Fill Out a Valid IRS 433-F Template

Guide to Writing IRS 433-F

Filling out the IRS 433-F form is an important step for individuals seeking to provide financial information to the IRS. This form helps in negotiating payment plans or resolving tax liabilities. To ensure accuracy and completeness, follow these steps carefully.

- Start by downloading the IRS 433-F form from the official IRS website or obtain a physical copy from a local IRS office.

- Fill in your personal information at the top of the form. Include your name, address, and Social Security number.

- Provide information about your employment. List your employer's name, address, and your job title.

- Detail your income. Include all sources of income, such as wages, self-employment earnings, and any other income streams.

- List your monthly expenses. Break down costs like housing, utilities, food, transportation, and any other regular expenses.

- Complete the asset section. Report any assets you own, such as bank accounts, real estate, vehicles, and investments.

- Review the form for accuracy. Ensure all information is correct and complete before signing.

- Sign and date the form at the bottom. This confirms that the information you provided is true to the best of your knowledge.

- Submit the form to the appropriate IRS office. You can mail it or, in some cases, submit it electronically.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS 433-F form is used to collect financial information from taxpayers who owe back taxes, enabling the IRS to evaluate their ability to pay. |

| Usage | This form is typically required during the process of setting up a payment plan or negotiating an offer in compromise with the IRS. |

| Information Required | Taxpayers must provide detailed information about their income, expenses, assets, and liabilities when completing this form. |

| Submission | The completed IRS 433-F form can be submitted online or via mail, depending on the specific instructions provided by the IRS. |

FAQ

What is the IRS 433-F form?

The IRS 433-F form is a financial statement used by the Internal Revenue Service (IRS) to gather information about an individual's or business's financial situation. This form helps the IRS assess a taxpayer's ability to pay their tax liabilities. It collects details about income, expenses, assets, and liabilities, providing a comprehensive view of the taxpayer's financial standing.

Who needs to file the IRS 433-F form?

The IRS 433-F form is typically required for individuals or businesses that are undergoing collection actions, such as installment agreements or offers in compromise. If you owe taxes and cannot pay the full amount, the IRS may request this form to evaluate your financial circumstances. It is essential for anyone seeking to negotiate payment terms with the IRS.

How do I complete the IRS 433-F form?

Completing the IRS 433-F form involves several steps:

- Gather financial documents, including pay stubs, bank statements, and records of expenses.

- Fill out the form with accurate information about your income, expenses, assets, and liabilities.

- Be honest and thorough, as the IRS may verify the information provided.

- Review the completed form for accuracy before submitting it to the IRS.

Ensure that all figures are current and reflect your financial situation as accurately as possible.

What happens after I submit the IRS 433-F form?

Once you submit the IRS 433-F form, the IRS will review the information provided. They may reach out for additional documentation or clarification. The IRS will use this information to determine your ability to pay your tax debt and may offer options such as an installment agreement or an offer in compromise. It is important to respond promptly to any requests from the IRS to avoid delays in processing your case.

Fill out Other Forms

Early Miscarriage Bleeding - It ensures that all legal aspects of the miscarriage are addressed.

Aws Welder Certification - Indicating the date of testing ensures the qualification is fresh and relevant, adhering to any time-sensitive regulations.

Utilizing the Work Release form can significantly enhance an individual's ability to reintegrate into society post-incarceration. This vital legal document allows for temporary employment, which can foster a sense of responsibility and independence. By carefully understanding its provisions, individuals and their families can better navigate the complexities of the legal system, ultimately leading to successful rehabilitation. For more information, you can refer to the Work Release Form.

Blank Ada Claim Form - Patient identification numbers can assist in tracking claims through the system.

