Fill Out a Valid IRS Schedule C 1040 Template

Guide to Writing IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals or those who run a business as a sole proprietorship. This form allows you to report income and expenses related to your business activities. Follow these steps to complete the form accurately.

- Gather Your Information: Collect all necessary documents, including your business income records, expense receipts, and any other relevant financial information.

- Enter Your Business Information: At the top of the form, provide your business name, address, and the type of business you operate. If you have a trade name, include that as well.

- Report Income: In Part I, list your gross receipts or sales. If you have returns and allowances, subtract them to find your net income.

- Detail Your Expenses: Move to Part II. Categorize your business expenses, such as advertising, car and truck expenses, and supplies. Be sure to include all relevant costs.

- Calculate Your Net Profit or Loss: After entering your expenses, subtract the total from your gross income. This will give you your net profit or loss, which you will report on your Form 1040.

- Complete the Additional Sections: If applicable, fill out any additional sections, such as the cost of goods sold or information about your vehicle.

- Sign and Date the Form: Once you have reviewed everything for accuracy, sign and date the form. If someone else prepared it, they should also sign it.

- Submit the Form: Finally, attach the completed Schedule C to your Form 1040 and submit it to the IRS by the tax deadline.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income and expenses from their business activities. |

| Filing Requirement | Individuals must file Schedule C if they have net earnings of $400 or more from self-employment. |

| Due Date | The form is typically due on April 15th, the same day as the individual income tax return, unless an extension is filed. |

| Income Reporting | All business income must be reported, including cash, checks, and credit card payments. |

| Deductible Expenses | Common deductible expenses include costs for supplies, utilities, and business-related travel. |

| State-Specific Forms | Some states may require additional forms for self-employment income, governed by state laws such as California's Revenue and Taxation Code. |

FAQ

What is IRS Schedule C?

IRS Schedule C is a form used by sole proprietors to report income and expenses from their business. It is filed along with Form 1040, the individual income tax return. This form allows self-employed individuals to calculate their net profit or loss, which is then reported on their personal tax return.

Who needs to file Schedule C?

Any individual who operates a business as a sole proprietor must file Schedule C. This includes freelancers, independent contractors, and anyone earning income from self-employment. If your business earned income, even if it was a small amount, you generally need to report it.

What information is required on Schedule C?

Schedule C requires several pieces of information, including:

- Your business name and address.

- Your business activity and the principal product or service you offer.

- Income earned from your business.

- Expenses related to running your business, such as supplies, utilities, and advertising.

Accurate records of all income and expenses are essential for completing this form correctly.

How do I calculate my net profit or loss on Schedule C?

To calculate your net profit or loss, subtract your total business expenses from your total business income. If your income exceeds your expenses, you have a net profit. If your expenses are higher, you report a net loss. This figure is then transferred to your Form 1040.

What types of expenses can I deduct on Schedule C?

You can deduct a variety of business expenses on Schedule C, including:

- Cost of goods sold.

- Advertising and marketing costs.

- Office supplies and equipment.

- Utilities and rent for business space.

- Travel expenses related to your business.

- Professional fees, such as legal and accounting services.

It’s important to keep thorough records and receipts for all deductions claimed.

Can I file Schedule C electronically?

Yes, you can file Schedule C electronically. Many tax preparation software programs support e-filing for Schedule C along with your Form 1040. This method is often faster and can help reduce errors compared to paper filing.

What happens if I make a mistake on Schedule C?

If you discover a mistake after filing Schedule C, you can file an amended return using Form 1040-X. This form allows you to correct errors, including incorrect income or expenses. It’s essential to address any mistakes promptly to avoid potential penalties or interest charges.

Where can I find more information about Schedule C?

For more information about Schedule C, you can visit the IRS website. The IRS provides detailed instructions and resources that can help you understand how to complete the form accurately. Additionally, consulting with a tax professional can provide personalized guidance.

Fill out Other Forms

Imm 1294 Form 2023 Pdf Download - The personal information you provide may be shared with other governmental bodies for verification.

The importance of accurately completing financial documentation in family law cases cannot be overstated, especially when utilizing the Notice Florida form, which assists in ensuring compliance with required financial disclosures for individuals earning $50,000 or more annually.

Receipt for Cash Payment - Provides evidence of cash transactions.

