Fill Out a Valid IRS 1096 Template

Guide to Writing IRS 1096

The IRS 1096 form is a summary of information returns you submit to the IRS. Completing this form correctly is essential for reporting various types of income and ensuring compliance with tax regulations. Follow these steps to fill out the form accurately.

- Gather your information returns. Collect all the forms you are submitting, such as 1099s or W-2s.

- Obtain the IRS 1096 form. You can download it from the IRS website or order a physical copy.

- Fill in your name and address. Write your name and business address in the designated fields at the top of the form.

- Provide your Employer Identification Number (EIN) or Social Security Number (SSN). Enter the appropriate number in the box provided.

- Indicate the type of return. Check the box that corresponds to the type of information returns you are submitting.

- Count your forms. Determine the total number of forms you are submitting and enter this number in the designated box.

- Fill in the total amount reported. Sum the amounts from all the information returns and write this total in the appropriate box.

- Sign and date the form. Ensure that the form is signed by an authorized person and include the date.

- Make a copy for your records. Keep a copy of the completed form and the attached information returns for your files.

- Submit the form. Mail the completed 1096 form along with the information returns to the IRS at the address specified in the form instructions.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1096 is used to summarize and transmit other information returns to the IRS. |

| Filing Requirement | Businesses must file Form 1096 if they submit paper copies of Forms 1099, 1098, or other related forms. |

| Due Date | The form is typically due on February 28th for paper filings and March 31st for electronic submissions. |

| Who Files | Any entity that issues information returns, such as employers and financial institutions, must file this form. |

| Signature Requirement | A signature is not required on Form 1096, but the person preparing the form must sign it. |

| Information Included | The form includes the total number of forms being submitted and the total dollar amount reported. |

| Penalties | Failure to file Form 1096 on time can result in penalties, which vary based on how late the form is submitted. |

| State-Specific Forms | Some states have their own versions of Form 1096, governed by state tax laws. |

| Electronic Filing | While electronic filing is encouraged, Form 1096 must still be filed on paper if other forms are submitted on paper. |

| Record Keeping | Taxpayers should keep a copy of Form 1096 and the accompanying forms for at least three years. |

FAQ

What is the IRS 1096 form?

The IRS 1096 form is a summary form that accompanies certain information returns when filed with the IRS. It is used to report the total number of forms being submitted, such as 1099s, W-2Gs, or other related forms. Essentially, it acts as a cover sheet for these information returns, ensuring that the IRS receives a complete record of all submissions.

Who needs to file Form 1096?

Any individual or business that submits paper copies of specific information returns must file Form 1096. This includes, but is not limited to:

- Businesses reporting payments made to independent contractors using Form 1099-NEC.

- Entities reporting miscellaneous income using Form 1099-MISC.

- Organizations reporting certain gambling winnings using Form W-2G.

If you are filing these forms electronically, you do not need to file Form 1096.

When is the deadline to file Form 1096?

The deadline to file Form 1096 is typically the same as the deadline for the information returns it summarizes. For example, if you are reporting payments made during the previous calendar year, the forms are generally due by January 31 for most types of payments. However, if you are filing for Forms 1099 that require reporting by February 28, then Form 1096 is also due on that date. Always check the IRS website for any updates or changes to deadlines.

How do I fill out Form 1096?

Filling out Form 1096 is straightforward. Here are the key steps:

- Provide your name and address in the designated fields.

- Enter your Employer Identification Number (EIN) or Social Security Number (SSN).

- Indicate the type of return you are summarizing (e.g., 1099-NEC, 1099-MISC).

- List the total number of forms you are submitting and the total amount reported.

- Sign and date the form before submitting it to the IRS.

Make sure to keep a copy for your records. Accuracy is essential, as errors can lead to penalties or delays in processing.

Fill out Other Forms

What Does a Roof Warranty Cover - The warranty offers long-term protection for a wise home investment.

Having a solid understanding of the California Vehicle Purchase Agreement is vital for anyone looking to buy or sell a vehicle in California. This document not only clarifies the terms of the sale but also protects the interests of both the buyer and seller. For those seeking an example or template, you can find one at https://californiadocsonline.com/vehicle-purchase-agreement-form, which can guide you through the necessary details to ensure a compliant and successful transaction.

How Long Is the Waiting List for Section 8 - Maintaining open communication with the Housing Authority is advisable as you navigate this process.

