Fill Out a Valid Mortgage Statement Template

Guide to Writing Mortgage Statement

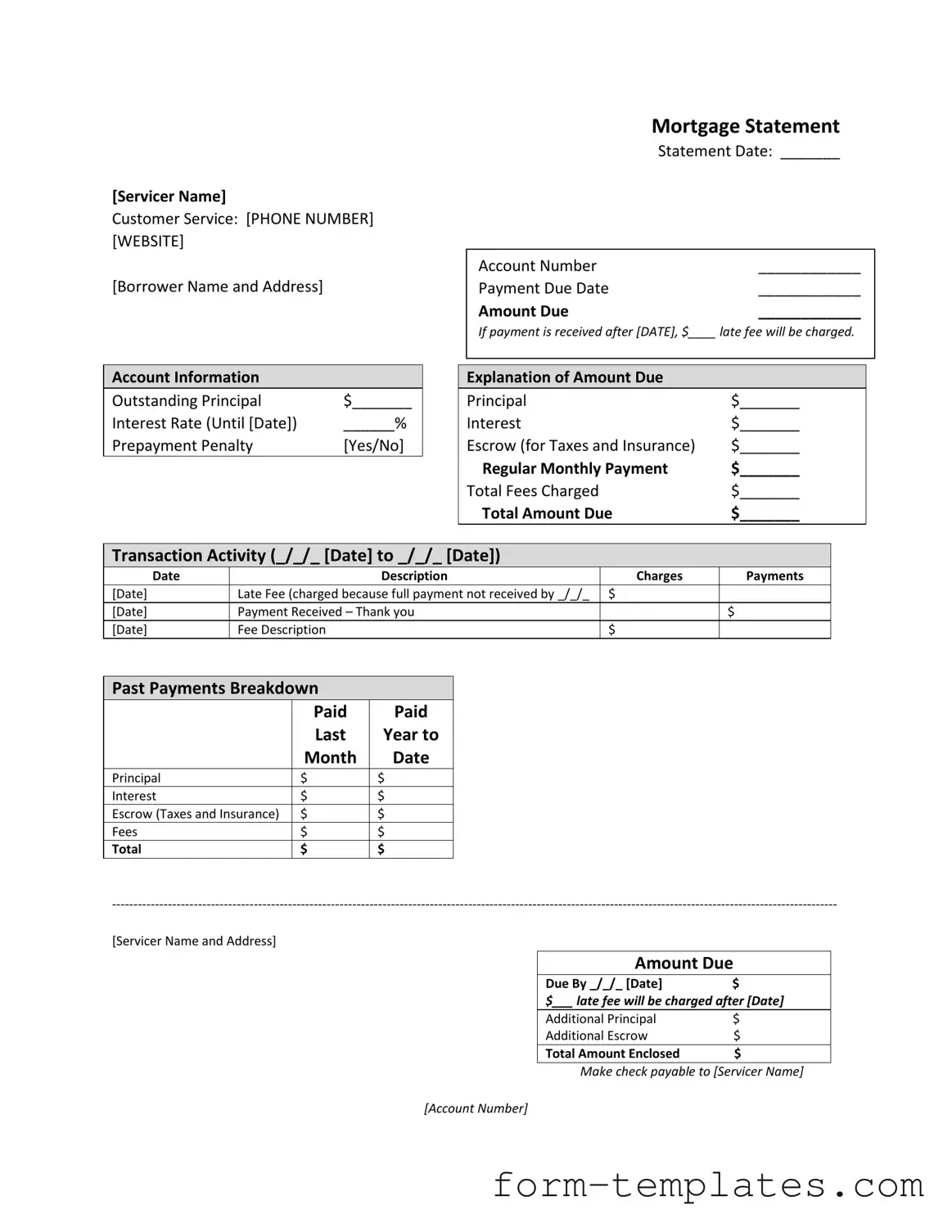

Follow these steps to fill out the Mortgage Statement form accurately. Completing this form will help you keep track of your mortgage payments and any outstanding amounts.

- Start by entering the Servicer Name and their Customer Service Phone Number and Website at the top of the form.

- Fill in your Borrower Name and Address in the designated area.

