Fill Out a Valid Generic Direct Deposit Template

Guide to Writing Generic Direct Deposit

After completing the Generic Direct Deposit form, submit it to your employer or the designated payroll department. Ensure all information is accurate to avoid delays in processing your direct deposit.

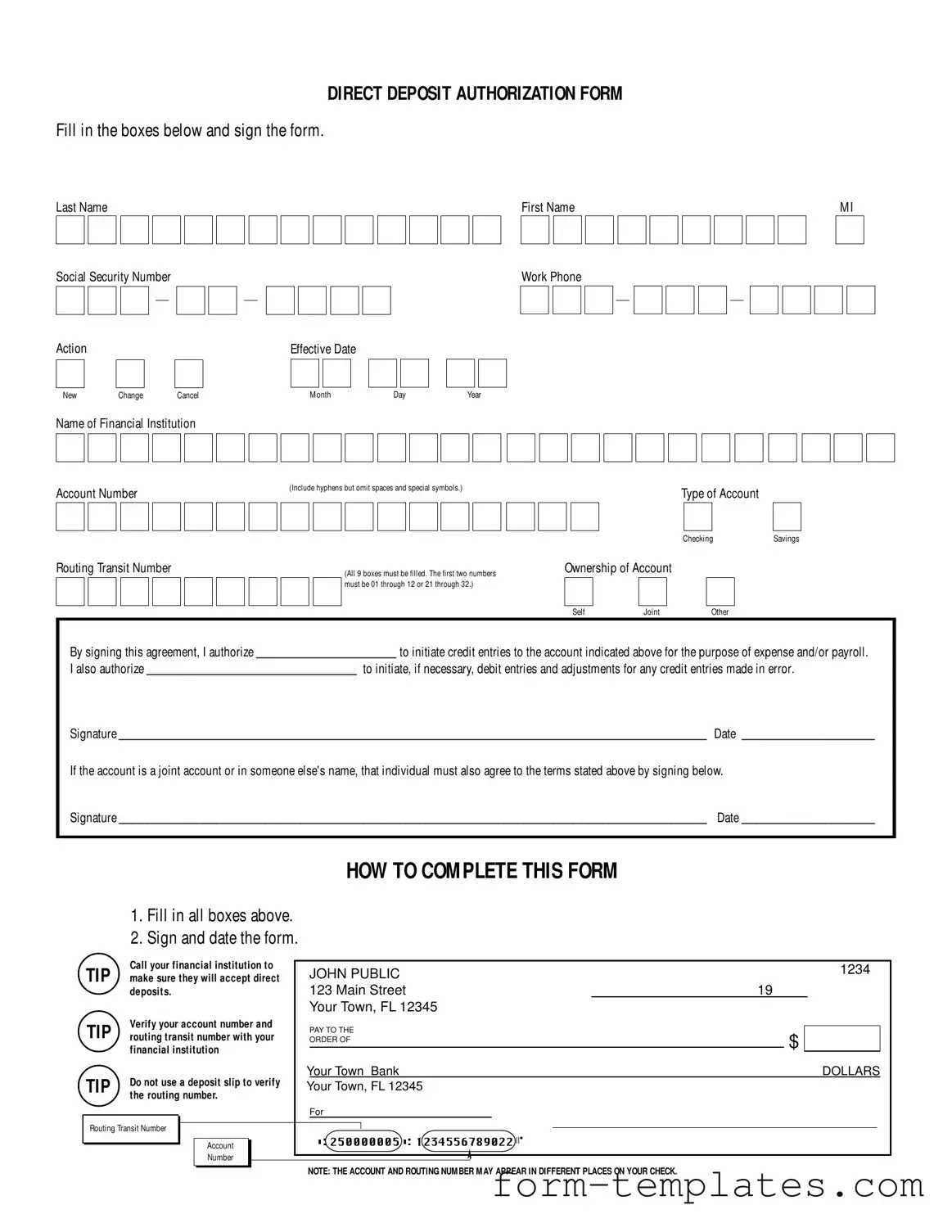

- Fill in your last name, first name, and middle initial in the designated boxes.

- Provide your Social Security Number in the specified format.

- Select the appropriate action: New, Change, or Cancel.

- Enter the effective date using the month, day, and year format.

- Input your work phone number.

- Write the name of your financial institution in the provided box.

- Fill in your account number, including hyphens, without spaces or special symbols.

- Indicate the type of account by checking either Savings or Checking.

- Complete the routing transit number, ensuring all 9 boxes are filled correctly.

- Select the ownership of the account by checking the appropriate option: Self, Joint, or Other.

- Sign the form to authorize the initiation of credit entries to your account.

- Write the date next to your signature.

- If applicable, have the joint account holder or other individual sign the form and provide the date next to their signature.

