Printable Deed in Lieu of Foreclosure Form for the State of New York

Guide to Writing New York Deed in Lieu of Foreclosure

After completing the New York Deed in Lieu of Foreclosure form, the next steps involve ensuring that all parties involved understand the implications of the deed and that it is properly recorded. This may include submitting the form to the appropriate county clerk's office and notifying any relevant parties, such as lenders or other stakeholders.

- Obtain the New York Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Provide the names and addresses of the grantor (the property owner) and grantee (the lender or financial institution).

- Include a description of the property being transferred. This should include the address and any relevant parcel identification numbers.

- State the consideration, or the value exchanged for the deed, typically noted as "for the sum of $1 and other good and valuable consideration."

- Sign the form in the designated area. The grantor must sign in the presence of a notary public.

- Have the signature notarized. The notary will add their seal and signature to the form.

- Make copies of the completed and notarized form for your records.

- Submit the original deed to the county clerk's office in the county where the property is located for recording.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal process where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | In New York, the process is governed by the New York Real Property Actions and Proceedings Law (RPAPL) and applicable contract laws. |

| Advantages | This option can help borrowers avoid the lengthy and costly foreclosure process, potentially preserving their credit score better than a foreclosure would. |

| Considerations | Borrowers should be aware that lenders may require a full review of the borrower's financial situation and may not accept the deed in lieu if there are other liens on the property. |

FAQ

- Current financial situation

- Property condition

- Amount owed on the mortgage

- Attempts to sell the property

- Avoiding the lengthy foreclosure process.

- Potentially reducing the impact on your credit score compared to a foreclosure.

- Relieving the borrower from the mortgage debt.

- Allowing for a smoother transition to rental or alternative housing.

- It may still negatively affect your credit score.

- You may lose any equity built up in the property.

- Not all lenders accept Deeds in Lieu of Foreclosure.

- Tax implications may arise, as forgiven debt can be considered taxable income.

- Contact your lender to discuss your financial situation and express interest in a Deed in Lieu of Foreclosure.

- Submit required documentation, such as financial statements and proof of hardship.

- Negotiate terms with the lender.

- Sign the Deed in Lieu of Foreclosure and any related documents.

- Transfer the property title to the lender.

- Proof of income and expenses.

- Tax returns for the past few years.

- Current mortgage statements.

- Any correspondence with the lender regarding the mortgage.

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process in which a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish ownership of the property in exchange for the cancellation of the mortgage debt.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically includes homeowners who are facing financial difficulties and are unable to keep up with mortgage payments. Lenders may consider factors such as:

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to opting for a Deed in Lieu of Foreclosure, including:

What are the drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also some drawbacks to consider:

How does the process work?

The process generally involves the following steps:

What documentation is required?

Typically, the following documents are needed:

Can I change my mind after signing the Deed in Lieu of Foreclosure?

Once the Deed in Lieu of Foreclosure is signed and recorded, it is generally considered final. It is crucial to be certain about this decision before proceeding, as reversing it can be complicated and may not be possible.

Will I be responsible for any fees or costs?

Homeowners may be responsible for certain fees associated with the process, such as closing costs or property maintenance until the transfer is complete. It is advisable to discuss these potential costs with the lender beforehand.

How will a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure will likely have a negative impact on your credit score, although it may be less severe than a full foreclosure. The exact effect can vary based on individual credit histories and other factors.

What should I do if my lender denies my request for a Deed in Lieu of Foreclosure?

If your lender denies your request, you may explore other options, such as loan modification, short sale, or seeking assistance from a housing counselor. It can be beneficial to understand all available options before making a decision.

Consider Popular Deed in Lieu of Foreclosure Forms for Specific States

California Voluntary Foreclosure Deed - An option that can lead to a resolution without extensive legal proceedings.

In order to streamline the payment process, employers often utilize a standardized form, such as the Payroll Check form, to ensure all necessary information is captured, including the employee's name, pay period, and amount earned. For those looking to enhance their payroll efficiency, a useful resource is the Blank Check Template, which can aid in creating accurate and timely payroll checks.

Sample Deed in Lieu of Foreclosure - It allows homeowners to exit their mortgage obligation without further legal action.

Foreclosure Vs Deed in Lieu - It can serve as a strategic approach to managing debt effectively before it escalates into foreclosure.

