Attorney-Approved Lady Bird Deed Document

Guide to Writing Lady Bird Deed

Completing a Lady Bird Deed form is a straightforward process that allows property owners to designate beneficiaries while retaining control over their property during their lifetime. Following these steps will help ensure that the form is filled out correctly and meets your needs.

- Obtain the Form: Start by downloading the Lady Bird Deed form from a reliable source or visiting a local legal office to acquire a physical copy.

- Fill in Your Information: At the top of the form, enter your full name and address as the current property owner. Ensure that this information is accurate.

- Property Description: Provide a detailed description of the property being transferred. This typically includes the address, legal description, and any relevant identifiers such as parcel numbers.

- Designate Beneficiaries: Clearly list the names and addresses of the individuals or entities you wish to designate as beneficiaries. Be specific to avoid any confusion later.

- Sign the Form: After filling out the necessary information, sign the form in the designated area. Ensure that you do this in the presence of a notary public.

- Notarization: Have the form notarized to verify your identity and the authenticity of your signature. This step is crucial for the form to be legally binding.

- Record the Deed: Finally, take the notarized form to your local county clerk or recorder’s office to have it officially recorded. This step finalizes the process and makes the deed part of public records.

After completing these steps, you will have successfully filled out the Lady Bird Deed form. It is advisable to keep a copy for your records and to inform your beneficiaries about the deed and its implications. This proactive approach can help avoid confusion in the future.

PDF Form Specs

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed is a type of transfer-on-death deed that allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Retained Rights | With a Lady Bird Deed, the property owner can sell, mortgage, or change the beneficiaries without needing consent from the heirs. |

| State-Specific Use | Lady Bird Deeds are primarily recognized in states like Florida, Texas, and Michigan, each governed by specific state laws regarding property transfers. |

| Tax Benefits | One advantage of a Lady Bird Deed is that it can help avoid probate, potentially saving time and money for the beneficiaries. |

| Medicaid Considerations | Lady Bird Deeds can protect the property from being counted as an asset for Medicaid eligibility, depending on state regulations. |

| Simple Process | Creating a Lady Bird Deed typically involves filling out a form, signing it in front of a notary, and recording it with the county clerk. |

FAQ

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed provides a way to avoid probate, as the property automatically transfers to the designated beneficiaries upon the owner's death. The owner retains the right to sell, mortgage, or change the beneficiaries without their consent.

What are the benefits of using a Lady Bird Deed?

There are several advantages to utilizing a Lady Bird Deed:

- Avoiding Probate: The property transfers directly to beneficiaries without going through the probate process, which can be lengthy and costly.

- Retaining Control: The property owner retains full control over the property during their lifetime, allowing them to sell or change the deed as needed.

- Tax Benefits: The property may receive a step-up in basis upon the owner's death, potentially reducing capital gains taxes for beneficiaries.

- Medicaid Protection: In some cases, a Lady Bird Deed can protect the property from being counted as an asset for Medicaid eligibility.

Who can create a Lady Bird Deed?

Any individual who owns real property can create a Lady Bird Deed. This includes homeowners, landowners, or anyone with a vested interest in the property. However, it is important to consider the implications of such a deed, including how it may affect estate planning and tax situations. Consulting with a qualified attorney or estate planner is advisable to ensure that the deed aligns with the owner's overall estate strategy.

Are there any drawbacks to a Lady Bird Deed?

While a Lady Bird Deed offers numerous benefits, there are potential drawbacks to consider:

- Limited Applicability: Not all states recognize Lady Bird Deeds, so it is essential to confirm whether this option is available in your jurisdiction.

- Impact on Medicaid: Although it can protect against Medicaid claims, improper use of a Lady Bird Deed may lead to penalties or complications regarding Medicaid eligibility.

- Loss of Control: While the original owner retains control during their lifetime, once they pass away, the property automatically transfers to the beneficiaries, which may not align with future intentions.

Other Lady Bird Deed Templates:

Property Gift Deed Rules - By completing a Gift Deed, the donor ensures that the transfer of ownership is legally recognized.

What Is Deed in Lieu of Foreclosure - It can also streamline the process of handing over the property without additional legal entanglements.

Utilizing a Check Register form is essential for anyone looking to keep precise records of their checking account activity, and for those who prefer a structured approach, a Blank Check Template can be a great resource to streamline the process. This tool enables users to efficiently log deposits and withdrawals, ensuring they maintain an accurate account balance and avoid unnecessary fees.

Problems With Transfer on Death Deeds California - By using this deed, individuals can help ensure a smoother transition for their heirs.

