Attorney-Approved Gift Deed Document

Guide to Writing Gift Deed

Filling out a Gift Deed form is an important step in transferring ownership of property or assets. Once completed, the form should be signed and notarized to ensure its legal validity. Here’s how to properly fill out the form.

- Obtain the Gift Deed form: You can usually find this form online or at your local county clerk's office.

- Enter the date: Write the date on which the gift is being made at the top of the form.

- Identify the donor: Fill in the full name and address of the person giving the gift.

- Identify the recipient: Provide the full name and address of the person receiving the gift.

- Describe the property: Clearly describe the property or asset being gifted. Include any relevant details like the address for real estate or a description for personal property.

- State the intention: Write a clear statement indicating that the donor intends to give the property as a gift.

- Sign the form: The donor must sign the form. If applicable, have the recipient sign as well.

- Notarization: Take the completed form to a notary public to have it notarized, which adds an extra layer of authenticity.

- Make copies: After notarization, make copies of the signed and notarized form for both the donor and the recipient.

After completing these steps, the Gift Deed is ready to be filed with the appropriate authorities, if required, or kept for personal records. Always check local regulations to ensure compliance with any additional requirements.

Gift DeedDocuments for Specific US States

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property or assets from one person to another without any exchange of money. |

| Intent | The primary intent of a Gift Deed is to make a voluntary transfer of property, indicating the giver’s intention to donate the asset without expecting anything in return. |

| Requirements | To be valid, a Gift Deed typically requires the donor's signature, the recipient's acceptance, and a clear description of the property being gifted. |

| State-Specific Forms | Each state may have its own specific form for a Gift Deed. For example, in California, the California Gift Deed form must comply with state laws outlined in the California Civil Code. |

| Tax Implications | Gift Deeds may have tax implications. In the U.S., gifts above a certain value may be subject to federal gift tax regulations. |

| Revocation | A Gift Deed can generally be revoked before it is executed. Once executed, it becomes irrevocable unless specific conditions are met. |

| Notarization | While notarization is not always required, having a Gift Deed notarized can help validate the document and may be necessary for certain types of property transfers. |

| Recording | In many states, it is advisable to record the Gift Deed with the local county recorder’s office to provide public notice of the transfer and protect the recipient's ownership rights. |

FAQ

What is a Gift Deed?

A Gift Deed is a legal document that facilitates the transfer of property or assets from one person to another without any exchange of money. This form is commonly used to convey real estate, personal property, or financial assets as a gift. The giver, known as the donor, voluntarily transfers ownership to the recipient, known as the donee. This transfer is usually irrevocable, meaning that once the gift is made, the donor cannot reclaim it.

What are the requirements for a valid Gift Deed?

To ensure that a Gift Deed is valid, several key requirements must be met:

- Intention: The donor must have a clear intention to give the gift without expecting anything in return.

- Acceptance: The donee must accept the gift. This can be done verbally or in writing.

- Consideration: Unlike other types of property transfers, a Gift Deed does not require monetary consideration.

- Legal Capacity: Both the donor and donee must have the legal capacity to enter into the agreement. This generally means they must be of sound mind and of legal age.

- Written Document: The Gift Deed should be in writing and signed by the donor. In some cases, notarization may be required to validate the document.

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when a gift is made. In the United States, the IRS imposes a gift tax on the donor if the value of the gift exceeds a certain threshold, which is adjusted annually. For 2023, the annual exclusion amount is $17,000 per recipient. Gifts exceeding this amount may require the donor to file a gift tax return. However, there are exemptions, such as gifts made for educational or medical expenses, that may not incur tax. It is advisable to consult a tax professional to understand the specific implications of your situation.

Can a Gift Deed be revoked?

Generally, a Gift Deed is irrevocable once it has been executed and delivered. This means that the donor cannot change their mind and take back the gift. However, there are some exceptions. If the gift was made under duress, fraud, or undue influence, it may be possible to challenge the validity of the Gift Deed. Additionally, if the donor retains some control over the property or asset, it may be argued that the gift was not completed. Legal advice should be sought in such situations.

How do I create a Gift Deed?

Creating a Gift Deed involves several steps:

- Determine the property or asset you wish to gift.

- Draft the Gift Deed, ensuring it includes all necessary details, such as the names of the donor and donee, a description of the property, and the intention to gift.

- Have the document signed by the donor. Depending on local laws, it may also need to be notarized.

- Deliver the Gift Deed to the donee to finalize the transfer.

- Consider recording the Gift Deed with the appropriate local government office, especially for real estate, to ensure public notice of the transfer.

Other Gift Deed Templates:

Problems With Transfer on Death Deeds California - The deed must be properly recorded with the local property office.

For employers looking to streamline their payroll process, utilizing a reliable Blank Check Template can greatly enhance the efficiency and clarity of issuing employee payments, ensuring that all necessary details are accurately captured in the Payroll Check form.

Lady Bird Johnson Deed - This deed permits the original owner to sell or mortgage the property without needing consent from heirs.

