Fill Out a Valid Goodwill donation receipt Template

Guide to Writing Goodwill donation receipt

After gathering your items for donation, you will need to complete the Goodwill donation receipt form. This form serves as proof of your charitable contribution, which may be important for tax purposes. Follow the steps below to ensure that you fill it out correctly.

- Obtain a Goodwill donation receipt form. You can find this at your local Goodwill location or download it from their website.

- Fill in your name in the designated space. Make sure to write it clearly.

- Provide your address, including the city, state, and zip code.

- Enter the date of your donation. This is typically the date you drop off your items.

- List the items you are donating. Be specific about each item, including quantity and condition.

- Estimate the fair market value of each item. This helps in determining the total value of your donation.

- Sign and date the form at the bottom. Your signature confirms that the information provided is accurate.

Once you have completed the form, keep a copy for your records. You may need it when filing your taxes or for any future reference regarding your donation.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose of Receipt | The Goodwill donation receipt serves as proof of your charitable contribution, which can be used for tax deductions. |

| Itemization | Donors should list the items donated on the receipt. This helps establish the value of the donation for tax purposes. |

| Fair Market Value | Donors are encouraged to assess the fair market value of the donated items. This value is necessary for accurate tax reporting. |

| State-Specific Forms | Some states may have specific requirements for donation receipts. For example, California requires detailed descriptions of donated items under state tax law. |

| Record Keeping | It is important to keep the receipt for your records. The IRS may request documentation during an audit. |

FAQ

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided by Goodwill Industries to donors when they make a charitable donation. This receipt serves as proof of the donation and can be used for tax deduction purposes. It typically includes details such as the date of the donation, a description of the items donated, and the donor's name and address.

Why do I need a receipt for my donation?

A receipt is important for several reasons. First, it provides documentation that you made a charitable contribution, which is necessary for claiming tax deductions. Second, it helps you keep track of your charitable giving throughout the year. Lastly, it can serve as a record in case of any discrepancies or audits by tax authorities.

How do I obtain a Goodwill donation receipt?

To obtain a Goodwill donation receipt, simply ask for one when you drop off your items at a Goodwill location. Staff members will typically provide a receipt on the spot. If you forget to ask, you can request one later by contacting the specific Goodwill store where you made your donation.

What information is included on the receipt?

A Goodwill donation receipt generally includes the following information:

- Date of donation

- Description of items donated

- Name and address of the donor

- Goodwill's name and address

- Signature of the Goodwill representative (if applicable)

Can I estimate the value of my donated items?

Yes, you can estimate the value of your donated items. However, Goodwill does not assign a value to the items on the receipt. It is the donor's responsibility to determine the fair market value of the items. Resources such as online valuation guides or thrift store pricing can help you establish an appropriate value for your donation.

What types of items can I donate to Goodwill?

Goodwill accepts a wide range of items, including:

- Clothing and accessories

- Household goods

- Electronics

- Furniture

- Toys and games

However, there are some restrictions. Goodwill does not accept items that are damaged, hazardous, or recalled. Always check with your local Goodwill for specific guidelines.

Do I need to itemize my donations for tax purposes?

Yes, if you plan to claim a tax deduction for your donations, you should itemize them. The IRS requires that you provide a detailed list of your donated items, including their estimated values. The Goodwill receipt can serve as supporting documentation for your tax records.

What should I do if I lose my donation receipt?

If you lose your donation receipt, you can contact the Goodwill location where you made the donation. They may be able to provide a duplicate receipt or help you reconstruct the details of your donation. Keep in mind that having a receipt is crucial for tax purposes, so it's best to keep it in a safe place.

Fill out Other Forms

Soccer Player Evaluation Template - Defensive tactical awareness measures a player's ability to regain possession strategically.

The Chase Print Counter Checks form not only provides customers with a convenient option to obtain temporary checks for immediate use, but it also emphasizes the importance of having the right tools, such as a Blank Check Template, to facilitate a seamless banking experience.

Transfer Shares - Each section aids in tracking the history of ownership for corporate stocks.

How to Change a Car Title - The final waiver of lien lays the groundwork for clear property ownership free from additional claims.

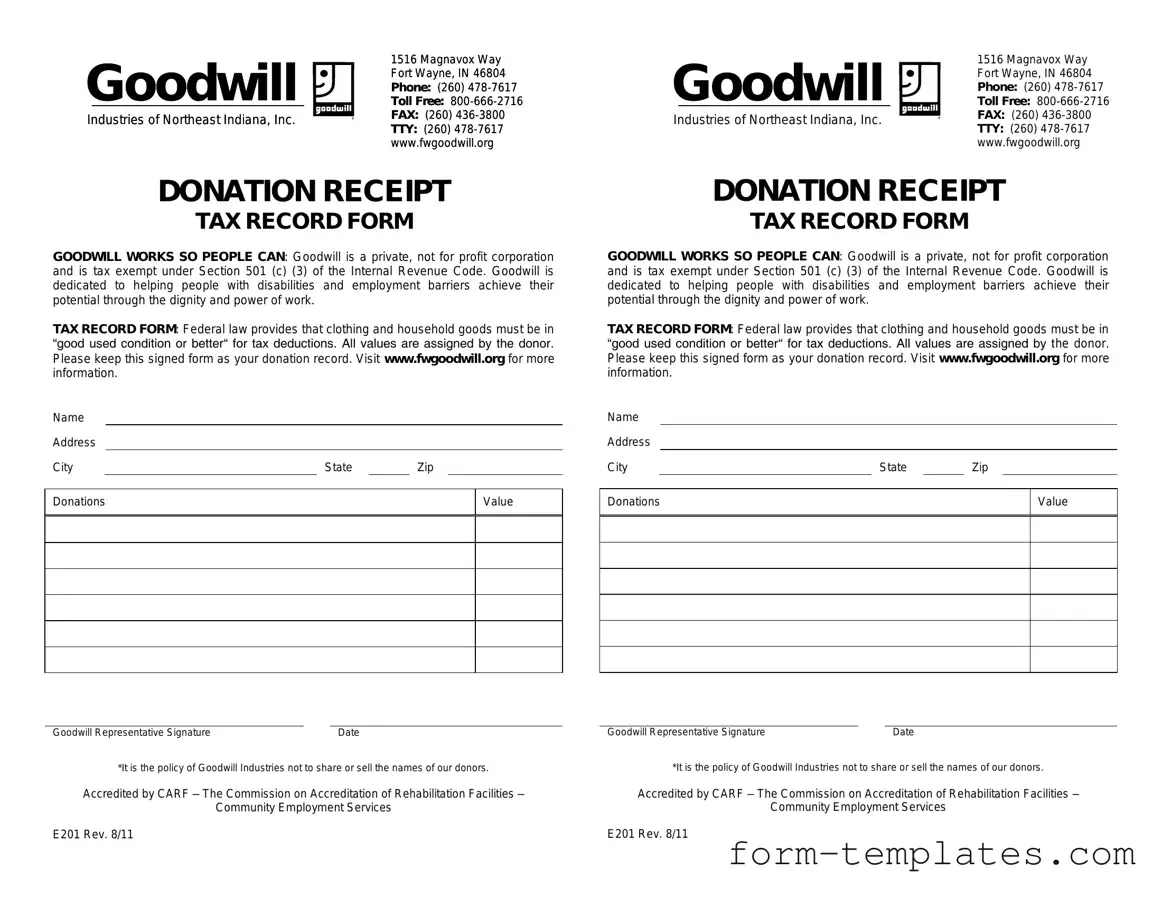

Goodwill donation receipt Example

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11