Fill Out a Valid Gift Letter Template

Guide to Writing Gift Letter

Filling out a Gift Letter form is a straightforward process. This form is often used in financial transactions, particularly in real estate, to document a gift of money. Once completed, the form will need to be submitted to the appropriate party, such as a lender or financial institution, as part of your application process.

- Begin by writing the date at the top of the form.

- Enter the names of both the giver and the recipient in the designated fields.

- Provide the address of the recipient.

- Clearly state the amount of money being gifted.

- Include a brief description of the purpose of the gift, if required.

- Sign and date the form to confirm the information is accurate.

- If necessary, have the recipient sign the form as well.

- Make copies of the completed form for your records.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | A gift letter form is used to document a financial gift, typically for a home purchase. |

| Donor Information | The form requires details about the donor, including name, address, and relationship to the recipient. |

| Recipient Information | It also includes information about the recipient, such as their name and the property address. |

| Amount of Gift | The specific amount of the gift must be clearly stated on the form. |

| No Repayment | The letter should confirm that the gift does not need to be repaid. |

| State-Specific Forms | Some states may have specific requirements for gift letters, governed by local laws. |

| Signature Requirement | Both the donor and recipient typically need to sign the letter to validate it. |

| Usage in Mortgage Applications | Lenders often require a gift letter as part of the mortgage application process to verify funds. |

FAQ

What is a Gift Letter form?

A Gift Letter form is a document used to verify that a financial contribution made to a homebuyer is indeed a gift and not a loan. This form is typically required by lenders when someone receives money from a family member or friend to help with a down payment or closing costs.

Who can provide a gift for a home purchase?

Generally, gifts can come from family members, such as parents, siblings, or grandparents. Some lenders may also accept gifts from close friends or other individuals, but this often depends on the lender’s specific guidelines.

What information is typically included in a Gift Letter?

A Gift Letter usually includes:

- The donor's name and contact information

- The recipient's name

- The amount of the gift

- A statement confirming that the funds are a gift and do not need to be repaid

- The relationship between the donor and the recipient

- The date the gift was given

Do I need to provide proof of the gift?

Yes, lenders often require proof of the gift. This may include bank statements showing the transfer of funds, along with the completed Gift Letter form. This helps the lender confirm that the money is indeed a gift and not a loan.

Can I use a Gift Letter for any type of loan?

Gift Letters are most commonly used for mortgage loans. However, not all loan types allow gifts, so it’s important to check with your lender. Each lender may have different rules regarding the acceptance of gift funds.

Is there a limit on how much I can receive as a gift?

While there is no universal limit on the amount of a gift, lenders may have their own guidelines. Additionally, the IRS has gift tax limits, which can affect how much can be given without tax implications. It’s advisable to consult with a tax professional for specifics.

Can I write my own Gift Letter?

Yes, you can write your own Gift Letter, but it must include all the necessary information outlined earlier. Some lenders provide a template or specific requirements, so check with them to ensure your letter meets their standards.

What happens if the Gift Letter is not provided?

If a Gift Letter is not provided, the lender may consider the funds as a loan. This could affect your ability to qualify for the mortgage or increase your debt-to-income ratio. It’s best to provide the letter to avoid complications during the loan process.

Fill out Other Forms

Emotional Support Animal Letter From Therapist - Having an emotional support animal can reduce feelings of loneliness and isolation.

In addition to the CID Name Check Request form, individuals may find it useful to create a Fillable Blank Check to ensure all necessary information is included and presented in a clear manner, streamlining the background check process.

Where to Find Old Immunization Records - Each entry helps comply with state and federal vaccination guidelines.

Florida 4 Point Inspection - The presence of older electrical and plumbing systems might require additional scrutiny from the inspector.

Gift Letter Example

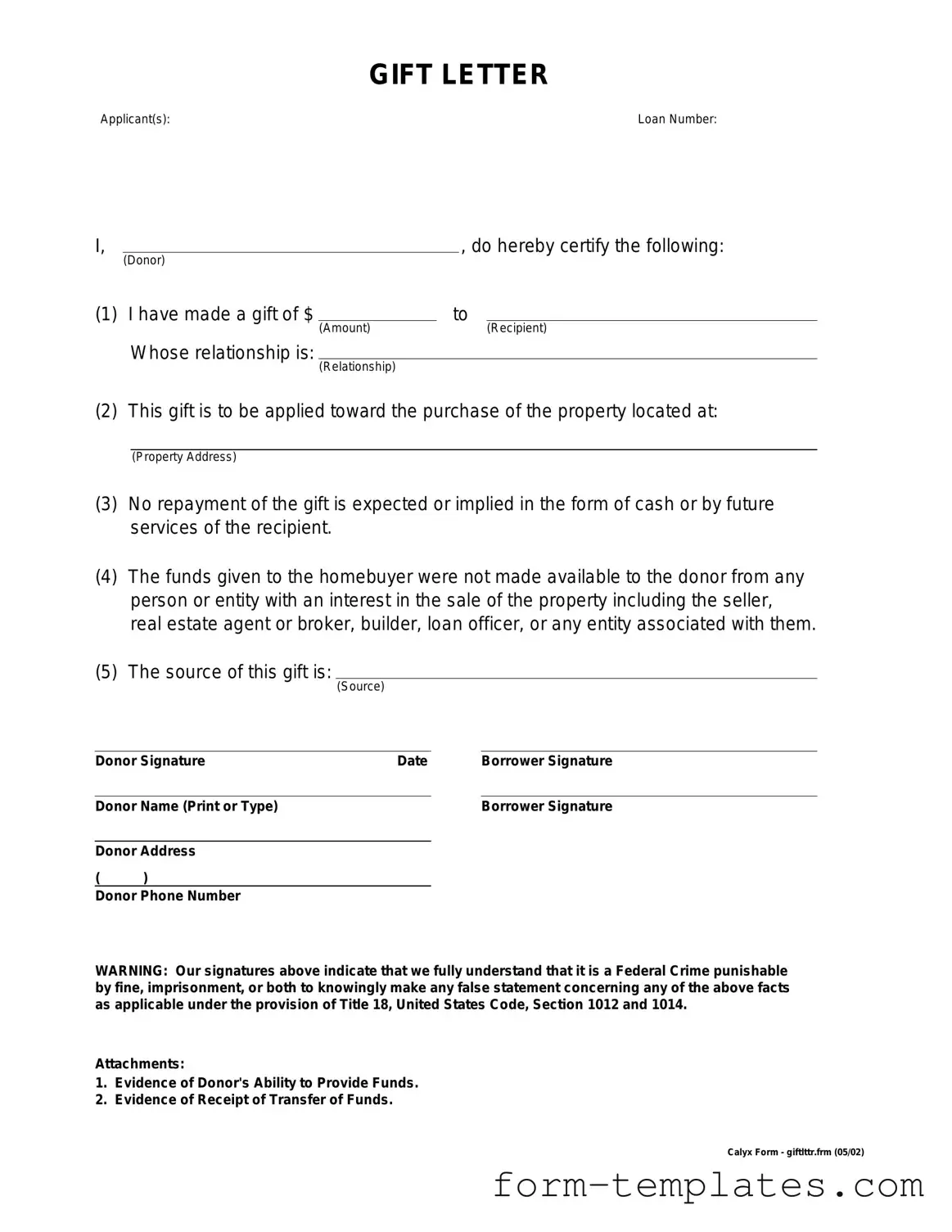

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)