Fill Out a Valid IRS Schedule B 941 Template

Guide to Writing IRS Schedule B 941

Once you have gathered all necessary information, you are ready to begin filling out the IRS Schedule B (Form 941). This form is essential for reporting your tax liability and ensuring compliance with federal tax regulations. Follow the steps below to complete it accurately.

- Start with your basic information. Enter your name, business name, address, and Employer Identification Number (EIN) at the top of the form.

- In the first section, indicate the quarter for which you are filing the form. This will help the IRS track your submissions correctly.

- Next, provide the total number of employees you had during the quarter. This number is crucial for calculating your tax obligations.

- List the total wages paid to your employees during the quarter. Be sure to include all taxable wages.

- Calculate and enter the total taxes withheld from employee wages. This includes federal income tax and other applicable deductions.

- In the next section, report any adjustments to your tax liability. This may include corrections from previous filings.

- Sign and date the form. Ensure that the person signing is authorized to do so on behalf of the business.

- Finally, keep a copy of the completed form for your records before submitting it to the IRS by the due date.

By following these steps, you will ensure that the IRS Schedule B (Form 941) is filled out correctly and submitted on time. This helps maintain compliance and avoid any potential penalties.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule B (Form 941) is used to report the number of employees and the total wages paid during the quarter. |

| Filing Frequency | This form must be filed quarterly by employers who withhold income taxes and pay Social Security and Medicare taxes. |

| Due Dates | Schedule B must be filed with Form 941 by the last day of the month following the end of the quarter. |

| State-Specific Forms | Some states may have additional requirements. For example, California employers must comply with the California Employment Development Department (EDD) regulations. |

| Penalties | Failure to file Schedule B on time can result in penalties, which may include fines and interest on unpaid taxes. |

FAQ

-

What is IRS Schedule B (Form 941)?

IRS Schedule B (Form 941) is a form used by employers to report their tax liability for federal income tax withheld and social security and Medicare taxes. It specifically details the employer's tax liability for each quarter of the year. This form is submitted along with Form 941, which is the Employer's Quarterly Federal Tax Return.

-

Who needs to file Schedule B?

Employers who report a tax liability of $100,000 or more in a single day during the lookback period must file Schedule B. This requirement applies to all employers, regardless of the size of their business, if they meet this threshold. Additionally, if you are notified by the IRS to file Schedule B, you must comply.

-

When is Schedule B due?

Schedule B is due at the same time as Form 941. Generally, Form 941 must be filed by the last day of the month following the end of the quarter. For example, for the first quarter ending March 31, the due date is April 30. Ensure you file on time to avoid penalties.

-

How do I fill out Schedule B?

To complete Schedule B, you will need to provide information on your tax liability for each month of the quarter. Follow these steps:

- Enter the total tax liability for each month.

- Indicate any adjustments or corrections if applicable.

- Ensure all calculations are accurate to avoid discrepancies.

Refer to the IRS instructions for detailed guidance on each line item.

-

What happens if I don’t file Schedule B?

Failing to file Schedule B when required can lead to penalties. The IRS may impose fines for late filings or inaccuracies. It’s crucial to comply with all filing requirements to avoid unnecessary financial burdens.

-

Can I e-file Schedule B?

Yes, you can e-file Schedule B along with Form 941. Many payroll software programs offer e-filing options that simplify the process. Ensure that your software is updated and compliant with IRS requirements.

-

Where can I find IRS Schedule B?

You can download IRS Schedule B (Form 941) directly from the IRS website. It is available in PDF format, which you can print and fill out manually, or you can use an electronic version if you are e-filing.

-

Is there assistance available for filling out Schedule B?

If you need help completing Schedule B, consider consulting a tax professional or accountant. They can provide personalized guidance based on your business's specific circumstances. Additionally, the IRS offers resources and instructions that can assist you in the process.

-

What if I make a mistake on Schedule B?

If you discover an error after submitting Schedule B, you should correct it as soon as possible. You can file an amended Form 941 to rectify the mistake. It’s important to address errors promptly to minimize any potential penalties.

Fill out Other Forms

Reiwa Rental Application Form - You have the right to receive a copy of your Tenancy Agreement if accepted.

When engaging in the sale of a mobile home in Florida, it's vital to utilize the appropriate documentation to formalize the transaction. The Florida Mobile Home Bill of Sale form serves this purpose by acting as a receipt and ensuring that both parties are protected. For those looking to streamline this process, you can obtain the necessary documentation by accessing the Mobile Home Bill of Sale form, which outlines the essential details required for a smooth transfer of ownership.

Sex Yes No Maybe - It solidifies consent as a fundamental part of exploration.