What Is Deed in Lieu of Foreclosure - This form is often used as a last resort for borrowers who cannot sell their property in a declining market.

Gift Deed Example

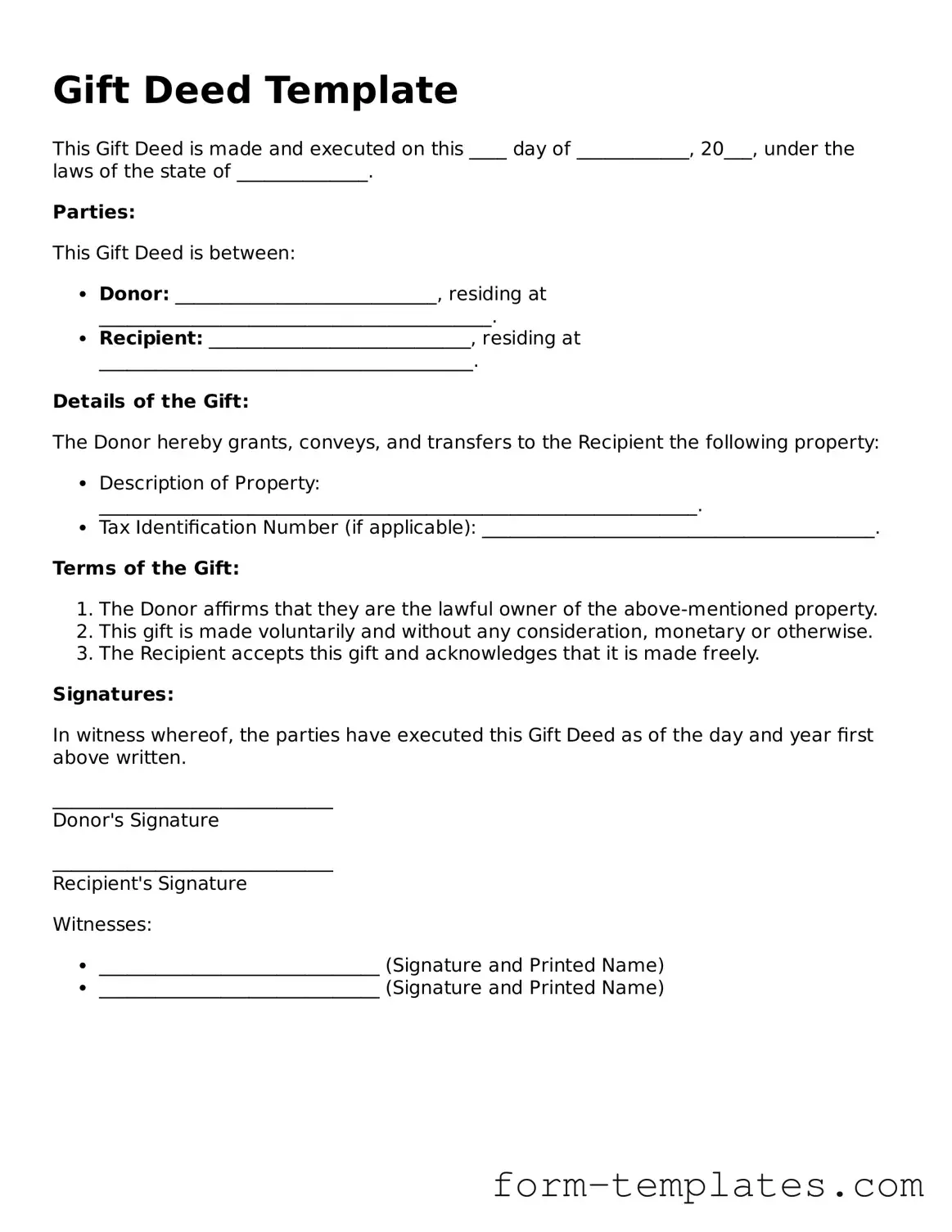

Gift Deed Template

This Gift Deed is made and executed on this ____ day of ____________, 20___, under the laws of the state of ______________.

Parties:

This Gift Deed is between:

- Donor: ____________________________, residing at __________________________________________.

- Recipient: ____________________________, residing at ________________________________________.

Details of the Gift:

The Donor hereby grants, conveys, and transfers to the Recipient the following property:

- Description of Property: ________________________________________________________________.

- Tax Identification Number (if applicable): __________________________________________.

Terms of the Gift:

- The Donor affirms that they are the lawful owner of the above-mentioned property.

- This gift is made voluntarily and without any consideration, monetary or otherwise.

- The Recipient accepts this gift and acknowledges that it is made freely.

Signatures:

In witness whereof, the parties have executed this Gift Deed as of the day and year first above written.

______________________________

Donor's Signature

______________________________

Recipient's Signature

Witnesses:

- ______________________________ (Signature and Printed Name)

- ______________________________ (Signature and Printed Name)