Lady Bird Deed Example

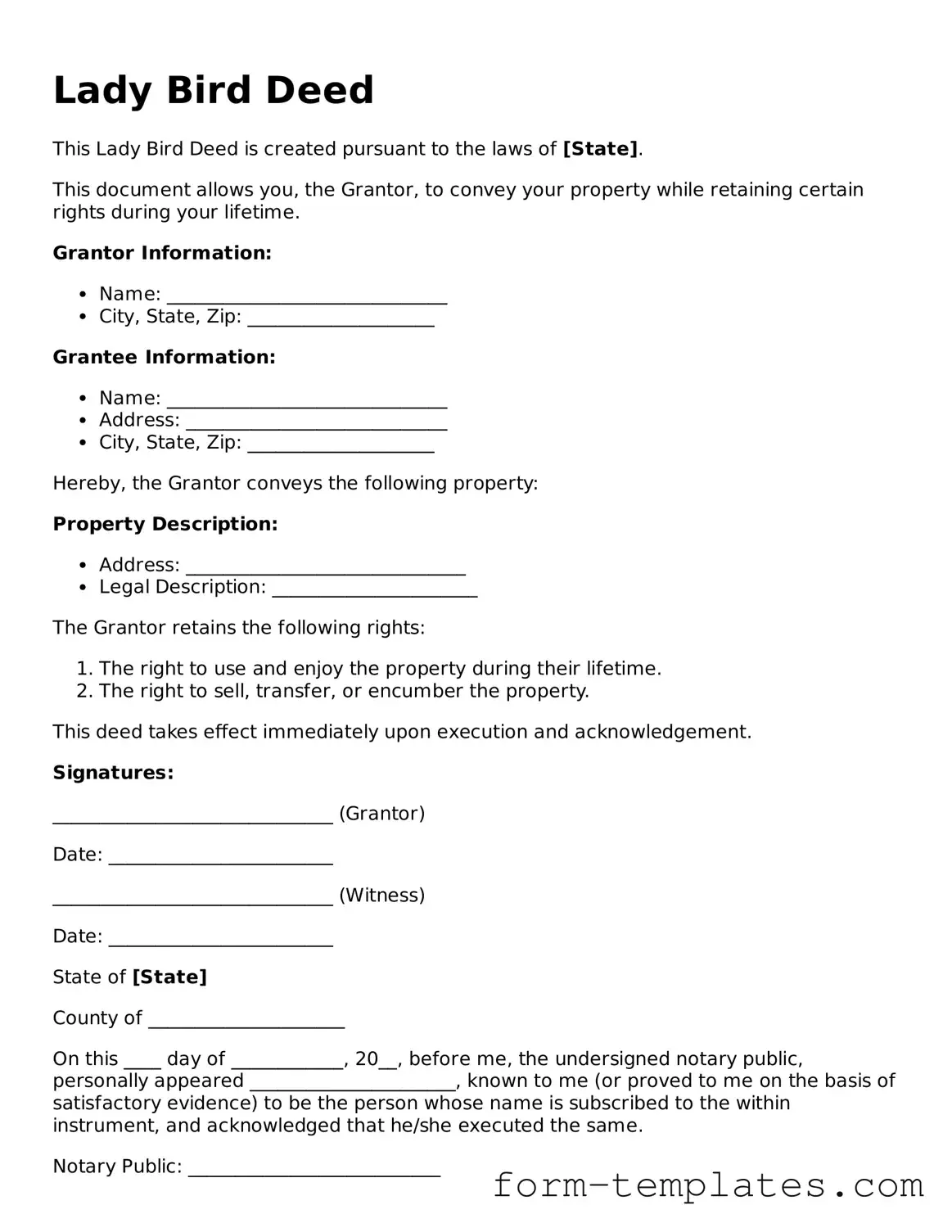

Lady Bird Deed

This Lady Bird Deed is created pursuant to the laws of [State].

This document allows you, the Grantor, to convey your property while retaining certain rights during your lifetime.

Grantor Information:

- Name: ______________________________

- City, State, Zip: ____________________

Grantee Information:

- Name: ______________________________

- Address: ____________________________

- City, State, Zip: ____________________

Hereby, the Grantor conveys the following property:

Property Description:

- Address: ______________________________

- Legal Description: ______________________

The Grantor retains the following rights:

- The right to use and enjoy the property during their lifetime.

- The right to sell, transfer, or encumber the property.

This deed takes effect immediately upon execution and acknowledgement.

Signatures:

______________________________ (Grantor)

Date: ________________________

______________________________ (Witness)

Date: ________________________

State of [State]

County of _____________________

On this ____ day of ____________, 20__, before me, the undersigned notary public, personally appeared ______________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

Notary Public: ___________________________

My Commission Expires: __________________