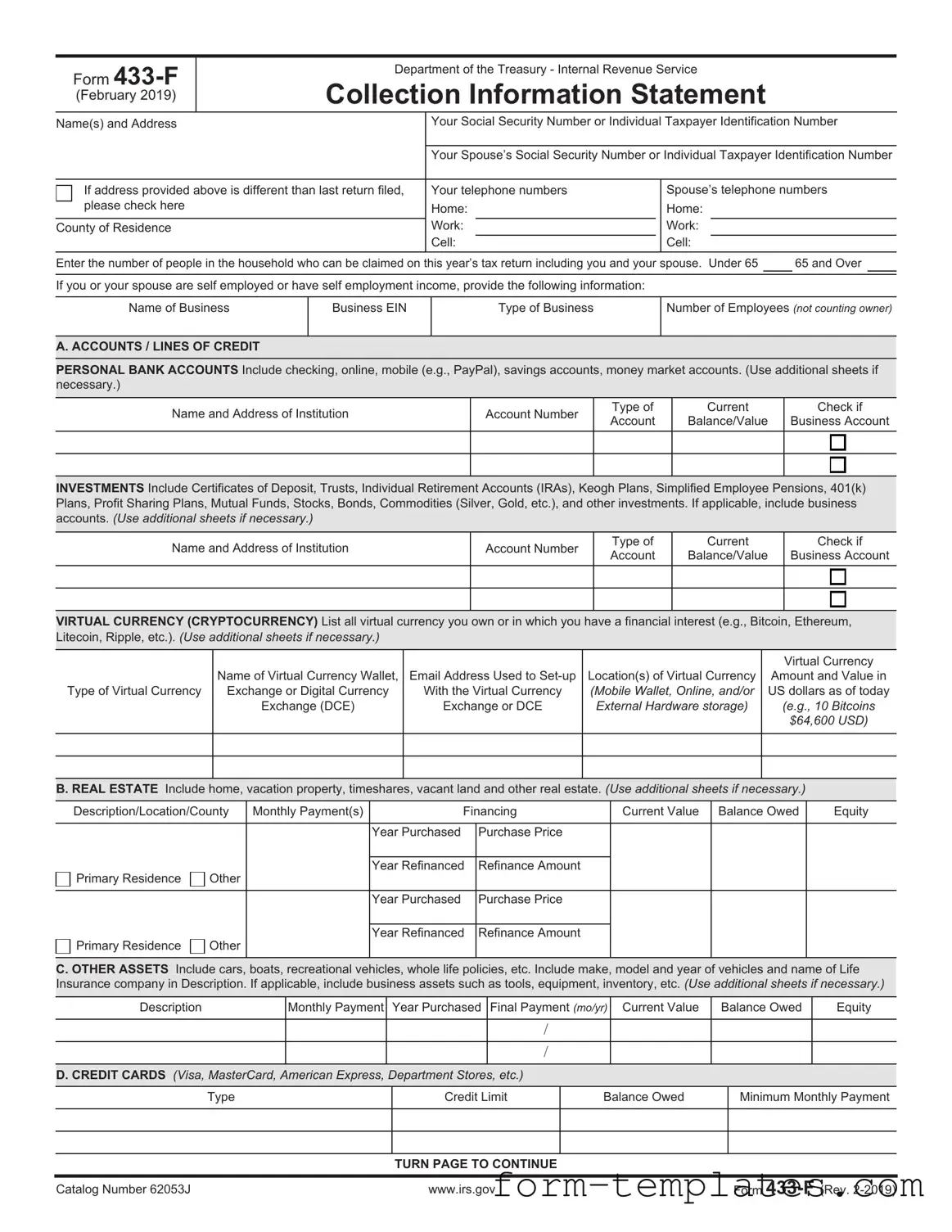

IRS 433-F Example

Form

(February 2019)

Department of the Treasury - Internal Revenue Service

Collection Information Statement

Name(s) and Address |

Your Social Security Number or Individual Taxpayer Identification Number |

|||||||

|

|

|

|

|

||||

|

Your Spouse’s Social Security Number or Individual Taxpayer Identification Number |

|||||||

|

|

|

|

|

|

|||

If address provided above is different than last return filed, |

Your telephone numbers |

|

Spouse’s telephone numbers |

|||||

please check here |

Home: |

|

Home: |

|

|

|

||

County of Residence |

Work: |

|

|

Work: |

|

|

|

|

|

Cell: |

|

|

Cell: |

|

|

|

|

Enter the number of people in the household who can be claimed on this year’s tax return including you and your spouse. Under 65 |

|

65 and Over |

||||||

|

|

|

|

|

|

|

|

|

If you or your spouse are self employed or have self employment income, provide the following information:

Name of Business

Business EIN

Type of Business

Number of Employees (not counting owner)

A. ACCOUNTS / LINES OF CREDIT

PERSONAL BANK ACCOUNTS Include checking, online, mobile (e.g., PayPal), savings accounts, money market accounts. (Use additional sheets if necessary.)

