Fill Out a Valid IRS 940 Template

Guide to Writing IRS 940

Completing the IRS 940 form is an essential step for employers who need to report their annual Federal Unemployment Tax Act (FUTA) liability. Following the correct steps will help ensure that your form is filled out accurately and submitted on time. Below are the steps to guide you through the process.

- Gather necessary information, including your Employer Identification Number (EIN), business name, and address.

- Obtain a copy of the IRS 940 form, which can be downloaded from the IRS website or requested directly from the IRS.

- Start with Part 1 of the form, where you will provide your business information, including the EIN and business name.

- In Part 2, report the total amount of wages subject to FUTA tax. Make sure to include only those wages that are applicable.

- Calculate the FUTA tax owed in Part 3. The form provides guidance on how to calculate this based on the total wages reported.

- Complete Part 4, where you will indicate any adjustments for state unemployment tax credits, if applicable.

- In Part 5, provide your signature and the date, confirming that the information is accurate to the best of your knowledge.

- Review the completed form for any errors or omissions before submitting.

- Submit the form by mail or electronically, following the instructions provided by the IRS.

Once you have completed these steps, it is important to keep a copy of the form for your records. Ensure that you meet any deadlines for submission to avoid penalties. Being thorough in this process can help you maintain compliance with federal regulations.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 940 is used to report annual Federal Unemployment Tax Act (FUTA) tax. Employers use it to calculate their tax liability for unemployment benefits. |

| Filing Frequency | This form must be filed annually, typically by January 31 of the following year for the previous calendar year. |

| Threshold for Filing | Employers who pay $1,500 or more in wages in any calendar quarter or have at least one employee for some part of a day in 20 or more weeks must file this form. |

| Tax Rate | The standard FUTA tax rate is 6.0% on the first $7,000 of each employee's wages. However, employers may receive a credit of up to 5.4% if they pay state unemployment taxes. |

| State-Specific Forms | In addition to Form 940, employers may need to file state-specific unemployment tax forms, which are governed by state laws such as the California Unemployment Insurance Code or the Texas Unemployment Compensation Act. |

| Penalties for Late Filing | Failing to file Form 940 on time can result in penalties. The IRS may impose a penalty of 5% of the unpaid tax for each month the return is late, up to a maximum of 25%. |

| Amending the Form | If an employer discovers an error after submitting Form 940, they must file Form 940-X to correct it. This form is specifically designed for amendments. |

| Record Keeping | Employers should keep records of all wages paid, tax payments made, and copies of filed forms for at least four years after the due date of the tax return. |

FAQ

-

What is the IRS Form 940?

-

The IRS Form 940 is an annual tax form used by employers to report their Federal Unemployment Tax Act (FUTA) liability. This form is essential for businesses that pay wages to employees and are subject to unemployment tax. The information reported on this form helps the IRS determine the amount of unemployment tax owed by the employer.

-

Who needs to file Form 940?

-

Employers who pay $1,500 or more in wages in any calendar quarter or have at least one employee for some part of a day in 20 or more weeks during the current or preceding calendar year must file Form 940. This includes businesses, non-profits, and government entities.

-

When is Form 940 due?

-

Form 940 is due annually by January 31 of the following year. If you deposit all FUTA tax when due, you have until February 10 to file the form. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

-

How do I file Form 940?

-

Form 940 can be filed electronically or by mail. To file electronically, you can use the IRS e-file system or authorized e-file providers. If you choose to mail the form, send it to the address specified in the form instructions based on your location.

-

What information is required on Form 940?

-

Form 940 requires several pieces of information, including:

- Your business name and address

- Your Employer Identification Number (EIN)

- Total wages subject to FUTA tax

- FUTA tax liability for the year

- Any adjustments for prior year overpayments

-

What happens if I don’t file Form 940?

-

Failing to file Form 940 can lead to significant penalties. The IRS may impose a penalty of 5% of the unpaid tax for each month the form is late, up to a maximum of 25%. Additionally, interest will accrue on any unpaid taxes, which can increase the total amount owed.

-

Can I amend a previously filed Form 940?

-

Yes, if you need to correct errors on a previously filed Form 940, you can amend it by filing Form 940-X. This form is specifically designed for making corrections to your original filing. It is important to file the amendment as soon as you realize the error to minimize penalties.

-

What if I have no FUTA tax liability?

-

If you have no FUTA tax liability for the year, you still need to file Form 940. You will indicate that you have no liability on the form. Filing is necessary to maintain compliance with IRS requirements.

