Attorney-Approved LLC Share Purchase Agreement Document

Guide to Writing LLC Share Purchase Agreement

Completing an LLC Share Purchase Agreement is an essential step in transferring ownership of shares in a limited liability company. This document outlines the terms of the sale and protects both the buyer and seller. Follow these steps to ensure you fill out the form correctly.

- Identify the Parties: Write the full names and addresses of both the seller and the buyer at the top of the form. This establishes who is involved in the transaction.

- Describe the Shares: Clearly specify the number of shares being sold and any relevant details, such as the class of shares or their value.

- Purchase Price: Indicate the total purchase price for the shares. Be clear about the payment method and any terms related to the payment.

- Effective Date: Enter the date on which the agreement will take effect. This is important for determining when the transaction is legally binding.

- Representations and Warranties: Include any statements made by the seller about the shares. This might cover ownership, rights, and any liabilities associated with the shares.

- Signatures: Both parties should sign and date the agreement. Ensure that the signatures are legible and match the names provided at the beginning of the form.

- Witness or Notary: Depending on your state’s requirements, you may need a witness or notary public to validate the signatures. Check local laws to confirm this step.

After completing the form, review it carefully to ensure all information is accurate and complete. This document is a vital record of the transaction, so keeping a copy for your records is advisable.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement is a legal document that outlines the terms under which shares of a limited liability company (LLC) are bought and sold. |

| Purpose | This agreement serves to protect both the buyer and the seller by clearly defining the rights and obligations of each party involved in the transaction. |

| Governing Law | The governing law for the agreement typically depends on the state where the LLC is formed. Common states include Delaware, California, and New York, each having its own specific regulations. |

| Key Components | Essential elements of the agreement often include purchase price, payment terms, representations and warranties, and any conditions precedent to closing the sale. |

FAQ

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which an individual or entity agrees to purchase shares in a Limited Liability Company (LLC). This agreement is essential for clearly defining the rights and responsibilities of both the seller and the buyer during the transaction.

Who needs an LLC Share Purchase Agreement?

This agreement is necessary for anyone involved in the sale or purchase of shares in an LLC. This includes current members looking to sell their shares and prospective buyers who want to acquire ownership in the company. Having a formal agreement protects both parties and ensures a smooth transaction.

What key elements should be included in the agreement?

Important elements to include in an LLC Share Purchase Agreement are:

- Identification of the parties involved

- Description of the shares being sold

- Purchase price and payment terms

- Representations and warranties by both parties

- Conditions for closing the sale

- Confidentiality provisions

- Governing law

How is the purchase price determined?

The purchase price can be determined through various methods. Common approaches include:

- Valuation by an independent appraiser

- Agreement on a fixed price between the parties

- Using a formula based on the company’s financial performance

It is crucial for both parties to agree on a fair price to avoid disputes later.

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations under the agreement, the other party may have the right to seek remedies. This could include monetary damages or specific performance, which means requiring the defaulting party to fulfill their obligations as originally agreed. Legal advice is often necessary in these situations to navigate the complexities involved.

Can the agreement be modified after it is signed?

Yes, the LLC Share Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both parties to ensure clarity and enforceability.

Is it necessary to have a lawyer review the agreement?

While it is not legally required, having a lawyer review the LLC Share Purchase Agreement is highly advisable. A legal professional can help identify potential issues, ensure compliance with state laws, and protect your interests throughout the transaction.

What are the tax implications of buying or selling shares in an LLC?

The tax implications can vary based on individual circumstances and the structure of the LLC. Generally, sellers may be subject to capital gains taxes on any profit made from the sale. Buyers may also face tax considerations related to their new ownership. Consulting with a tax professional is recommended to understand the specific implications for your situation.

Fill out Popular Documents

How to Draft an Mou - Serves as an internal document for reference and clarification.

Homeschool Notice of Intent - Be the voice of your child's education by submitting this Letter of Intent today.

The CID Name Check Request form is a document used to request a background check on an individual by law enforcement officials. It facilitates the accurate identification of individuals through their personal information, including social security numbers. This form is essential for commanders and law enforcement to ensure thorough investigations and maintain security within military operations, and it can be prepared using resources like the Blank Check Template.

Cuddle Application - Users are encouraged to think about what qualities they seek in a cuddle buddy.

