Fill Out a Valid Louisiana act of donation Template

Guide to Writing Louisiana act of donation

After obtaining the Louisiana Act of Donation form, the next step is to complete it accurately. This form is essential for transferring property ownership and must be filled out with care to ensure that all necessary information is provided. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full name of the donor, including any middle initials.

- List the address of the donor, ensuring it includes the street, city, state, and zip code.

- Next, enter the full name of the donee (the person receiving the property).

- Include the address of the donee, similar to how you listed the donor's address.

- Describe the property being donated. Be specific about the type of property and any identifying details.

- Indicate any conditions or restrictions related to the donation, if applicable.

- Both the donor and donee should sign and date the form at the designated areas.

- Finally, ensure that the form is notarized if required, as this may be necessary for the donation to be legally binding.

Once the form is completed, it should be filed with the appropriate local authorities or kept with personal records, depending on the specific requirements of the donation process in Louisiana.

Document Breakdown

| Fact Name | Description |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer property ownership without compensation. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1469 through 1475. |

| Types of Donations | Donations can be inter vivos (during life) or mortis causa (upon death). |

| Requirements | The form must be in writing and signed by the donor. |

| Witnesses | Two witnesses are required for the validity of the act, unless notarized. |

| Notarization | Notarization is recommended but not mandatory for all donations. |

| Revocation | A donation can be revoked under certain circumstances, such as ingratitude or failure to fulfill conditions. |

| Tax Implications | Donations may have gift tax implications under federal law. |

| Record Keeping | It is advisable to record the act with the local parish clerk for public notice. |

| Legal Advice | Consulting with a legal professional is recommended to ensure compliance with all requirements. |

FAQ

- Real estate, such as land or homes

- Personal property, like vehicles, jewelry, or artwork

- Financial assets, including stocks or bonds

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property from one person to another without any exchange of money. It is commonly utilized for gifts of real estate or personal property, ensuring that the donor's intentions are clearly documented and legally binding.

Who can use the Act of Donation Form?

Any individual who wishes to donate property can use this form. However, both the donor (the person giving the property) and the donee (the person receiving the property) must be legally competent to enter into a contract. This typically means they must be at least 18 years old and of sound mind.

What types of property can be donated using this form?

The form can be used to donate various types of property, including:

Is the Act of Donation Form required to be notarized?

Yes, in Louisiana, the Act of Donation Form must be notarized to be legally valid, especially for real estate transactions. This step adds a layer of authenticity and ensures that the document is recognized by the courts.

Are there any tax implications for the donor or donee?

Yes, there may be tax implications for both parties. The donor could be subject to gift tax if the value of the donated property exceeds a certain threshold. The donee may also face tax responsibilities when they inherit the property. Consulting a tax professional is advisable to understand the specific implications.

Can the donor place conditions on the donation?

Yes, the donor can place conditions on the donation. These conditions must be clearly stated in the Act of Donation Form. For example, a donor might specify that the property must be used for a particular purpose or that the donee must maintain it in a certain way.

What happens if the donor changes their mind after signing the form?

Once the Act of Donation Form is signed and notarized, it is generally considered final. However, if the donor wishes to revoke the donation, they may need to follow specific legal procedures to do so, which could involve filing a revocation document. It is crucial to seek legal advice in such situations.

Is there a time limit for completing the donation process?

While there is no specific time limit for completing the donation process, it is advisable to act promptly. Delays can lead to complications, especially if the donor's circumstances change or if disputes arise regarding the property.

Can the Act of Donation Form be used for future donations?

The form can be used for multiple donations, but each donation should have its own separate Act of Donation Form. This ensures clarity and legal compliance for each transaction.

Where can I obtain a Louisiana Act of Donation Form?

The Louisiana Act of Donation Form can be obtained from various sources, including legal stationery stores, online legal document providers, or through an attorney. It’s important to ensure that the form complies with current Louisiana laws.

Fill out Other Forms

Dd Form 1750 - Efficient completion of this form reduces delays in receiving shipments.

