Attorney-Approved Loan Agreement Document

Guide to Writing Loan Agreement

Filling out the Loan Agreement form is a straightforward process that requires careful attention to detail. By following the steps below, you will ensure that all necessary information is accurately provided, setting the stage for a smooth transaction.

- Read the Instructions: Before you begin, take a moment to read any instructions that accompany the form. This will give you a clear understanding of what is required.

- Provide Borrower Information: Enter the full name, address, and contact information of the borrower. Ensure that all details are accurate and up to date.

- Enter Lender Information: Fill in the lender's name, address, and contact details. Double-check for any spelling errors.

- Specify Loan Amount: Clearly state the total amount of the loan. This figure should be precise and reflect what both parties have agreed upon.

- Outline Interest Rate: Indicate the interest rate applicable to the loan. Be sure to specify if it is fixed or variable.

- Set Loan Term: Define the duration of the loan. Specify the start and end dates, and include any relevant payment schedule details.

- Include Purpose of the Loan: Briefly describe the purpose for which the loan is being taken. This helps clarify the intent behind the agreement.

- Signatures: Ensure that both the borrower and lender sign the form. Include the date of signing to validate the agreement.

- Review the Form: After filling out the form, review all entries for accuracy. Make any necessary corrections before finalizing.

Loan AgreementDocuments for Specific US States

Loan Agreement Form Categories

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms and conditions under which a borrower receives funds from a lender. |

| Key Components | Common elements include the loan amount, interest rate, repayment schedule, and any collateral involved. |

| State-Specific Requirements | Each state may have specific requirements or disclosures that must be included in the agreement. |

| Governing Law | The Loan Agreement is typically governed by the laws of the state where the borrower resides or where the loan is originated. |

FAQ

What is a Loan Agreement?

A Loan Agreement is a formal document that outlines the terms and conditions under which one party lends money to another. It serves as a legally binding contract that protects both the lender and the borrower. The agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved.

Who should use a Loan Agreement?

Any individual or entity involved in a lending transaction should consider using a Loan Agreement. This includes:

- Individuals lending money to friends or family.

- Businesses providing loans to employees or clients.

- Financial institutions extending credit to borrowers.

Using a Loan Agreement helps ensure that all parties understand their rights and obligations, reducing the potential for disputes.

What key elements should be included in a Loan Agreement?

A comprehensive Loan Agreement should include the following elements:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: The schedule for repayment, including due dates and amounts.

- Collateral: Any assets pledged to secure the loan.

- Default Provisions: Conditions under which the borrower may default on the loan.

- Governing Law: The jurisdiction that will govern the agreement.

Including these elements helps clarify expectations and responsibilities for both parties.

What happens if the borrower defaults on the Loan Agreement?

If the borrower fails to meet the repayment terms outlined in the Loan Agreement, several consequences may occur. The lender may have the right to:

- Charge late fees as specified in the agreement.

- Take legal action to recover the owed amount.

- Seize collateral if the loan is secured.

It is essential for both parties to understand the implications of default before entering into the agreement.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the lender and the borrower. This ensures that any alterations are legally enforceable and reduces the risk of misunderstandings.

Is it necessary to have a lawyer review a Loan Agreement?

While it is not strictly necessary, having a lawyer review a Loan Agreement can be beneficial. A legal professional can help ensure that the terms are fair and compliant with applicable laws. This can provide peace of mind and reduce the likelihood of future disputes.

What should I do if I have questions about a Loan Agreement?

If you have questions about a Loan Agreement, consider the following steps:

- Review the document carefully to identify specific areas of concern.

- Consult with a legal professional who specializes in contract law.

- Discuss any uncertainties with the other party involved in the agreement.

Taking these steps can help clarify any doubts and ensure that all parties are on the same page.

Fill out Popular Documents

High School Transcript - Some students may need to provide additional information along with their transcripts when applying.

A Room Rental Agreement is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a room in a property. This agreement helps protect the rights of both parties and ensures clarity regarding payment, responsibilities, and rules. To gain further insights, it is beneficial to review a comprehensive Room Lease Agreement before proceeding. To get started, fill out the form by clicking the button below.

Waivers of Lien - It helps ensure that subcontractors do not file liens against the property.

Durable Power of Attorney California - The agent you choose should be someone you trust completely.

