Fill Out a Valid Independent Contractor Pay Stub Template

Guide to Writing Independent Contractor Pay Stub

Completing the Independent Contractor Pay Stub form is an essential step for both contractors and clients to ensure accurate payment records. By following the steps outlined below, you can effectively fill out the form, ensuring that all necessary information is included for proper documentation.

- Begin by entering the contractor's name at the top of the form. This identifies the individual receiving payment.

- Next, fill in the contractor's address. Include the street address, city, state, and zip code.

- Provide the date of payment. This is the date when the payment is being issued.

- In the payment period section, specify the start and end dates of the work period for which the payment is being made.

- List the services rendered or tasks completed during the payment period. Be specific to ensure clarity.

- Indicate the rate of pay for the services provided. This could be an hourly rate or a flat fee.

- Calculate the total amount due by multiplying the rate of pay by the number of hours worked or the agreed-upon flat fee.

- If applicable, include any deductions that should be subtracted from the total amount. This could include taxes or other withholdings.

- Finally, sign and date the form to confirm that the information is accurate and complete.

After completing the form, keep a copy for your records and provide a copy to the contractor. This ensures transparency and helps both parties maintain accurate financial records.

Document Breakdown

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for an independent contractor during a specific pay period. |

| Purpose | This form serves to provide transparency in payments made to independent contractors, ensuring both parties have a clear record of transactions. |

| State-Specific Requirements | In California, the governing law for independent contractor payments can be found in the California Labor Code, which outlines the rights and responsibilities of independent contractors. |

| Contents | The form typically includes details such as the contractor's name, payment period, total earnings, deductions, and net pay. |

| Legal Importance | Having a well-documented pay stub can help resolve disputes regarding payments and can be essential for tax reporting purposes. |

FAQ

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions of an independent contractor for a specific pay period. It serves as a record of payment, detailing the amount earned, any taxes withheld, and other deductions. This form is essential for both the contractor and the business that hired them, as it provides transparency in financial transactions.

Why do I need an Independent Contractor Pay Stub?

Having an Independent Contractor Pay Stub is important for several reasons:

- It helps contractors track their income and expenses.

- It provides proof of income for loan applications or tax purposes.

- It ensures compliance with tax regulations by documenting earnings.

- It clarifies the payment terms agreed upon between the contractor and the client.

What information is included in an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub typically includes the following information:

- Contractor's name and contact information.

- Client's name and contact information.

- Pay period dates.

- Total earnings for the period.

- Deductions, such as taxes or fees.

- Net pay after deductions.

How do I create an Independent Contractor Pay Stub?

Creating an Independent Contractor Pay Stub can be done easily using various templates available online. You can also use accounting software that offers pay stub generation features. To create a pay stub:

- Gather all necessary information about the contractor and the client.

- Calculate total earnings and any deductions.

- Fill out the pay stub template with the relevant details.

- Review the information for accuracy before issuing it to the contractor.

Is an Independent Contractor Pay Stub required by law?

While there is no federal law requiring businesses to provide pay stubs to independent contractors, many states have their own regulations. It is advisable to check local laws to ensure compliance. Providing a pay stub can help avoid disputes and maintain good relationships between contractors and clients.

What should I do if there is an error on my Independent Contractor Pay Stub?

If you find an error on your Independent Contractor Pay Stub, address it promptly. Contact the client or business that issued the pay stub and explain the issue. They should provide a corrected version. Keeping clear communication helps resolve discrepancies quickly and ensures accurate records for both parties.

Fill out Other Forms

U.S. Corporation Income Tax Return - Filing Form 1120 helps maintain the corporation's good standing with tax authorities.

When it comes to protecting your healthcare preferences, completing a Living Will form is crucial for ensuring your wishes are clearly outlined. For more information, you can access the practical guide on the Living Will documentation process here.

Rochdale Village Income Requirements - Discover the vibrant culture within Rochdale Village.

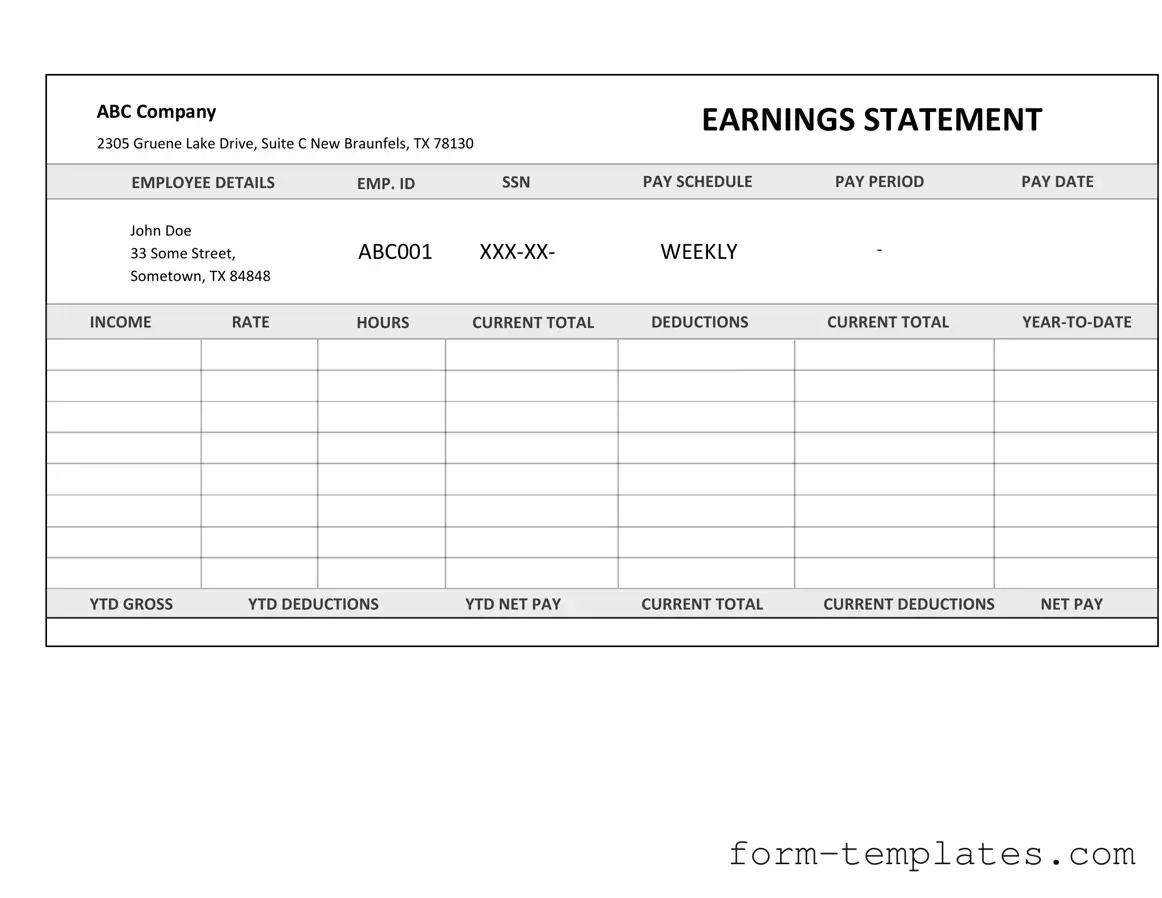

Independent Contractor Pay Stub Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |