Fill Out a Valid IRS 2553 Template

Guide to Writing IRS 2553

Filling out IRS Form 2553 is a crucial step for small business owners who wish to elect S corporation status. After completing the form, it is important to submit it to the IRS within the specified timeframe to ensure that your election is recognized. Below are the steps to accurately fill out the form.

- Obtain a copy of IRS Form 2553. You can download it from the IRS website or request a physical copy.

- At the top of the form, enter the name of your corporation as it appears on your articles of incorporation.

- Provide the corporation's address, including the city, state, and ZIP code.

- Fill in the Employer Identification Number (EIN) of your corporation. If you do not have one, you must apply for it before completing the form.

- Indicate the date of incorporation in the appropriate section.

- Specify the tax year the corporation will use. Most corporations use a calendar year, but some may choose a fiscal year.

- List the names, addresses, and Social Security numbers of all shareholders, along with the number of shares owned by each.

- Sign and date the form. An authorized officer of the corporation must sign it.

- Submit the completed form to the appropriate IRS address, which is listed in the instructions on the form.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect S corporation status for tax purposes. |

| Eligibility | To qualify, a business must meet specific criteria, including having 100 or fewer shareholders. |

| Filing Deadline | The form must be filed within 75 days of the start of the tax year for which the election is to be effective. |

| Shareholder Requirements | All shareholders must be individuals, certain trusts, or estates. Corporations and partnerships cannot be shareholders. |

| State-Specific Forms | Some states require separate forms to recognize S corporation status, such as California's Form 100S. |

| Revocation | Once elected, the S corporation status can be revoked, but specific procedures must be followed. |

| Tax Implications | S corporations generally avoid double taxation, as income is passed through to shareholders. |

| Form Signature | The form must be signed by all shareholders, confirming their consent to the S corporation election. |

| IRS Processing Time | It may take the IRS several weeks to process Form 2553 and confirm the S corporation election. |

FAQ

What is IRS Form 2553?

IRS Form 2553 is used by small businesses to elect to be taxed as an S Corporation. This election allows the business to avoid double taxation on corporate income, meaning profits are taxed only at the shareholder level rather than at both the corporate and individual levels.

Who is eligible to file Form 2553?

To be eligible to file Form 2553, a business must meet the following criteria:

- Be a domestic corporation.

- Have 100 or fewer shareholders.

- All shareholders must be individuals, certain trusts, or estates.

- Have only one class of stock.

- Not be an ineligible corporation, such as certain financial institutions or insurance companies.

When should Form 2553 be filed?

Form 2553 should be filed within two months and 15 days after the beginning of the tax year the election is to take effect. If the form is not filed on time, the election may not be valid for that year, which could result in unintended tax consequences.

What information is required on Form 2553?

The form requires basic information about the corporation, including:

- The name and address of the corporation.

- The date of incorporation.

- The tax year the corporation operates on.

- The names and addresses of all shareholders, along with their consent to the S Corporation election.

What happens after filing Form 2553?

After submitting Form 2553, the IRS will review the application. If approved, the business will be recognized as an S Corporation for tax purposes. The IRS will send a confirmation letter, which should be kept for your records. If there are issues with the application, the IRS may contact you for clarification or additional information.

Can Form 2553 be revoked?

Yes, a corporation can revoke its S Corporation status by submitting a statement to the IRS. This statement must include specific information, such as the name of the corporation, the tax year, and the effective date of the revocation. Revocation can have significant tax implications, so it is advisable to consult a tax professional before proceeding.

What are the consequences of not filing Form 2553?

If a corporation does not file Form 2553, it will be taxed as a C Corporation. This means the corporation will face double taxation—once at the corporate level and again when profits are distributed to shareholders. This can lead to higher overall tax liabilities for the business and its owners.

Fill out Other Forms

How Long Is the Waiting List for Section 8 - Even with an extension, you must submit a Request for Tenancy Approval (RTA) promptly to maintain your assistance.