New York Deed in Lieu of Foreclosure Example

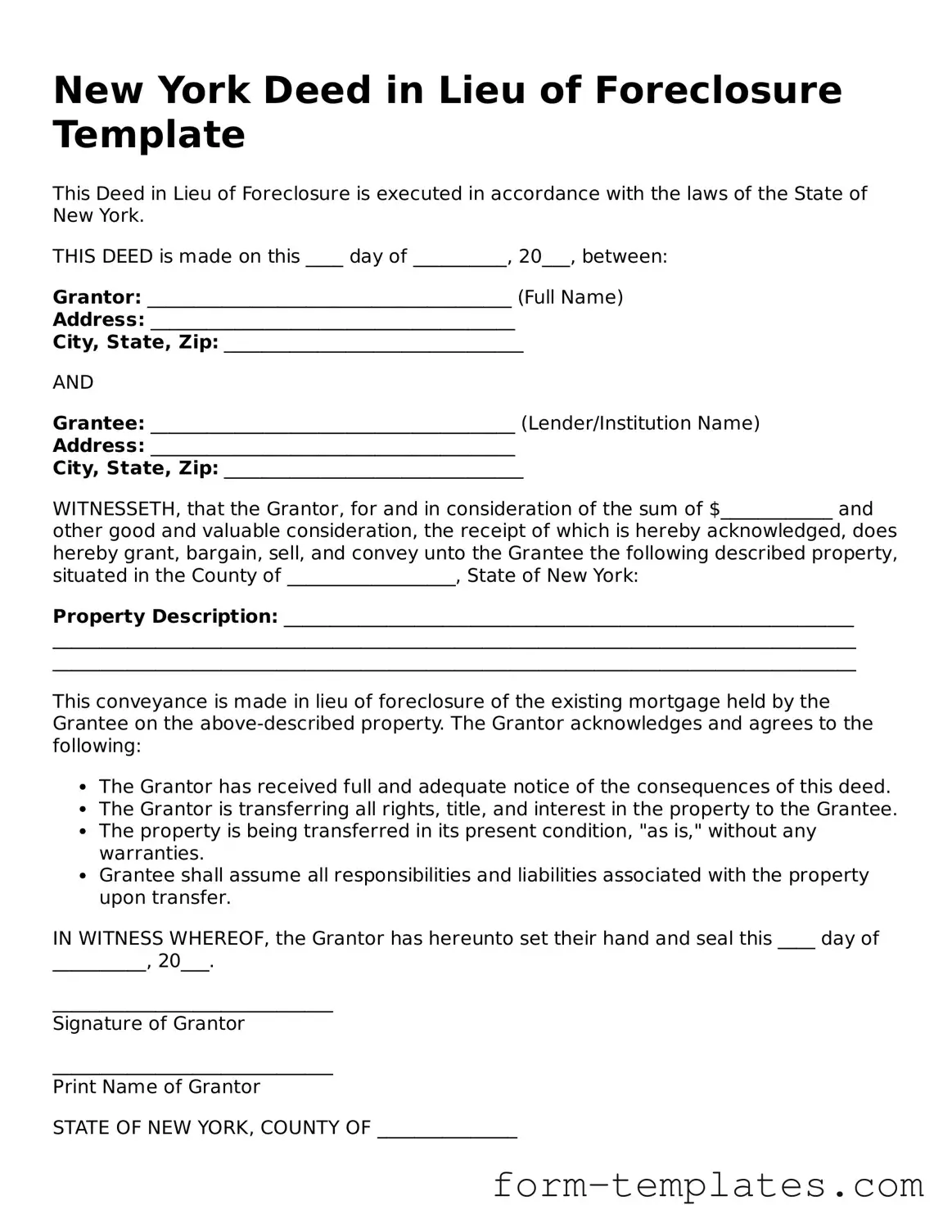

New York Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of New York.

THIS DEED is made on this ____ day of __________, 20___, between:

Grantor: _______________________________________ (Full Name)

Address: _______________________________________

City, State, Zip: ________________________________

AND

Grantee: _______________________________________ (Lender/Institution Name)

Address: _______________________________________

City, State, Zip: ________________________________

WITNESSETH, that the Grantor, for and in consideration of the sum of $____________ and other good and valuable consideration, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell, and convey unto the Grantee the following described property, situated in the County of __________________, State of New York:

Property Description: _____________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

This conveyance is made in lieu of foreclosure of the existing mortgage held by the Grantee on the above-described property. The Grantor acknowledges and agrees to the following:

- The Grantor has received full and adequate notice of the consequences of this deed.

- The Grantor is transferring all rights, title, and interest in the property to the Grantee.

- The property is being transferred in its present condition, "as is," without any warranties.

- Grantee shall assume all responsibilities and liabilities associated with the property upon transfer.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal this ____ day of __________, 20___.

______________________________

Signature of Grantor

______________________________

Print Name of Grantor

STATE OF NEW YORK, COUNTY OF _______________

On this ____ day of __________, 20___, before me, a Notary Public in and for said State, personally appeared ______________________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is(are) subscribed to the within instrument, and acknowledged to me that they executed the same.

______________________________

Notary Public