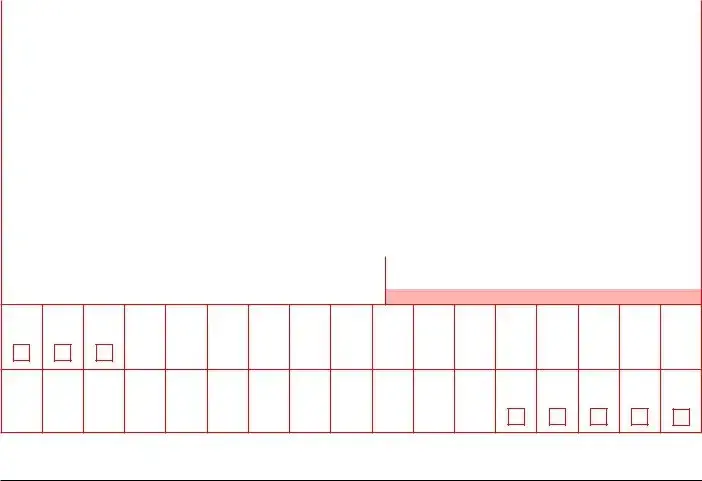

IRS 1096 Example

Attention filers of Form 1096:

This form is provided for informational purposes only. It appears in red, similar to the official IRS form. The official printed version of this IRS form is scannable, but a copy, printed from this website, is not. Do not print and file a Form 1096 downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

To order official IRS information returns, which include a scannable Form 1096 for filing with the IRS, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically. To file electronically, you must have software, or a service provider, that will create the file in the proper format. More information can be found at:

•IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE), or

•IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

Do Not Staple 6969

Form 1096 |

|

Annual Summary and Transmittal of |

|

|

|

|

|

|

|

|

|

OMB No. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

|||||||||||||||||||

Department of the Treasury |

|

|

U.S. Information Returns |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FILER’S name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (including room or suite number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

For Official Use Only |

|||||||||||||||||||||

Name of person to contact |

|

|

Telephone number |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

Fax number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Employer identification number |

2 Social security number |

|

3 Total number of forms |

4 Federal income tax withheld |

5 Total amount reported with this Form 1096 |

||||||||||||||||||||||||||

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Enter an “X” in only one box below to indicate the type of form being filed.

32 50

1098

81

78 |

|

84 |

|

03 |

|

74 |

|

83 |

|

80 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

79 |

|

85 |

|

73 |

91 |

|

86 |

|

92 |

|

10 |

|

16 |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3921 |

||||||||||||||||||||||||||||||

93 |

95 |

71 |

|

96 |

97 |

|

31 |

|

|

1A |

98 |

|

75 |

|

94 |

43 |

|

25 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3922

26

5498

28

72

2A 27

Return this entire page to the Internal Revenue Service. Photocopies are not acceptable.

Send this form, with the copies of the form checked in box 6, to the IRS in a flat mailer (not folded).

Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature ▶ |

Title ▶ |

Date ▶ |

|

Instructions |

Enter the filer’s name, address (including room, suite, or other unit |

||

Future developments. For the latest information about developments |

number), and taxpayer identification number (TIN) in the spaces |

||

provided on the form. The name, address, and TIN of the filer on this |

|||

related to Form 1096, such as legislation enacted after it was |

|||

form must be the same as those you enter in the upper left area of |

|||

published, go to www.irs.gov/Form1096. |

|||

Forms 1097, 1098, 1099, 3921, 3922, 5498, or |

|||

|

|||

Reminder. The only acceptable method of electronically filing |

When to file. File Form 1096 as follows. |

|

|

information returns listed on this form in box 6 with the IRS is through |

• With Forms 1097, 1098, 1099, 3921, 3922, or |

||

the FIRE System. See Pub. 1220. |

|||

February 28, 2023. |

|

||

Purpose of form. Use this form to transmit paper Forms 1097, 1098, |

|

||

• With Forms |

|||

1099, 3921, 3922, 5498, and |

|||

• With Forms 5498, file by May 31, 2023. |

|

||

Caution: If you are required to file 250 or more information returns of |

|

||

|

|

||

any one type (excluding Form |

Where To File |

|

|

you are required to file electronically but fail to do so, and you do not |

Send all information returns filed on paper with Form 1096 to the |

||

have an approved waiver, you may be subject to a penalty. The |

|||

Taxpayer First Act of 2019, enacted July 1, 2019, authorized the |

following. |

|

|

Department of the Treasury and the IRS to issue regulations that |

If your principal business, office |

|

||

reduce the |

Use the following |

|||

or agency, or legal residence in |

||||

regulations are issued and effective for 2022 tax returns required to be |

the case of an individual, is |

address |

||

filed in 2023, we will post an article at www.irs.gov/Form1099 |

||||

|

located in |

|

||

explaining the change. Until regulations are issued, however, the |

|

|

||

|

▲ |

▲ |

||

number remains at 250, as reflected in these instructions. For more |

|

|||

|

|

|

||

information, see part F in the 2022 General Instructions for Certain |

Alabama, Arizona, Arkansas, Delaware, |

|

||

Information Returns. |

Florida, Georgia, Kentucky, Maine, |

Internal Revenue Service |

||

|

Massachusetts, Mississippi, New |

|||

Forms |

P.O. Box 149213 |

|||

Hampshire, New Jersey, New Mexico, |

||||

of the number of returns. |

New York, North Carolina, Ohio, Texas, |

Austin, TX |

||

Who must file. Any person or entity who files any of the forms shown |

Vermont, Virginia |

|

||

|

|

|

||

in line 6 above must file Form 1096 to transmit those forms to the IRS. |

|

|

|

|

Caution: Your name and TIN must match the name and TIN used on |

|

|

|

|

your 94X series tax return(s) or you may be subject to information |

|

|

|

|

return penalties. Do not use the name and/or TIN of your paying agent |

|

|

|

|

or service bureau. |

|

|

|

|

|

|

|

||

For more information and the Privacy Act and Paperwork Reduction Act Notice, |

Cat. No. 14400O |

Form 1096 (2022) |

||

see the 2022 General Instructions for Certain Information Returns. |

|

|

|

|

Form 1096 (2022) |

Page 2 |

Alaska, Colorado, Hawaii, Idaho, |

|

|

Illinois, Indiana, Iowa, Kansas, |

|

|

Michigan, Minnesota, Missouri, |

Internal Revenue Service Center |

|

Montana, Nebraska, Nevada, North |

P.O. Box 219256 |

|

Dakota, Oklahoma, Oregon, South |

Kansas City, MO |

|

Carolina, South Dakota, Tennessee, |

|

|

Utah, Washington, Wisconsin, Wyoming |

|

|

|

|

|

California, Connecticut, |

Internal Revenue Service Center |

|

District of Columbia, Louisiana, |

||

1973 North Rulon White Blvd. |

||

Maryland, Pennsylvania, |

||

Ogden, UT 84201 |

||

Rhode Island, West Virginia |

||

|

If your legal residence or principal place of business is outside the United States, file with the Internal Revenue Service, P.O. Box 149213, Austin, TX

Transmitting to the IRS. Group the forms by form number and transmit each group with a separate Form 1096. For example, if you must file both Forms 1098 and

Box 1 or 2. Enter your TIN in either box 1 or 2, not both. Individuals not in a trade or business must enter their social security number (SSN) in box 2. Sole proprietors and all others must enter their employer identification number (EIN) in box 1. However, sole proprietors who do not have an EIN must enter their SSN in box 2. Use the same EIN or SSN on Form 1096 that you use on Form 1097, 1098, 1099, 3921, 3922, 5498, or

Box 3. Enter the number of forms you are transmitting with this Form 1096. Do not include blank or voided forms or the Form 1096 in your total. Enter the number of correctly completed forms, not the number of pages, being transmitted. For example, if you send one page of

Box 4. Enter the total federal income tax withheld shown on the forms being transmitted with this Form 1096.

Box 5. No entry is required if you are filing Form

Form |

Box 1 |

Form |

Box 1 |

Form 1098 |

Boxes 1 and 6 |

Form |

Box 4c |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 4 |

Form |

Boxes 1d and 13 |

Form |

Box 2 |

Form |

Box 2 |

Form |

Boxes 1a, 2a, 3, 9, 10, and 11 |

Form |

Boxes 1, 3, 8, 10, 11, and 13 |

Form |

Box 1a |

Form |

Box 1 |

Form |

Boxes 1 and 2 |

Form |

Boxes 1, 2, 3, 5, 6, 8, 9, 10, 11, and 13 |

Form |

Box 1 |

Form |

Boxes 1, 2, 5, 6, and 8 |

Form |

Boxes 1, 2, 3, and 5 |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 2 |

Form |

Box 1 |

Form |

Boxes 1 and 2 |

Form 3921 |

Boxes 3 and 4 |

Form 3922 |

Boxes 3, 4, and 5 |

Form 5498 |

Boxes 1, 2, 3, 4, 5, 8, 9, 10, 12b, 13a, |

|

and 14a |

Form |

Boxes 1 and 2 |

Form |

Boxes 1 and 2 |

Form |

Box 1 |

Corrected returns. For information about filing corrections, see the 2022 General Instructions for Certain Information Returns. Originals and corrections of the same type of return can be submitted using one Form 1096.