-

Where can I find more information about Form 940?

-

Additional information regarding Form 940 can be found on the IRS website. The IRS provides detailed instructions, FAQs, and resources to assist employers in understanding their obligations under the FUTA tax. You may also consult a tax professional for personalized guidance.

Fill out Other Forms

How to Get Acord Insurance Certificate - The Acord 50 WM serves as a proof of policy documentation.

To ensure a smooth renting experience, it is essential to have a clear understanding of the terms outlined in a Room Rental Agreement. This legal document, which can be found through the provided link, protects both the landlord's and tenant's rights, detailing payment schedules, responsibilities, and house rules. For more information, you can refer to the Room Lease Agreement.

Unconditional Waiver and Release on Final Payment Texas - This document is prepared by the State Bar of Texas for legal professionals.

Form 6059B Customs Declaration - Completing the CBP 6059B is a legal requirement for anyone entering the U.S.

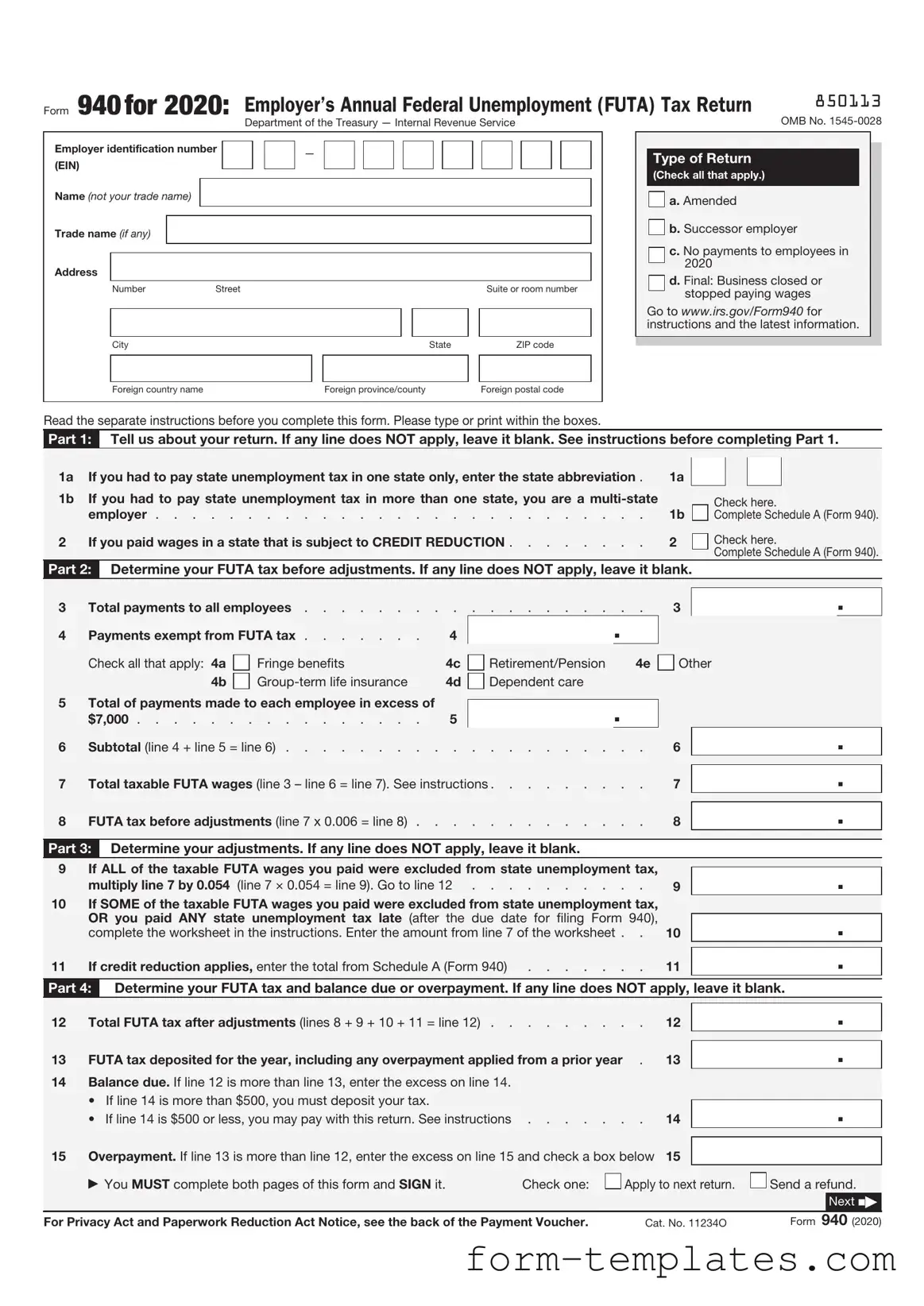

IRS 940 Example

Form 940for 2020: Employer’s Annual Federal Unemployment (FUTA) Tax Return |

850113 |

|

OMB No. |

||

Department of the Treasury — Internal Revenue Service |

Employer identification number |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Number |