IRS Schedule B 941 Example

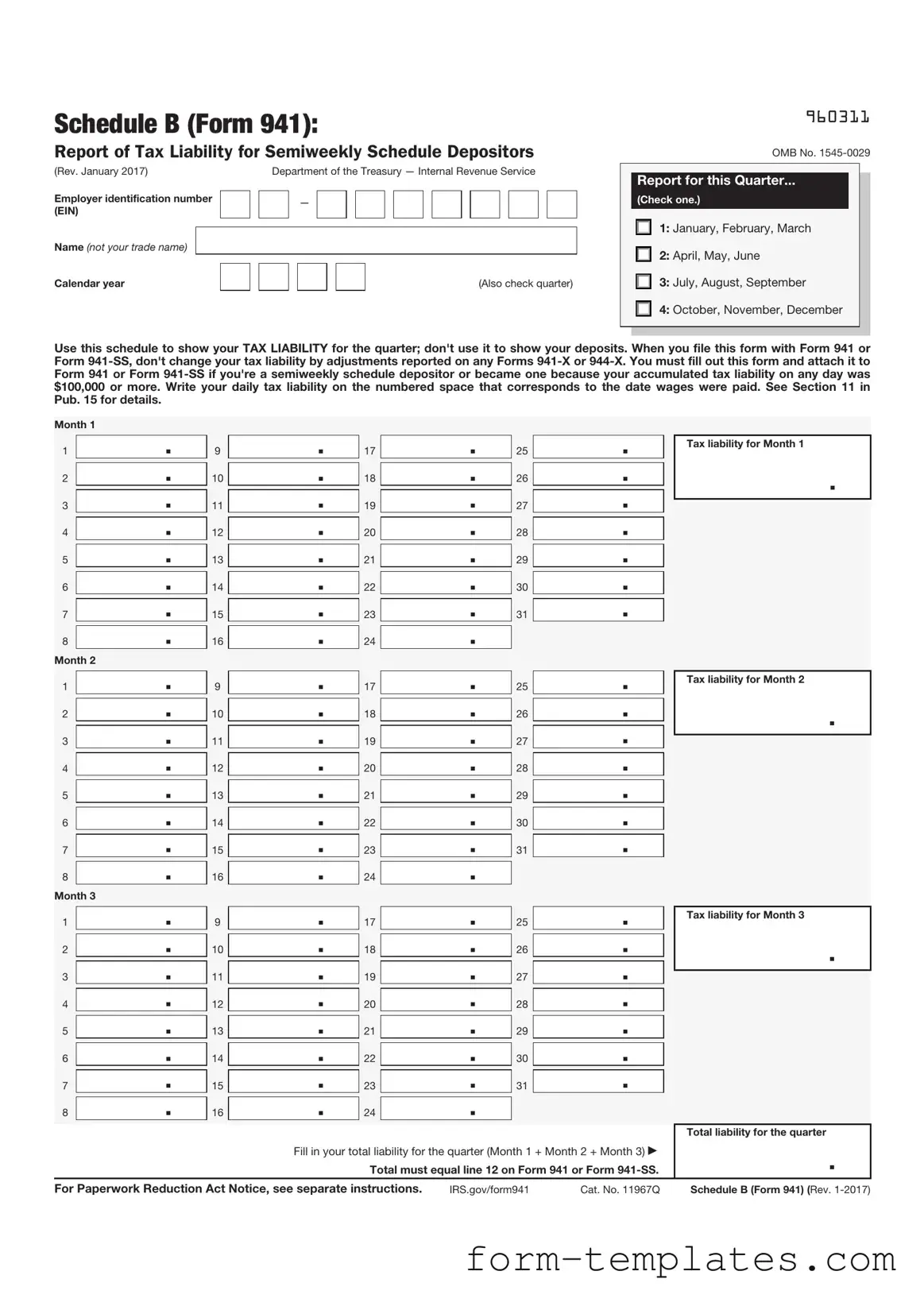

Schedule B (Form 941):

Report of Tax Liability for Semiweekly Schedule Depositors

(Rev. January 2017) |

|

|

Department of the Treasury — Internal Revenue Service |

|||||||||||||||||||

Employer identification number |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Also check quarter) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

960311

OMB No.

Report for this Quarter...

(Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form

Month 1

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 2

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 3

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

Tax liability for Month 1

.

Tax liability for Month 2

.

1 |

|

. |

9 |

|

. |

17 |

|

|

. |

25 |

|

. |

|

Tax liability for Month 3 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

2 |

|

. |

10 |

|

. |

18 |

|

|

. |

26 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

. |

11 |

|

. |

19 |

|

|

. |

27 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

. |

12 |

|

. |

20 |

|

|

. |

28 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

. |

13 |

|

. |

21 |

|

|

. |

29 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

. |

14 |

|

. |

22 |

|

|

. |

30 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

. |

15 |

|

. |

23 |

|

|

. |

31 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

. |

16 |

|

. |

24 |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability for the quarter |

|

|

|

|

Fill in your total liability for the quarter (Month 1 + Month 2 + Month 3) |

. |

|||||||||

|

|

|

|

|

|

Total must equal line 12 on Form 941 or Form |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

IRS.gov/form941 |

Cat. No. 11967Q |

Schedule B (Form 941) (Rev. |

|||||||||||