Name and Address of Institution

Account Number

Type of Account

Current

Balance/Value

Check if

Business Account

INVESTMENTS Include Certificates of Deposit, Trusts, Individual Retirement Accounts (IRAs), Keogh Plans, Simplified Employee Pensions, 401(k) Plans, Profit Sharing Plans, Mutual Funds, Stocks, Bonds, Commodities (Silver, Gold, etc.), and other investments. If applicable, include business accounts. (Use additional sheets if necessary.)

Name and Address of Institution

Account Number

Type of Account

Current

Balance/Value

Check if

Business Account

VIRTUAL CURRENCY (CRYPTOCURRENCY) List all virtual currency you own or in which you have a financial interest (e.g., Bitcoin, Ethereum, Litecoin, Ripple, etc.). (Use additional sheets if necessary.)

Type of Virtual Currency

Name of Virtual Currency Wallet,

Exchange or Digital Currency

Exchange (DCE)

Email Address Used to

With the Virtual Currency

Exchange or DCE

Location(s) of Virtual Currency (Mobile Wallet, Online, and/or External Hardware storage)

Virtual Currency

Amount and Value in US dollars as of today (e.g., 10 Bitcoins $64,600 USD)

B. REAL ESTATE Include home, vacation property, timeshares, vacant land and other real estate. (Use additional sheets if necessary.)

Description/Location/County |

Monthly Payment(s) |

Financing |

Current Value |

Balance Owed |

Equity |

||

|

|

|

|

|

|

|

|

|

|

|

Year Purchased |

Purchase Price |

|

|

|

|

|

|

|

|

|

|

|

Primary Residence |

Other |

|

Year Refinanced |

Refinance Amount |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Year Purchased |

Purchase Price |

|

|

|

|

|

|

|

|

|

|

|

Primary Residence |

Other |

|

Year Refinanced |

Refinance Amount |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

C. OTHER ASSETS Include cars, boats, recreational vehicles, whole life policies, etc. Include make, model and year of vehicles and name of Life Insurance company in Description. If applicable, include business assets such as tools, equipment, inventory, etc. (Use additional sheets if necessary.)