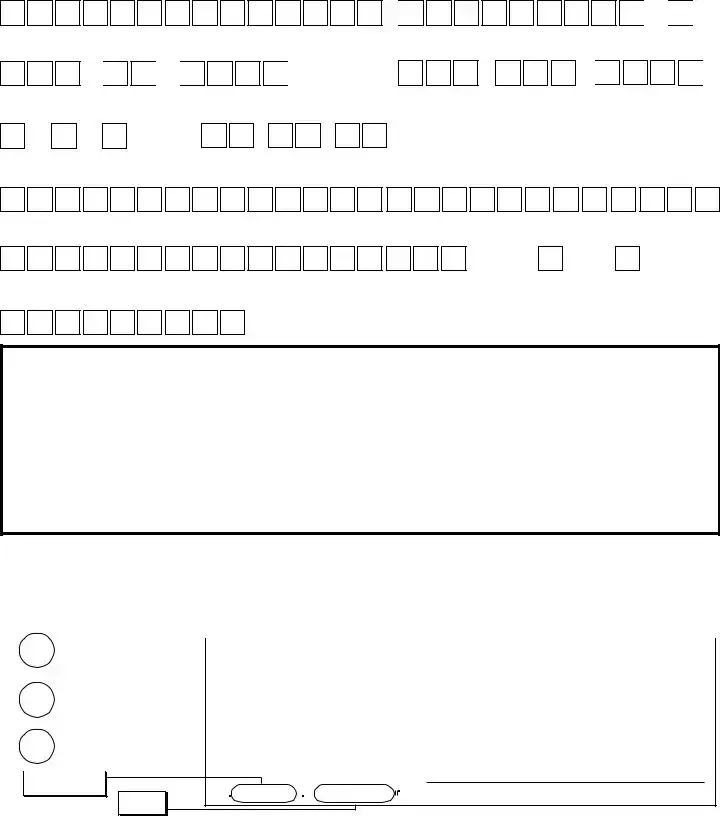

Before finalizing, verify the accuracy of your account number and routing transit number with your financial institution. Avoid using a deposit slip for verification, as the account and routing numbers may appear in different locations on your check.

Document Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Generic Direct Deposit form allows individuals to authorize automatic deposits into their bank accounts. |

| Required Information | Users must provide their last name, first name, Social Security number, and contact information. |

| Account Details | Account number and routing transit number must be included. Ensure all nine digits of the routing number are filled. |

| Account Types | Individuals can choose between a savings account or a checking account for direct deposits. |

| Ownership | Account ownership can be categorized as self, joint, or other. Joint account holders must also sign the form. |

| Authorization | By signing the form, the individual authorizes the designated entity to initiate credit and, if necessary, debit entries. |

| Effective Date | The form allows users to specify the effective date for the changes, whether it's a new setup, change, or cancellation. |

| Verification | It is advised to verify the account and routing numbers with the financial institution before submitting the form. |

| Legal Compliance | In Florida, the governing law regarding direct deposits is found under Florida Statutes, Chapter 655. |

FAQ

What is the Generic Direct Deposit form used for?

The Generic Direct Deposit form is used to authorize your employer or another organization to deposit funds directly into your bank account. This can include payroll, expense reimbursements, or other payments. By completing this form, you ensure that your funds are deposited securely and efficiently without the need for paper checks.

How do I complete the Generic Direct Deposit form?

Completing the form is straightforward. Follow these steps:

- Fill in all required fields, including your name, Social Security number, and account details.

- Select whether this is a new authorization, a change, or a cancellation.

- Indicate the type of account (savings or checking) and provide the routing transit number.

- Sign and date the form to validate your authorization.

It’s also a good idea to call your financial institution to confirm that they accept direct deposits and to verify your account and routing numbers.

What should I do if my account is a joint account?

If your account is a joint account or is in someone else's name, that individual must also sign the form. This ensures that all account holders agree to the terms of the direct deposit authorization. Without their signature, the form may not be accepted by your employer or financial institution.

What if I make a mistake on the form?

If you realize that you have made a mistake after submitting the form, contact your employer or the organization that requested the form as soon as possible. They can guide you on how to correct the information. If necessary, you may need to fill out a new form to ensure that your direct deposit details are accurate.

Fill out Other Forms

Health Insurance Marketplace Statement - Filing the 1095-A accurately can help ensure you receive any tax benefits you qualify for.

The process of requesting a background check can be streamlined by utilizing the CID Name Check Request form, which provides commanders and law enforcement officials with a reliable means of identifying individuals. To assist you in this process, you might find it helpful to use a Fillable Blank Check to ensure all necessary details are accurately documented. By completing the form, you will facilitate the retrieval of essential information such as social security numbers.

Geico Supplements - The GEICO Supplement Request Form is designed for use by repair facilities only.

Generic Direct Deposit Example

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.