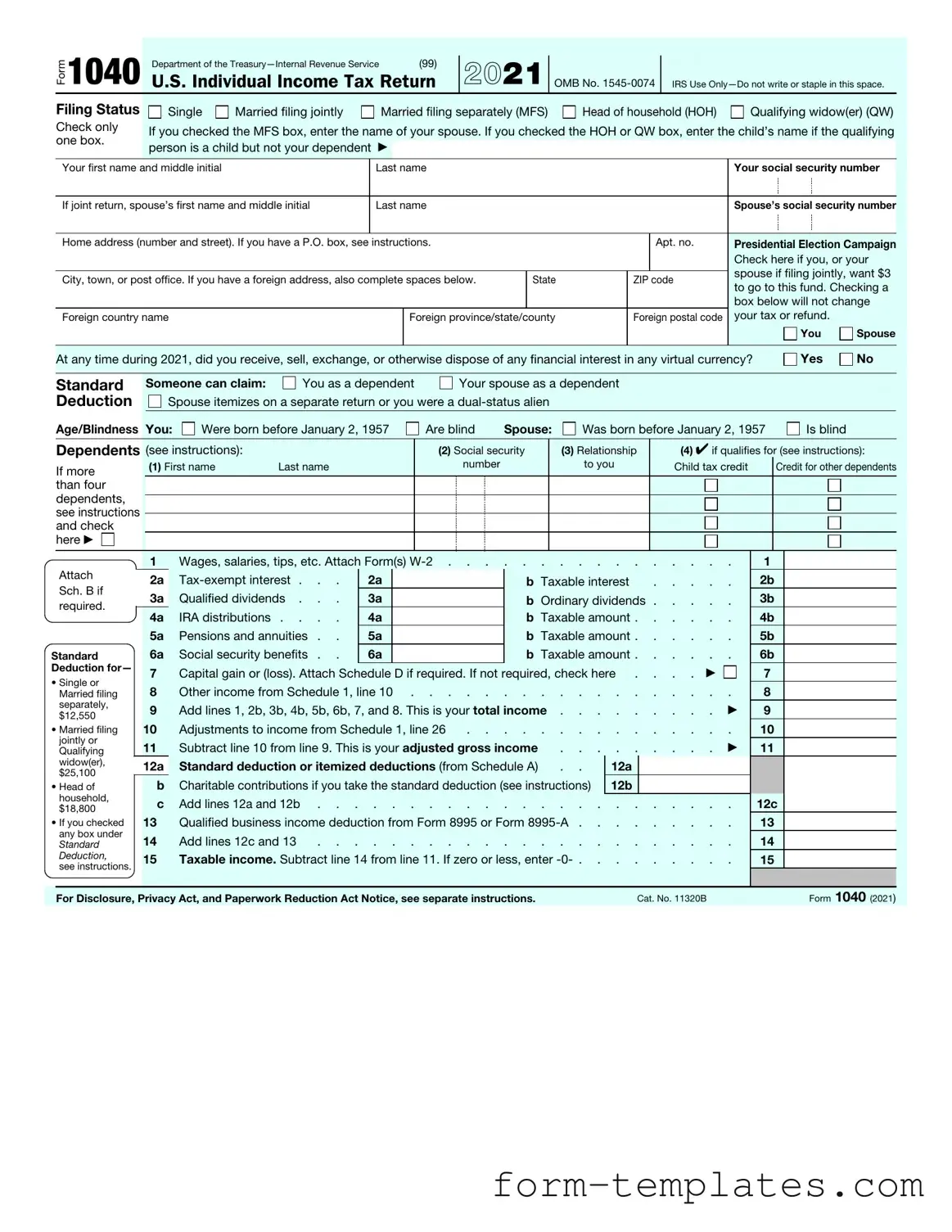

Fill Out a Valid IRS 1040 Template

Guide to Writing IRS 1040

Filling out the IRS 1040 form can seem daunting, but with a clear plan, you can tackle it step by step. After you complete the form, you'll be ready to submit it to the IRS, ensuring you meet your tax obligations.

- Gather your documents. Collect your W-2s, 1099s, and any other income statements. Don’t forget receipts for deductions and credits.

- Start with your personal information. Fill in your name, address, and Social Security number at the top of the form.

- Indicate your filing status. Check the appropriate box for single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report your income. Enter your total income from all sources, including wages, dividends, and any other income.

- Adjust your income if applicable. If you have any adjustments, like student loan interest or retirement contributions, subtract these from your total income.

- Calculate your taxable income. This is done by subtracting your deductions from your adjusted gross income.