Description |

Monthly Payment Year Purchased Final Payment (mo/yr) Current Value |

Balance Owed |

Equity |

/

/

D. CREDIT CARDS (Visa, MasterCard, American Express, Department Stores, etc.)

Type

Credit Limit

Balance Owed

Minimum Monthly Payment

TURN PAGE TO CONTINUE

Catalog Number 62053J |

www.irs.gov |

Form |

Page 2 of 4

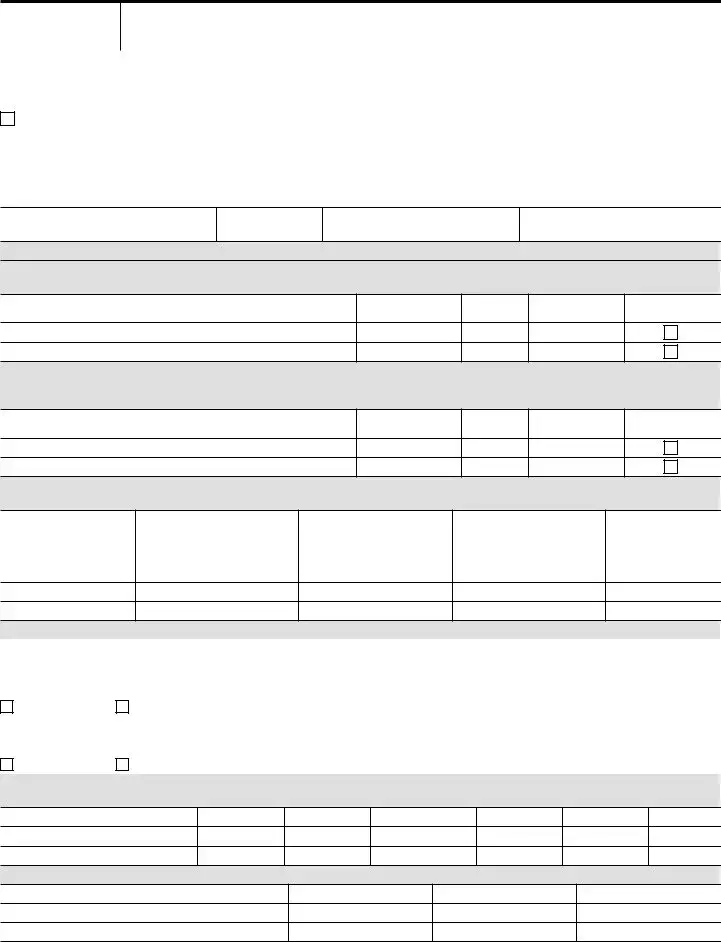

E. BUSINESS INFORMATION Complete E1 for Accounts Receivable owed to you or your business. (Use additional sheets if necessary.) Complete E2 if you or your business accepts credit card payments. Include virtual currency wallet, exchange or digital currency exchange.

E1. Accounts Receivable owed to you or your business

Name |

Address |

Amount Owed |

|

|

|

|

|

|

|

|

|

List total amount owed from additional sheets

Total amount of accounts receivable available to pay to IRS now

E2. Name of individual or business on account

Credit Card

(Visa, Master Card, etc.)

Issuing Bank Name and Address

Merchant Account Number

F. EMPLOYMENT INFORMATION If you have more than one employer, include the information on another sheet of paper. (If attaching a copy of current pay stub, you do not need to complete this section.)

Your current Employer (name and address)

How often are you paid (check one) |

|

|

|

|

|

||||

Weekly |

Biweekly |

Monthly |

|||||||

Gross per pay period |

|

|

|

|

|

|

|

|

|

Taxes per pay period (Fed) |

|

(State) |

(Local) |

||||||

How long at current employer |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

Spouse’s current Employer (name and address)

How often are you paid (check one)

Weekly |

Biweekly |

|

Monthly |

||||||

Gross per pay period |

|

|

|

|

|

|

|

|

|

Taxes per pay period (Fed) |

|

|

(State) |

(Local) |

|||||

How long at current employer |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

G.

Alimony Income

Child Support Income

Net Self Employment Income

Net Rental Income

Unemployment Income

Pension Income

Interest/Dividends Income

Social Security Income

Other:

H. MONTHLY NECESSARY LIVING EXPENSES List monthly amounts. (For expenses paid other than monthly, see instructions.)

1. Food / Personal Care See instructions. If you do not spend more than |

4. Medical |

Actual Monthly |

IRS Allowed |

||

the standard allowable amount for your family size, fill in the Total amount |

Health Insurance |

Expenses |

|

||

only. |

|

|

|

|

|

Actual Monthly |

IRS Allowed |

|

|

||

|

Out of Pocket Health Care |

|

|

||

|

Expenses |

|

|

||

Food |

|

|

Expenses |

|

|

|

|

|

|

||

|

|

Total |

|

|

|

Housekeeping Supplies |

|

|

|

|

|

Clothing and Clothing Services |

|

|

5. Other |

Actual Monthly |

IRS Allowed |

Personal Care Products & Services |

|

|

|

Expenses |

|

|

|

|

|

||

Miscellaneous |

|

|

Child / Dependent Care |

|

|

Total |

|

|

Estimated Tax Payments |

|

|

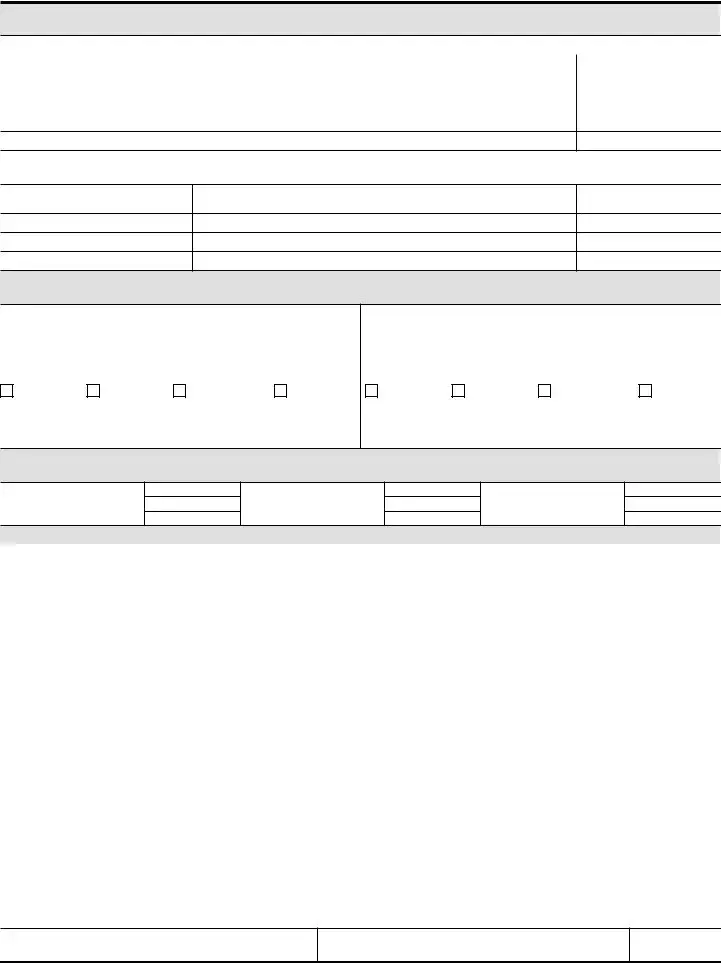

2. Transportation |

Actual Monthly |

IRS Allowed |

Term Life Insurance |

|

|

|

Expenses |

Retirement (Employer Required) |

|

|

|

|

|

|

|

||

Gas / Insurance / Licenses / |

|

|

Retirement (Voluntary) |

|

|

Parking / Maintenance etc. |

|

|

Union Dues |

|

|

Public Transportation |

|

|

Delinquent State & Local Taxes |

|

|

Total |

|

|

(minimum payment) |

|

|

3. Housing & Utilities |

Actual Monthly |

IRS Allowed |

Student Loans (minimum |

|

|

|

Expenses |

payment) |

|

|

|

|

|

|

|

||

Rent |

|

|

Court Ordered Child Support |

|

|

Electric, Oil/Gas, Water/Trash |

|

|

Court Ordered Alimony |

|

|

Telephone/Cell/Cable/Internet |

|

|

Other Court Ordered Payments |

|

|

Real Estate Taxes and Insurance |

|

|

Other (specify) |

|

|

(if not included in B above) |

|

|

Other (specify) |

|

|

Maintenance and Repairs |

|

|

Other (specify) |

|

|

Total |

|

|

Total |

|

|

Under penalty of perjury, I declare to the best of my knowledge and belief this statement of assets, liabilities and other information is true, correct and complete.

Your signature

Spouse’s signature

Date

Catalog Number 62053J |

www.irs.gov |

Form |

Page 3 of 4

Instructions for Form

What is the purpose of Form 433F?

Form

Note: You may be able to establish an Online Payment Agreement on the IRS web site. To apply online, go to https://www.irs.gov, click on “I need to pay my taxes,” and select “Installment Agreement” under the heading “What if I can't pay now?”

If you are requesting an Installment Agreement, you should submit Form 9465, Installment Agreement Request, along with Form

Please retain a copy of your completed form and supporting documentation. After we review your completed form, we may contact you for additional information. For example, we may ask you to send supporting documentation of your current income or substantiation of your stated expenditures.

If any section on this form is too small for the information you need to supply, please use a separate sheet.

Section A – Accounts / Lines of Credit

List all accounts, even if they currently have no balance. However, do not enter bank loans in this section. Include business accounts, if applicable. If you are entering information for a stock or bond, etc. and a question does not apply, enter N/A.

Section B – Real Estate

List all real estate you own or are purchasing including your home. Include insurance and taxes if they are included in your monthly payment. The county/description is needed if different than the address and county you listed above. To determine equity, subtract the amount owed for each piece of real estate from its current market value.

Section C – Other Assets

List all cars, boats and recreational vehicles with their make, model and year. If a vehicle is leased, write “lease” in the “year purchased” column. List whole life insurance policies with the name of the insurance company. List other assets with a description such as “paintings”, “coin collection”, or “antiques”. If applicable, include business assets, such as tools, equipment, inventory, and intangible assets such as domain names, patents, copyrights, etc. To determine equity, subtract the amount owed from its current market value. If you are entering information for an asset and a question does not apply, enter N/A.

Section D – Credit Cards

List all credit cards and lines of credit, even if there is no balance owed.

Section E – Business Information

Complete this section if you or your spouse are

E1: List all Accounts Receivable owed to you or your business. Include federal, state and local grants and contracts.