To streamline the payment process, employers may utilize resources such as the Blank Check Template, which simplifies the creation and distribution of payroll checks, ensuring that all necessary details are captured accurately for employee compensation.

How Can I Change My Address - The PS 3575 assists in workforce planning and strategy.

Louisiana act of donation Example

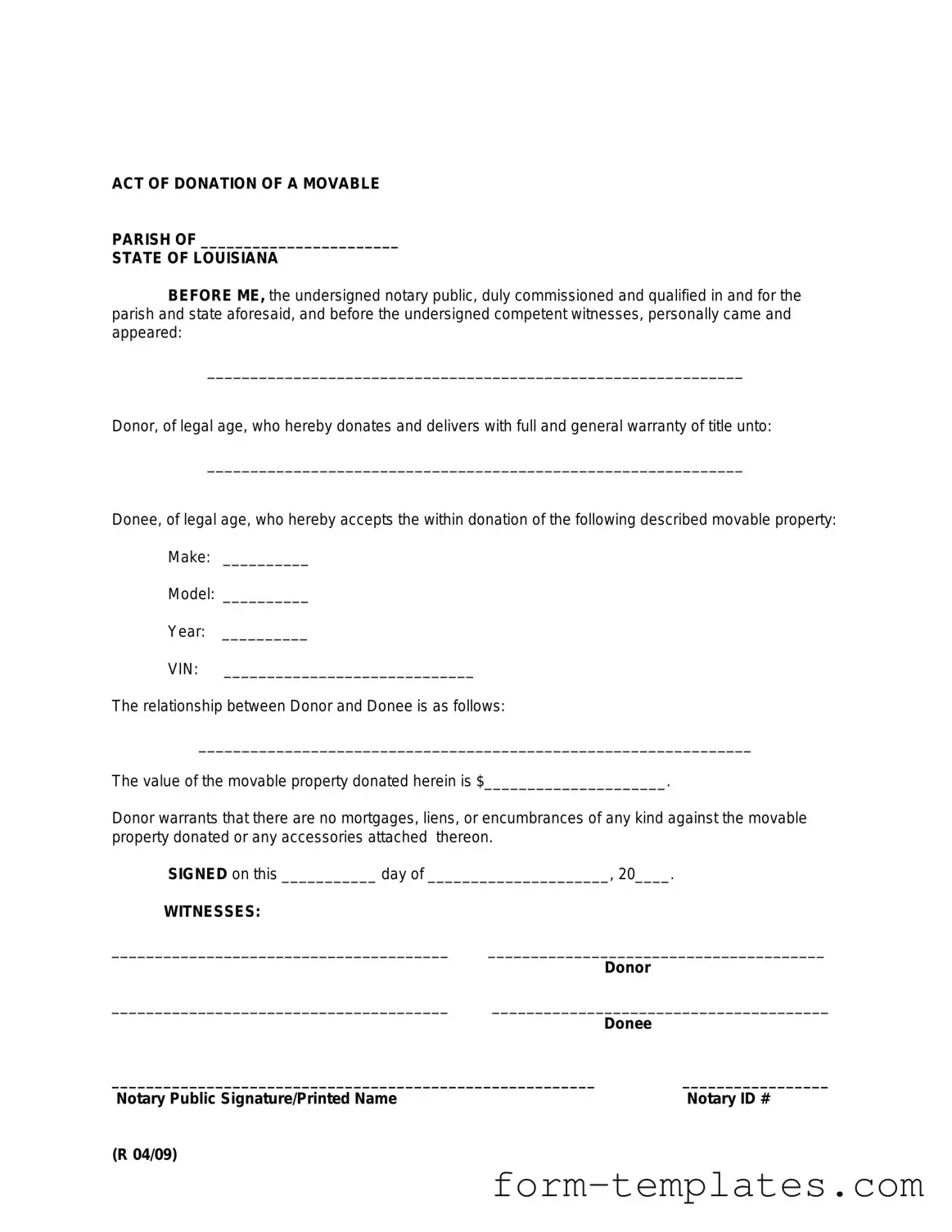

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)