- Determine your tax liability. Use the tax tables provided by the IRS to find out how much tax you owe based on your taxable income.

- Claim your credits. If you qualify for any tax credits, list them here to reduce your overall tax liability.

- Calculate your total tax. Add any other taxes owed, such as self-employment tax, to your tax liability.

- Determine your payments. Include any withholding from your W-2s and any estimated tax payments you've made.

- Calculate your refund or amount owed. Subtract your total payments from your total tax to see if you will receive a refund or owe money.

- Sign and date the form. Don’t forget to sign and date your return. If you’re filing jointly, your spouse must also sign.

Once you've completed these steps, review your form for accuracy. After that, you can file it electronically or mail it to the IRS based on your preference.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS 1040 form is used by individuals to file their annual income tax returns. It reports income, deductions, and credits to determine tax liability. |

| Filing Status | Taxpayers must select a filing status on the 1040 form, such as single, married filing jointly, or head of household. This status affects tax rates and eligibility for certain deductions. |

| Income Reporting | All sources of income must be reported on the 1040 form. This includes wages, dividends, and capital gains. Accurate reporting is crucial to avoid penalties. |

| Deductions and Credits | The form allows taxpayers to claim deductions and tax credits, which can significantly reduce the amount of tax owed. Common deductions include mortgage interest and student loan interest. |

| Filing Deadline | The deadline for submitting the IRS 1040 form is typically April 15th of each year. Extensions may be requested, but any taxes owed must still be paid by the deadline to avoid penalties. |

| State-Specific Forms | Many states have their own tax forms that correspond with the IRS 1040. For example, California uses Form 540, governed by the California Revenue and Taxation Code. |

FAQ

What is the IRS 1040 form?

The IRS 1040 form is the standard individual income tax return form used by taxpayers in the United States. It is used to report income, calculate taxes owed, and claim tax credits and deductions. This form is essential for individuals who need to file their annual tax returns with the Internal Revenue Service (IRS). The 1040 form has several variations, including the 1040-SR for seniors and the 1040-NR for non-resident aliens. Each version is tailored to meet specific taxpayer needs.

Who needs to file a 1040 form?

Generally, anyone who earns income in the U.S. may need to file a 1040 form. Here are some specific situations where filing is required:

- If you earned at least the minimum income threshold set by the IRS for your filing status.

- If you owe special taxes, such as self-employment tax or alternative minimum tax.

- If you received advance payments of the premium tax credit or need to reconcile your health coverage.

- If you want to claim a refund for taxes withheld or estimated payments made during the year.

Even if your income is below the threshold, it may still be beneficial to file to claim refundable credits or to receive a refund of withheld taxes.

What documents do I need to complete the 1040 form?

To accurately fill out the 1040 form, gather the following documents:

- Income Statements: W-2 forms from employers, 1099 forms for freelance work, and any other income documentation.

- Deduction Records: Receipts for deductible expenses, such as medical costs, mortgage interest, and charitable contributions.

- Tax Credit Information: Documentation for any credits you plan to claim, such as education credits or child tax credits.

- Previous Year’s Tax Return: Having last year’s return can help you with consistency and accuracy.

Organizing these documents beforehand can make the filing process smoother and less stressful.

How do I file the 1040 form?

Filing the 1040 form can be done in several ways, depending on your preference:

- Online Filing: Many taxpayers choose to file electronically using tax software. This method is often faster and allows for direct deposit of refunds.

- Paper Filing: You can also print the form, fill it out by hand, and mail it to the IRS. Ensure you send it to the correct address based on your location.

- Tax Professional: Hiring a tax professional can provide personalized assistance, especially if your tax situation is complex.

Regardless of the method you choose, ensure that your form is completed accurately and submitted by the tax deadline to avoid penalties.

Fill out Other Forms

What Is Chart in Computer - Highlight important findings in each column.

The importance of a clear and detailed agreement cannot be overstated when entering into a financial transaction, such as a loan, and utilizing a Promissory Note form ensures that both parties understand their responsibilities and the specific terms governing the loan.

Player Evaluation Form Basketball - Off-ball defense is commendable but should include sharper focus on maintaining awareness of assignments.

IRS 1040 Example

Form

1040

Department of the |

(99) |

U.S. Individual Income Tax Return

2021

OMB No.

