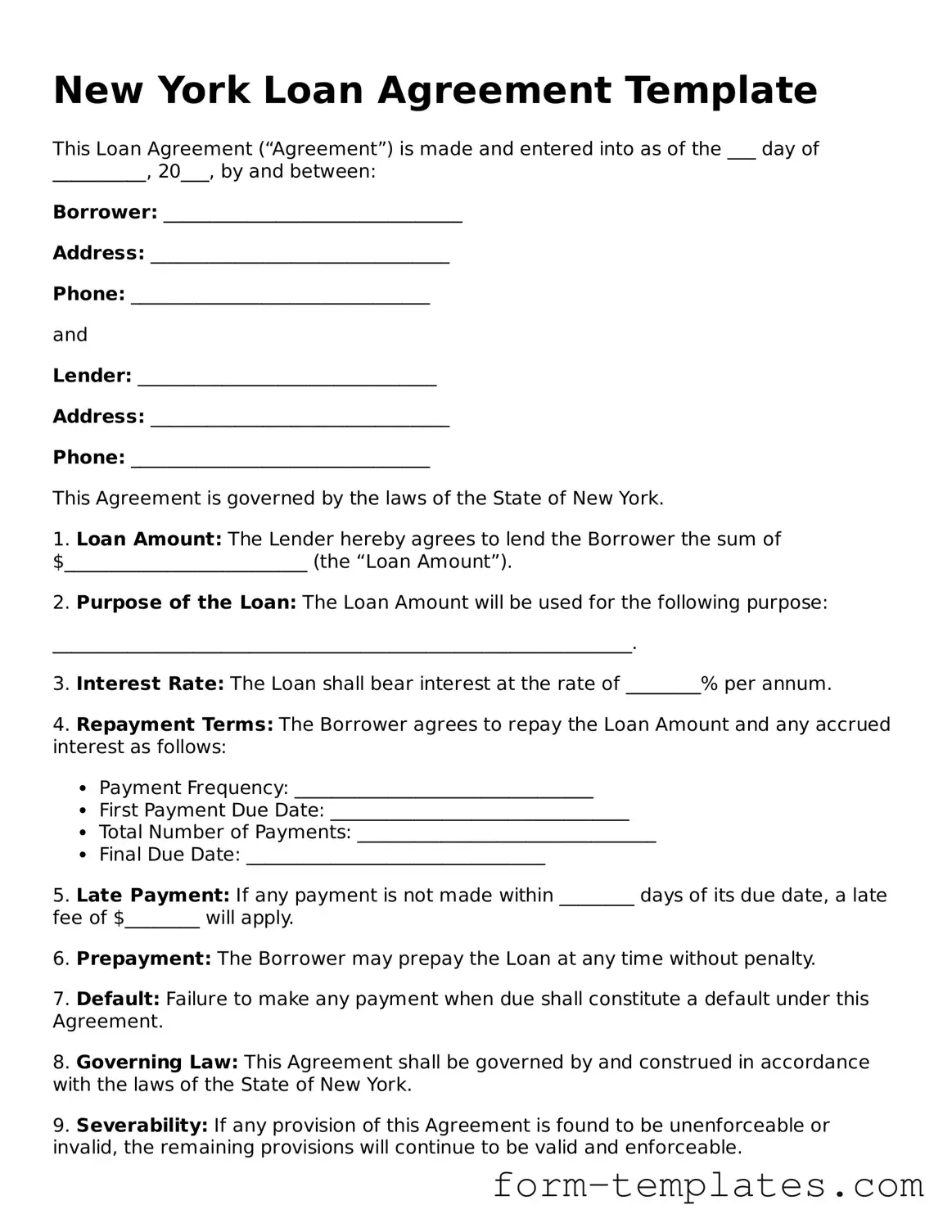

New York Loan Agreement Example

New York Loan Agreement Template

This Loan Agreement (“Agreement”) is made and entered into as of the ___ day of __________, 20___, by and between:

Borrower: ________________________________

Address: ________________________________

Phone: ________________________________

and

Lender: ________________________________

Address: ________________________________

Phone: ________________________________

This Agreement is governed by the laws of the State of New York.

1. Loan Amount: The Lender hereby agrees to lend the Borrower the sum of $__________________________ (the “Loan Amount”).

2. Purpose of the Loan: The Loan Amount will be used for the following purpose:

______________________________________________________________.

3. Interest Rate: The Loan shall bear interest at the rate of ________% per annum.

4. Repayment Terms: The Borrower agrees to repay the Loan Amount and any accrued interest as follows:

- Payment Frequency: ________________________________

- First Payment Due Date: ________________________________

- Total Number of Payments: ________________________________

- Final Due Date: ________________________________

5. Late Payment: If any payment is not made within ________ days of its due date, a late fee of $________ will apply.

6. Prepayment: The Borrower may prepay the Loan at any time without penalty.

7. Default: Failure to make any payment when due shall constitute a default under this Agreement.

8. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

9. Severability: If any provision of this Agreement is found to be unenforceable or invalid, the remaining provisions will continue to be valid and enforceable.

10. Entire Agreement: This Agreement constitutes the entire understanding between the parties and supersedes all prior agreements.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the day and year first above written.

______________________________ Borrower Signature

______________________________ Date

______________________________ Lender Signature

______________________________ Date

This template provides a structured format for a loan agreement tailored to New York state and ensures that essential information is captured. Adjust the specifics according to the particular arrangement between the borrower and lender.