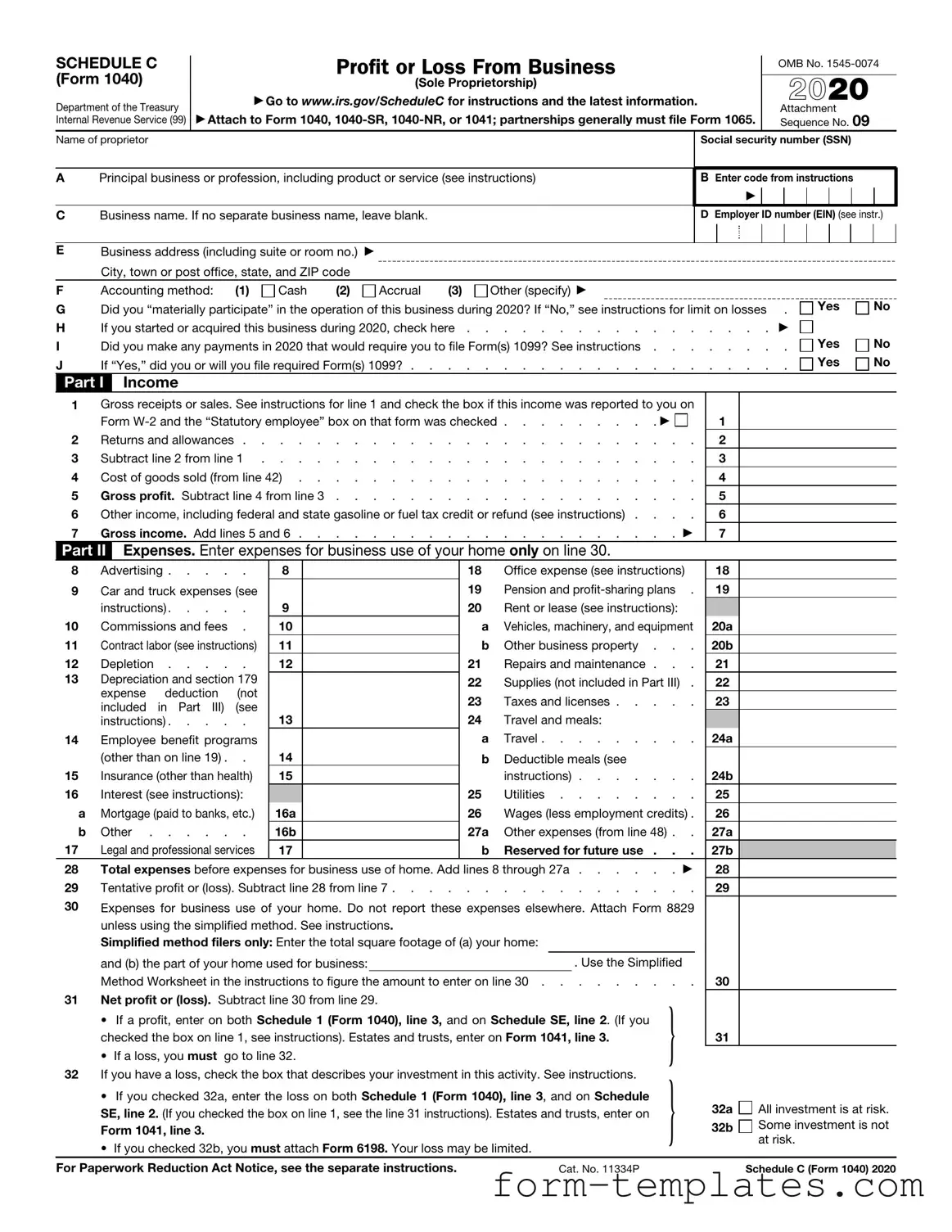

IRS Schedule C 1040 Example

SCHEDULE C |

|

Profit or Loss From Business |

|

OMB No. |

|||||||

|

|

||||||||||

(Form 1040) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

(Sole Proprietorship) |

|

2020 |

|

|||||||

Department of the Treasury |

|

▶ Go to www.irs.gov/ScheduleC for instructions and the latest information. |

|

|

|||||||

|

|

|

|

Attachment |

|||||||

Internal Revenue Service (99) |

|

▶ Attach to Form 1040, |

Sequence No. 09 |

||||||||

Name of proprietor |

|

|

|

Social security number (SSN) |

|||||||

|

|

|

|

|

|

|

|

|

|

||

A |

Principal business or profession, including product or service (see instructions) |

|

B Enter code from instructions |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C |

Business name. If no separate business name, leave blank. |

D Employer ID number (EIN) (see instr.) |

|||||||||

EBusiness address (including suite or room no.) ▶ City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

Accrual |

(3) |

Other (specify) ▶ |

G |

Did you “materially participate” in the operation of this business during 2020? If “No,” see instructions for limit on losses . |