Netspend Customer Service Number 24/7 - Focus on clarity when detailing incidents on the form for better results.

The FedEx Release Form is a document that allows you to authorize the delivery of your package even if you're not home at the time of arrival. This form ensures that your shipment is left at your preferred location, provided that you follow specific instructions and sign accordingly. To obtain a printable version of the FedEx Release Form, visit Top Document Templates for further assistance.

Printable Trucking Company Owner Operator Lease Agreement Form Pdf - The agreement reinforces the independent contractor status of the Owner Operator, ensuring they maintain their own crew and operations.

IRS 2553 Example

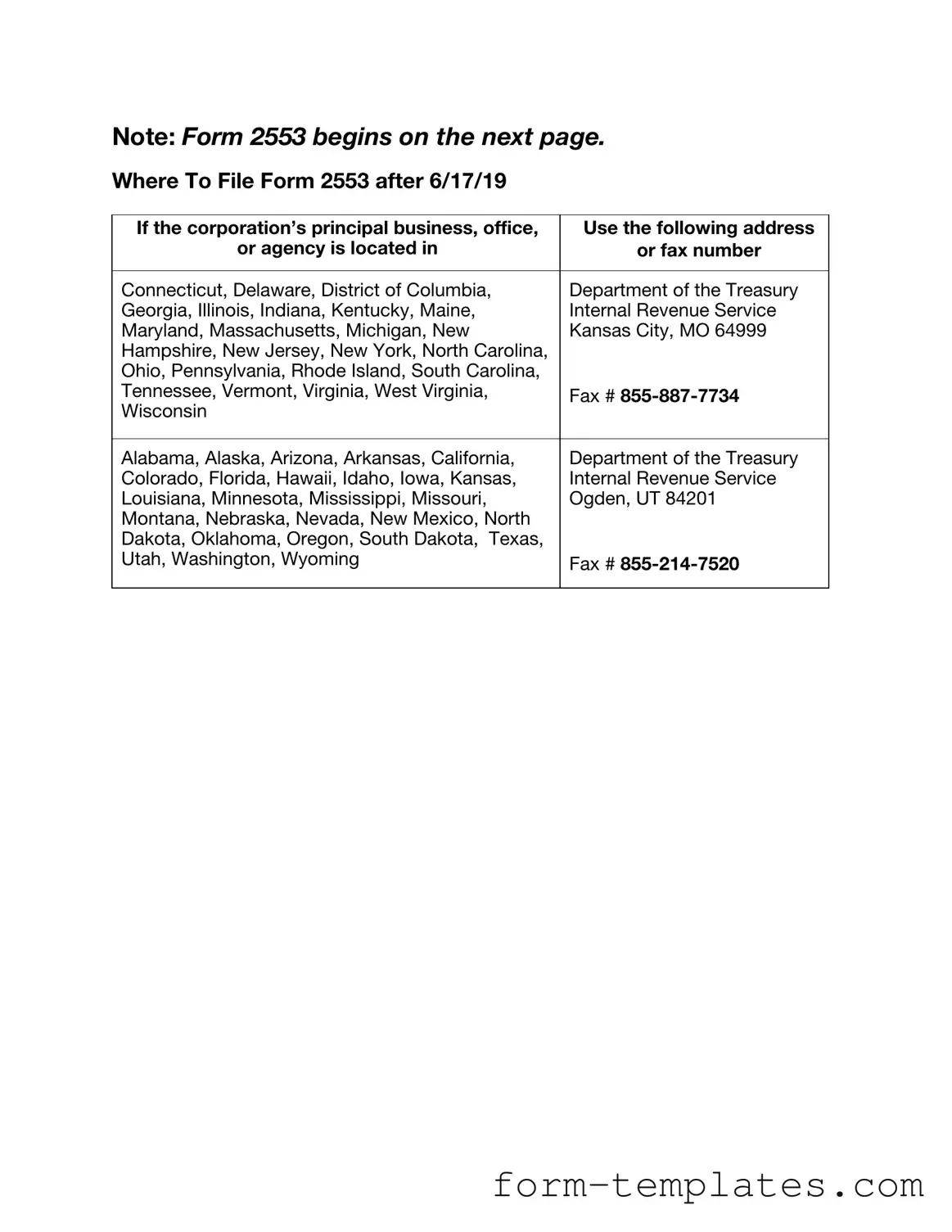

Note: Form 2553 begins on the next page.

