Attorney-Approved Mortgage Lien Release Document

Guide to Writing Mortgage Lien Release

Once you have gathered the necessary information and documents, you are ready to fill out the Mortgage Lien Release form. This form is crucial for formally releasing a mortgage lien on a property, signaling that the debt has been satisfied. Follow the steps below to ensure that the form is completed correctly.

- Begin by entering the name of the borrower as it appears on the original mortgage documents.

- Next, provide the address of the property associated with the mortgage. Ensure that the address is accurate to avoid any confusion.

- Identify the lender's name and address. This should also match the information on the original mortgage documents.

- Fill in the date when the mortgage was paid off. This is important for the record-keeping of both the borrower and the lender.

- Sign the form in the designated area. The signature should match the name of the borrower as listed at the top.

- Have the form notarized. A notary public will verify your identity and witness your signature, adding an extra layer of authenticity to the document.

- Submit the completed form to the appropriate county or local office where property records are maintained. This step is essential for officially recording the release of the lien.

After you have submitted the form, it will be processed by the local office. You may receive confirmation of the release, which serves as proof that the mortgage lien has been lifted. Keep this confirmation in a safe place for your records.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a legal document that confirms a mortgage has been paid off and releases the lender's claim on the property. |

| Purpose | This form is essential for clearing the title of the property, allowing the owner to sell or refinance without any encumbrances. |

| State-Specific Forms | Each state may have its own version of the form. For example, in California, the governing law is under the California Civil Code § 2941. |

| Filing Requirements | After completion, the form must be filed with the county recorder's office where the property is located to ensure public record of the release. |

FAQ

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a document that officially removes a lien from a property. This typically occurs once a mortgage has been paid off, indicating that the lender no longer has a claim to the property. The release serves as proof that the borrower has fulfilled their financial obligations to the lender.

Why is a Mortgage Lien Release important?

This form is crucial for homeowners because it clears the title of the property, allowing for a smooth sale or transfer in the future. Without this release, the lien may hinder the homeowner’s ability to sell or refinance the property.

Who needs to file a Mortgage Lien Release?

The borrower, usually the homeowner, is responsible for filing the Mortgage Lien Release after paying off their mortgage. The lender must also sign the form to confirm that the lien is being released.

How do I obtain a Mortgage Lien Release form?

You can typically obtain a Mortgage Lien Release form from your lender or financial institution. Many lenders provide this form as part of the payoff process. Additionally, you may find templates online, but ensure they meet your state’s requirements.

What information is needed to complete the form?

To complete the Mortgage Lien Release form, you will need:

- Your name and address

- The lender’s name and address

- The property address

- The loan number

- The date of the mortgage payoff

What happens after I file the Mortgage Lien Release?

After filing the form, it will be recorded with the local county recorder’s office. This step officially updates public records to reflect that the lien has been released. You should receive a copy for your records as proof of the release.

Is there a fee associated with filing a Mortgage Lien Release?

Yes, there may be a small fee for recording the Mortgage Lien Release with the county. The amount varies by location, so it's best to check with your local recorder's office for specific details.

Can I file a Mortgage Lien Release myself?

Yes, you can file the Mortgage Lien Release yourself. However, if you're unsure about the process or the paperwork, consider seeking assistance from a real estate attorney or a title company to ensure everything is completed correctly.

What if my lender refuses to sign the Mortgage Lien Release?

If your lender refuses to sign the release, first check that your mortgage is indeed paid off. If it is, contact the lender to discuss the issue. If necessary, you may need to escalate the matter or seek legal advice to resolve any disputes.

How long does it take to process a Mortgage Lien Release?

The processing time for a Mortgage Lien Release can vary. Generally, it takes a few days to a few weeks, depending on the lender and the local recording office. It’s a good idea to follow up to ensure that the release has been recorded properly.

Other Mortgage Lien Release Templates:

Release of Liability Dmv - Establishes an official record that you’ve transferred ownership.

Understanding the importance of the FedEx Release Form is crucial for anyone who frequently ships packages but may not always be present to receive them. This form not only authorizes the delivery of your packages in your absence but also provides clear guidelines for selecting delivery locations. For more resources and templates, visit PDF Templates Online, where you can find useful tools to assist with your shipping needs.

Film Release Form Template - This form can outline provisions for re-versioning the actor’s work.