Street |

|

|

|

|

Suite or room number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/county |

|

Foreign postal code |

||

Type of Return

(Check all that apply.)

a. Amended

a. Amended

b. Successor employer

b. Successor employer

c. No payments to employees in 2020

d. Final: Business closed or stopped paying wages

Go to www.irs.gov/Form940 for instructions and the latest information.

Read the separate instructions before you complete this form. Please type or print within the boxes.

Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1.

1a |

If you had to pay state unemployment tax in one state only, enter the state abbreviation . |

1a |

|

1b |

If you had to pay state unemployment tax in more than one state, you are a |

|

|

|

employer |

1b |

|

2 |

If you paid wages in a state that is subject to CREDIT REDUCTION |

2 |

|

|

Check here.

Complete Schedule A (Form 940).

Check here.

Complete Schedule A (Form 940).

Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank.

3 |

Total payments to all employees |

. |

3 |

|

|

|

|

. |

||||||||||

4 |

Payments exempt from FUTA tax |

4 |

|

|

|

. |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Check all that apply: 4a |

|

Fringe benefits |

4c |

|

Retirement/Pension |

4e |

|

Other |

|

|

|

|

|||||

|

|

4b |

|

4d |

|

Dependent care |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5 |

Total of payments made to each employee in excess of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

. |

|

|

|

|

|

|

|

|

||||||

|

$7,000 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||

6 |

Subtotal (line 4 + line 5 = line 6) |

. |

6 |

|

|

|

. |

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

7 |

Total taxable FUTA wages (line 3 – line 6 = line 7). See instructions |

. |

7 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

8 |

FUTA tax before adjustments (line 7 x 0.006 = line 8) |

. |

8 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3: |

Determine your adjustments. If any line does NOT apply, leave it blank. |

|

|

|

|

|

|

|

|

|||||||||

9 |

If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

. |

||||||||||||

|

multiply line 7 by 0.054 |

(line 7 × 0.054 = line 9). Go to line 12 |

. |

9 |

|

|

|

|||||||||||

10 |

If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, |

|

|

|

|

|

|

|

||||||||||

|

OR you paid ANY state unemployment tax late (after the due date for filing Form 940), |

|

|

|

|

|

|

. |

||||||||||

|

complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet . |

. |

10 |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

11 |

If credit reduction applies, enter the total from Schedule A (Form 940) |

. |

11 |

|

|

|

|

. |

||||||||||

|

|

|

||||||||||||||||

Part 4: |

Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

12 |

Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12) |

. |

12 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

13 |

FUTA tax deposited for the year, including any overpayment applied from a prior year |

. |

13 |

|

|

|

|

. |

||||||||||

14 |

Balance due. If line 12 is more than line 13, enter the excess on line 14. |

|

|

|

|

|

|

|

|

|||||||||

|

• If line 14 is more than $500, you must deposit your tax. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

14 |

|

|

|

|

. |

|||||

|

• |

If line 14 is $500 or less, you may pay with this return. See instructions |

. |

|

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||

15 |

Overpayment. If line 13 is more than line 12, enter the excess on line 15 and check a box below |