IRS Use

Filing Status

Check only one box.

|

Single |

|

Married filing jointly |

|

Married filing separately (MFS) |

|

Head of household (HOH) |

|

Qualifying widow(er) (QW) |

|

|

|

|

|

If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying person is a child but not your dependent ▶

|

Your first name and middle initial |

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

If joint return, spouse’s first name and middle initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s social security number |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Home address (number and street). If you have a P.O. box, see instructions. |

|

|

|

|

|

|

|

|

|

Apt. no. |

Presidential Election Campaign |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you, or your |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

spouse if filing jointly, want $3 |

||||||||||||||

|

City, town, or post office. If you have a foreign address, also complete spaces below. |

|

State |

|

|

|

|

ZIP code |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

to go to this fund. Checking a |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

box below will not change |

||||||||||||||

|

Foreign country name |

|

|

|

|

|

|

|

|

|

|

Foreign province/state/county |

|

|

|

|

Foreign postal code |

your tax or refund. |

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

Spouse |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? |

|

|

|

|

|

|

Yes |

|

|

No |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard |

|

Someone can claim: |

|

|

|

You as a dependent |

|

|

Your spouse as a dependent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Deduction |

|

|

|

|

|

Spouse itemizes on a separate return or you were a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Age/Blindness You: |

|

|

Were born before January 2, 1957 |

|

|

Are blind |

Spouse: |

|

|

Was born before January 2, 1957 |

|

|

|

|

Is blind |

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Dependents (see instructions): |

|

|

|

|

|

|

|

|

|

(2) Social security |

|

(3) Relationship |

(4) ✔ if qualifies for (see instructions): |

||||||||||||||||||||||||||||||||||||||||

|

If more |

|

|

(1) First name |

Last name |

|

|

|

|

|

|

|

number |

|

|

|

|

|

to you |

Child tax credit |

|

|

Credit for other dependents |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

than four |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

dependents, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

and check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

here ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach |

|

|

1 |

|

|

|

|

Wages, salaries, tips, etc. Attach Form(s) |

. |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

2 |

a |

|

|

2a |

|

|

|

|

|

|

|

|

b Taxable interest |

. . . . |

|

|

. |

|

|

2b |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Sch. B if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

3 |

a |

|

|

Qualified dividends . . . |

3a |

|

|

|

|

|

|

|

|

b Ordinary dividends . . . . |

. |

|

|

3b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

4a |

IRA distributions . . . . |

4a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

4b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

5a |

Pensions and annuities . . |

5a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

5b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Standard |

|

|

6a |

Social security benefits . . |

6a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

6b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Deduction for— |

7 |

|

|

|

|

Capital gain or (loss). Attach Schedule D if required. If not required, check here . |

. . . ▶ |

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

• Single or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8 |

|

|

|

|

Other income from Schedule 1, line 10 |

. |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Married filing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

separately, |

9 |

|

|

|

|

Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income |

▶ |

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

$12,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

• Married filing |

10 |

|

|

|

|

Adjustments to income from Schedule 1, line 26 |

. |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

jointly or |

11 |

|

|

|

|

Subtract line 10 from line 9. This is your adjusted gross income |

. . . . . . . . . |

|

|

▶ |

|

11 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

widow(er), |

|

|

|

12 |

a |

|

|

Standard deduction or itemized deductions (from Schedule A) |

. . |

12a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

$25,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

b |

Charitable contributions if you take the standard deduction (see instructions) |

12b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

• Head of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

household, |

|

|

|

c |

Add lines 12a and 12b |

. |

|

|

12c |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

$18,800 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

• If you checked |

13 |

|

|

|

|

Qualified business income deduction from Form 8995 or Form |

. |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

any box under |

14 |

|

|

|

|

Add lines 12c and 13 |

. . . . . . . . . . . . . . . . . . . . . . |

|

|

. |

|

|

14 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Standard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

Deduction, |

15 |

|

|

|

|

Taxable income. Subtract line 14 from line 11. If zero or less, enter |

. |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. |

|

|

|

|

Cat. No. 11320B |

|

|

|

|

|

|

|

|

|

Form 1040 (2021) |

||||||||||||||||||||||||||||||||||||||

|

|

Form 1040 (2021) |

Page 2 |

|

16 |

Tax (see instructions). Check if any from Form(s): 1 |

8814 |

2 |

4972 |

|

3 |

|

|

. . |

16 |

|

|||

|

17 |

Amount from Schedule 2, line 3 |

. . . . . . . . |

17 |

|

||||||||||

|

18 |

Add lines 16 and 17 |

. . . . . . . . |

18 |

|

||||||||||

|

19 |

Nonrefundable child tax credit or credit for other dependents from Schedule 8812 |