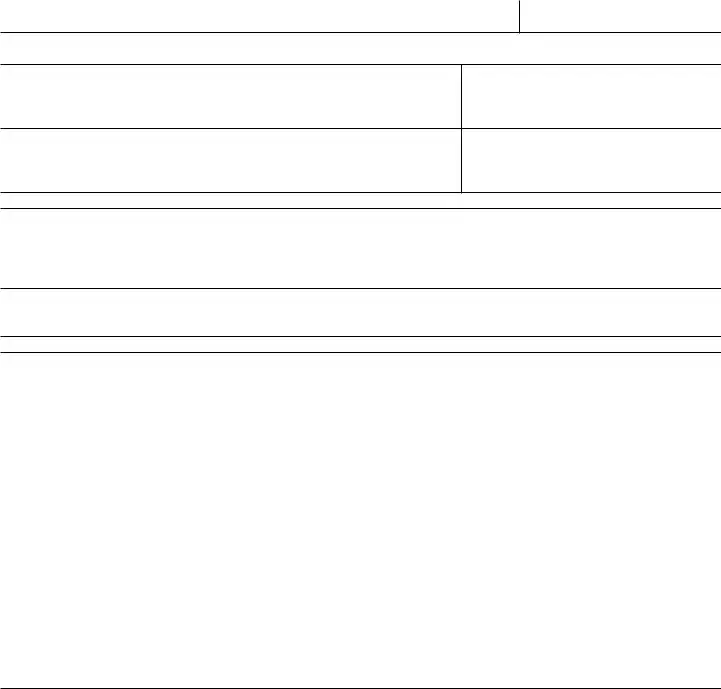

Where To File Form 2553 after 6/17/19

If the corporation’s principal business, office, |

Use the following address |

or agency is located in |

or fax number |

|

|

Connecticut, Delaware, District of Columbia, |

Department of the Treasury |

Georgia, Illinois, Indiana, Kentucky, Maine, |

Internal Revenue Service |

Maryland, Massachusetts, Michigan, New |

Kansas City, MO 64999 |

Hampshire, New Jersey, New York, North Carolina, |

|

Ohio, Pennsylvania, Rhode Island, South Carolina, |

|

Tennessee, Vermont, Virginia, West Virginia, |

Fax # |

Wisconsin |

|

|

|

Alabama, Alaska, Arizona, Arkansas, California, |

Department of the Treasury |

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, |

Internal Revenue Service |

Louisiana, Minnesota, Mississippi, Missouri, |

Ogden, UT 84201 |

Montana, Nebraska, Nevada, New Mexico, North |

|

Dakota, Oklahoma, Oregon, South Dakota, Texas, |

|

Utah, Washington, Wyoming |

Fax # |

|

|

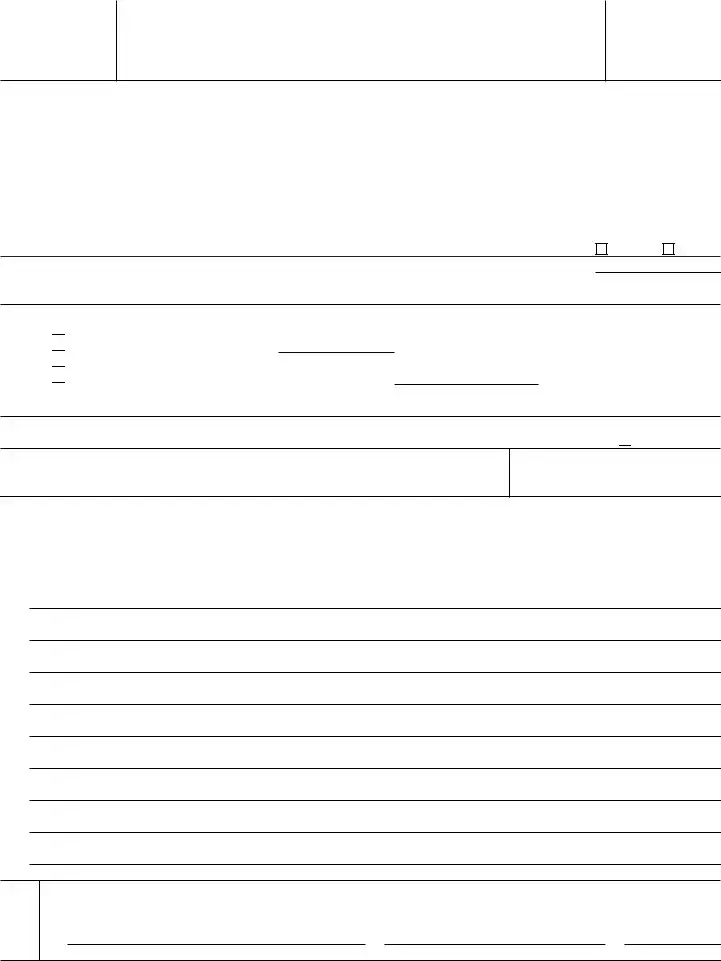

Form 2553

(Rev. December 2017)

Department of the Treasury Internal Revenue Service

Election by a Small Business Corporation

(Under section 1362 of the Internal Revenue Code)

(Including a late election filed pursuant to Rev. Proc.

▶You can fax this form to the IRS. See separate instructions.

▶Go to www.irs.gov/Form2553 for instructions and the latest information.

OMB No.

Note: This election to be an S corporation can be accepted only if all the tests are met under Who May Elect in the instructions, all shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information have been provided.

Part I |

|

Election Information |

|

|

|

|

|

|

|

Name (see instructions) |

A Employer identification number |

||

Type |

|

|

|

|

|

|

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

B Date incorporated |

|

|||

or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City or town, state or province, country, and ZIP or foreign postal code |

C State of incorporation |

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

D |

Check |

the applicable box(es) if the corporation (entity), after applying for the EIN shown in A above, changed its |

name or |

address |

||

EElection is to be effective for tax year beginning (month, day, year) (see instructions) . . . . . . ▶

Caution: A corporation (entity) making the election for its first tax year in existence will usually enter the beginning date of a short tax year that begins on a date other than January 1.

FSelected tax year:

(1) Calendar year

Calendar year

(2) Fiscal year ending (month and day) ▶

Fiscal year ending (month and day) ▶

(3)

(4)

If box (2) or (4) is checked, complete Part II.

GIf more than 100 shareholders are listed for item J (see page 2), check this box if treating members of a family as one shareholder results in no more than 100 shareholders (see test 2 under Who May Elect in the instructions) ▶

HName and title of officer or legal representative whom the IRS may call for more information

Telephone number of officer or legal representative

IIf this S corporation election is being filed late, I declare I had reasonable cause for not filing Form 2553 timely. If this late election is being made by an entity eligible to elect to be treated as a corporation, I declare I also had reasonable cause for not filing an entity classification election timely and the representations listed in Part IV are true. See below for my explanation of the reasons the election or elections were not made on time and a description of my diligent actions to correct the mistake upon its discovery. See instructions.