LLC Share Purchase Agreement Example

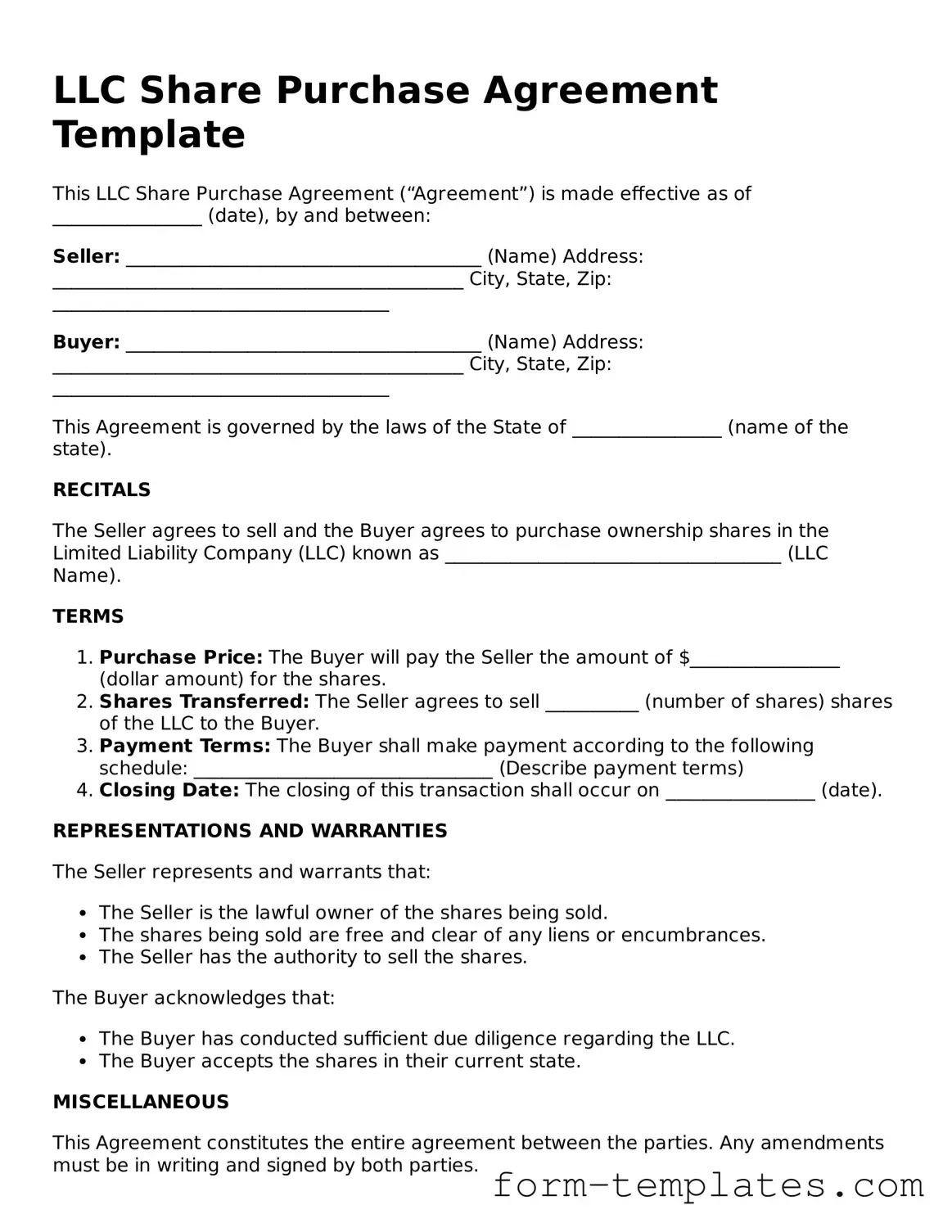

LLC Share Purchase Agreement Template

This LLC Share Purchase Agreement (“Agreement”) is made effective as of ________________ (date), by and between:

Seller: ______________________________________ (Name) Address: ____________________________________________ City, State, Zip: ____________________________________

Buyer: ______________________________________ (Name) Address: ____________________________________________ City, State, Zip: ____________________________________

This Agreement is governed by the laws of the State of ________________ (name of the state).

RECITALS

The Seller agrees to sell and the Buyer agrees to purchase ownership shares in the Limited Liability Company (LLC) known as ____________________________________ (LLC Name).

TERMS

- Purchase Price: The Buyer will pay the Seller the amount of $________________ (dollar amount) for the shares.

- Shares Transferred: The Seller agrees to sell __________ (number of shares) shares of the LLC to the Buyer.

- Payment Terms: The Buyer shall make payment according to the following schedule: ________________________________ (Describe payment terms)

- Closing Date: The closing of this transaction shall occur on ________________ (date).

REPRESENTATIONS AND WARRANTIES

The Seller represents and warrants that:

- The Seller is the lawful owner of the shares being sold.

- The shares being sold are free and clear of any liens or encumbrances.

- The Seller has the authority to sell the shares.

The Buyer acknowledges that:

- The Buyer has conducted sufficient due diligence regarding the LLC.

- The Buyer accepts the shares in their current state.

MISCELLANEOUS

This Agreement constitutes the entire agreement between the parties. Any amendments must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller Signature: _______________________________ Date: ____________

Buyer Signature: _______________________________ Date: ____________