E2: Complete if you or your business accepts credit card payments (e.g., Visa, MasterCard, etc.) and/or virtual currency wallet, exchange or digital currency exchange.

Section F – Employment Information

Complete this section if you or your spouse are wage earners.

If attaching a copy of current pay stub, you do not need to complete this section.

Section G –

List all

Net

spouse earns after you pay ordinary and necessary monthly business expenses. This figure should relate to the yearly net profit from Schedule C on your Form 1040 or your current year profit and loss statement. Please attach a copy of Schedule C or your current year profit and loss statement. If net income is a loss, enter “0”.

Net Rental Income is the amount you earn after you pay ordinary and necessary monthly rental expenses. This figure should relate to the amount reported on Schedule E of your Form 1040.

Do not include depreciation expenses. Depreciation is a

If net rental income is a loss, enter “0”.

Other Income includes distributions from partnerships and subchapter S corporations reported on Schedule

Section H – Monthly Necessary Living Expenses

Enter monthly amounts for expenses. For any expenses not paid monthly, convert as follows:

If a bill is paid … |

Calculate the monthly |

|

amount by … |

||

|

||

Quarterly |

Dividing by 3 |

|

|

|

|

Weekly |

Multiplying by 4.3 |

|

|

|

|

Biweekly (every two |

Multiplying by 2.17 |

|

weeks) |

||

|

||

Semimonthly (twice |

Multiplying by 2 |

|

each month) |

||

|

Catalog Number 62053J |

www.irs.gov |

Form |

Page 4 of 4

For expenses claimed in boxes 1 and 4, you should provide the IRS allowable standards, or the actual amount you pay if the amount exceeds the IRS allowable standards. IRS allowable standards can be found by accessing https://www.irs.gov/

Substantiation may be required for any expenses over the standard once the financial analysis is completed.

The amount claimed for Miscellaneous cannot exceed the standard amount for the number of people in your family. The miscellaneous allowance is for expenses incurred that are not included in any other allowable living expense items. Examples are credit card payments, bank fees and charges, reading material and school supplies.

If you do not have access to the IRS web site, itemize your actual expenses and we will ask you for additional proof, if required. Documentation may include pay statements, bank and investment statements, loan statements and bills for recurring expenses, etc.

Housing and Utilities – Includes expenses for your primary residence. You should only list amounts for utilities, taxes and insurance that are not included in your mortgage or rent payments.

Rent – Do not enter mortgage payment here. Mortgage payment is listed in Section B.

Transportation – Include the total of maintenance, repairs, insurance, fuel, registrations, licenses, inspections, parking, and tolls for one month.

Public Transportation – Include the total you spend for public transportation if you do not own a vehicle or if you have public transportation costs in addition to vehicle expenses.

Medical – You are allowed expenses for health insurance and

Health insurance – Enter the monthly amount you pay for yourself or your family.

covered by health insurance, and include:

•Medical services

•Prescription drugs

•Dental expenses

•Medical supplies, including eyeglasses and contact lenses. Medical procedures of a purely cosmetic nature, such as plastic surgery or elective dental work are generally not allowed.

Child / Dependent Care – Enter the monthly amount you pay for the care of dependents that can be claimed on your Form 1040.

Estimated Tax Payments – Calculate the monthly

amount you pay for estimated taxes by dividing the quarterly amount due on your Form 1040ES by 3.

Life Insurance – Enter the amount you pay for term life insurance only. Whole life insurance has cash value and should be listed in Section C.

Delinquent State & Local Taxes – Enter the minimum

amount you are required to pay monthly. Be prepared to provide a copy of the statement showing the amount you owe and if applicable, any agreement you have for monthly payments.

Student Loans – Minimum payments on student loans for the taxpayer’s

Court Ordered Payments – For any court ordered

payments, be prepared to submit a copy of the court order portion showing the amount you are ordered to pay, the signatures, and proof you are making the payments. Acceptable forms of proof are copies of cancelled checks or copies of bank or pay statements.

Other Expenses not listed above – We may allow

other expenses in certain circumstances. For example, if the expenses are necessary for the health and welfare of the taxpayer or family, or for the production of income. Specify the expense and list the minimum monthly payment you are billed.

Catalog Number 62053J |

www.irs.gov |

Form |