Mortgage Lien Release Example

Mortgage Lien Release Template

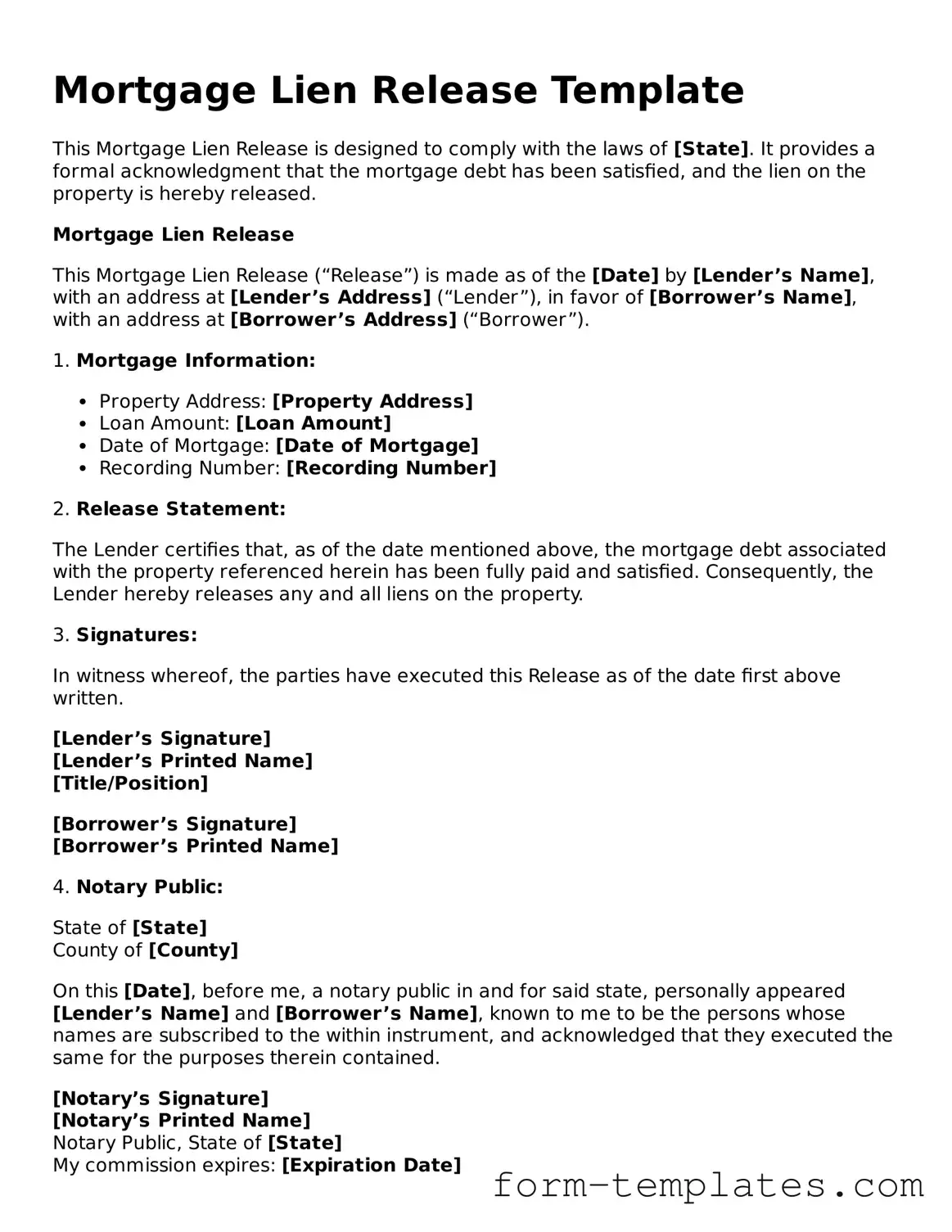

This Mortgage Lien Release is designed to comply with the laws of [State]. It provides a formal acknowledgment that the mortgage debt has been satisfied, and the lien on the property is hereby released.

Mortgage Lien Release

This Mortgage Lien Release (“Release”) is made as of the [Date] by [Lender’s Name], with an address at [Lender’s Address] (“Lender”), in favor of [Borrower’s Name], with an address at [Borrower’s Address] (“Borrower”).

1. Mortgage Information:

- Property Address: [Property Address]

- Loan Amount: [Loan Amount]

- Date of Mortgage: [Date of Mortgage]

- Recording Number: [Recording Number]

2. Release Statement:

The Lender certifies that, as of the date mentioned above, the mortgage debt associated with the property referenced herein has been fully paid and satisfied. Consequently, the Lender hereby releases any and all liens on the property.

3. Signatures:

In witness whereof, the parties have executed this Release as of the date first above written.

[Lender’s Signature]

[Lender’s Printed Name]

[Title/Position]

[Borrower’s Signature]

[Borrower’s Printed Name]

4. Notary Public:

State of [State]

County of [County]

On this [Date], before me, a notary public in and for said state, personally appeared [Lender’s Name] and [Borrower’s Name], known to me to be the persons whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

[Notary’s Signature]

[Notary’s Printed Name]

Notary Public, State of [State]

My commission expires: [Expiration Date]