Printable Durable Power of Attorney Form for the State of New York

Guide to Writing New York Durable Power of Attorney

Filling out the New York Durable Power of Attorney form is an important step in ensuring that your financial matters can be managed by someone you trust if you are unable to do so yourself. Below are the steps to guide you through the process of completing this form accurately.

- Obtain the New York Durable Power of Attorney form. This can typically be found online or at legal supply stores.

- Carefully read through the entire form before starting to fill it out. Familiarize yourself with the sections and requirements.

- In the first section, provide your full name and address. This identifies you as the principal.

- Next, select an agent who will act on your behalf. Include their full name and address. This person should be someone you trust to handle your financial affairs.

- Decide if you want to grant your agent specific powers or general powers. If you choose specific powers, clearly outline what those powers are in the designated section.

- If applicable, include any limitations or instructions regarding the agent's authority. This can help ensure your wishes are followed.

- Review the section regarding alternate agents. If your primary agent cannot serve, you may want to designate a backup.

- Sign and date the form in the presence of a notary public. Your signature confirms your intent to create this Durable Power of Attorney.

- Have the notary public sign and seal the document. This adds an official verification to your form.

- Distribute copies of the completed form to your agent, any alternate agents, and relevant financial institutions or individuals.

Once the form is filled out and notarized, it is advisable to keep the original in a safe place while ensuring that your agent and any other relevant parties have access to copies. This will facilitate smooth management of your affairs should the need arise.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in New York allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The New York Durable Power of Attorney form is governed by the New York General Obligations Law, specifically Article 5, Title 15. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally incompetent or incapacitated, ensuring continuous decision-making authority for the agent. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are still mentally competent to do so. |

| Agent's Authority | The agent's powers can be broad or limited, depending on how the Durable Power of Attorney is drafted. It is essential to clearly outline these powers to avoid misunderstandings. |

FAQ

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial and legal affairs if you become unable to do so yourself. This document remains effective even if you become incapacitated, hence the term "durable." It gives your agent the authority to make decisions on your behalf, ensuring that your affairs are handled according to your wishes.

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose almost anyone to be your agent, as long as they are at least 18 years old and mentally competent. Common choices include trusted family members, close friends, or professionals like attorneys or accountants. It’s crucial to select someone you trust, as they will have significant control over your financial matters.

What powers can I grant to my agent?

You have the flexibility to specify the powers you wish to grant your agent. These can include:

- Managing bank accounts and investments

- Paying bills and taxes

- Buying or selling property

- Making healthcare decisions (if included)

It’s important to clearly outline the scope of authority in the document to avoid any confusion or misuse.

How do I create a Durable Power of Attorney in New York?

To create a Durable Power of Attorney in New York, follow these steps:

- Choose your agent and discuss your wishes with them.

- Obtain the New York Durable Power of Attorney form.

- Fill out the form, specifying the powers you wish to grant.

- Sign the document in front of a notary public.

Once completed, give copies to your agent, your financial institutions, and keep a copy for yourself.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that may have a copy of the original document. It’s wise to keep a record of the revocation for your own reference.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your family may need to go through a court process to have someone appointed as your guardian. This can be time-consuming and costly, and it may not reflect your wishes. Having a Durable Power of Attorney in place allows you to make your preferences known and ensures that someone you trust is in charge of your affairs.

Consider Popular Durable Power of Attorney Forms for Specific States

How to Get Power of Attorney Florida - The form requires clear identification of both you and your appointed agent.

To avoid any misunderstandings during the renting process, it is essential to familiarize yourself with the terms laid out in the agreement, such as those found in the Room Lease Agreement, which provides a comprehensive framework for the landlord-tenant relationship.

Blank Durable Power of Attorney - It simplifies financial management during times of illness or incapacity.