15 |

|

|

|

|

. |

|||||||||||

|

|

You MUST complete both pages of this form and SIGN it. |

|

|

Check one: |

|

|

|

Apply to next return. |

|

Send a refund. |

|||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Next N |

|

|

|

|

|

|

||||||||||||||

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. |

Cat. No. 11234O |

|

Form |

940 (2020) |

||||||||||||||

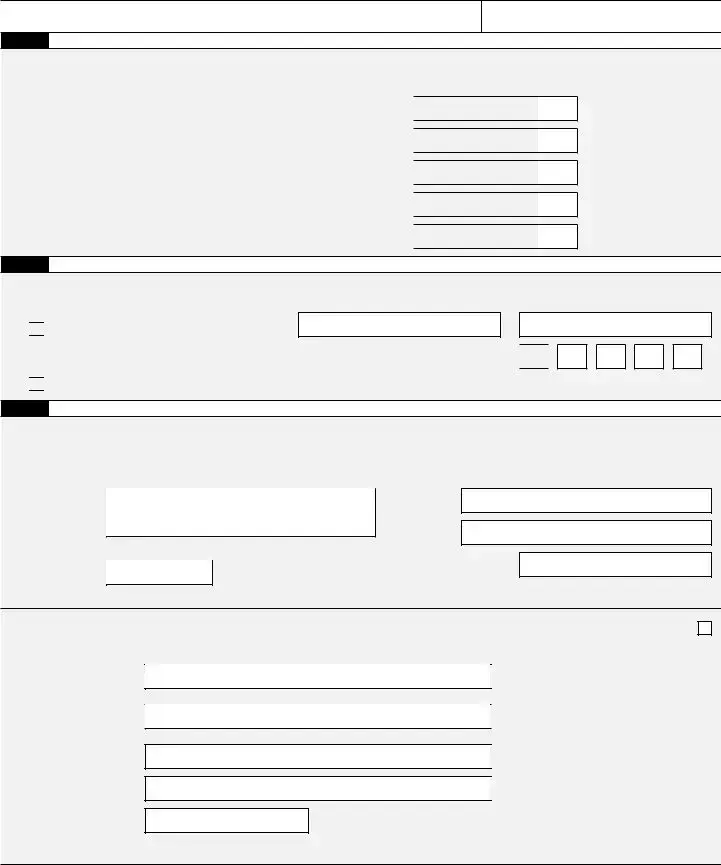

850212

Name (not your trade name)

Employer identification number (EIN)

Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6.

16Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank.

16a |

1st quarter (January 1 – March 31) . . |

. . |

. |

. |

. |

. |

. |

16a |

16b |

2nd quarter (April 1 – June 30) . . . |

. . |

. |

. |

. |

. |

. |

16b |

16c |

3rd quarter (July 1 – September 30) . |

. . |

. |

. |

. |

. |

. |

16c |

16d |

4th quarter (October 1 – December 31) |

. . |

. |

. |

. |

. |

. |

16d |

17 Total tax liability for the year (lines 16a + 16b + 16c + 16d = line 17) 17

.

.

.

.

.

.

.

.

.

.

Total must equal line 12.

Part 6: May we speak with your

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details.

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number

Select a

No.

No.

Part 7: Sign here. You MUST complete both pages of this form and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign your name here

Date

/ /

Print your name here

Print your title here

Best daytime phone

Paid Preparer Use Only

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

Check if you are

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

Date |

/ |

/ |

|

|

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

Page 2 |

Form 940 (2020) |

Form

Purpose of Form

Complete Form

Making Payments With Form 940

To avoid a penalty, make your payment with your 2020 Form 940 only if your FUTA tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. If your total FUTA tax after adjustments (Form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. See When Must You Deposit Your FUTA Tax? in the Instructions for Form

940.Also see sections 11 and 14 of Pub. 15 for more information about deposits.

Use Form

may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15.

Specific Instructions

Box

Box

Box

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your EIN, “Form 940,” and “2020” on your check or money order. Don’t send cash. Don’t staple Form

•Detach Form

Note: You must also complete the entity information above Part 1 on Form 940.

Detach Here and Mail With Your Payment and Form 940. |

|

|||||

|

|

|

|

|||

Form |

|

Payment Voucher |

|

OMB No. |

||

|

|

|||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Department of the Treasury |

|

Don’t staple or attach this voucher to your payment. |

|

2020 |

||

Internal Revenue Service |

|

|

||||

1 Enter your employer identification number (EIN). |

2 |

|

Dollars |

|

Cents |

|

|

|

Enter the amount of your payment. |

|

|

|

|

|

|

Make your check or money order payable to “United States Treasury” |

|

|

|

|

|

|

|

|

|

|

|

3Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code; or your city, foreign country name, foreign province/county, and foreign postal code.

Form 940 (2020)

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Chapter 23, Federal Unemployment Tax Act, of Subtitle C, Employment Taxes, of the Internal Revenue Code imposes a tax on employers with respect to employees. This form is used to determine the amount of the tax that you owe. Section 6011 requires you to provide the requested information if you are liable for FUTA tax under section 3301. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner or provide a false or fraudulent form, you may be subject to penalties.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose

your tax information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions to administer their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

9 hr., 19 min. |

Learning about the law or the form . . |

1 hr., 23 min. |

Preparing, copying, assembling, and |

|

sending the form to the IRS |

1 hr., 36 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 940 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,