19 |

|

|||||||||||

|

20 |

Amount from Schedule 3, line 8 |

. . . . . . . . |

20 |

|

||||||||||

|

21 |

Add lines 19 and 20 |

. . . . . . . . |

21 |

|

||||||||||

|

22 |

Subtract line 21 from line 18. If zero or less, enter |

. . . . . . . . |

22 |

|

||||||||||

|

23 |

Other taxes, including |

. . . . . . . . |

23 |

|

||||||||||

|

24 |

Add lines 22 and 23. This is your total tax |

. . . . . |

. . |

▶ |

24 |

|

||||||||

|

25 |

Federal income tax withheld from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Form(s) |

|

25a |

|

|

|

|

|

|

|||||

|

b |

Form(s) 1099 |

|

25b |

|

|

|

|

|

|

|||||

|

c |

Other forms (see instructions) |

|

25c |

|

|

|

|

|

|

|||||

|

d |

Add lines 25a through 25c |

. . . . . . . . |

25d |

|

||||||||||

If you have a |

26 |

2021 estimated tax payments and amount applied from 2020 return . . |

. . . . . . . . |

26 |

|

||||||||||

27a |

Earned income credit (EIC) |

|

27a |

|

|

|

|

|

|

||||||

qualifying child, |

|

|

|

|

|

|

|

||||||||

attach Sch. EIC. |

|

Check here if you were born after January 1, 1998, and before |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

January 2, 2004, and you satisfy all the other requirements for |

|

|

|

|

|

|

|

|

|

||||

|

|

taxpayers who are at least age 18, to claim the EIC. See instructions ▶ |

|

|

|

|

|

|

|

|

|

||||

|

b |

Nontaxable combat pay election . . . . |

27b |

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Prior year (2019) earned income . . . . |

27c |

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

Refundable child tax credit or additional child tax credit from Schedule 8812 |

|

28 |

|

|

|

|

|

|

|||||

|

29 |

American opportunity credit from Form 8863, line 8 |

|

29 |

|

|

|

|

|

|

|||||

|

30 |

Recovery rebate credit. See instructions |

|

30 |

|

|

|

|

|

|

|||||

|

31 |

Amount from Schedule 3, line 15 |

|

31 |

|

|

|

|

|

|

|||||

|

32 |

Add lines 27a and 28 through 31. These are your total other payments and refundable credits |

▶ |

32 |

|

||||||||||

|

33 |

Add lines 25d, 26, and 32. These are your total payments . . . . |

. . . . . |

. . |

▶ |

33 |

|

||||||||

Refund |

34 |

If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid |

|

. . |

34 |

|

|||||||||

35a |

Amount of line 34 you want refunded to you. If Form 8888 is attached, check here . . |

. |

▶ |

|

35a |

|

|||||||||

|

|

|

|||||||||||||

Direct deposit? |

▶ b |

Routing number |

|

▶ c Type: |

|

|

Checking |

|

Savings |

|

|

||||

See instructions. |

▶ d |

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

Amount of line 34 you want applied to your 2022 estimated tax . |

. |

▶ |

|

36 |

|

|

|

|

|

|

|||

Amount |

37 |

Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions |

|

. |

▶ |

37 |

|

||||||||

You Owe |

38 |

Estimated tax penalty (see instructions) . . . |

. . . . . |

. |

▶ |

|

38 |

|

|

|

|

|

|

||

Third Party |

Do |

you want to allow another person to discuss this return with the IRS? See |

|

|

|

|

|

|

|||||||

Designee |

instructions |

. . . . . . . . . . . . . . . . . . . |

. |

▶ |

Yes. Complete below. |

No |

|||||||||

|

Designee’s |

|

Phone |

|

|

|

|

|

Personal identification |

|

|||||

|

name ▶ |

|

no. ▶ |

|

|

|

|

|

number (PIN) ▶ |

|

|

||||

Sign

Here

Joint return? See instructions. Keep a copy for your records.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature |

Date |

Your occupation |

If the IRS sent you an Identity |

||||||

|

|

|

Protection PIN, enter it here |

||||||

|

|

|

(see inst.) ▶ |

|

|

|

|

|

|

Spouse’s signature. If a joint return, both must sign. |

Date |

Spouse’s occupation |

If the IRS sent your spouse an |

||||||

▲ |

|

|

Identity Protection PIN, enter it here |

||||||

|

|

|

(see inst.) ▶ |

|

|

|

|

|

|

Phone no. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Preparer’s name |

Preparer’s signature |

Date |

PTIN |

|

Check if: |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Phone no. |

|

|

|

|

|

|

|

Use Only |

|

|

|

|

|

|

|

|

|

||

|

|

Firm’s address ▶ |

|

|

|

Firm’s EIN |

▶ |

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

Go to www.irs.gov/Form1040 for instructions and the latest information. |

|

|

|

|

|

Form 1040 (2021) |

|||||