||||||

H |

If you started or acquired this business during 2020, check here . |

. . . . . . . . . . . . . . . . ▶ |

|||||

I |

Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions |

||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

||||||

Yes

Yes  No

No

Yes

Yes

No

No

Yes

Yes  No

No

Part I Income

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|||||||||||

|

Form |

. . . . . . . . |

. ▶ |

1 |

|

|||||||||

2 |

Returns and allowances |

. . . . . . . . . . . |

|

2 |

|

|||||||||

3 |

Subtract line 2 from line 1 |

. . . . . . . . . . . |

|

3 |

|

|||||||||

4 |

Cost of goods sold (from line 42) |

. . . . . . . . . . . |

|

4 |

|

|||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

. . . . . . . . . . . |

|

5 |

|

|||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . |

. |

. ▶ |

7 |

|

||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

||||||||

8 |

Advertising |

8 |

|

|

18 |

Office expense (see instructions) |

18 |

|

||||||

9 |

Car and truck expenses (see |

|

|

|

19 |

Pension and |

19 |

|

||||||

|

instructions) |

9 |

|

|

20 |

Rent or lease (see instructions): |

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

b |

Other business property . . . |

20b |

|

||||||

12 |

Depletion |

12 |

|

|

21 |

Repairs and maintenance . . . |

21 |

|

||||||

13 |

Depreciation and section 179 |

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

||||||

|

expense deduction (not |

|

|

|

|

|||||||||

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|||||||

|

included in Part III) (see |

|

|

|

|

|||||||||

|

instructions) |

13 |

|

|

24 |

Travel and meals: |

|

|

|

|

|

|||

14 |

Employee benefit programs |

|

|

|

a |

Travel |

24a |

|

||||||

|

(other than on line 19) . . |

14 |

|

|

b |

Deductible meals (see |

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

instructions) |

24b |

|

||||||

16 |

Interest (see instructions): |

|

|

|

25 |

Utilities |

25 |

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

26 |

Wages (less employment credits) . |

26 |

|

||||||

b |

Other |

16b |

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

||||||

17 |

Legal and professional services |

17 |

|

|

b |

Reserved for future use . . . |

27b |

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a . . . . |

. |

. ▶ |

28 |

|

|||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

. . . . . . . . . . . |

|

29 |

|

|||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

and (b) the part of your home used for business: |

|

|

|

|

. Use the Simplified |

|

|

||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

} |

|

|

|

||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

|

31 |

|

|||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

|

} |

|

|

|

||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

32a |

All investment is at risk. |

|||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on |

|

|

|||||||||||

|

|

|

32b |

Some investment is not |

||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

at risk. |

|||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

|

|

||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

|

Schedule C (Form 1040) 2020 |

||||||

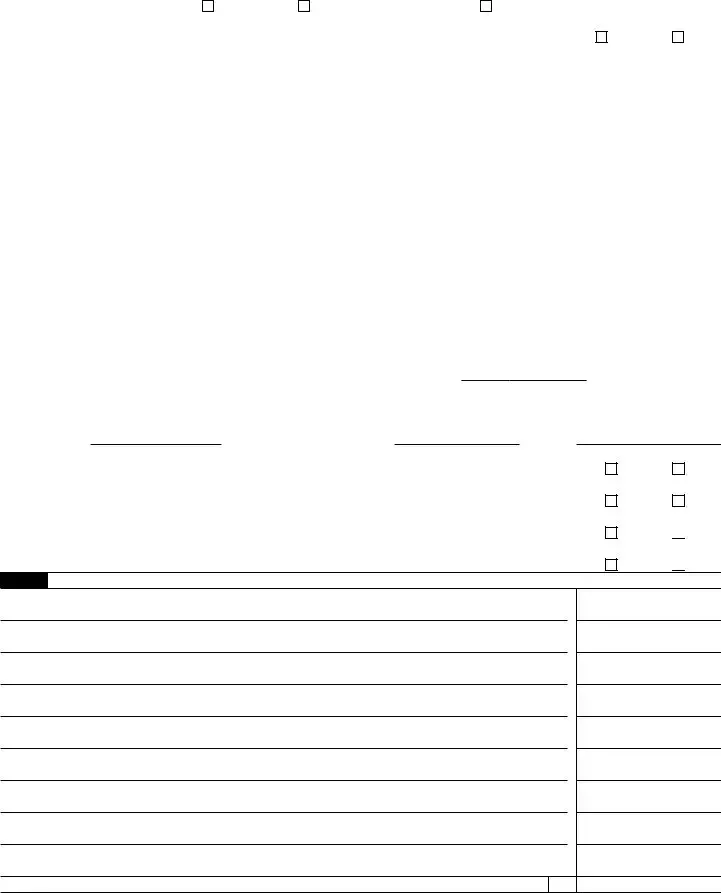

Schedule C (Form 1040) 2020 |

Page 2 |

|

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

|

|||

36 |

Purchases less cost of items withdrawn for personal use |

36 |

|

|||

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

|

|||

38 |

Materials and supplies |

38 |

|

|||

39 |

Other costs |

39 |

|

|||

40 |

Add lines 35 through 39 |

40 |

|

|||

41 |

Inventory at end of year |

41 |

|

|||

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

|

|||

Part IV |

Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 |

|||||

|

|

and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must |

||||

|

|

file Form 4562. |

|

|

|

|

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

|

|

44Of the total number of miles you drove your vehicle during 2020, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

|

45 |

Was your vehicle available for personal use during |

. . . . . . . . . . . . . |

Yes |

|

46 |

Do you (or your spouse) have another vehicle available for personal use?. |

. . . . . . . . . . . . . |

Yes |

|

47a |

Do you have evidence to support your deduction? |

. . . . . . . . . . . . . |

Yes |

|

b |

If “Yes,” is the evidence written? |

. . . . . . . . . . . . . |

Yes |

|

Part V Other Expenses. List below business expenses not included on lines

No

No

No

No

No

No

48 Total other expenses. Enter here and on line 27a . . . . . . . . . . . . . . . .

48

Schedule C (Form 1040) 2020