|

Under penalties of perjury, I declare that I have examined this election, including accompanying documents, and, to the best of my |

||

Sign knowledge and belief, the election contains all the relevant facts relating to the election, and such facts are true, correct, and complete. |

|||

Here |

▲Signature of officer |

|

|

|

Title |

Date |

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 18629R |

Form 2553 (Rev. |

|

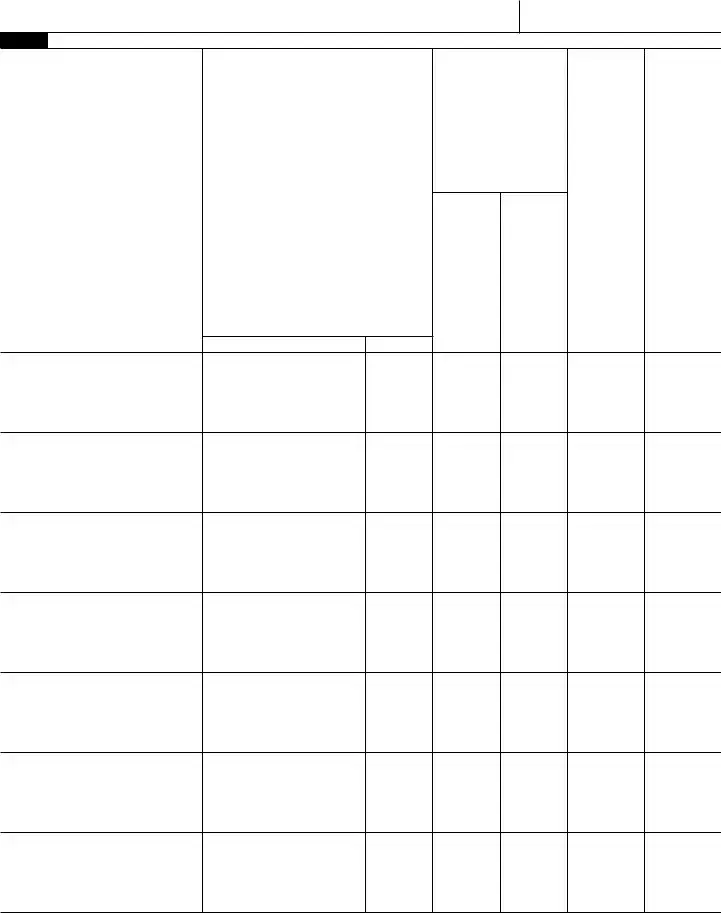

Form 2553 (Rev. |

Page 2 |

Name |

Employer identification number |

Part I Election Information (continued) Note: If you need more rows, use additional copies of page 2.

J

Name and address of each

shareholder or former shareholder required to consent to the election.

(see instructions)

K

Shareholder’s Consent Statement

Under penalties of perjury, I declare that I consent to the election of the

Signature |

Date |

L

Stock owned or

percentage of ownership

(see instructions)

Number of |

|

shares or |

|

percentage |

Date(s) |

of ownership |

acquired |

M |

|

Social security |

|

number or |

N |

employer |

Shareholder’s |

identification |

tax year ends |

number (see |

(month and |

instructions) |

day) |

Form 2553 (Rev.

