Printable Deed Form for the State of New York

Guide to Writing New York Deed

Filling out a New York Deed form is an important step in transferring property ownership. After completing the form, you will need to have it signed and notarized before filing it with the appropriate county office. Follow these steps carefully to ensure that your deed is filled out correctly.

- Begin by entering the date at the top of the form. This is the date when the deed is being executed.

- Next, identify the grantor (the person or entity transferring the property). Provide their full name and address.

- Then, list the grantee (the person or entity receiving the property). Include their full name and address as well.

- In the description section, provide a detailed description of the property being transferred. Include the address and any relevant legal descriptions.

- Specify the consideration amount, which is the value of the property or the payment made for the transfer.

- Indicate the type of deed being used (e.g., warranty deed, quitclaim deed). Make sure to select the one that fits your situation.

- Have the grantor sign the form in the designated area. Ensure that the signature is clear and matches the name provided.

- After signing, the grantor must have their signature notarized. This step is crucial for the deed to be legally valid.

- Finally, submit the completed deed form to the appropriate county clerk's office for recording. Be sure to check if there are any filing fees.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose of a Deed | A deed is a legal document that transfers ownership of real estate from one party to another. |

| Types of Deeds | In New York, common types of deeds include warranty deeds, quitclaim deeds, and bargain and sale deeds. |

| Governing Laws | New York real estate transactions are governed by the New York Real Property Law. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) in the presence of a notary public. |

| Recording the Deed | To protect ownership rights, the deed should be recorded in the county clerk’s office where the property is located. |

| Consideration | The deed must include a statement of consideration, which is the amount paid for the property, even if it’s a nominal amount. |

| Legal Description | A precise legal description of the property must be included in the deed to clearly identify the property being transferred. |

FAQ

What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property from one party to another in the state of New York. It serves as proof of the transfer and includes essential information such as the names of the grantor (seller) and grantee (buyer), a description of the property, and the date of the transfer. Different types of deeds exist, including warranty deeds and quitclaim deeds, each serving different purposes and offering varying levels of protection to the buyer.

What information is required on a New York Deed form?

To complete a New York Deed form, several key pieces of information must be included:

- The full names and addresses of the grantor and grantee.

- A legal description of the property being transferred, which may include the tax map number.

- The consideration or amount paid for the property.

- The date of the transfer.

- Any applicable signatures, typically from the grantor and a notary public.

Providing accurate and complete information is crucial to ensure the deed is valid and enforceable.

How do I file a New York Deed form?

Filing a New York Deed form involves several steps:

- Complete the deed form accurately, ensuring all required information is included.

- Have the deed notarized. This is essential for the document to be legally binding.

- File the deed with the appropriate county clerk's office where the property is located. This usually requires a filing fee.

- Obtain a copy of the filed deed for your records.

It is advisable to check with the local county clerk's office for any specific requirements or additional documents that may be needed.

What are the tax implications of transferring property with a New York Deed?

When transferring property in New York, there may be tax implications to consider:

- Transfer taxes may apply. New York State imposes a transfer tax on real estate transactions, which is typically based on the sale price of the property.

- Local transfer taxes may also be applicable, depending on the municipality.

- Consideration of capital gains tax may be necessary if the property has appreciated in value since its purchase.

Consulting with a tax professional or attorney is recommended to fully understand the tax consequences associated with the property transfer.

Consider Popular Deed Forms for Specific States

Legal House Deed Document - A title search is often conducted to inform Deed drafting.

Employers looking to streamline their payment process may find the use of a Payroll Check form beneficial, as it provides a clear structure for issuing payments. Additionally, utilizing resources like the Blank Check Template can further simplify the creation of these checks, ensuring all necessary details are neatly captured for each employee.

Sample Deed for House - Federal laws may affect certain transactions involving deeds in specific situations.

