Attorney-Approved Investment Letter of Intent Document

Guide to Writing Investment Letter of Intent

Filling out the Investment Letter of Intent form is a straightforward process. Completing this form accurately is essential for moving forward with your investment plans. Once you have filled out the form, you can submit it to the relevant parties for review and further action.

- Obtain the form: Ensure you have the correct version of the Investment Letter of Intent form. This can usually be found on the relevant organization's website or requested directly from them.

- Read the instructions: Before you start filling it out, take a moment to read any accompanying instructions. This will help you understand what information is required.

- Fill in your personal information: Start by entering your name, address, phone number, and email. Make sure this information is current and accurate.

- Provide investment details: Indicate the amount you intend to invest and any specific terms or conditions related to your investment.

- Include relevant dates: Enter the date of submission and any other important dates that may be required on the form.

- Sign the form: After completing all sections, sign and date the form to validate your intent.

- Review your entries: Double-check all information for accuracy. Ensure there are no typos or missing details.

- Submit the form: Send the completed form to the designated recipient, whether by email, mail, or an online submission platform, as specified in the instructions.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent serves as a preliminary agreement outlining the terms and conditions of a potential investment between parties. |

| Non-Binding Nature | This document is typically non-binding, meaning it expresses an intention to invest but does not create a legal obligation to proceed. |

| Key Components | Common elements include the investment amount, the timeline for investment, and any conditions that must be met before finalizing the deal. |

| Confidentiality | Many Investment Letters of Intent include clauses that protect the confidentiality of the information shared between the parties. |

| Governing Law | The governing law may vary by state; for example, in California, it is governed by California Civil Code. |

| Expiration | These letters often specify an expiration date, after which the terms are no longer valid unless extended by mutual agreement. |

FAQ

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary terms and conditions of a potential investment agreement. It serves as a formal expression of interest from an investor to engage in negotiations with a company or individual regarding an investment opportunity.

Why is an Investment Letter of Intent important?

The LOI is important because it establishes a mutual understanding between the parties involved. It helps clarify the key points of the investment, which can include the amount of investment, valuation, and other critical terms. This clarity can facilitate smoother negotiations and help prevent misunderstandings later in the process.

What should be included in an Investment Letter of Intent?

An effective Investment Letter of Intent typically includes:

- The names and contact information of the parties involved

- A description of the investment opportunity

- The proposed investment amount

- Key terms and conditions

- A timeline for the investment process

- Confidentiality clauses, if necessary

Is an Investment Letter of Intent legally binding?

Generally, an Investment Letter of Intent is not legally binding, but it can include binding provisions, such as confidentiality agreements or exclusivity clauses. It is essential to clearly state which parts of the LOI are binding and which are not to avoid any confusion.

How does an Investment Letter of Intent differ from a contract?

An LOI is more of a preliminary document that outlines the intent to negotiate further, while a contract is a formal agreement that is legally enforceable. The LOI lays the groundwork for future negotiations, whereas a contract finalizes the terms agreed upon by both parties.

Who typically prepares the Investment Letter of Intent?

What happens after an Investment Letter of Intent is signed?

Once the LOI is signed, both parties typically move forward with due diligence, which involves a thorough investigation of the investment opportunity. This stage may include financial audits, legal reviews, and other assessments to ensure that both parties are comfortable proceeding to a formal agreement.

Can an Investment Letter of Intent be revoked?

Yes, an Investment Letter of Intent can be revoked by either party, provided that the LOI does not contain any binding provisions that would prevent such action. It is essential to communicate clearly and promptly if one party wishes to withdraw their interest.

How long is an Investment Letter of Intent valid?

The validity period of an LOI can vary based on the agreement between the parties. It is common to specify a timeline within the document, often ranging from a few weeks to several months, during which negotiations should take place.

What should I do if I have questions about my Investment Letter of Intent?

If you have questions about your LOI, it is advisable to consult with a legal professional who specializes in investment agreements. They can provide guidance tailored to your specific situation and help ensure that your interests are protected.

Other Investment Letter of Intent Templates:

Letter of Intent to Buy a Business - It typically details the proposed purchase price and terms, signaling the seriousness of the buyer's intentions.