- Write the Statement Date, Account Number, Payment Due Date, and Amount Due in the respective fields.

- Indicate the late fee amount that will be charged if payment is received after the specified date.

- In the Account Information section, fill in the Outstanding Principal, Interest Rate, and whether there is a Prepayment Penalty (Yes or No).

- Break down the Amount Due by filling in the amounts for Principal, Interest, Escrow (for Taxes and Insurance), Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- In the Transaction Activity section, list the Date, Description, Charges, and Payments for each transaction.

- Document any Late Fees charged due to missed payments and any payments received.

- In the Past Payments Breakdown, enter the amounts paid for Principal, Interest, Escrow, and Fees for the last year.

- Calculate the Total Amount Enclosed and write it in the appropriate section.

- Make your check payable to the Servicer Name and include your Account Number on the check.

- Review the Important Messages section for information on partial payments and delinquency notices.

Document Breakdown

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for easy contact. |

| Payment Details | It specifies the payment due date, amount due, and any applicable late fees if payment is not received on time. |

| Account Information | Key details such as outstanding principal, interest rate, and whether there is a prepayment penalty are clearly outlined. |

| Transaction Activity | This section tracks the payment history, including dates, charges, and payments made over a specified period. |

| Delinquency Notice | A warning is provided if payments are late, highlighting the risk of fees and potential foreclosure. |

| Financial Assistance | The statement offers information for borrowers experiencing financial difficulty, guiding them to seek mortgage counseling. |

FAQ

What is a Mortgage Statement?

A Mortgage Statement is a document provided by your mortgage servicer. It outlines your account details, including the amount due, payment history, and any fees charged. This statement helps you keep track of your mortgage payments and outstanding balance.

What information is included in a Mortgage Statement?

Your Mortgage Statement includes several important details:

- Account number

- Payment due date

- Outstanding principal and interest rate

- Escrow amounts for taxes and insurance

- Total amount due

- Transaction activity

- Past payments breakdown

How do I read the amount due section?

The amount due section breaks down your total payment into several parts:

- Principal: The amount that goes towards reducing your loan balance.

- Interest: The cost of borrowing the money.

- Escrow: Funds set aside for property taxes and insurance.

- Total Fees Charged: Any additional fees that may apply.

Adding these amounts together gives you the total amount due.

What happens if I make a late payment?

If your payment is received after the due date, a late fee will be charged. The amount of the late fee is specified in your statement. It is important to pay on time to avoid these extra charges.

What is a partial payment?

A partial payment is any amount less than your total monthly payment. If you make a partial payment, it will not be applied to your mortgage balance immediately. Instead, it will be held in a suspense account until you pay the remaining balance.

What does delinquency mean?

Delinquency means that you have not made your mortgage payment by the due date. If you are late, your statement will indicate how many days you are delinquent. It is crucial to address this promptly to avoid additional fees and potential foreclosure.

What should I do if I’m experiencing financial difficulty?

If you are having trouble making your mortgage payments, it’s important to reach out for help. Your Mortgage Statement may provide information on mortgage counseling or assistance programs available to you.

How can I contact my mortgage servicer?

Your Mortgage Statement includes contact information for your servicer. Look for the customer service phone number and website listed at the top of the statement. They can help answer any questions you may have.

What is an escrow account?

An escrow account is used to hold funds for property taxes and homeowners insurance. Your monthly mortgage payment often includes an amount that goes into this account. This ensures that these bills are paid on time, helping to avoid penalties.

Can I make additional payments towards my principal?

Yes, you can make additional payments towards your principal. This can help reduce your overall loan balance and may save you money on interest over time. Check your Mortgage Statement for details on how to make these payments.

Fill out Other Forms

Free Doctors Note - This note certifies that a patient was unable to attend work or school due to health issues.

A Room Rental Agreement is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a room in a property. This agreement helps protect the rights of both parties and ensures clarity regarding payment, responsibilities, and rules. For detailed information and to access the necessary forms, visit the Room Lease Agreement page before you proceed.

Judge May Continue Criminal Charges Against - Requesting a continuance may benefit your case if more preparation time is needed.

Mortgage Statement Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.