Loan Agreement Example

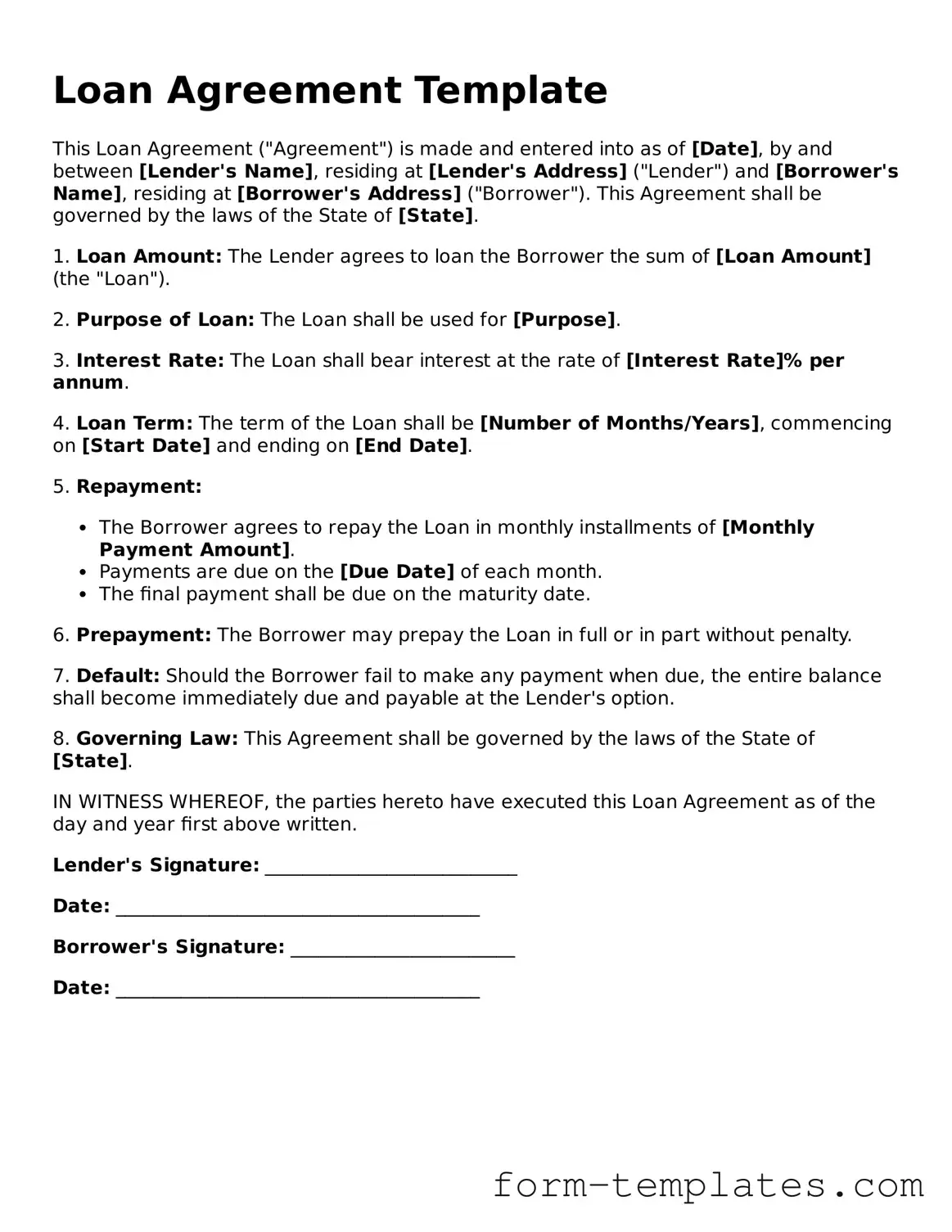

Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of [Date], by and between [Lender's Name], residing at [Lender's Address] ("Lender") and [Borrower's Name], residing at [Borrower's Address] ("Borrower"). This Agreement shall be governed by the laws of the State of [State].

1. Loan Amount: The Lender agrees to loan the Borrower the sum of [Loan Amount] (the "Loan").

2. Purpose of Loan: The Loan shall be used for [Purpose].

3. Interest Rate: The Loan shall bear interest at the rate of [Interest Rate]% per annum.

4. Loan Term: The term of the Loan shall be [Number of Months/Years], commencing on [Start Date] and ending on [End Date].

5. Repayment:

- The Borrower agrees to repay the Loan in monthly installments of [Monthly Payment Amount].

- Payments are due on the [Due Date] of each month.

- The final payment shall be due on the maturity date.

6. Prepayment: The Borrower may prepay the Loan in full or in part without penalty.

7. Default: Should the Borrower fail to make any payment when due, the entire balance shall become immediately due and payable at the Lender's option.

8. Governing Law: This Agreement shall be governed by the laws of the State of [State].

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the day and year first above written.

Lender's Signature: ___________________________

Date: _______________________________________

Borrower's Signature: ________________________

Date: _______________________________________