New York Durable Power of Attorney Example

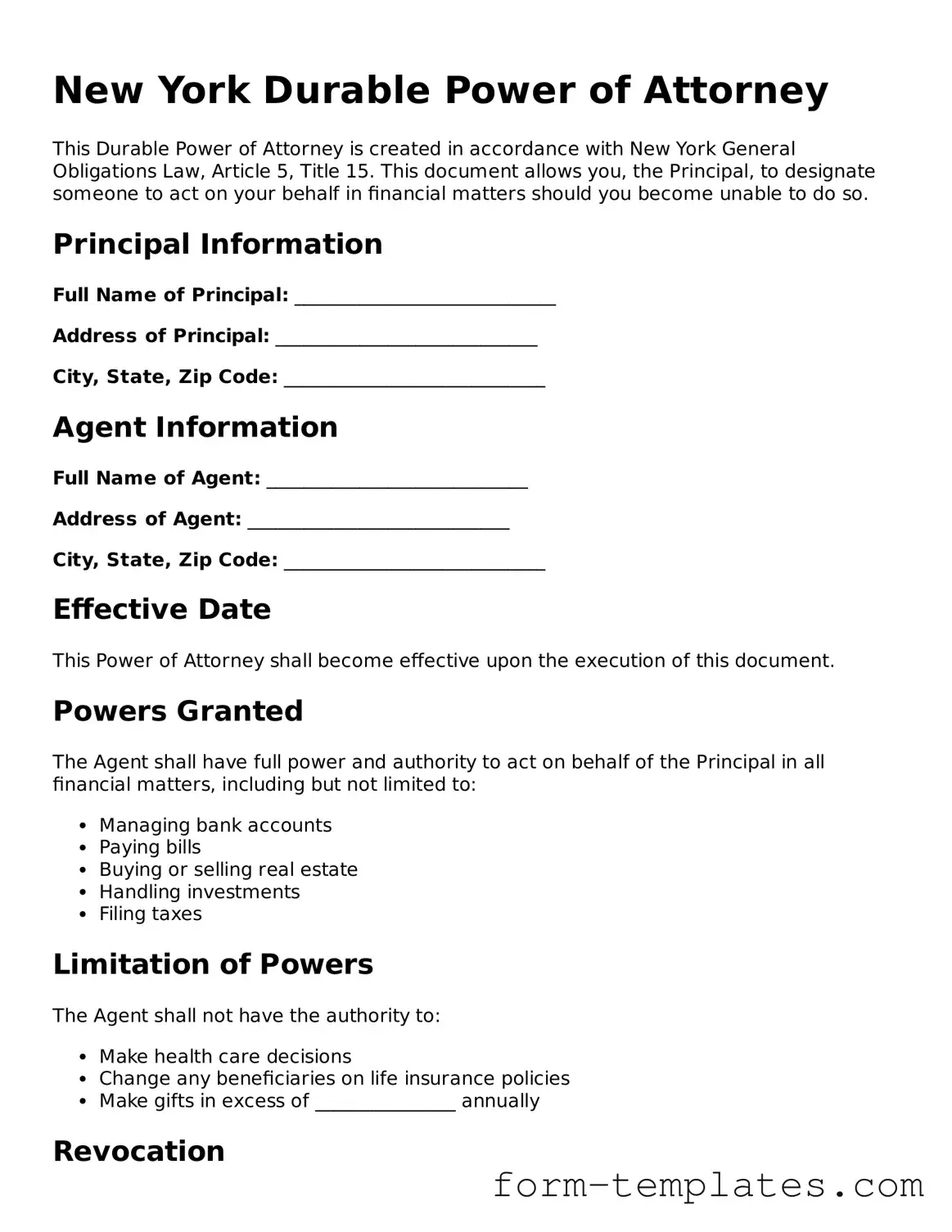

New York Durable Power of Attorney

This Durable Power of Attorney is created in accordance with New York General Obligations Law, Article 5, Title 15. This document allows you, the Principal, to designate someone to act on your behalf in financial matters should you become unable to do so.

Principal Information

Full Name of Principal: ____________________________

Address of Principal: ____________________________

City, State, Zip Code: ____________________________

Agent Information

Full Name of Agent: ____________________________

Address of Agent: ____________________________

City, State, Zip Code: ____________________________

Effective Date

This Power of Attorney shall become effective upon the execution of this document.

Powers Granted

The Agent shall have full power and authority to act on behalf of the Principal in all financial matters, including but not limited to:

- Managing bank accounts

- Paying bills

- Buying or selling real estate

- Handling investments

- Filing taxes

Limitation of Powers

The Agent shall not have the authority to:

- Make health care decisions

- Change any beneficiaries on life insurance policies

- Make gifts in excess of _______________ annually

Revocation

This Durable Power of Attorney may be revoked by the Principal at any time, as long as the Principal is competent to do so.

Signature

By signing below, the Principal acknowledges and confirms that they understand the contents and implications of this Durable Power of Attorney.

Signature of Principal: ____________________________

Date: ____________________________

Witnesses

This document must be witnessed by two individuals who are not named as Agents or beneficiaries.

Signature of Witness 1: ____________________________

Print Name of Witness 1: ____________________________

Signature of Witness 2: ____________________________

Print Name of Witness 2: ____________________________