Investment Letter of Intent Example

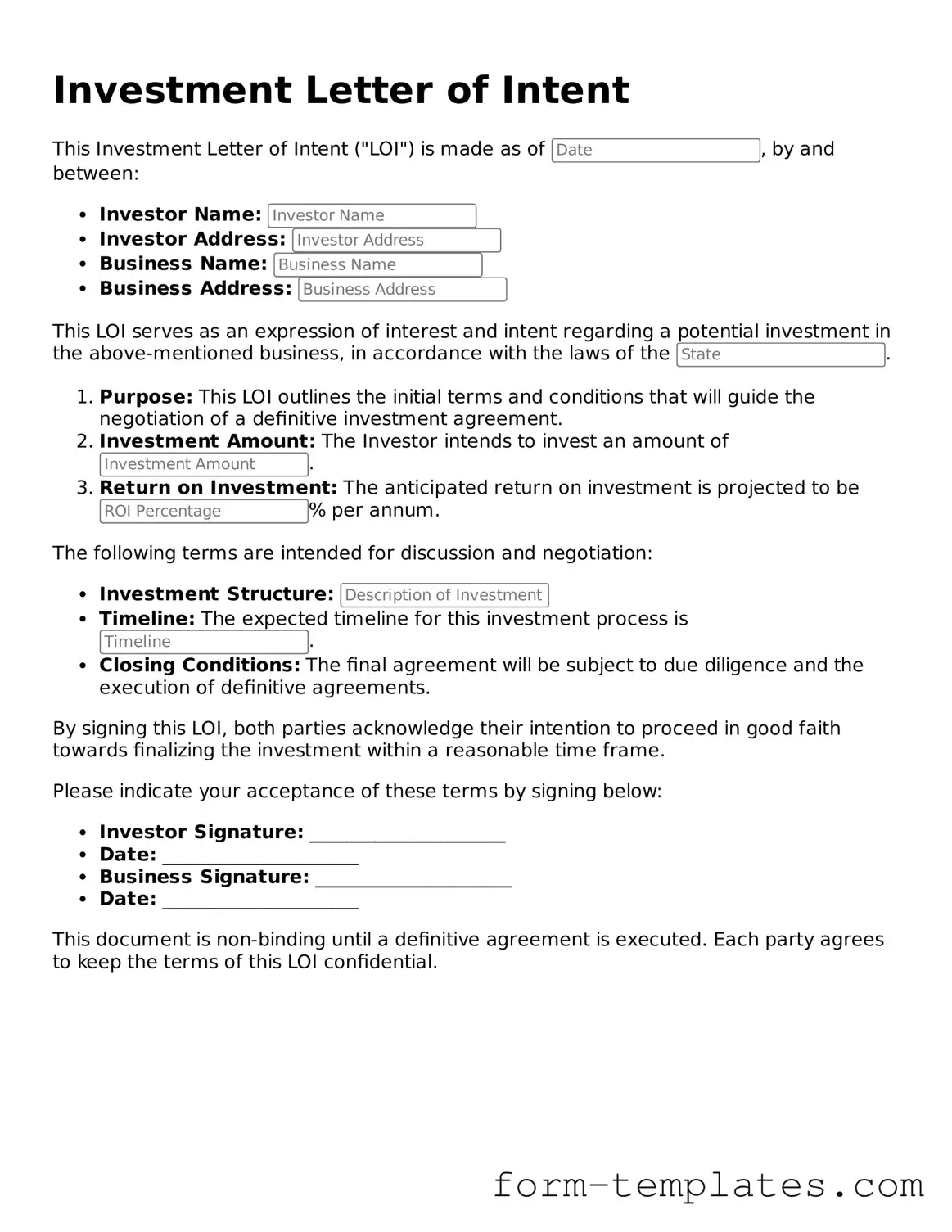

Investment Letter of Intent

This Investment Letter of Intent ("LOI") is made as of , by and between:

- Investor Name:

- Investor Address:

- Business Name:

- Business Address:

This LOI serves as an expression of interest and intent regarding a potential investment in the above-mentioned business, in accordance with the laws of the .

- Purpose: This LOI outlines the initial terms and conditions that will guide the negotiation of a definitive investment agreement.

- Investment Amount: The Investor intends to invest an amount of .

- Return on Investment: The anticipated return on investment is projected to be % per annum.

The following terms are intended for discussion and negotiation:

- Investment Structure:

- Timeline: The expected timeline for this investment process is .

- Closing Conditions: The final agreement will be subject to due diligence and the execution of definitive agreements.

By signing this LOI, both parties acknowledge their intention to proceed in good faith towards finalizing the investment within a reasonable time frame.

Please indicate your acceptance of these terms by signing below:

- Investor Signature: _____________________

- Date: _____________________

- Business Signature: _____________________

- Date: _____________________

This document is non-binding until a definitive agreement is executed. Each party agrees to keep the terms of this LOI confidential.