New York Deed Example

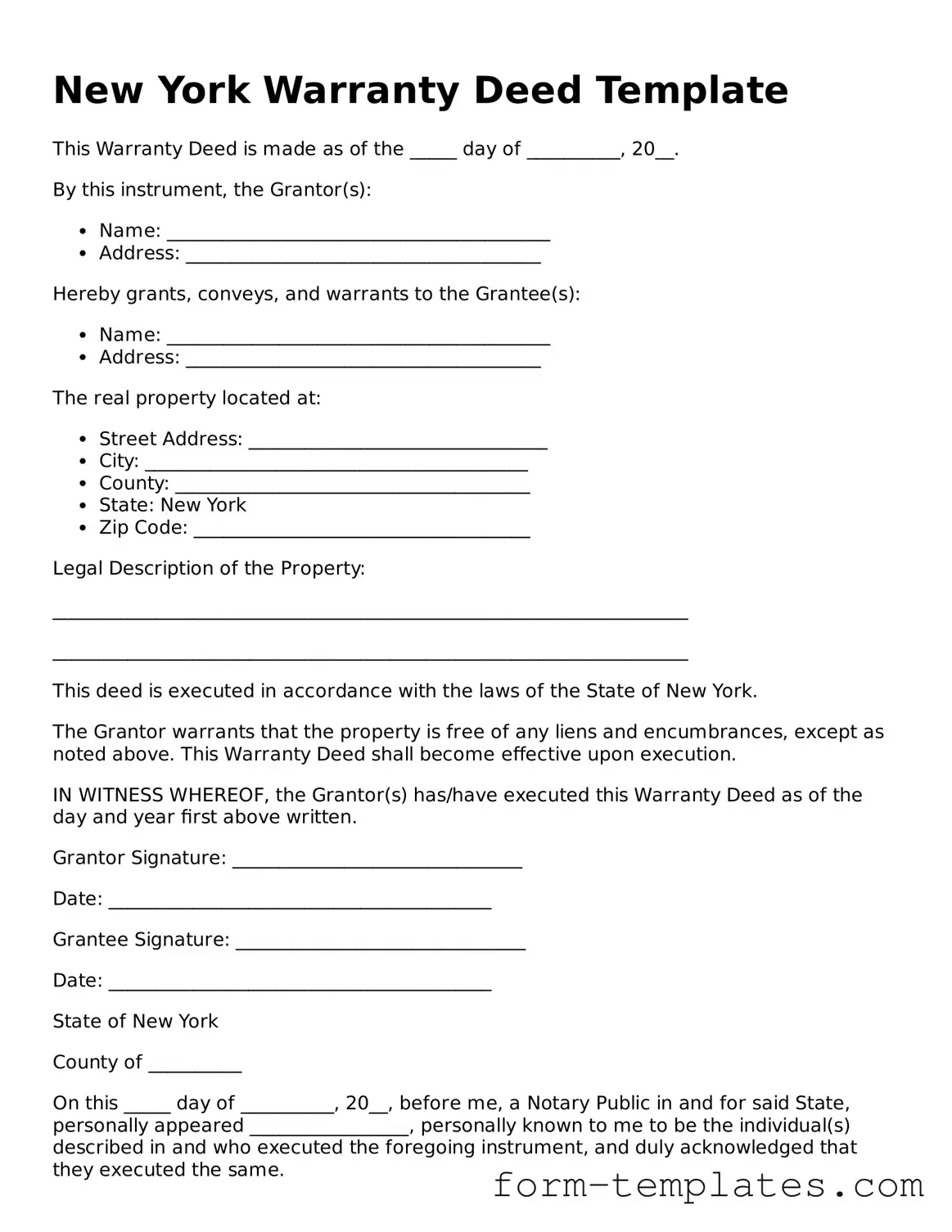

New York Warranty Deed Template

This Warranty Deed is made as of the _____ day of __________, 20__.

By this instrument, the Grantor(s):

- Name: _________________________________________

- Address: ______________________________________

Hereby grants, conveys, and warrants to the Grantee(s):

- Name: _________________________________________

- Address: ______________________________________

The real property located at:

- Street Address: ________________________________

- City: _________________________________________

- County: ______________________________________

- State: New York

- Zip Code: ____________________________________

Legal Description of the Property:

____________________________________________________________________

____________________________________________________________________

This deed is executed in accordance with the laws of the State of New York.

The Grantor warrants that the property is free of any liens and encumbrances, except as noted above. This Warranty Deed shall become effective upon execution.

IN WITNESS WHEREOF, the Grantor(s) has/have executed this Warranty Deed as of the day and year first above written.

Grantor Signature: _______________________________

Date: _________________________________________

Grantee Signature: _______________________________

Date: _________________________________________

State of New York

County of __________

On this _____ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared _________________, personally known to me to be the individual(s) described in and who executed the foregoing instrument, and duly acknowledged that they executed the same.

Notary Public: __________________________________

My Commission Expires: ___________________________