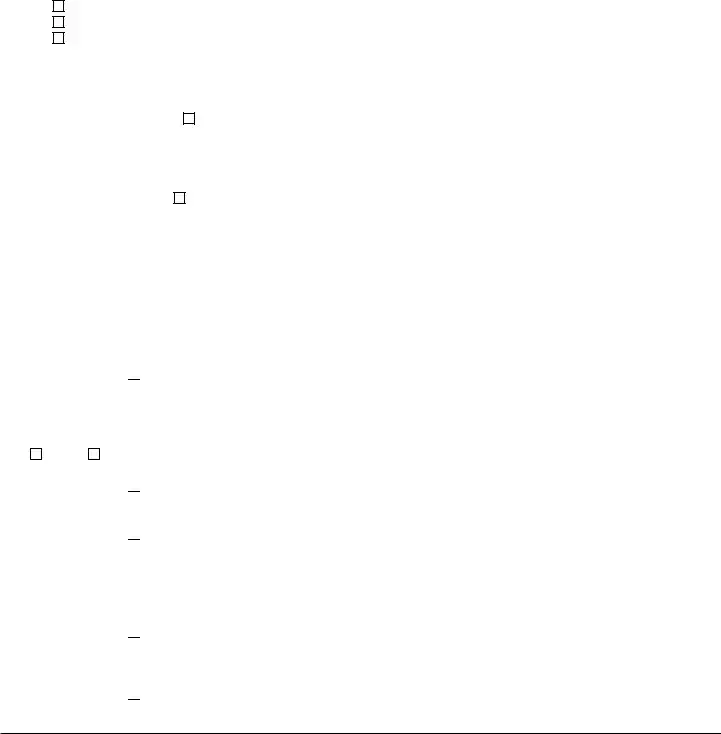

Form 2553 (Rev. |

Page 3 |

|

Name |

|

Employer identification number |

|

|

|

Part II |

Selection of Fiscal Tax Year (see instructions) |

|

Note: All corporations using this part must complete item O and item P, Q, or R. |

|

|

O Check the applicable box to indicate whether the corporation is: |

|

|

1. |

A new corporation adopting the tax year entered in item F, Part I. |

|

2. |

An existing corporation retaining the tax year entered in item F, Part I. |

|

3. |

An existing corporation changing to the tax year entered in item F, Part I. |

|

PComplete item P if the corporation is using the automatic approval provisions of Rev. Proc.

1. Natural Business Year ▶ |

I represent that the corporation is adopting, retaining, or changing to a tax year that qualifies |

as its natural business year (as defined in section 5.07 of Rev. Proc.

2. Ownership Tax Year ▶ |

I represent that shareholders (as described in section 5.08 of Rev. Proc. |

than half of the shares of the stock (as of the first day of the tax year to which the request relates) of the corporation have the same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item F, Part I, and that such tax year satisfies the requirement of section 4.01(3) of Rev. Proc.

Note: If you do not use item P and the corporation wants a fiscal tax year, complete either item Q or R below. Item Q is used to request a fiscal tax year based on a business purpose and to make a

QBusiness

1. Check here ▶  if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

Yes |

No |

2.Check here ▶

to show that the corporation intends to make a

to show that the corporation intends to make a

3.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

RSection 444

1.Check here ▶

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

2.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

Form 2553 (Rev.

Form 2553 (Rev. |

Page 4 |

Name |

Employer identification number |

Part III Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)* Note: If you are making more than

one QSST election, use additional copies of page 4.

Income beneficiary’s name and address

Social security number

Trust’s name and address

Employer identification number

Date on which stock of the corporation was transferred to the trust (month, day, year) . . . . . . . . ▶

In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is filed, I hereby make the election under section 1361(d)(2). Under penalties of perjury, I certify that the trust meets the definitional requirements of section 1361(d)(3) and that all other information provided in Part III is true, correct, and complete.

Signature of income beneficiary or signature and title of legal representative or other qualified person making the election |

|

Date |

*Use Part III to make the QSST election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation makes its election to be an S corporation. The QSST election must be made and filed separately if stock of the corporation is transferred to the trust after the date on which the corporation makes the S election.

Part IV Late Corporate Classification Election Representations (see instructions)

If a late entity classification election was intended to be effective on the same date that the S corporation election was intended to be effective, relief for a late S corporation election must also include the following representations.

1The requesting entity is an eligible entity as defined in Regulations section

2The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status;

3The requesting entity fails to qualify as a corporation solely because Form 8832, Entity Classification Election, was not timely filed under Regulations section

4The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the S corporation election was not timely filed pursuant to section 1362(b); and

5a The requesting entity timely filed all required federal tax returns and information returns consistent with its requested classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years, or

bThe requesting entity has not filed a federal tax or information return for the first year in which the election was intended to be effective because the due date has not passed for that year’s federal tax or information return.

Form 2553 (Rev.